Everything Has Its Time

Transition periods are oftentimes rough, but ultimately rewarding.

Admittedly, I did not spend enough time delving into what this post-election world looks like through the lens of markets. I wanted to let the dust settle first, and I believe it’s safe to say that it has now. A month after a red wave swept across the US, it seems as if many are operating under the belief that several of Trump’s proposed scenarios are not subject to change. Namely,

Drill, baby, drill.

Mass deportations and immigration overhaul.

Terminating the “green new scam” and consequently cutting energy prices in half within 12 months from his inauguration.

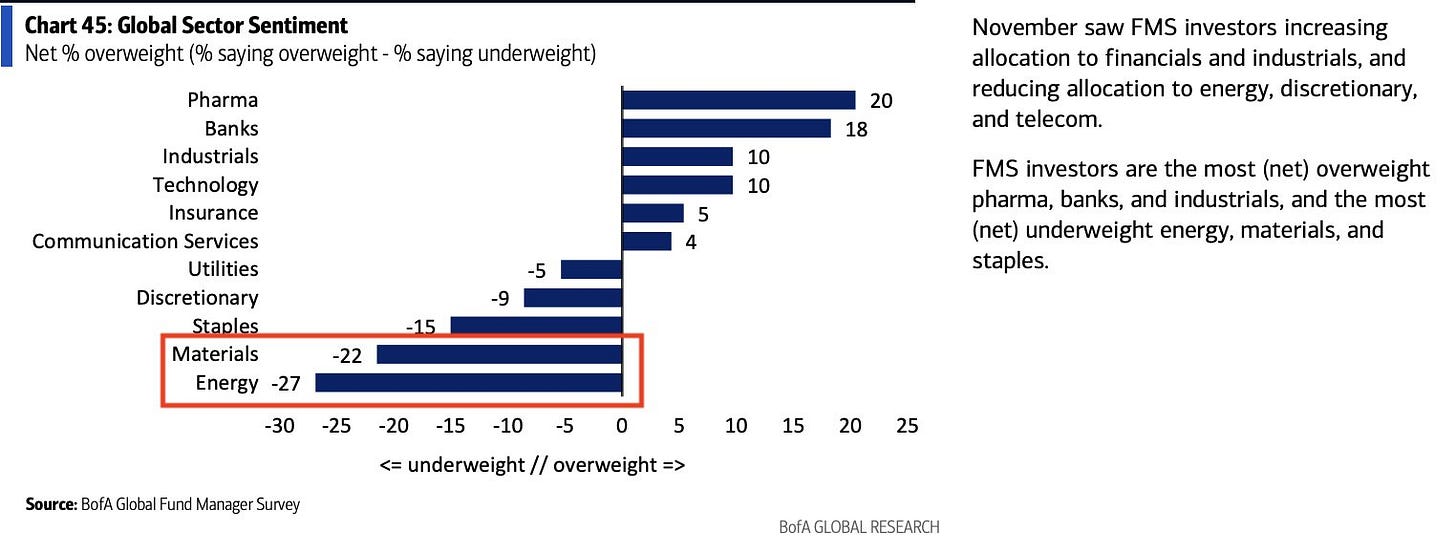

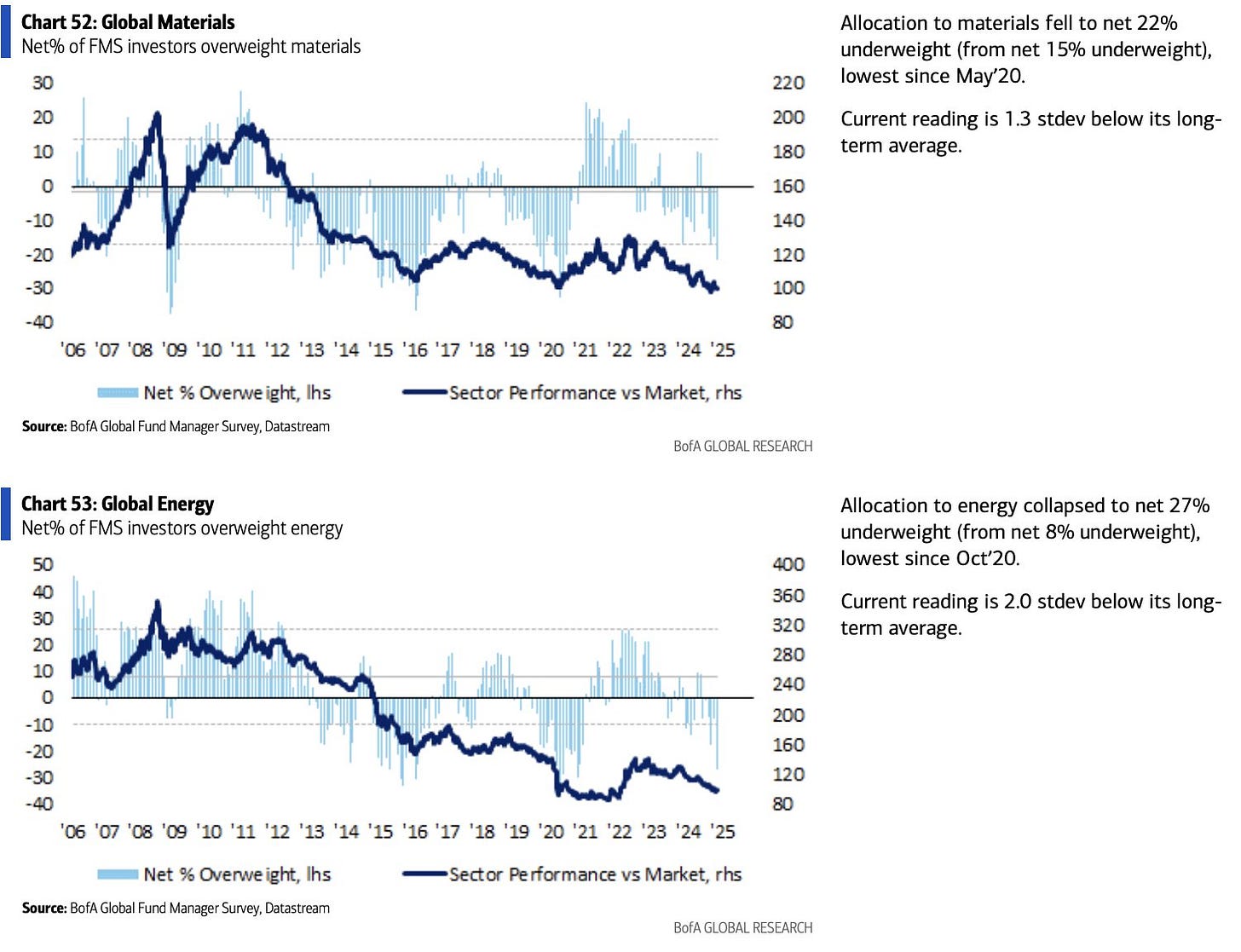

The first has rung through my mind incessantly since its advent. Further evidence of widespread acceptance that this is an incontrovertible outcome can be seen via positioning in energy & oil. Positioning and sentiment in this space were very low beforehand, which has countless times provided lucrative opportunities for both longs & shorts. As for investors, they have questioned why they didn’t just long tech with max leverage for the past 10yrs — completely understandable. However, everything has its time, and the time for energy & oil is soon approaching once again.

In reality, “drill, baby, drill” isn’t likely to be implemented anytime soon as companies remained focused on financial stability and shareholder returns instead of aggressive drilling expansion. Capital discipline and efficiency gains is the name of the game as shale industry execs realize the differences between now and Trump’s first term. Fears of disunity among OPEC+ should be laid to rest for good after the latest meeting as well. They seamlessly pulled off a multilayered deal that enables them to stay in the driver’s seat.

