The Fool Moon is Waning

With cross-asset vol this low, trading gets boring. It's time to have some fun again.

As the end of Q3 approaches, it’s time to do a bit of a recap on how we got here:

The reason why we went from “attempting” fiscal austerity in Q1 to “we will make it all up, times 10, with GROWTH, more than ever before” is because the market is the most significant domestic policy constraint.

Seeing complaints about losses in 401(k)s, the 10y moving +70bps in two days (a truly historic move), and the dollar not behaving itself — aka the triple yasu — will make the best of them do an abrupt about-face.

The financial and trade imbalances that exist within this system cannot be reversed, and dealing with them requires pain/wealth destruction while avoiding worst-case outcomes. It’s a great time to have courage.

The Fool Moon is Waning

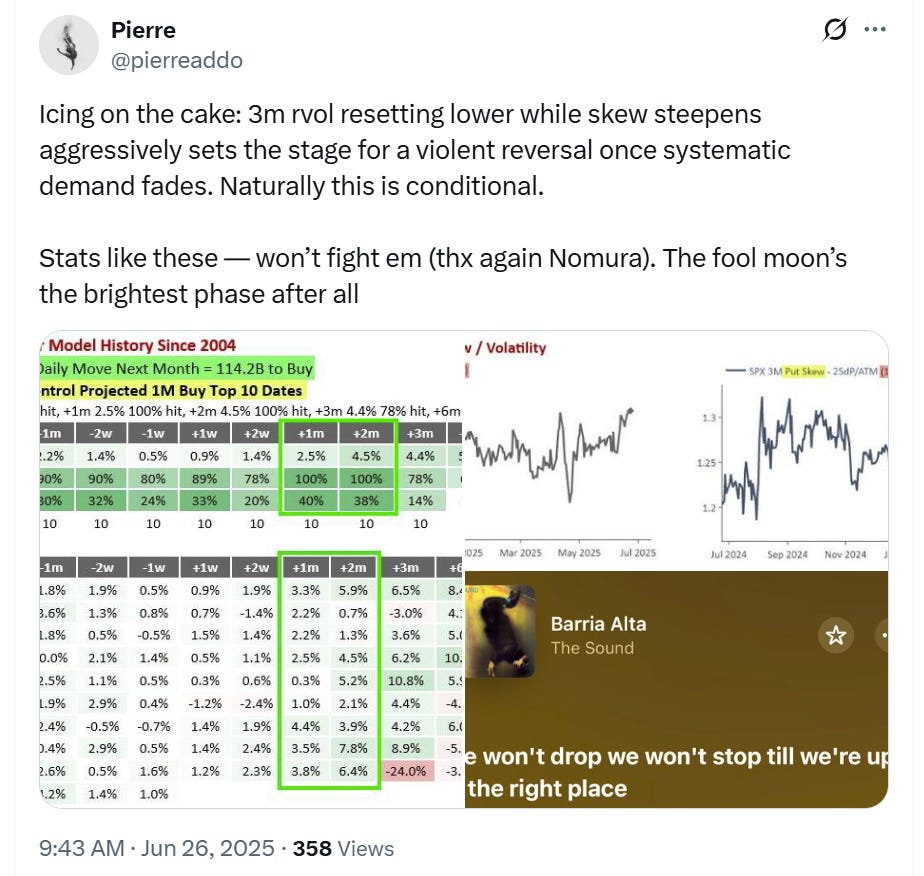

Back in late June — only a few days after my most recent post — Nomura’s McElligott dropped another gem which proved to be quite a lucrative signal.

