April Recap. Out of Breadth

Out of Breadth

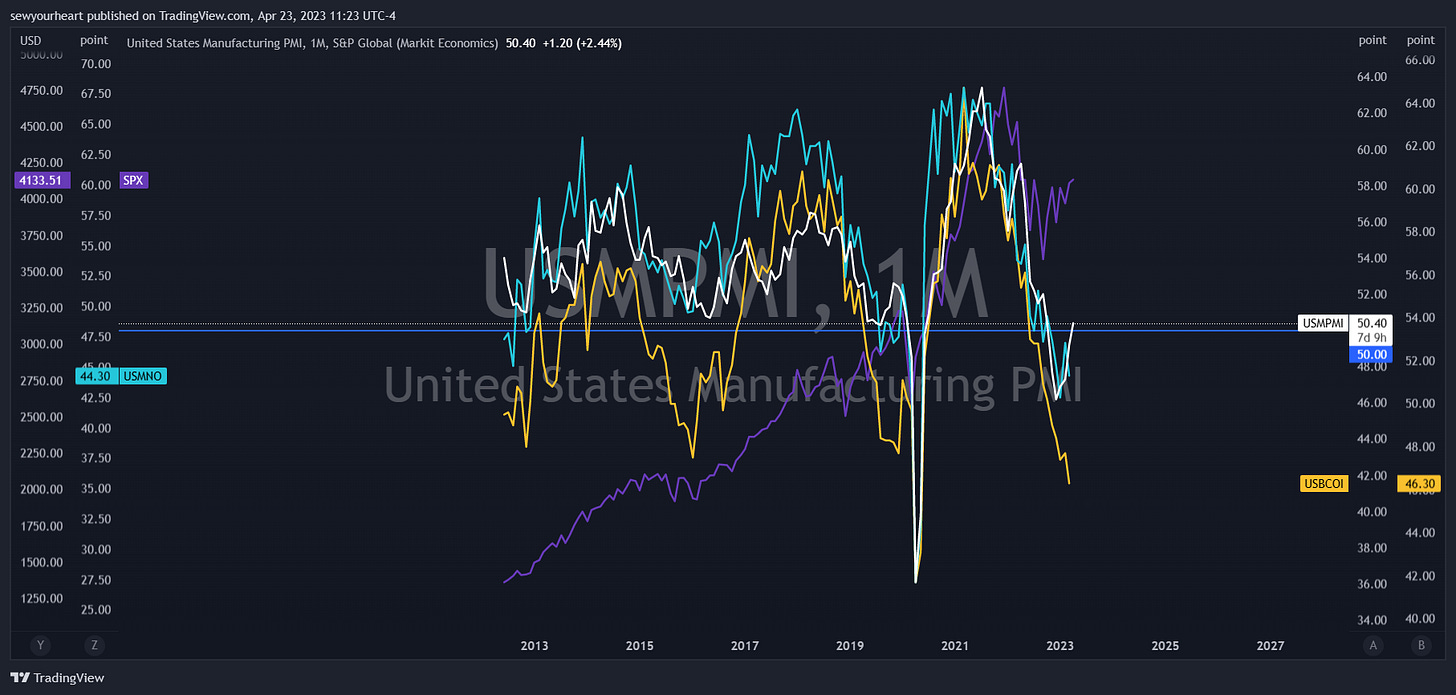

April has been a very uneventful month for financial markets. After the emergency liquidity injection from the Fed because of the banking crisis, the market has drifted back above the closely watched trendline and is now very close to where we recorded the highest call volume ever.

Net liquidity rose considerably amidst the banking crisis, and this prompted numerous claims that QT had ended. Deliberating about whether or not this was QE is pointless. Sentiment & positioning were already heavily skewed to the downside (rightfully so) and many were becoming privy to some of the effects that a historic rate hiking cycle can have on different parts of our financial system. This is the perfect environment for market participants to disregard the regime we’re in.

