Enjoy The Ride

EOY Recap Coming Soon

Quick positioning update:

Re-entered SPX puts on 10/19, closed over half on 10/26, and unloaded the rest on 11/1 in the early session.

Closed the last of my NVDA puts on 11/1 as well.

Closed the long vol hedge on 10/26.

Still (albeit slightly) long oil from 7/7.

Two things that were on the forefront of my mind since my last post:

The most aggressive rallies occur in bear markets.

Shorting is already difficult enough, don’t let your ego make you overstay your welcome.

That being said, the ATH crew has come out to play once again. The bear steepener — which has been the main driver of bonds + stocks since the July top — is presently on pause after Yellen’s stick save (QRA issuance), & the weak growth/labor market data. Bonds + stocks are still positively correlated (no bueno for risk), and FOMO is rising as the market looks past every mounting risk.

To clarify the Yellen stick save bit, the issuance was below expectations when the market was expecting more, resulting in a rally sparked by rates falling materially. So in an “unforeseen turn of events,” it was rates — yes the same rates that so many said didn’t matter for the first half of the year — that ignited this rally. This means that the long-term outlook has not changed at all whatsoever, while the short-term did so drastically.

Thus, equities and bonds (long end) will head lower longer-term, and as always it will be important to be patient & nimble if you are planning to short either of them. FWIW, I am still not on the Santa Rally sleigh.

First Slowly Then All at Once

Markets can turn on dimes as we’ve seen them do numerous times over the course of this bear market, but the economy does not. The signs of the changing economy show up over a period of many months, as it rolls over, or rejuvenates. In this instance, the economy is rolling over, and certain sectors & assets have different interest rate sensitivity.

The labor market — being one of the more salient sectors — has unequivocally been obfuscated by the pandemic, making it exceedingly difficult to read. It doesn’t help whenever the organization responsible for releasing the data isn’t being as honest as they should be, and that’s an understatement.

From ZeroHedge: “In total, 8 of the past 8 months have been revised sharply lower in what only idiots can not see is clearly mandated political propaganda designed to make the economy look stronger at first glance then quietly revise the growth away….the scariest number however did not come from the Establishment survey at all, but rather from the Household survey, where the number of employed workers plunged by 348K, the biggest drop since the covid lockdowns, This means that the US is already in recession.”

Is the US really in recession? What about Q3’s scorching hot 4.9% GDP? Surely the US cannot be in a recession with an economy this hot. A recurring theme in my posts is that history often rhymes. In Q4 of 2007, which was also later declared the advent of The Great Recession, GDP was also 4.9%.

But how could this be? We know that the unemployment rate is more indicative of a recession than GDP given how in 1947 there were two consecutive negative GDP readings without a recession. And in 2001, although GDP didn’t go negative for two straight quarters, there was still a recession. The key factor in each instance was the unemployment rate. More recently, last year we recorded two consecutive negative GDP readings without a recession because unemployment was clearly too low — and still declining.

The Sahm Rule

Knowing that the unemployment rate is of the utmost importance here, it’s time to turn to the Sahm Rule. The Sahm Rule states that a recession is likely underway when the 3 month moving average of the unemployment rate rises by at least half a percentage point (50 basis points) relative to its lowest point in the previous 12 months. With data obfuscation & political propaganda leading to many revisions — which isn’t new — let’s take a look at the current reading.

Now for the last two recessions.