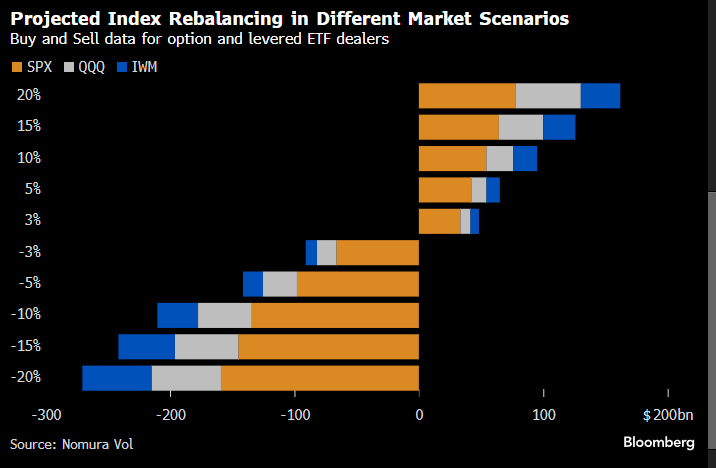

That’s a 100% hit rate 2 months out alongside some stellar excess return hit rates as well, and the results did not disappoint. Indices have rallied aggressively ever since, with every dip gobbled up almost immediately. However, on the flip side of this reset lower in 3-month realized vol due to the unrelenting buying from the systematic crowd was the potential for a violent reversal once systematic demand fades.

The reason I deemed this rally a fool moon is because it was almost entirely driven by systematic flows — the fundamentals are irrelevant —, and this type of rally gives false confidence and lulls many into a sense of false security in which they believe that hedging is pointless — hence SPX skew being crushed since late June as we rallied away from OTM put strikes.

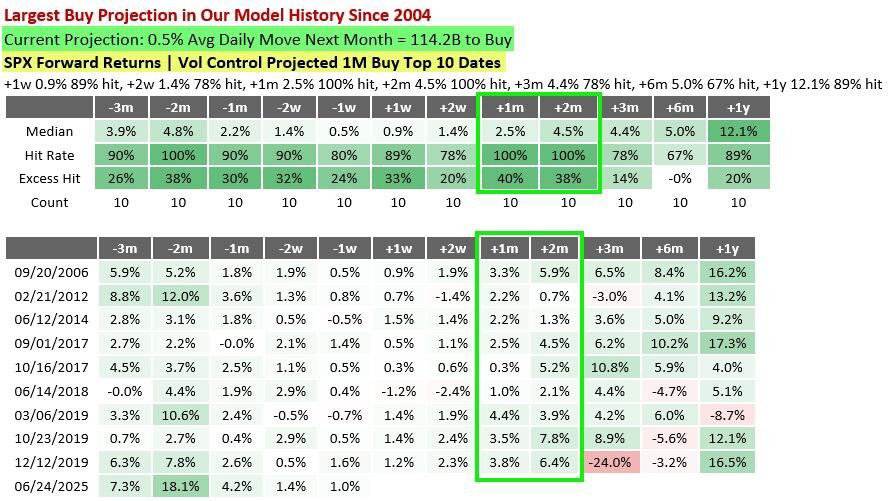

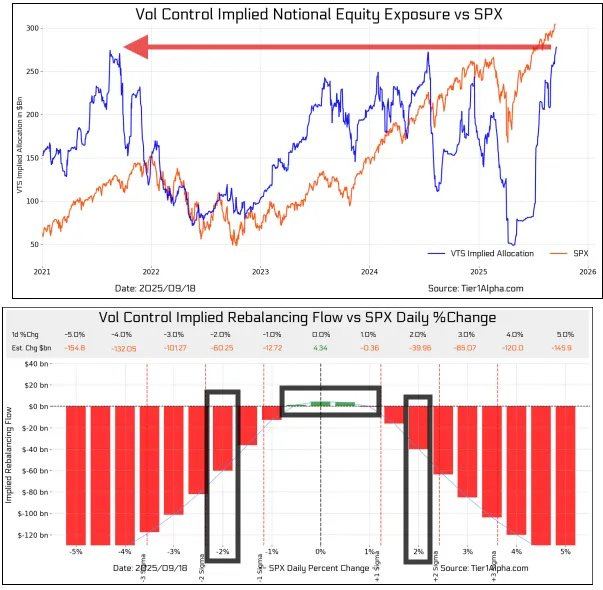

However, as of September 25th, 2025, systematic buying demand appears to have reached its limits, and the fundamentals will also be irrelevant as this cohort sells. Per T1Alpha:

“Vol-control funds are pressing against their five-year highs. A sharp move higher can be just as destabilizing for these funds as a selloff, forcing exposure cuts at precisely the wrong time. A 2% swing in either direction could trigger as much $40–60 billion in net selling requirements, completely detached from fundamentals or sentiment.” On the flip side there is little scope for more length with even a 0% average move leading to just ~$5bn in additional buying.”