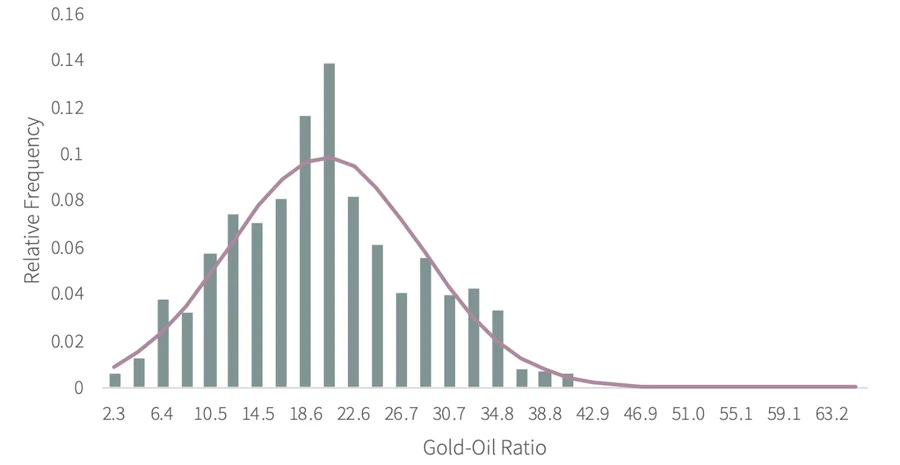

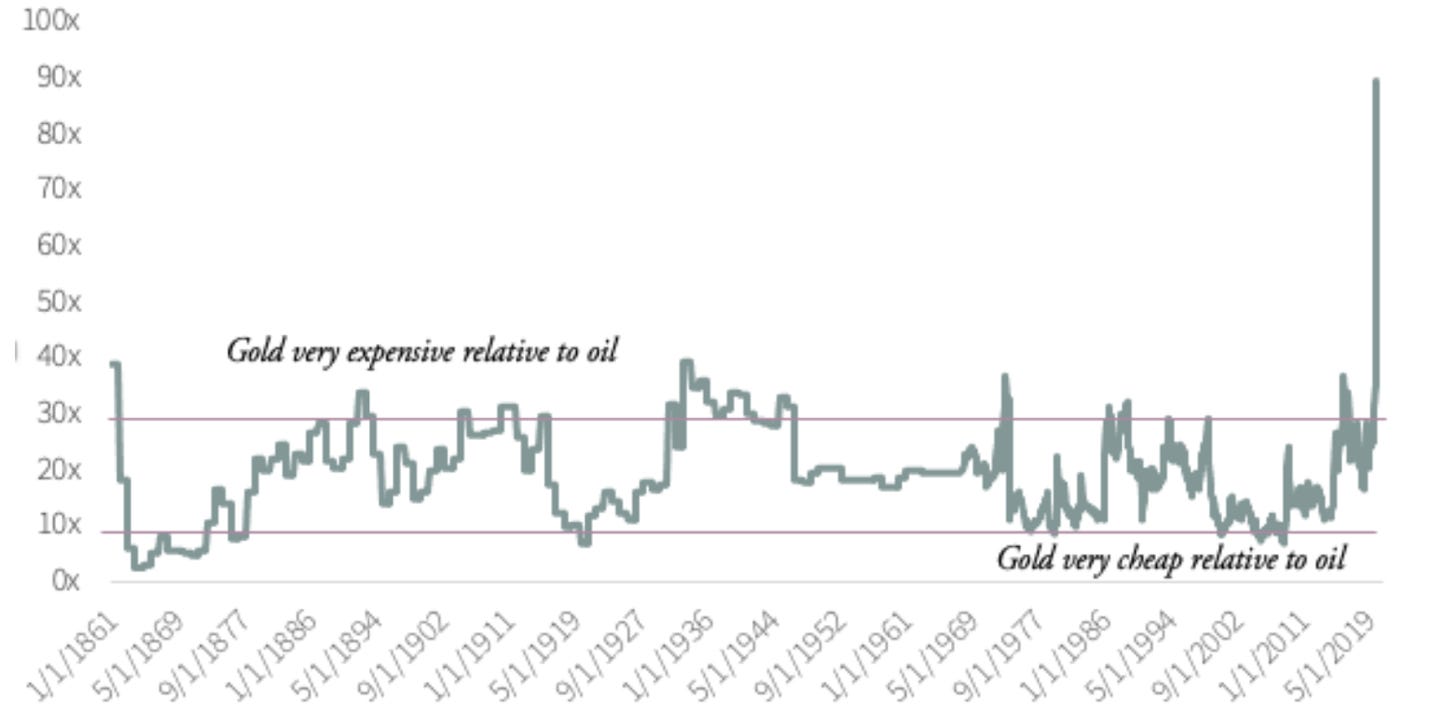

Nonetheless, investors’ perspectives are diametrically opposite. Positioning is near historical lows, sentiment is in hades, and the seemingly perpetual disconnect with fundamentals continues. But all hope is not lost. The gold-oil ratio is currently exceeding 30:1 (39.6), indicating that oil is cheap relative to gold. Historically, crude has returned 32% on average over the next 12 months, while gold has returned 4% on average. This ratio has spent 80% of the time between 10:1 and 30:1.

