Does He Know?

Genuinely asking here...

Long time no see.

I’ll start this off by saying that I have no position in equities right now — so I’m not talking my book here. I’ll expound upon why after a quick positioning update.

I rode the QQQ shorts from 444.87 > 415, TLT shorts from 94.60 > 87.50 (still have a *few* left), and am out of all of the CL longs from 69.80 > 87. I got some QQQ Put spreads on 5/6 & again on 5/10. Struck out on those and closed them on 5/15. Entered a starter position on CL shortly after that.

Now, there are a few reasons for my present perspective on equities.

The wrecking ball — rising oil, rising $, and a bear steepener — may reappear soon.

Transports aren’t playing ball.

As for the wrecking ball,

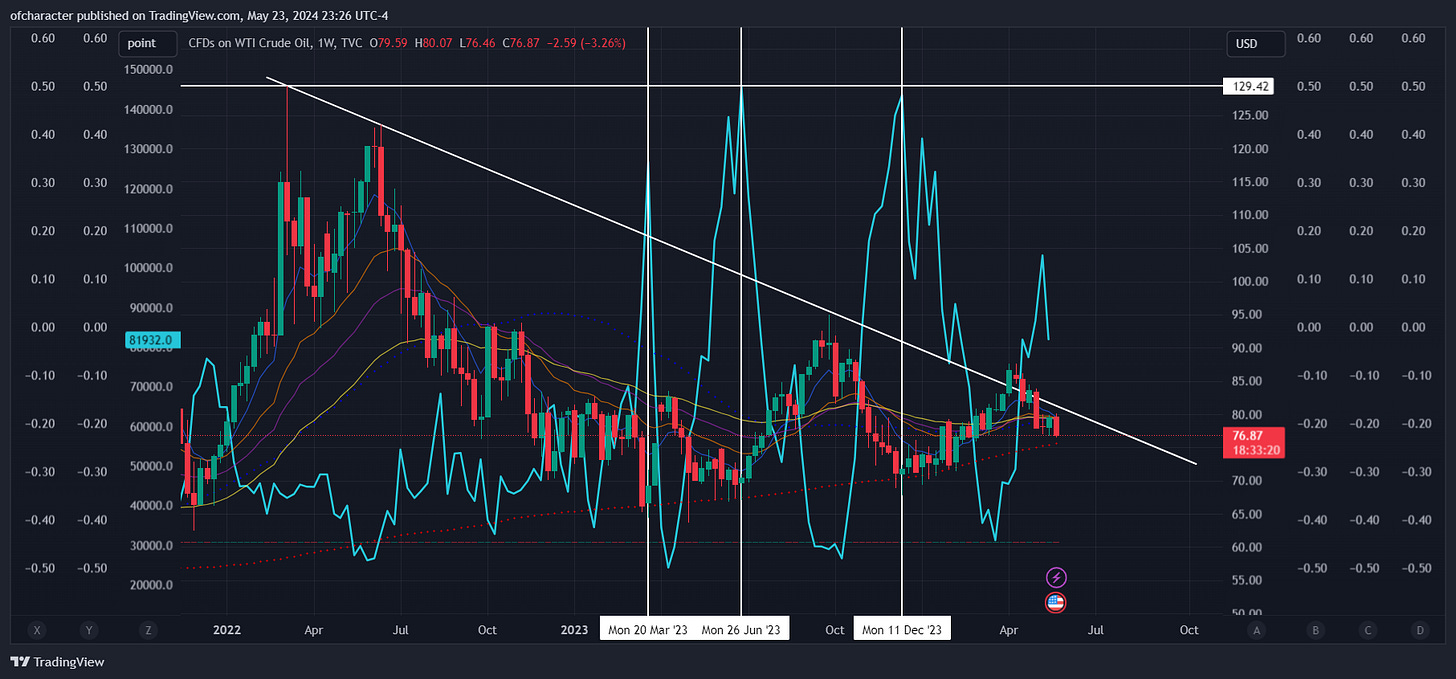

In light blue is managed money short positions in CL. I marked periods where positioning was conducive for upside. This helped me go long on 7/7/23 and again on 12/13/23.

The $ has clearly been weak as of late, but it’s not dead yet. Still has some life left.

And the long end wasn’t playing ball either. It’s recent performance has been nothing more than a countertrend rally. Also worth noting that the plethora of tailwinds for bonds couldn’t muster anything more than that.

Slowly but surely, the components of the wrecking ball will re-enter the playing field.

Transports

While re-reading one of my favorite books from Harry D Schultz — Bear Market Investing Strategies — I stumbled upon some pertinent information.

“Dow Theory was seen as a bellwether indicator of economic direction, rather than a stock market predictor. But, over the 100 plus years it has been in existence, it has forecast most major bull and bear markets…Dow Theory holds that whenever the DJIA moves to a new rally high (or low), the Dow Jones transportation average must do the same (thus “confirming the move”) shortly thereafter, or else the move is false and cannot long be sustained and a reversal will follow.”

Below I have marked periods where transports topped while the indices rallied higher — SPX specifically in these images (the same is true with the Dow as well).

And, drumroll please…

You are seeing this correctly. Transports have not made a new high since November 2021. This is the longest this divergence has held.

They can do one of two things here:

Catch up.

Signal a substantial decline.

I believe that they will choose the latter.

Transports to the broader market:

Until next time,

Pierre.