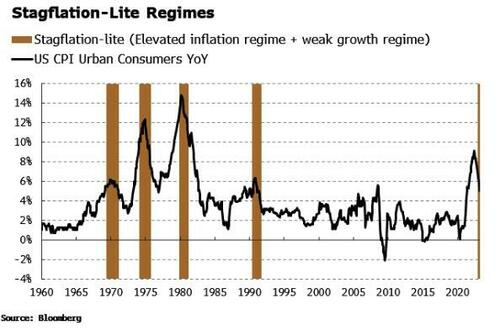

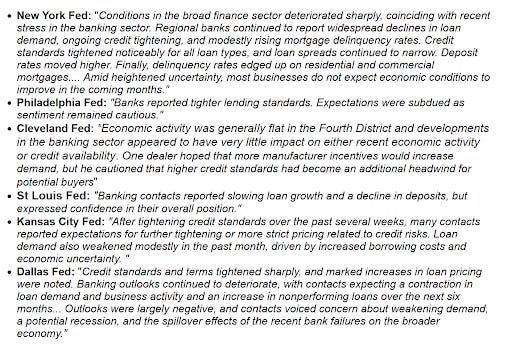

Speaking of regimes, headline inflation came in at 5.0% YoY & Core CPI (YoY) rose slightly while 1Y inflation expectations rose 1%. from 3.6%. We’re simultaneously receiving signs that this is a weak growth regime as well. High and persistent inflation coupled with weak growth screams stagflation despite not seeing a sharp rise in the unemployment rate.

Although the labor market appears to be commencing its softening process, it’s still not enough to deem this regime as entirely stagflationary. We’ll have to settle with “Stagflation-Lite” for now.

My base case for 2023 was stagflation first, deflationary bust second. In my most recent post I highlighted what I believed would be the Fed’s ultimate response to stress in the banking system.

“A banking crisis doesn’t resolve immediately (like our “leaders” want us to believe), and recognition/implementation lag are absolutely key factors to consider in the scenario where it cannot be contained. Given the Fed and the government’s historical track records, I’d expect a bailout package of epic proportions after the crisis has already spiraled out of control. It will be a textbook “too little too late” situation, and since monetary policy works with a lag, the accommodative policy won’t produce its intended results immediately. Inflation will spike again after the Fed makes this policy error.”

After much deliberation over this scenario, I believe that it’s important to elucidate something. Note how after the liquidity injection from the Fed, they proceeded to raise interest rates at the next meeting. The Fed needs to appear credible at all costs, so this was unsurprising. Higher for longer is still in play, but it will be taking a vacation after the next cracks in our financial system/economy manifest & prove to be exceedingly detrimental to the economy. This may happen sooner than most expect.

