Surprise, Surprise

It's still a brave new world for markets, for now...

It’s still a brave new world for markets, for now…

Firstly, let’s address the persistent disconnect between markets and rate cut expectations.

This comes at no surprise given that market participants have longed for a pivot since the beginning of this hiking cycle. A visual representation of this disconnect:

Equities have clearly trudged forward in spite of this monumental shift in expectations. My sentiment regarding this is still as follows:

It’s becoming apparent to the broader market that 7 rate cuts in 2024 was a pipe dream.

This is major because:

This historic rally was induced by unfounded rate cut expectations.

This shift in expectations coincided with February OpEx ahead of seasonal weakness.

Inflationary factors aren’t set to fizzle out anytime soon.

Thus, equities & bonds should respond commensurately to this shift. In fact, it looks like bonds are already responding. They won’t be in limbo for much longer.

However, there is still a large enough cohort that needs to see more on the inflation front in order to be convinced that Jan wasn’t just a blip. I believe that the only thing stopping this train momentarily is Feb CPI coming in hot. It would not only challenge the belief that Jan was just a blip, but also potentially cause a shift in the Fed’s dot plot as well. I think markets are severely underpricing the risk of this development.

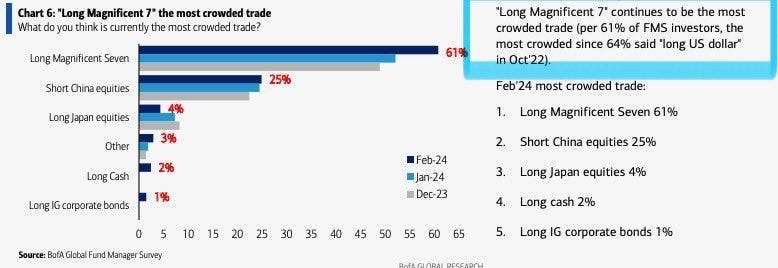

A huge contributor to this underpricing is the widespread love of Mag7.

And honestly, at this point, it is no longer the Mag7 leading this market. It’s more like NVDA/semis, or just solely NVDA. This momentum trade is currently as crowded as the long USD trade was in Oct ‘22, and that was a major inflection point.

This leads me to what occurred this Thursday and Friday. Early Thursday, I figured it was a no-brainer to get long Mar ‘24 915 NVDA Calls, as the road to $1,000 was all but solidified. I planned to sell them in the morning on Friday, irrespective of whether or not it had reached the big $1,000 mark because:

The stock was showing so much strength that it made me a bit uneasy.

I had errands to run at 11 am.

I took profits 10 mins before 11, was finished up around 2, and to my surprise, I saw that NVDA had sold off considerably. Oddly enough, earlier in the week on Tuesday, I noted that the weekly candle for NVDA was shaping up to be ugly. Then it rallied wildly in my face (lol), only to end up looking like this:

Naturally, momentum took a breather as well.

SPX is in a good spot to take a shot at some downside protection ( a much better spot then where I picked initially).

Bonds are in limbo once again.

And oil is as well. The 80-81 level has proved to be a significant resistance as noted in my last post.

Spot up, vol up is still in play.

And short vol can use a break here.

In conclusion, the only thing stopping this train momentarily is Feb CPI coming in hot. Macro factors aside, positioning is stretched (to say the least) & looks conducive for some sustained downside. Once again, I’m not calling a crash here, just a correction.

Positioning is basically the same as last time, with the addition of more Apr Put spreads on Friday:

Long June ‘24 69 CL Calls, Long May ‘24 83/90 CL Call spreads

Long June ‘24 4800 SPX Puts, Long Apr ‘24 4800/4650 Put spreads, Long Apr ‘24 5050/4950 Put spreads.

And as always, there is a chance that I’m wrong and we continue partying like it’s 2021. Will adjust if that is the case.

Until next time,

Pierre.