Since 1984, there have been 27 instances of a monthly close where the gold-oil ratio was at or above 30:1. There were 2 (Mar, Jul) in 1986, 1 (Oct) in 1988, 4 (Jan, Feb, Mar, Jul) in 2016, 12 in 2020, 1 (Jan) in 2021, and 7 (May, Jul, Aug Sep, Oct, Nov, Dec) in 2024. 74% of these monthly closes since 1984 have occurred over the last 4 years. From a yearly close perspective, since 1984 there have been only 2 instances where the gold-oil ratio was at 30:1 — 2020 & (as of right now) 2024.

In what may seem counterintuitive, this is a picture-perfect setup for oil. Oil looks to be building out a multi-month bottom before reality sets in, and almost everybody hates it. Per the Nov BofA FMS: “FMS investors are the most (net) overweight pharma, banks, and industrials, and the most (net) underweight energy, materials, and staples.

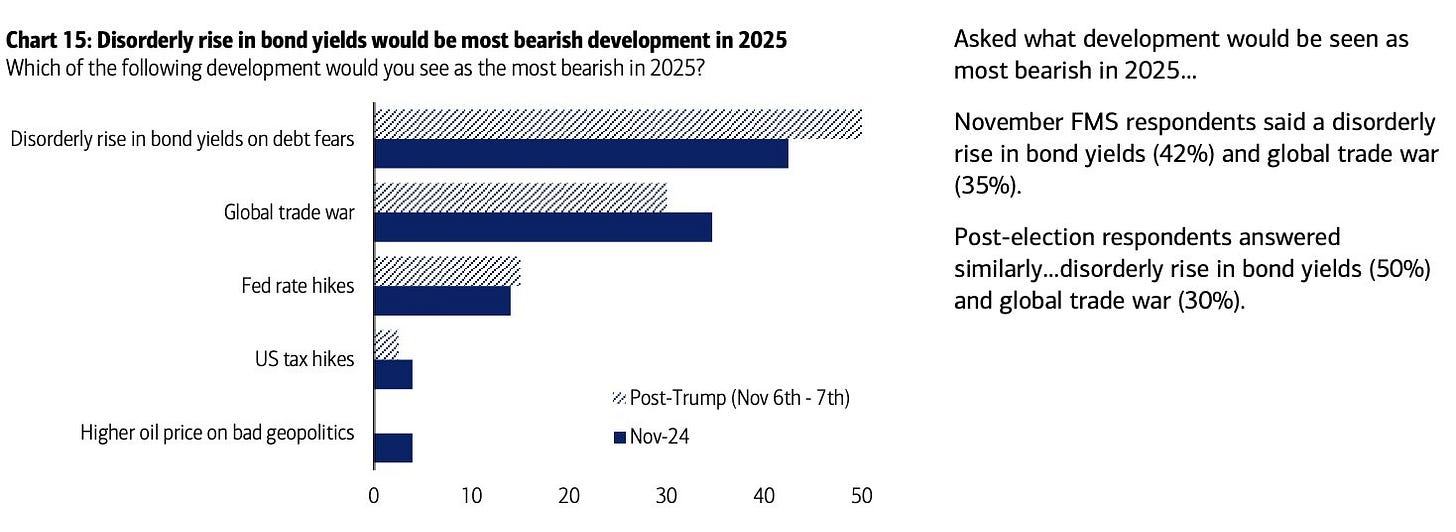

What’s intriguing is the change in their expectations post-election.

Two things stand out in this.

The complete disappearance of a higher oil price on bad geopolitics, especially given current conditions (ME still a tinderbox, geopol. climate arguably most turbulent ever, and Trump is not God).

A disorderly rise in bond yields based on debt fears has increased as the most bearish possible development in 2025 — this seems uncorroborated since debt has been a problem for years and monetary incompetence is largely responsible for yields’ path.

FMS respondents don’t seem to care that central banks are cutting rates at the fastest pace since May 2020 with China coming back online in spite of all the enmity, and both are distinctively supportive of inflation, higher long-term yields & oil prices as it stands. All things considered; oil & energy are set to have performances that defy consensus expectations.

What Does This Suggest for Equities?

