A Tale of Two Realities

The Fed's About to Make Another Policy Error?

March Madness

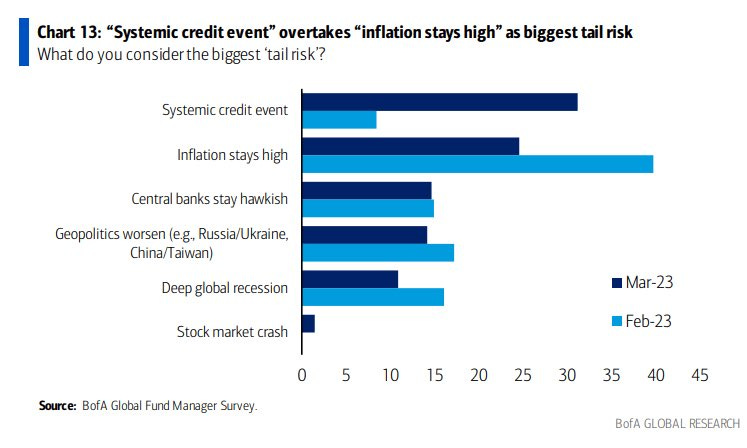

March has been eventful to say the least. The banking crisis awakened both rate and equity vol (albeit momentarily), created a plethora of new banking experts, and resurrected the “This is 2008” declarations. But the most salient development in March is the replacement of high & persistent inflation as the biggest tail risk for markets.

Higher for Longer Taking a Vacation?

Last October I highlighted and expounded the higher for longer mantra.

“Look no further than the Fed’s current mandate. I’m well aware of how this approach can be perceived to be quite paradoxical, primarily because of the Fed’s recent transitory inflation “mishap.” “Why should we listen to the Fed now when they tell us they’re raising rates?”, is a respectable question here. Below are a few appropriate responses.

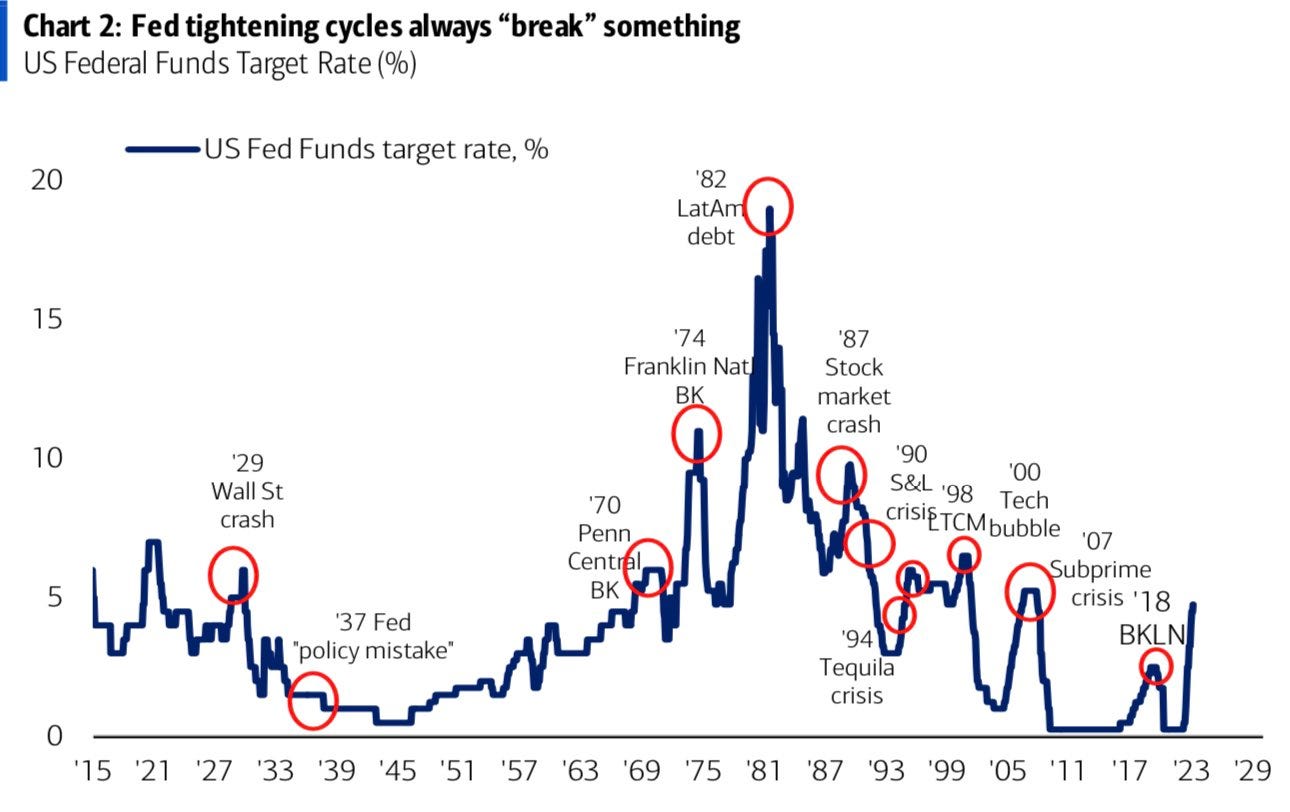

This is the end of the ZIRP/QE era for the foreseeable future thanks to profligate fiscal and monetary policy