For the sake of confluence, here’s Nomura’s view as well:

“Euphoria over artificial intelligence is inducing a “virtuous feedback loop” that’s turning growing ranks of skeptics into equity buyers at higher levels and increasing overall risk taking, McElligott wrote in a note to clients.

This behavior alongside many players at or near maximum exposure has built up downside risk in stocks, justifying the need for protection. “Even though it hurts, you cannot take your hedges off now, no matter how much they’re dragging performance,” the strategist said, setting out a list of reasons for investors to be vigilant….

Leveraged funds are currently producing the largest cumulative one-month notional buy flow, which is also heavily concentrated in the themes of AI, mega tech companies and semiconductors, McElligott said. This leads to a feedback loop that is part of the market’s grind higher.

If those flows were to reverse, they are also heavily skewed toward selling by nearly double the amount that they would buy if the market keeps rising, he said.” — BBG

With 1) VIXpiration and OpEx in the rear-view mirror and 2) a substantial amount of positive SPX gamma that rolled off as of last week, we are finally — after months of a seemingly never-ending dispersion party exacerbated by systematics — at a point where hedging is likely to be beneficial. As of September 19th, I hedged via medium/long-dated exposure for the first time in several months. Some eye-catching data from VolumeLeaders arrived shortly after this.

Think the gist is clear — there have been many abnormally large prints over the last few days.