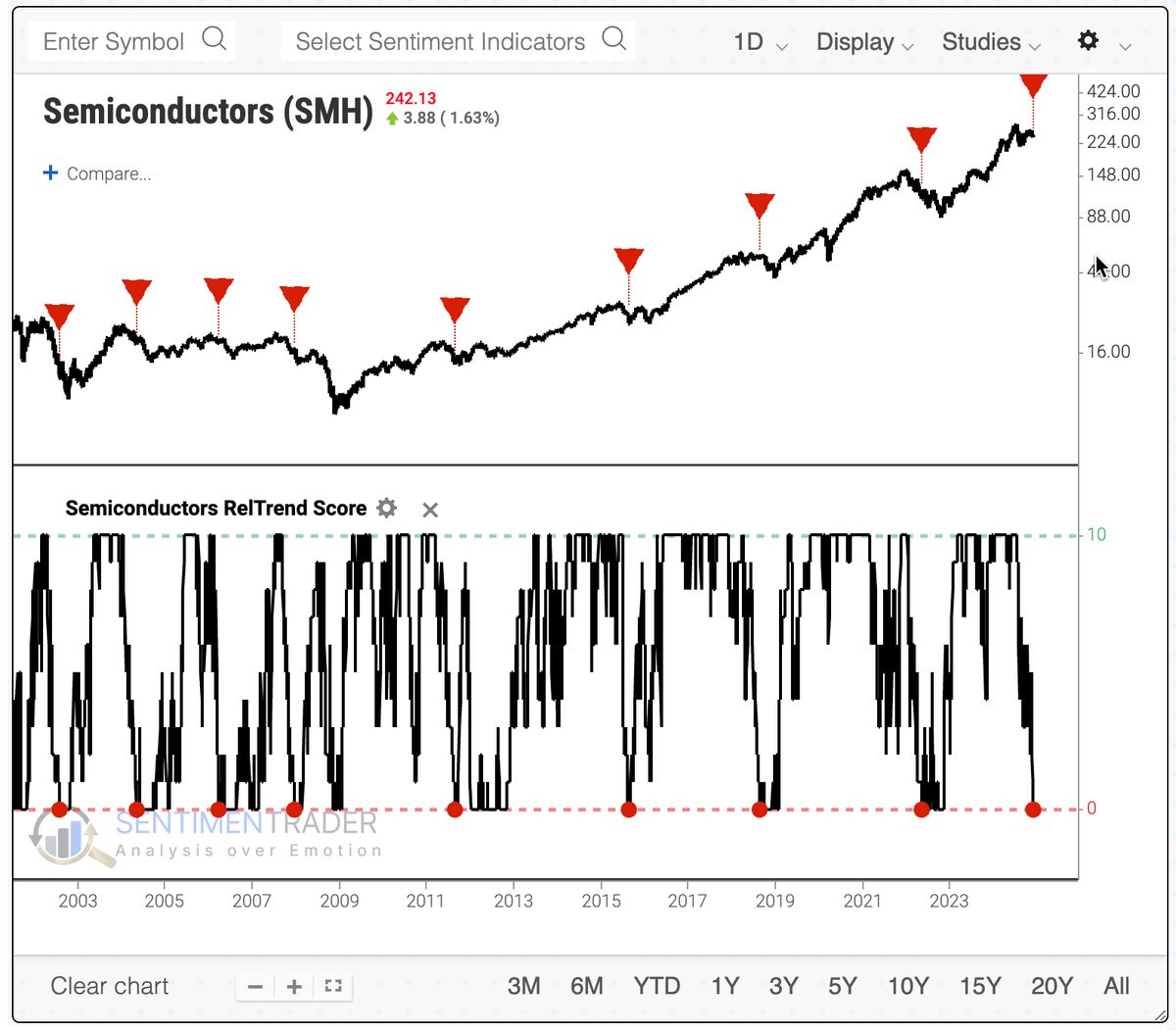

AI fever has taken the world by storm since May 2023. Consequently, semiconductors have performed exceptionally well over the same period. Needless to say, they are highly cyclical. Semiconductor cycles are triggered by a combination of demand surges, overinvestment, and macroeconomic shifts. Notably, there is a significant correlation between GDP and a semiconductor cycle. As I noted back in Q3 of ‘23, growth likely peaked, and I believe this will hold up. Growth is likely to be relatively stagnant for the foreseeable future, but nothing reminiscent of a deflationary bust.

