Risk Happens Fast

"There are decades where nothing happens; and there are weeks where decades happen"—Vladimir Ilyich Lenin.

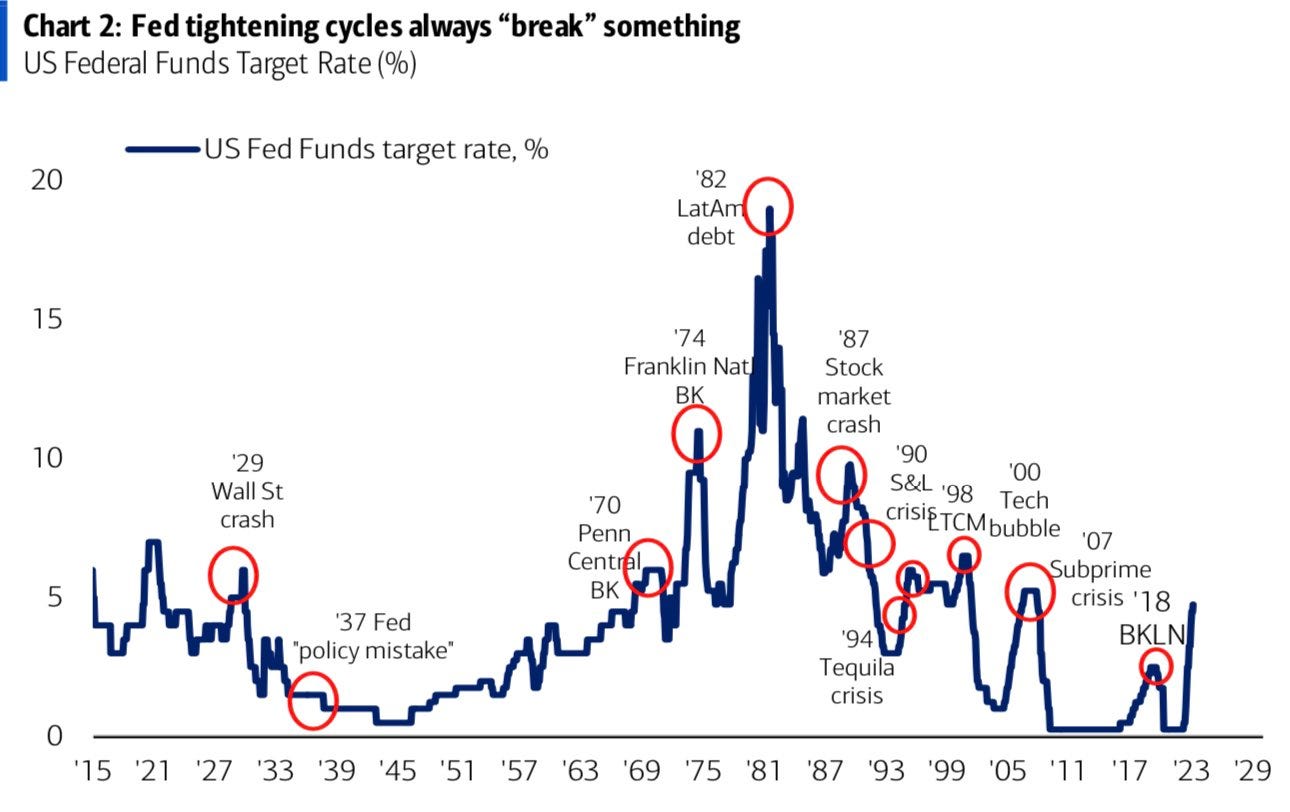

This’ll be a very short post as I’m going to refrain from behaving like an expert on the current banking fiasco. In my 2023 outlook post I mentioned that “The response lag from a historical pace of rate hikes will also make its presence felt in 2023, and it will augment volatility as well.”

This is not to say that I’m blaming the Fed for what’s happening with these banks. It appeared to be a combination of willful ignorance and a historic pace of rate hikes. All that matters now is whether or not the Fed will blink at the upcoming FOMC meeting.