Cross-Asset Picture/Cross-Asset Vol

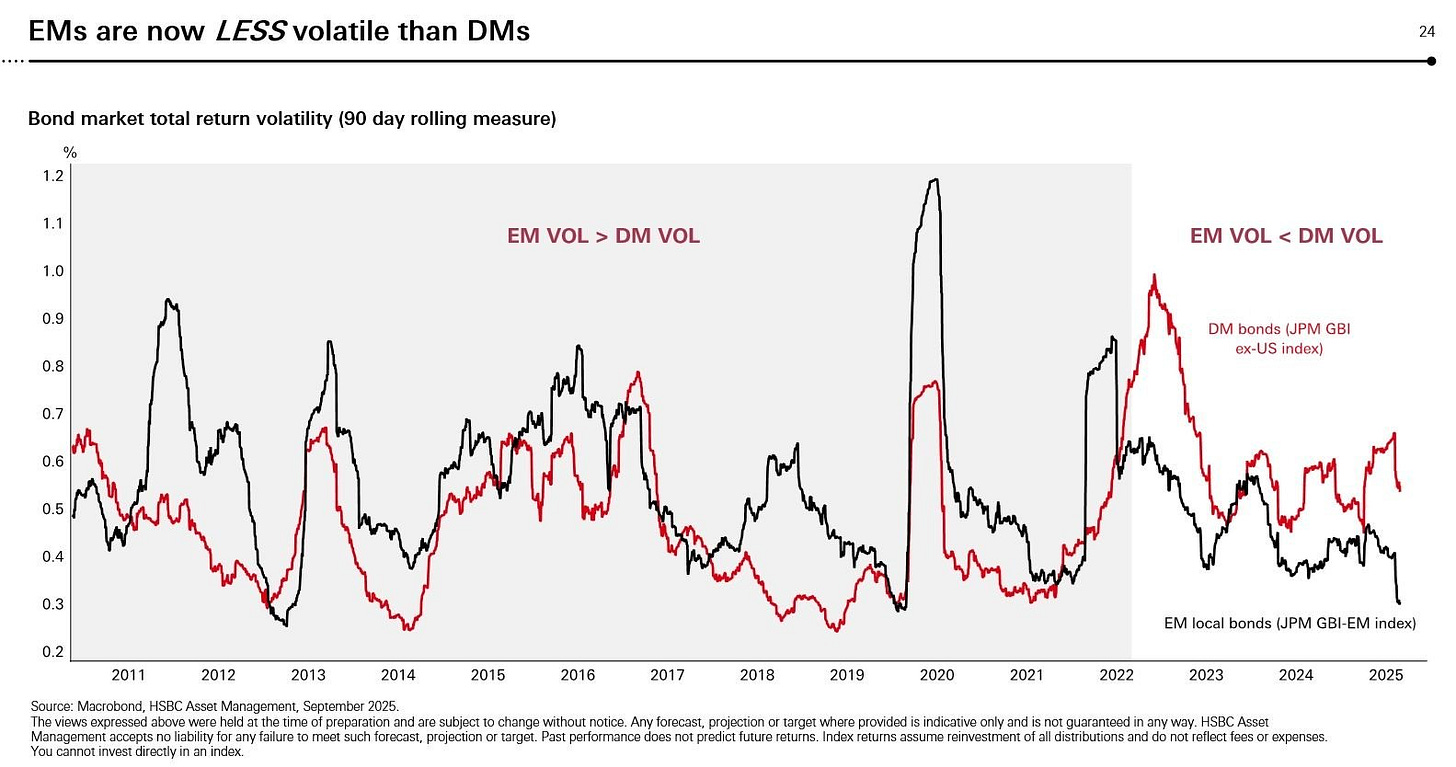

Arguably the safest assets in financial markets are now more volatile than their EM counterparts. This speaks volumes to me since the US shares another well-known EM characteristic: high susceptibility to political instability. It’s no wonder why many EM markets have performed so well this year, especially through Q1.