Fixate on policymaker constraints instead of preferences

Inflation should remain persistent for the next few months, which means all Fed pivot hopes for the foreseeable future are premature/gratuitous

Remember that profligacy is an invariable aspect of the Fed’s monetary policy. They were too loose for too long and now they will likely overtighten”

I made sure to say “for the foreseeable future” because of the complexity of this business cycle. Monetary policy works with a lag and traditional wisdom shows that it takes about 12-18 months for it to work its way throughout the economy. It’s now been one year since the beginning of this rate hiking cycle and the cracks are finally emerging.

Admittedly, I’ve deliberated a lot about the present accuracy of the bond market because of both response lag and the banking crisis. If there is a systemic credit event due to this banking crisis — which I believe is highly probable — then there would be a significant deflationary shock. My dilemma is that yields, rate vol, and credit spreads/stress indexes are all singing an entirely different tune from equities right now.

Who is Right? Who is Wrong?

Rate vol is alarmingly high due to the significant liquidity strain in the UST market while equity vol — aside from the recent move to 30 — has remained relatively low in comparison. Illiquidity begets volatility and as far as I’m concerned, stock market liquidity is abysmal. The market is being carried by the generals, which unsurprisingly do not perform well in higher interest rate regimes or deflationary shocks. This cannot and will not continue for too much longer.

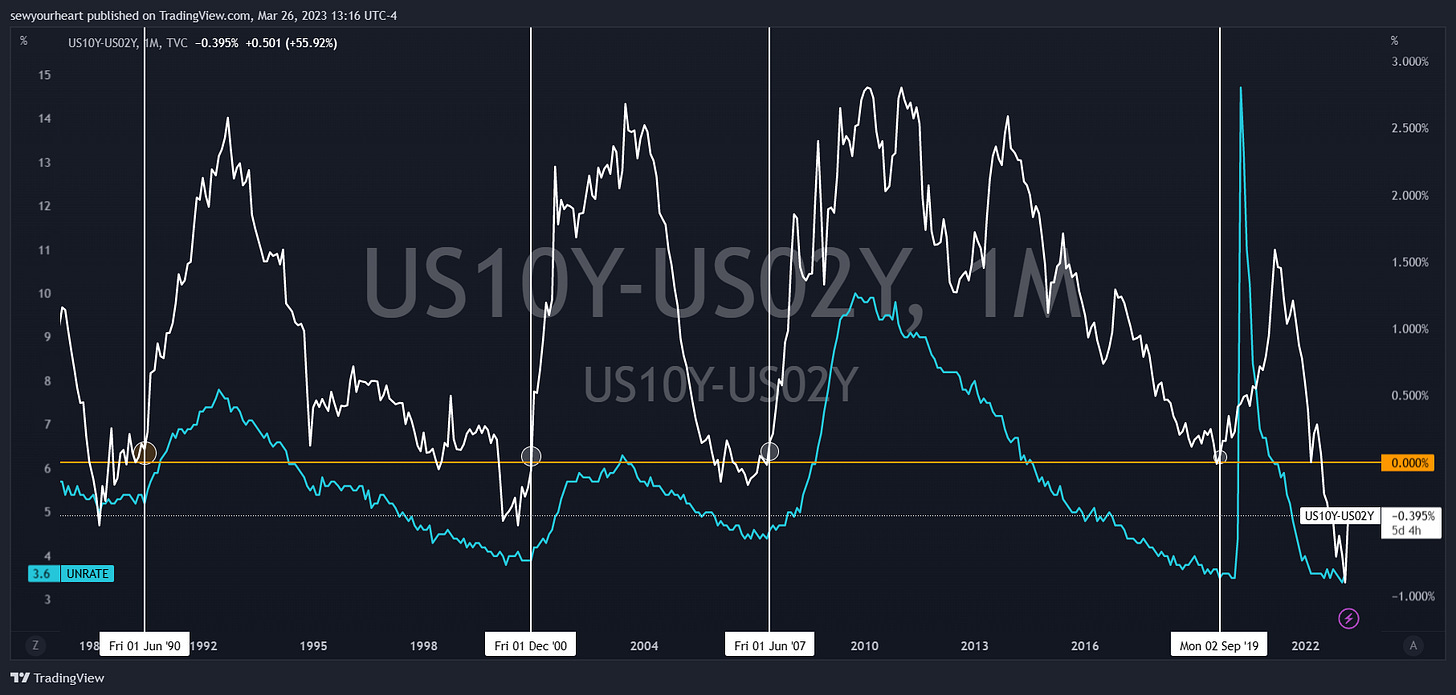

The YC has seen some steepening, but the short end has fallen much faster than the long end. This suggests that recession fears currently trump inflation fears and rate cuts may be right around the corner. It may also allude to a bottom in the unemployment rate.