I don’t believe they will — but if they do— that would be another major policy error committed by the Fed. The inflationary psychology that Powell claimed to be attempting to rout, would be reminiscent of the 70s again.

With pivotal data points releasing soon, market participants put inflation in the rear view mirror as the banking fiasco sparks fears across the financial system.

Last Friday I took a look at a chart that I thought was pertinent.

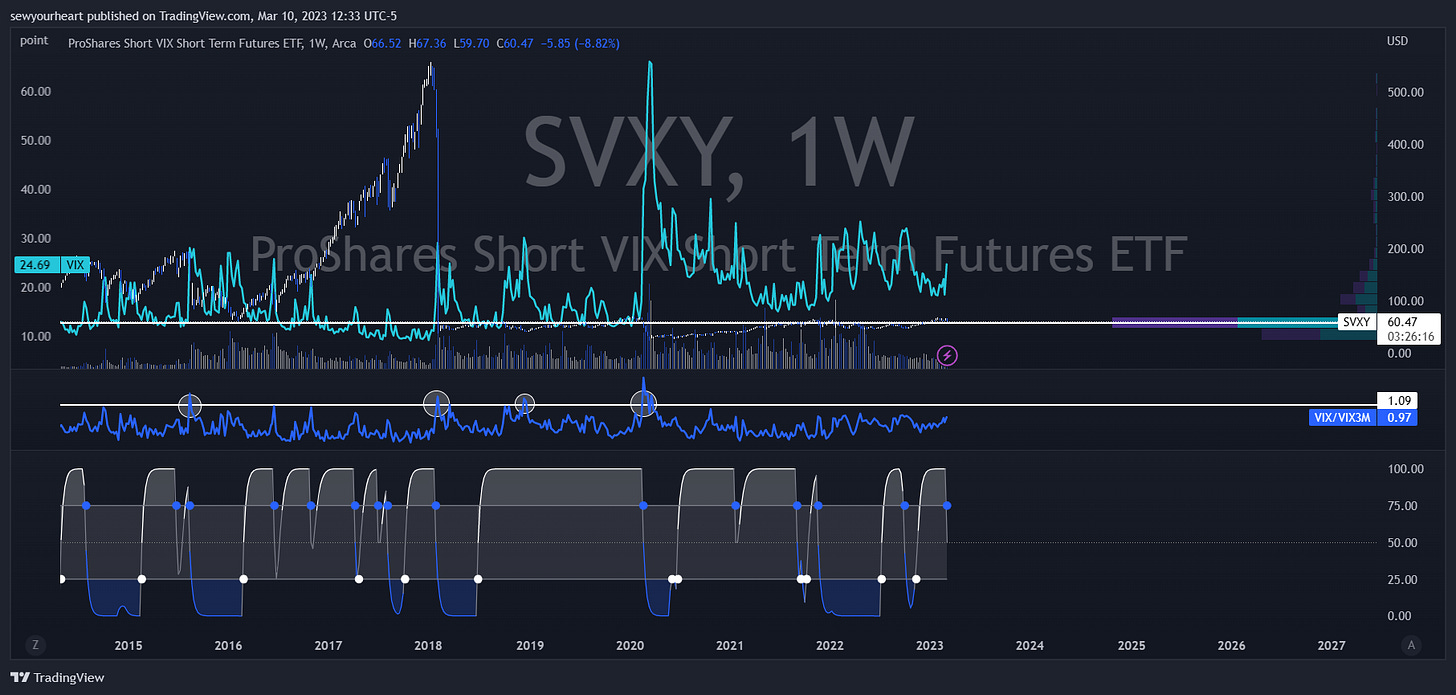

The VIX/VIX3M ratio is a great risk-off indicator. When it’s above 1.09, the chances that there will be a major selloff in equities increase, leading to an explosion in volatility. In this chart above I circled the times when the ratio crossed above 1.09 and coincided with a weekly sell signal on SVXY.

From left to right the dates and events that correspond with the readings:

August 17th, 2015 — Flash crash (spillover from China meltdown).

January 29th, 2018 — Volmaggedon.