Out of Breadth

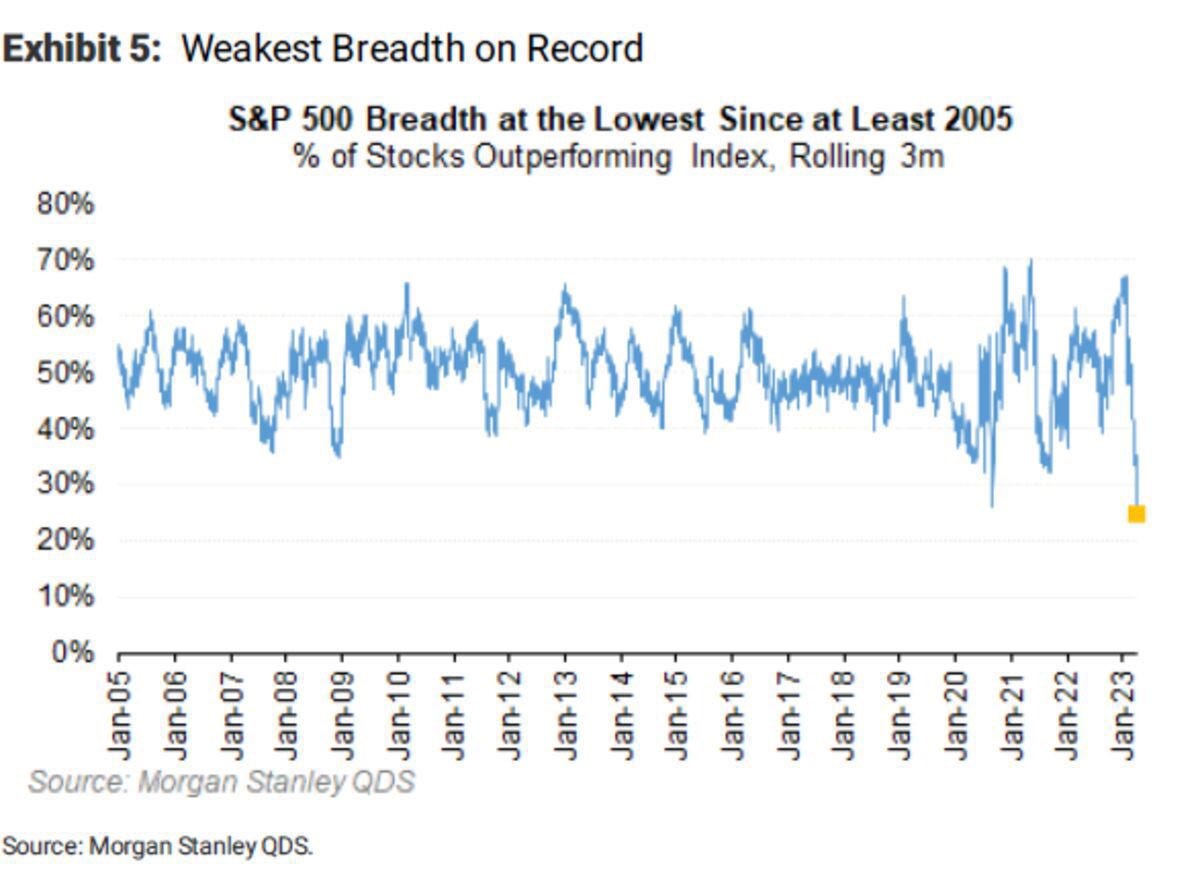

“Illiquidity begets volatility and as far as I’m concerned, stock market liquidity is abysmal. The market is being carried by the generals, which unsurprisingly do not perform well in higher interest rate regimes or deflationary shocks. This cannot and will not continue for too much longer.”

If simply charting the generals vs SPX wasn’t enough to illustrate my point, allow the chart above to do the job.

This lack of breadth into OpEx should be alarming to market participants who are believers in a new bull market. Supportive flows are gone which should allow for the market to move freely to the downside.