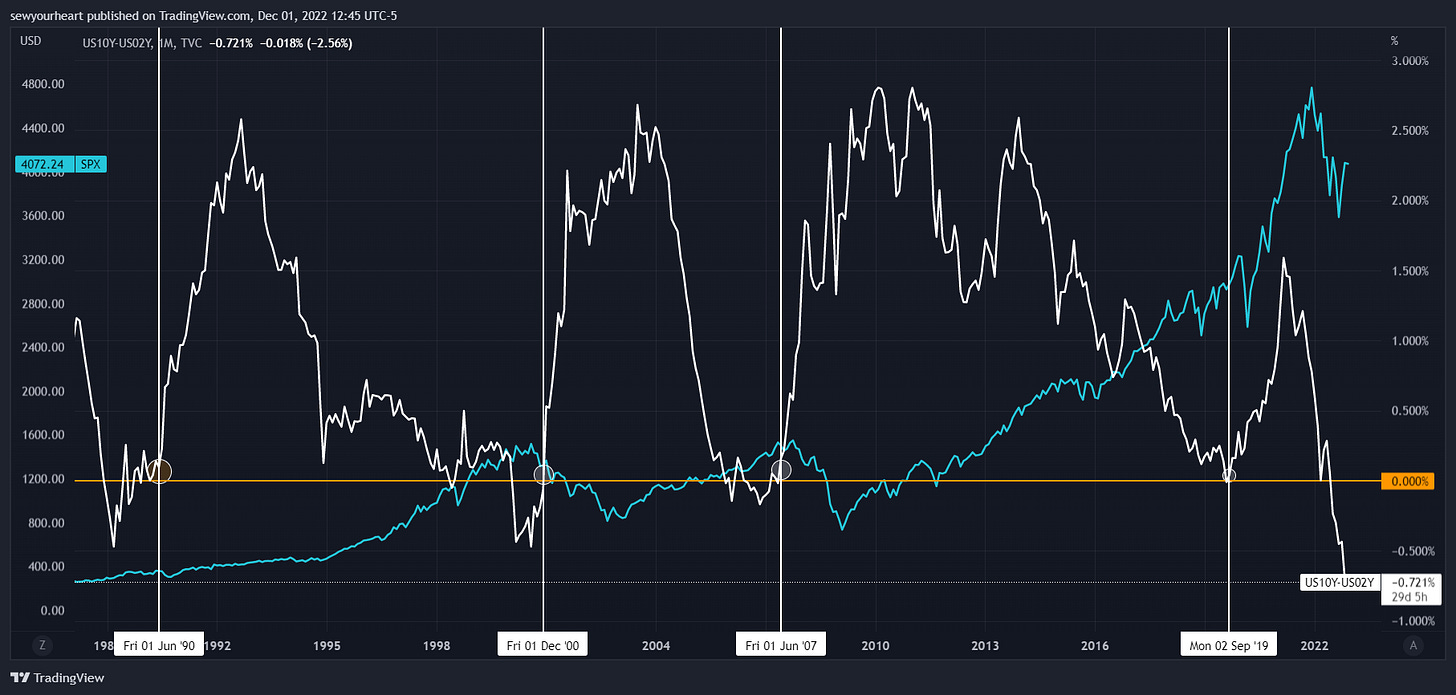

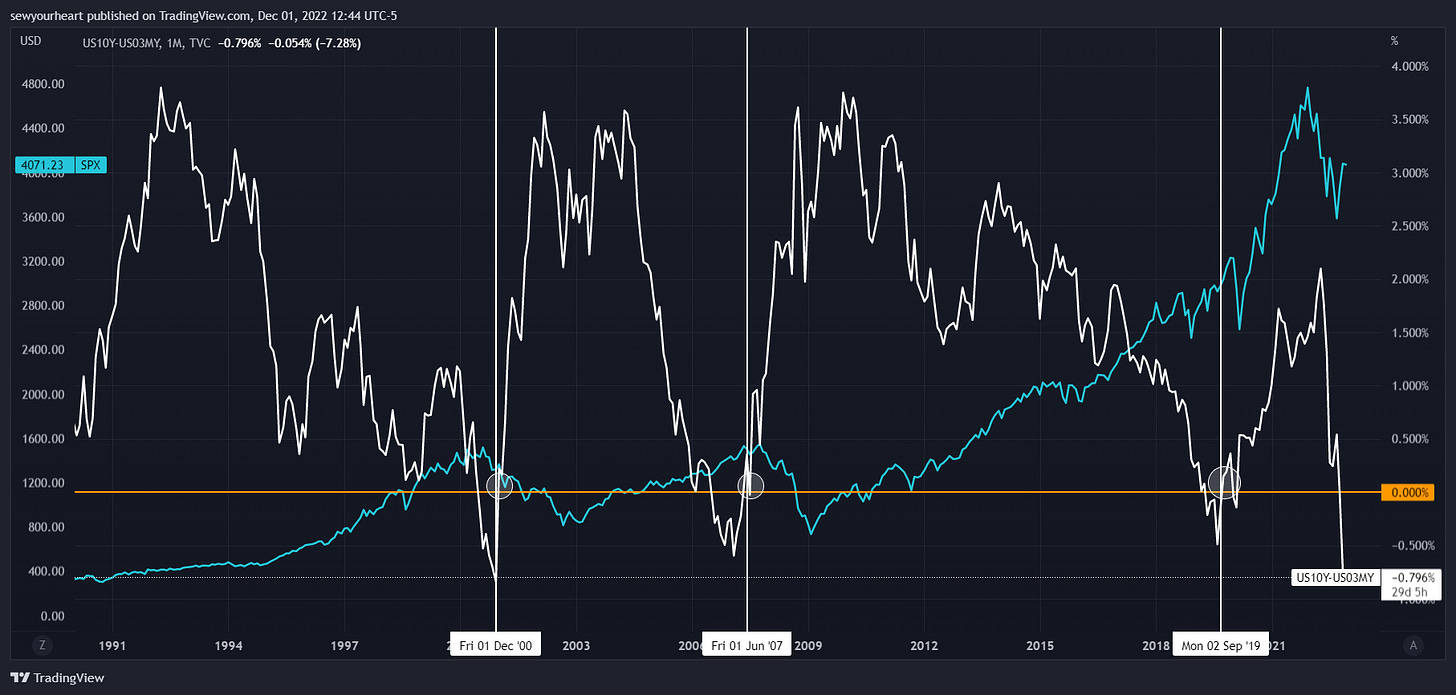

The major disparity between the 3 is that we presently have high, embedded inflation to deal with. I previously mentioned that the advent of the bear steepener would also mark the bottom of the unemployment rate. In every other cycle, the re-steepening/un-inverting of the yield curve coincides with the resumption of downtrends and the advent of recessions.

A quick blast from the past:

“As I’ve said before, bear markets are a process, and you can’t rush them.

For instance, many were quick to claim the advent of a recession in late July, but there remains a plethora of evidence to negate this claim.

Neither of the closely watched spreads of the yield curve have re-steepened yet. Everyone knows that they have inverted already, but few recognize that this is a testament to how early we are in this bear market. Re-steepening of the yield curve has coincided with the advent of recessions and further continuation of downturns.” —

If you are in the recession camp right now then what you really have on your hands is stagflation (a recession with high inflation), which we’ve only experienced once before in the US. Fiscal profligacy/irresponsibility doesn’t help alleviate any inflationary pressure either.

The Oil Market

Since KSA’s implementation of cuts in July, the oil market has been considerably tight, resulting in a surge in oil prices. As the market cools off after reaching a short-term peak in late September, I’m sure that many are confused as to how it’s doing so considering that we have serious geopolitical risk due to the war in the Middle East.

The world we entered into after 2020 began is undoubtedly more chaotic than what we are accustomed to. So, it’s unsurprising that most are apathetic towards genuine geopolitical risk. Think back to early 2022 when the Russia/Ukraine war commenced. Many loudly, and confidently proclaimed that the war would be over quickly — and in extreme cases, in less than a month. This was due to an inability to recognize the signs of the times.

Ecclesiastes 3 says it best, “To everything there is a season….a time of war, and a time of peace.”