December 17th, 2018 — No weekly sell signal, but ratio was over 1.09 and VIX rose considerably due to fears from overtightening and the China-US trade war.

February 24th, 2020 — COVID crash.

? ?, 2023? — Not guaranteed but looking more likely by the day.

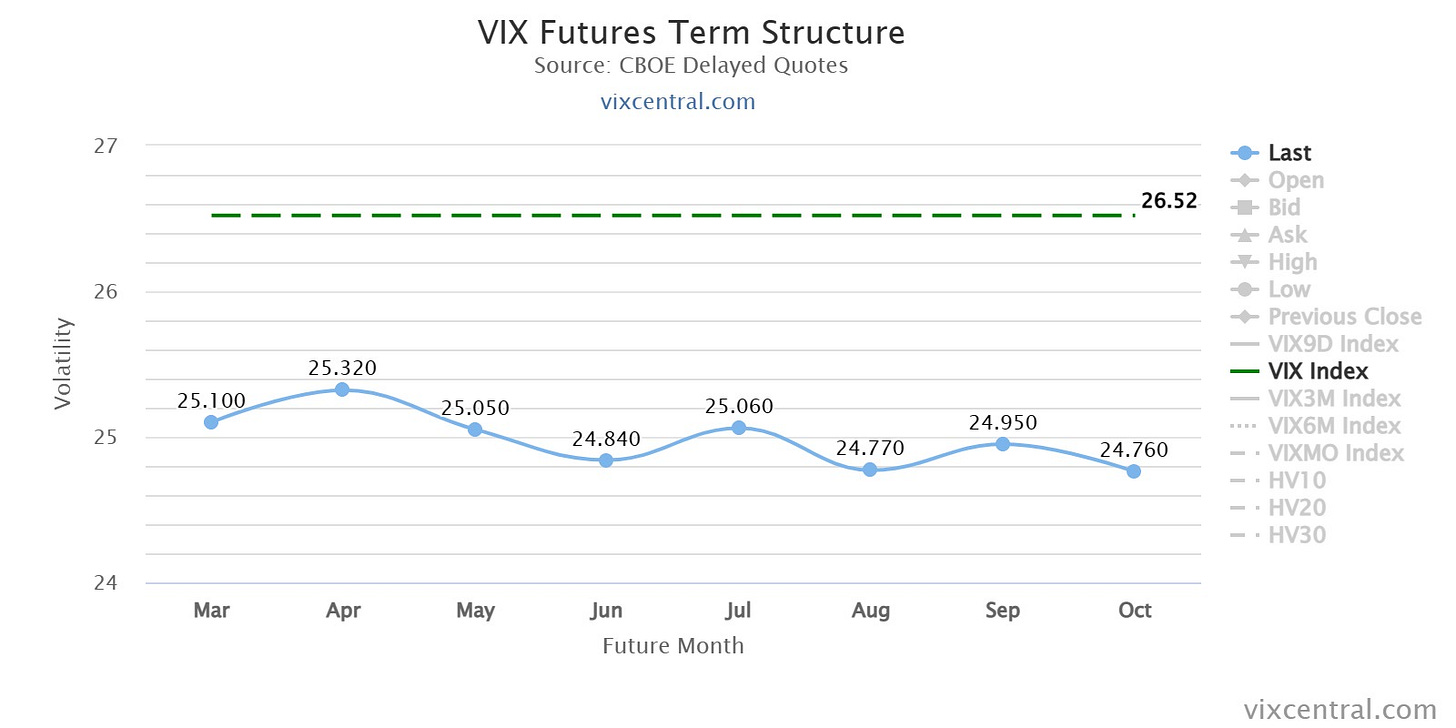

Today rate vol is higher than it was at the peak of the COVID crash.

Equity vol is elevated and looks like it will continue its ascendence. The VIX TS is elevated, and the front end is almost backwardated. Also the VIX/VIX3M ratio is now 1.00.

And the 2s10s steepener trade played out beautifully. This is a sign of distress in the financial system and the consequent desire for interest rate cuts in response to it.

This is one of those weeks where decades happen. Be vigilant.