Equally important are geopolitics and trade relations. Trade restrictions, export controls, and geopolitical tensions can disrupt supply chains. A few months ago, China constrained access of gallium to Europe, and gallium prices soared, nearly doubling. More recently, China restricted the export of gallium & germanium to the US under dual use policy. Both of these are critical to the manufacturing of semiconductors, and China is responsible for 98% of global gallium production. This move comes as a direct response to the US export controls on semiconductor tech in China and has the potential to leave ripple effects across several key industries.

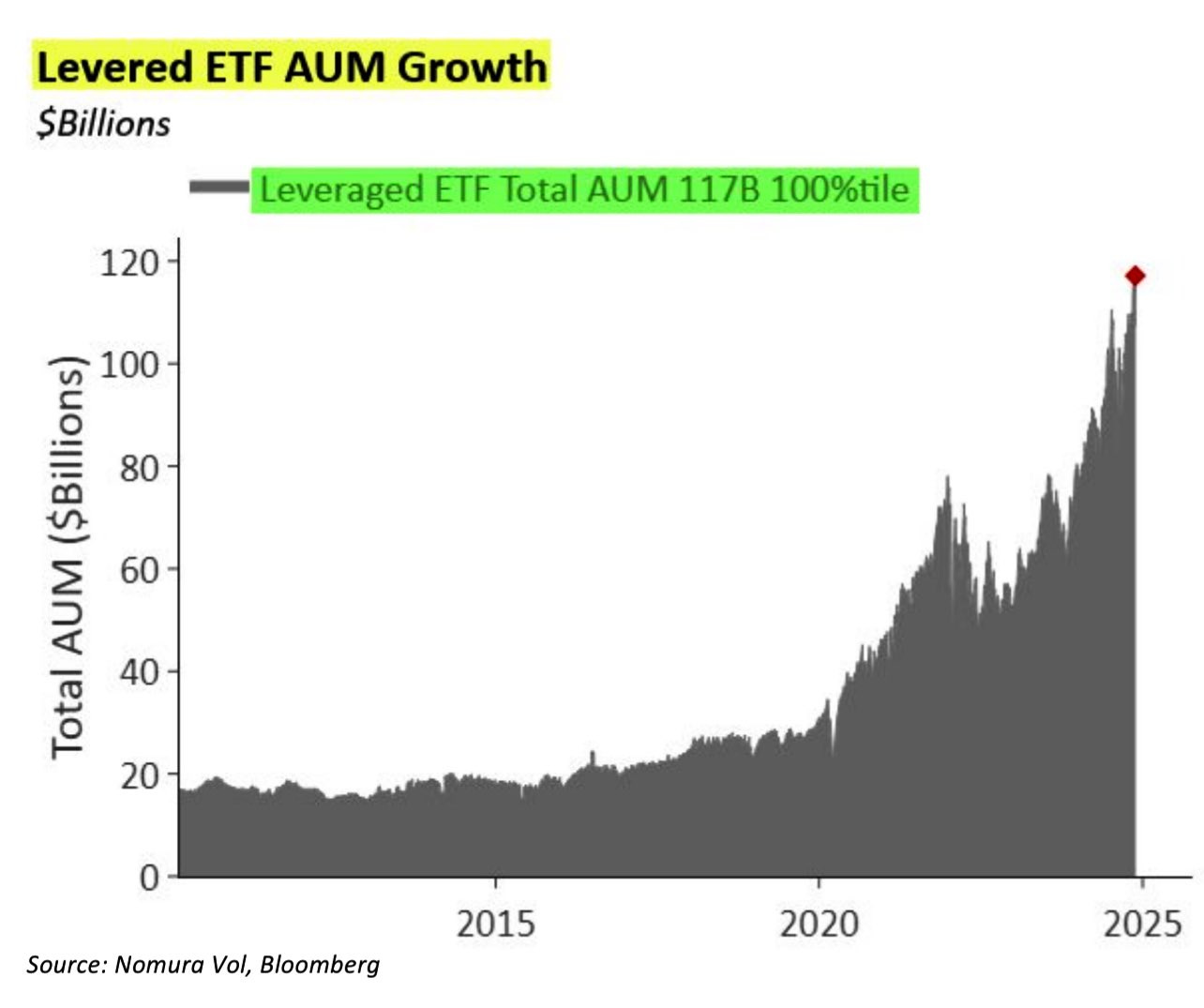

What’s arguably most salient, is leverage. The demand for leverage on long positions has risen with stock returns leaving the cost of leverage historically elevated. The cost of leverage is presently at levels last seen shortly before the GFC. One sign of this is seen in options activity, which reached nearly 70 million contracts on average in November (second highest on record), since they supply a leveraged way to bet on stocks with relatively little money. Another can be seen in increased leveraged ETF usage, which has recently hit record highs as well.