This is a time of war, and you can ascribe a 100% chance of this war in the Middle East escalating outside of the region. The sheer severity of the war so far despite countless calls for ceasefires should make this transpicuous.

Irrespective of this war, the fundamentals for oil are still conducive for more upside.

Riyadh, November 05, 2023, SPA -- An official source from the Ministry of Energy announced that the Kingdom of Saudi Arabia will continue the voluntary cut of one million barrels per day, which went into implementation in July 2023 and was later extended until the end of December 2023. Thus, the Kingdom’s production in the month of December 2023 will be approximately 9 million barrels per day.

The source stated that this voluntary cut decision will be reviewed next month to consider extending the cut, deepening the cut, or increasing production. The source also noted that this cut is in addition to the voluntary cut previously announced by the Kingdom in April 2023, which extends until the end of December 2024. The source confirmed that this additional voluntary cut comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets.

OPEC+ remains the captain of the oil market. Thus, all eyes should be on OPEC+. With regards to the oil market; there will be many more headlines in the future that are released with the intention of misleading you — so proceed with patience, discernment, and wisdom.

This bull is still a calf.

The Journey is Far From Over

As the final piece to the stagflation puzzle rears its ugly head, we are simultaneously stepping into a wave of opportunity. Regimes will continue to change at the blink of an eye, wealth will be transferred in copious amounts, & only those who keep coolheaded amidst all of the turbulence will succeed.

Job 5:20-22 “In famine He shall redeem you from death, and in war from the power of the sword. You shall be hidden from the scourge of the tongue, and you shall not be afraid of destruction when it comes. You shall laugh at destruction and famine, and you shall not be afraid of the beasts of the earth.”

I’ll be back with another EOY post before the end of December. It’s been a wild ride so far, and an enjoyable one as well.