The Coup de Grâce

False Narratives Continue to Bite the Dust

False Narratives Continue to Bite the Dust

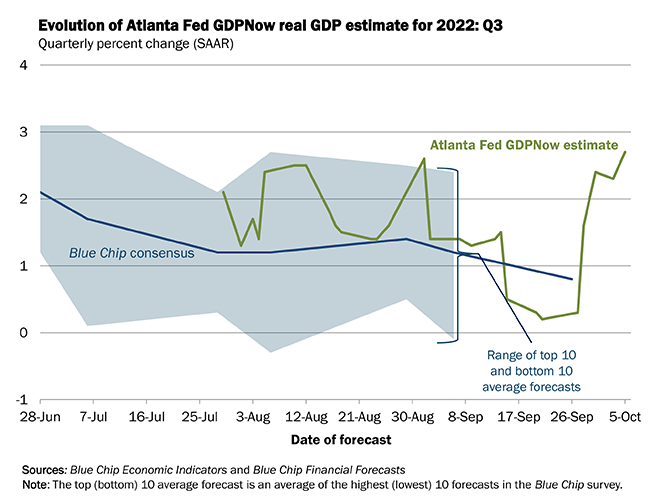

Throughout all the rumors of war and turmoil in the news this week there lied a salient detail that I believe went relatively unnoticed. The Atlanta Fed Q3 GDP estimate came in at a whopping 2.7% on October 5th.

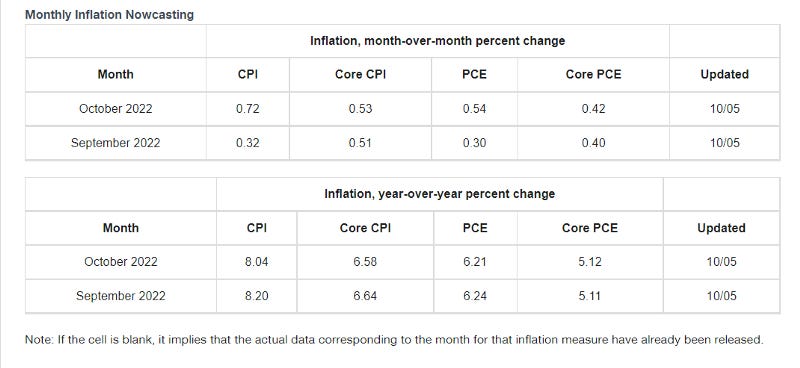

Those who were engrossed in any and all “we’re in a recession” discourse will be in for a surprise. This will be an unpleasant surprise for the fervent pivot supporters specifically because CPI is expected to come in hot for September as well.

Imagine the carnage that ensues from a hot September CPI print after the seemingly incessant “inflation’s peaked” discourse. Couple this with a subsequent positive Q3 GDP reading and two false narratives are killed in quick succession. The first, which is that inflation has definitively peaked; and the second, which is that we are currently in a recession.

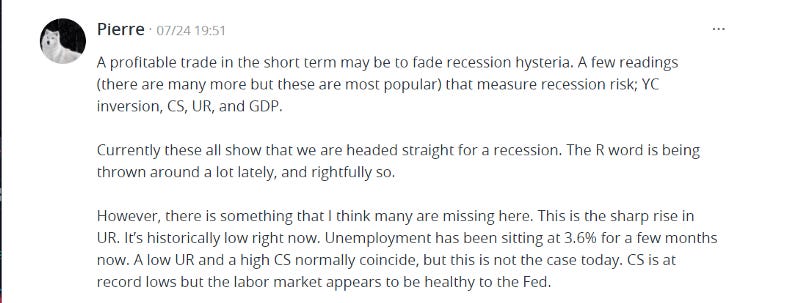

In late July I mentioned that fading the recession hysteria could end up being a profitable trade in the short term. It turned out to be quite a lucrative strategy. I also elucidated the noteworthy non recessionary data, signifying that we weren’t in a recession yet; irrespective of whatever the WH was saying at the time.

Here we are in October, where a hot CPI print and positive Q3 GDP could likely serve as a coup de grâce to the pivot fanatics. They would indisputably permit and incentivize the Fed to be more aggressive with reference to tightening.

Cui Bono?

Ultimately this begets the question, “cui bono?” The Fed’s profligacy is unfortunately an invariable aspect of its monetary policy. While this is a crime worthy of severe punishment, this appears to be the only way to rectify the market’s excesses that have crept into it over the last decade and a half. This is the unpleasant wake-up call for all of the unheeding QE addicts bathed in obstinance.