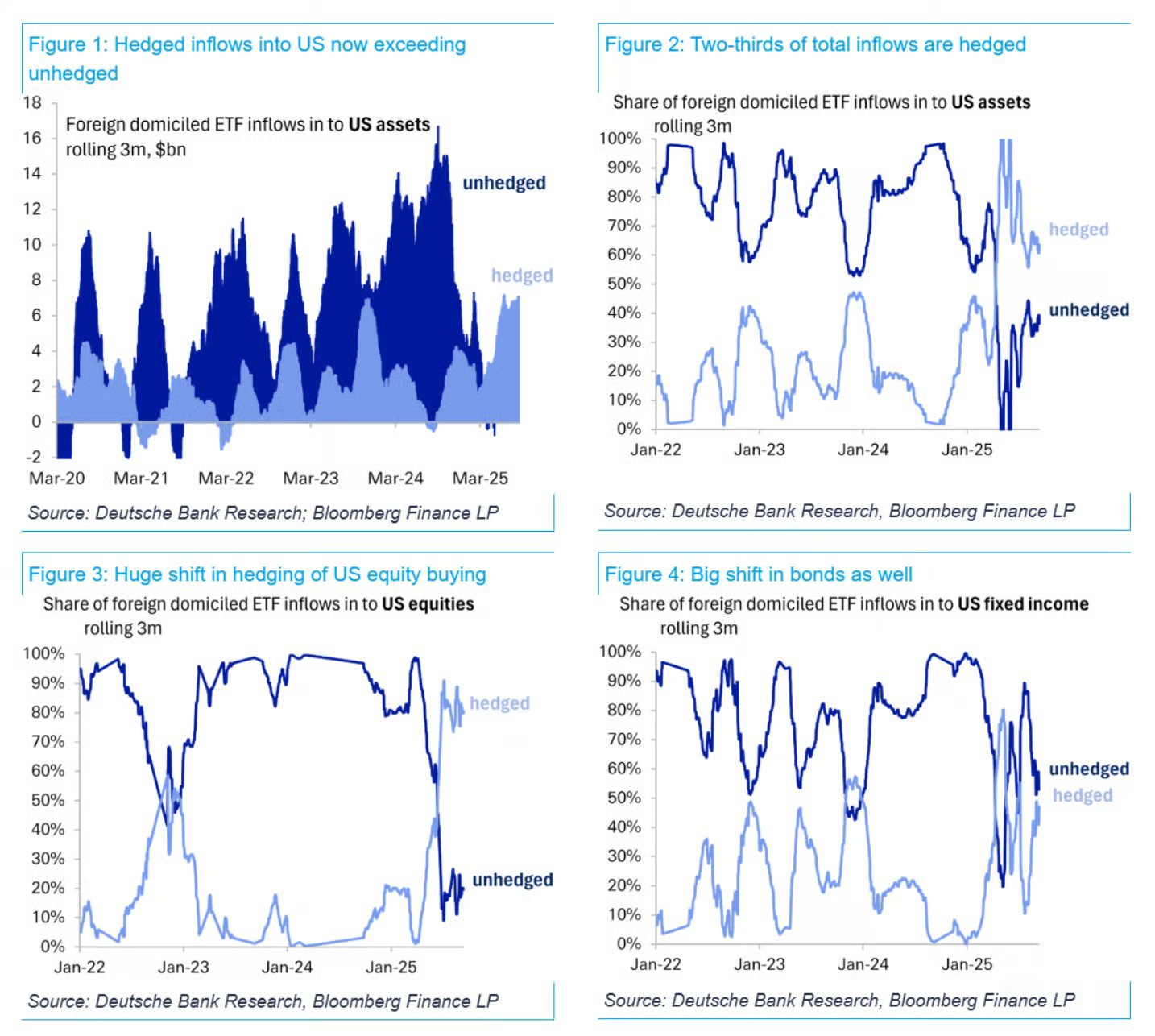

Earlier this year, I covered the dynamic where unhedged foreign FX investors were seeing compounded losses as the dollar fell materially alongside equities. Looks like they no longer want dollar exposure. It’ll be interesting to see how this evolves.

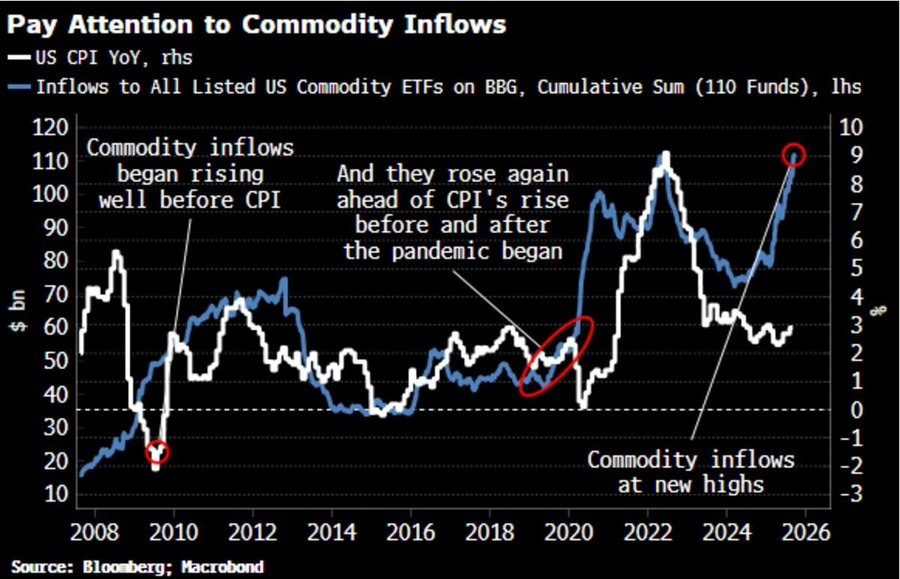

With gold/silver roaring higher and retail seeing stocks as escape valves, de-anchored inflation expectations are to blame.

We are in year 3 of inflation being the top concern for Americans, yet there is no appetite from the monetary or fiscal side to do what it takes to address it. So, naturally, people are long dollar debasement, long risk assets, & long mental instability as casino culture & financial nihilism proliferate.

Too many myopically focus on CPI prints as opposed to what embedded inflation does to a nation’s psychology. People rightly loathe inflation since it disproportionately affects society, leading to a divide between winners and losers. The winners have the means to protect themselves from the loss of purchasing power while the losers don’t. This imbalance in security is what makes structural inflation politically and socially combustible — it significantly erodes faith in the system. This dynamic persists, becoming increasingly less tolerable, until it reaches a breaking point.

Ultimately, inflation targeting is ineffective because it’s systematic debasement disguised as price stability. As Volcker noted: “And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability.” The zeitgeist of inflationary periods teaches a valuable lesson: prevention is better than cure.

The end game — otherwise known as stagflation — until these dynamics change is still: yields up, dollar down, and equities down.

Until next time,

Pierre