Per Nomura: “Retail is absolutely jamming into this slow melt-up in US equities as per the current record AUM in leveraged ETFs, which as I always say, can tend to act as a source of late-day “Synthetic NEGATIVE/SHORT gamma” which is somewhat counterbalancing against the previously mentioned “Long gamma” from the options sellers… which will be problematic on a reversal LOWER day, of course then amplifying the selloff into their EOD rebalance…but for now, it’s feeding upside momentum, as “(Synthetic) Short gamma” cuts two way.”

Some of the most popular leveraged ETFs are TQQQ, SOXL, QLD, FNGU, & NVDL — this brings me back to semis. Per Sentimentrader: “The Relative Trend Score for SMH has cycled from 10 (all of the trend metrics for the SMH/S&P 500 ratio are positive) to 0 (none of them are). After similar cycles, SMH suffered a negative return all but one time over the next six months. The S&P 500 tended to struggle as well.”

So, the market leaders for the past year & some change are set to roll over and virtually nobody cares. These are not charts that entice me to increase LT holdings. And neither are these.

It looks like new leaders will eventually emerge and this transition period is not likely to be conspicuous or tractable.

Conclusion

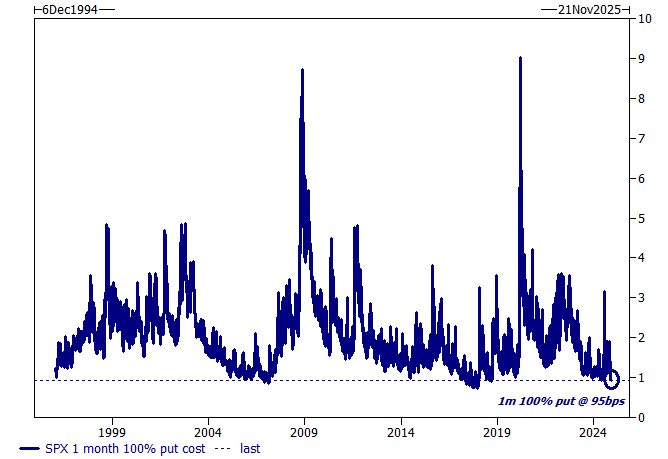

The market remains exceedingly sanguine with a record high % of US consumers expecting equities to be higher in the coming year and rates much lower, reflecting “Trump optimism.” The cost of leverage is at historic heights while the cost of portfolio protection is at generational lows. Per ZH: “The Goldman trader explains that the 1 month 100% strike put costs 95 basis points. This means that you break even if the S&P trades lower by 50 handles (from here) any time over the next month!”

This is not a call to sell everything, of course, but as leadership gradually — and then suddenly — shifts beneath the surface, it will likely pay to have protection.

What’s the Trade?

I have been in & out of trades lately, namely,

Long XLE via March call spreads 88s > 97s

Long CL via March call spreads 67s > 71s

Short TLT via Jan put spreads 98s > 89s & 93s

Short SPX & NDX via March SPX put spreads/ Feb QQQ puts 140 pts from SPX & 730 from NDX, trimmed to 30% by 11/20. Now back to a full position as of 12/6 — Jun exp.

I will let the dust settle from the recent OPEC+ meeting before going long oil via CL and XLE again. Long China looks tempting but if I do try that again (initially Jan 23rd) it will not be in size (as it stands right now). Crypto looks enticing as there is certainly a place for digital currency in our system, but only as a trade, not an investment (yet). Commodities, the long-end, and cross-asset vol are going higher long-term. Aggressively adding to LT equity holdings is not currently in my plans. Overall, I think one can stay long US equities without worry in the short-term — unless you’re overleveraged, and many people are —, but not purchasing protection at these levels is incredibly injudicious.

Many will learn the differences between a mid & late cycle Trump presidency — reality often differs from expectations.

“Is there anything of which it may be said, “See, this is new”?

It has already been in ancient times before us.

There is no remembrance of former things,

Nor will there be any remembrance of things that are to come

By those who will come after. (Ecclesiastes 1:10-11).