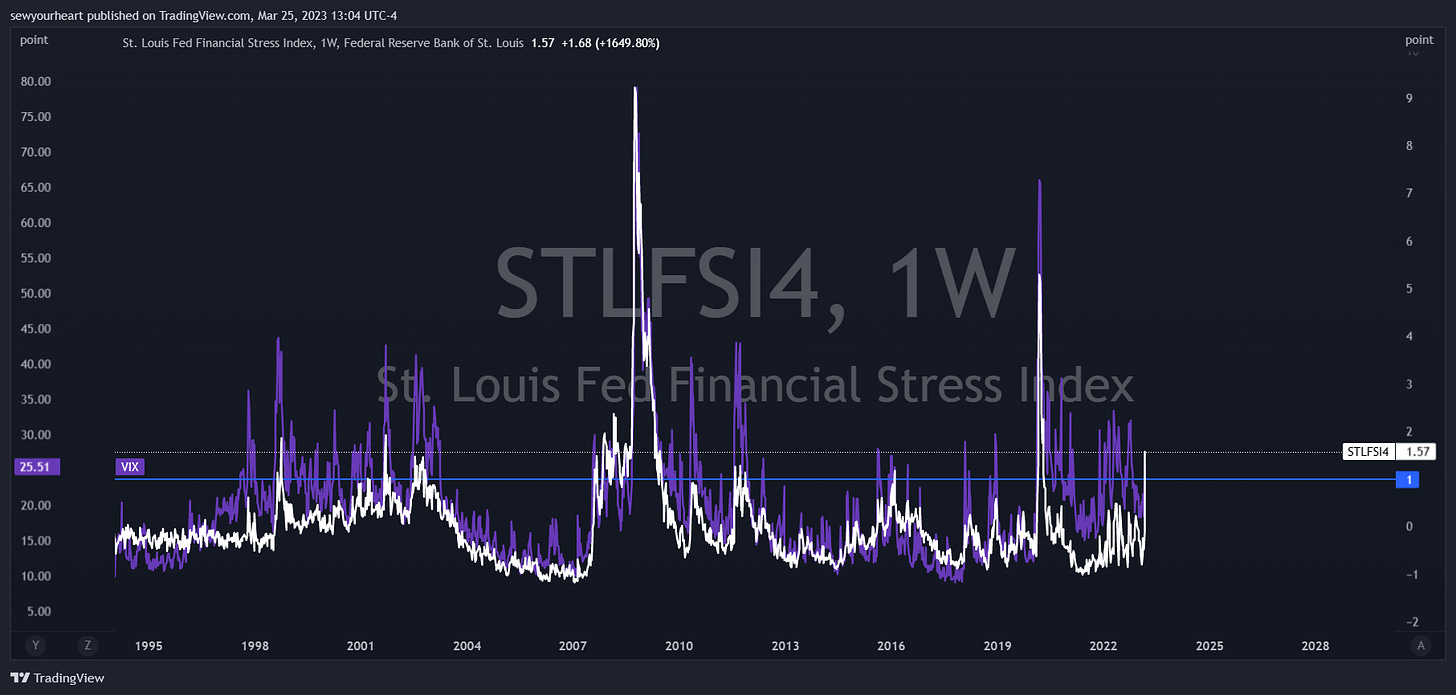

I observed the Fed Stress Index late last year and used it to confirm that this bear market is in the nascent stage. It also displayed the Fed’s ability to continue tightening with impunity. It’s now showing that there is noteworthy stress — maybe enough to force the Fed to change policy soon — in the financial system.

It’s About Time

All things considered; I believe that the bond market is presently right. It was wrong all of 2022, but after 12 months of this historic rate hiking cycle, it seems that the odds are in the bond markets favor.

A banking crisis doesn’t resolve immediately (like our “leaders” want us to believe), and recognition/implementation lag are absolutely key factors to consider in the scenario where it cannot be contained. Given the Fed and the government’s historical track records, I’d expect a bailout package of epic proportions after the crisis has already spiraled out of control. It will be a textbook “too little too late” situation, and since monetary policy works with a lag, the accommodative policy won’t produce its intended results immediately. Inflation will spike again after the Fed makes this policy error.

Short Volatility and Invite Me to Your Funeral

The VIX calls I bought on 1/17 for May when the VIX was 19 did well. Given the present circumstances, I’m long vol again and expecting equity vol to truly wake up sooner than later.

A bon entendeur: The more you hear “everything is fine” after a fiasco ensues, the less it actually is.