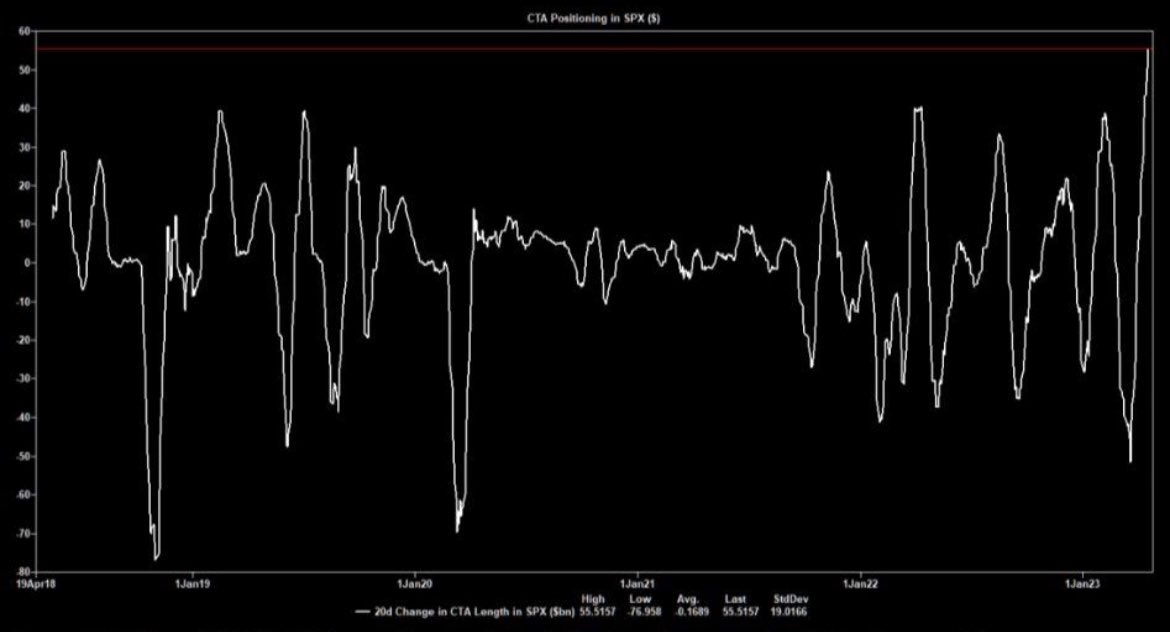

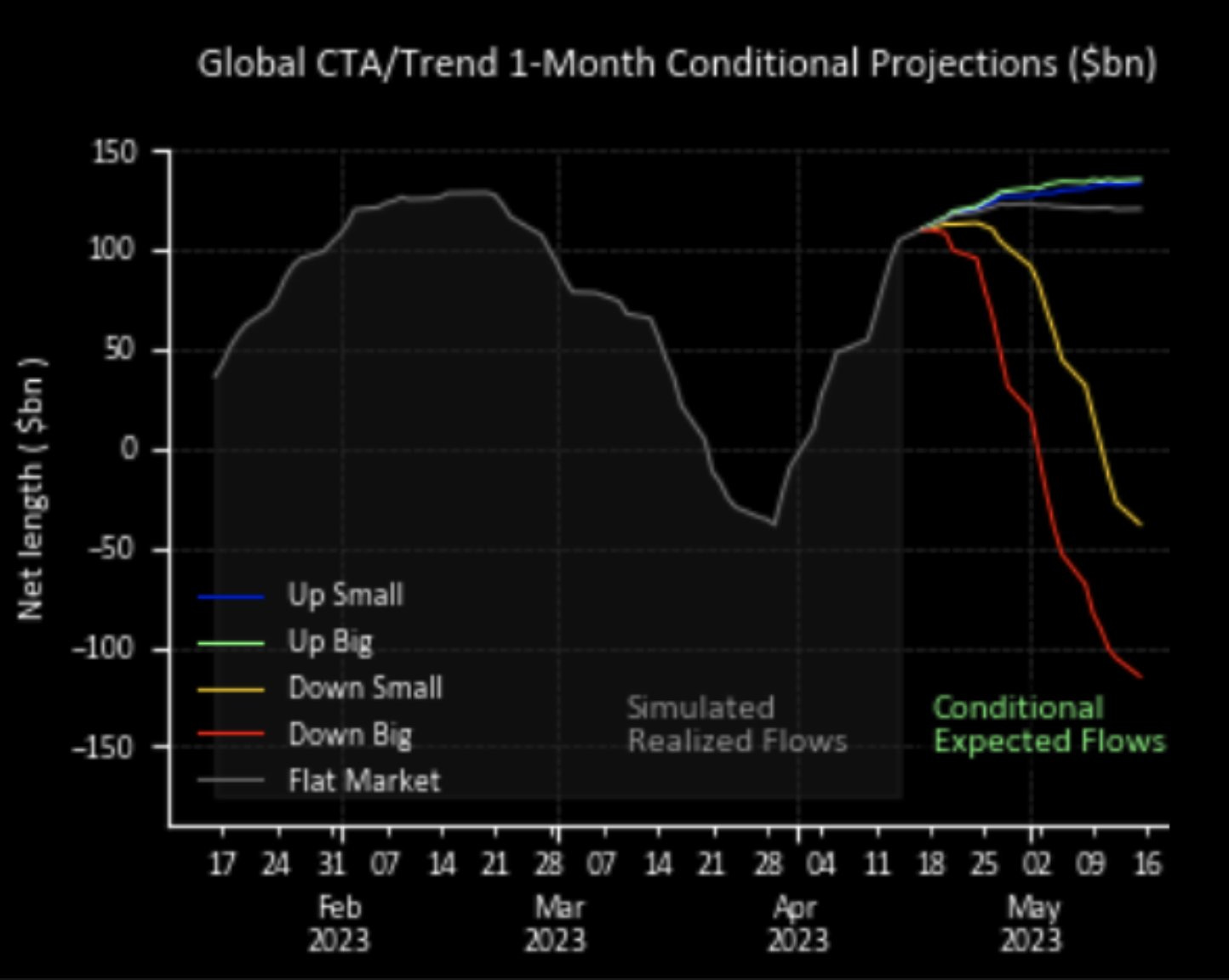

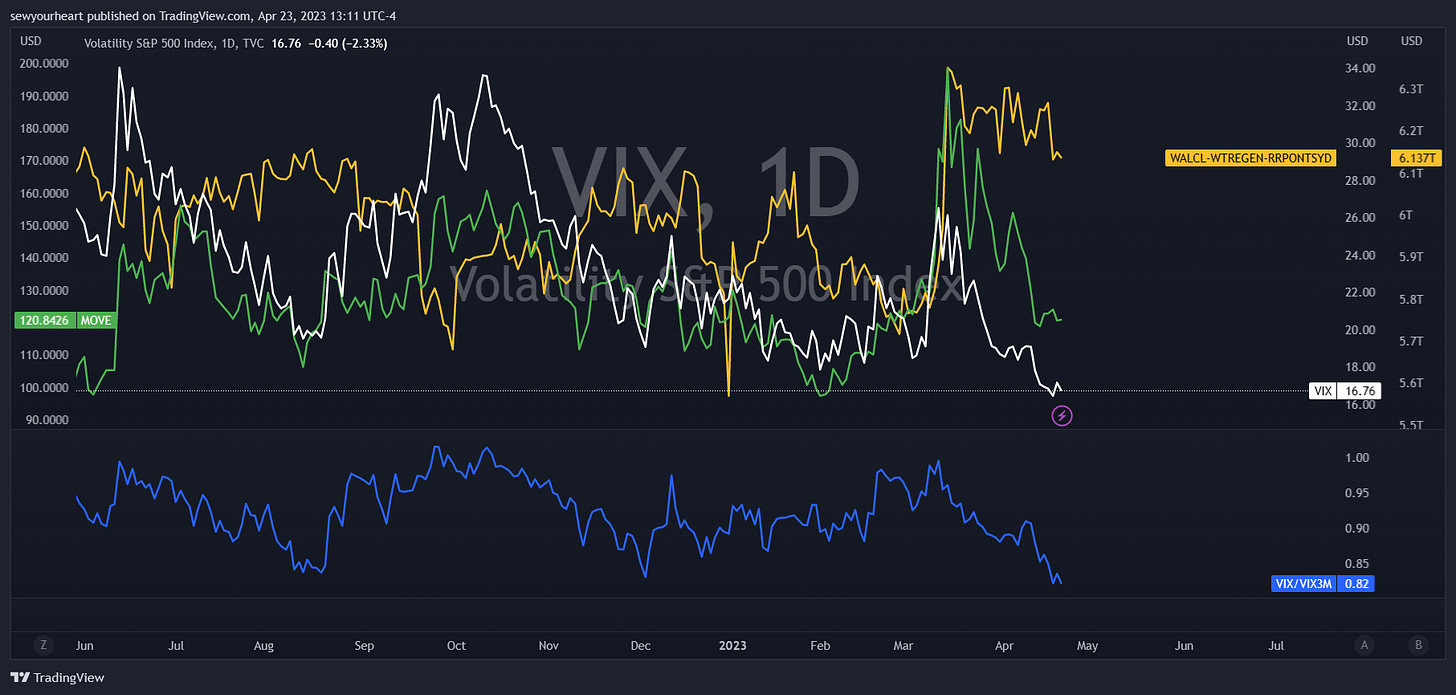

CTAs are also heavily long right now (they were heavily short into the banking crisis) and R:R is skewed to the downside into the generals/big tech earnings while vol is incredibly low.

Short vol is almost always a profitable trade. However, with the above conditions considered & debt ceiling woes that may need to be addressed as early as late May, it doesn’t seem wise to get too comfortable being short vol here.

I forgot to include the expiry for my long vol position in my last post, but I ended up cutting the position, taking a small loss initially & reentering this Friday with VIX August calls. If vol gets any lower, I’ll add to the position as I see fit.

Lastly, further upside is possible, albeit limited, and the possibility for us to drift higher in the near future on abysmal breadth shouldn’t be dismissed. If you go short any of the indexes (I might on Monday) you should definitely buy time & size appropriately.