"The Most Anticipated Recession" Nothing Changes Sentiment Like Price pt. 2 / 2H Prep

The narrative is changing again

“There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen. Yet this difference is tremendous; for it is almost always the case that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa.” — Frédéric Bastiat

This will be my last macro related post for a bit so as to avoid an overabundance of information. This will contain many bits & pieces from my previous posts.

The Most Profound ZIRP Consequence

There are clear drawbacks to ZIRP such as capital misallocation & frugality extinction, but the most noteworthy is the creation of instant gratification culture. The exacerbation of people’s innate impatience has profound “unseen” effects. This mindset definitely seeps into every corner but the salient one here is the financial markets.

“Bear markets are a process, you can’t rush them. They are natural and inevitable. Knowledge of this is essential, especially after over a decade of artificial growth.” —

Vicissitudes of Economic Life

·We’re about a week away from the Q3 GDP reading that will put all of those engrossed in recent recession hysteria in a collective stupor. The Atlanta Fed Q3 GDP estimate is currently up .2% from the 2.7% reported on October 5th. This is not to say that I believe we won’t be in a recession anytime soon. After all, the factors contributing to this positive…

My recession outlook from October remains the same; being that the recession is going to be severe (hard landing) and its advent will be in 2023. However, the consensus view is presently shifting. We have arrived at the “what rate hikes?” part of the cycle and “what recession?” preceded this. Biden is loudly proclaiming that “Bidenomics” has saved the country from existential ruin — see community notes please — while the indexes & AI related equities are rising almost endlessly.

My objective here is not to tell you — as many have already — that this isn’t healthy behavior. Rather, I feel the need to expound upon why it is 100% normal.

Firstly, I’ll refer to some portions from my previous posts.

“Each rally has commenced because of widespread blind optimism, only to fizzle out when the bears have turned bullish. These rallies continue until there is unanimity in opinion in which the majority are thoroughly convinced that this is a new bull market. The July/August rally begot several articles proclaiming that we were in a new bull market. Similar articles that share the same sentiment are being published again.” —

Beware of Complacency

·Inflation for October was 7.7% y/y. This is a .5% decrease from September’s CPI release. The market’s reaction to a miniscule downtick in persistent inflation for one month is a testament to how unhealthy this market is. The pivot fanatics unleashed hell on Twitter taking premature victory laps, as is customary.

Admittedly, this rally has continued for longer than I initially expected it to. However, the narrative shift due to price is something that I’m happy to see when assessing whether or not we are forming a top or bottom, irrespective of my current positioning.

“But at what point does this rally become a new bull market?”

My answer to this is exceedingly simple. There are many, but this is appropriate for me.

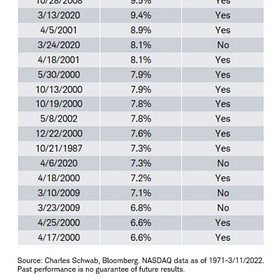

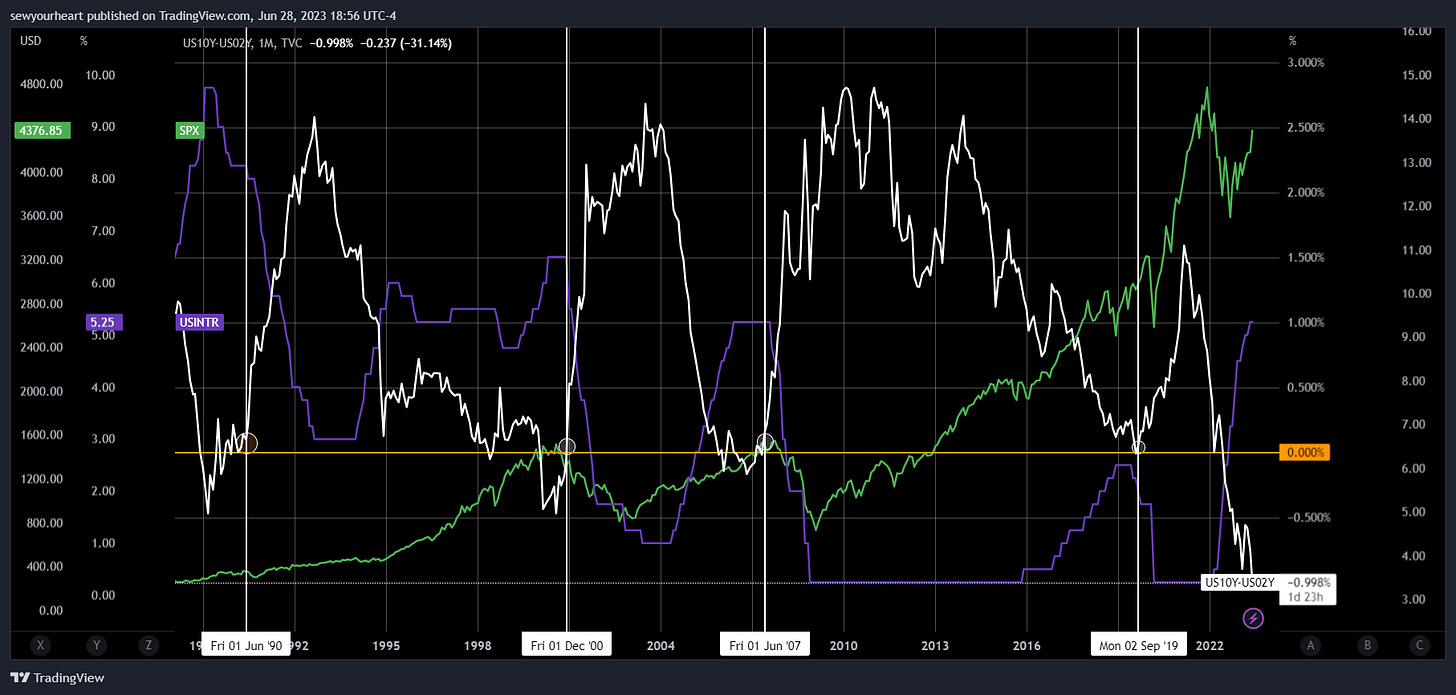

“Neither of the closely watched spreads of the yield curve have re-steepened yet. Everyone knows that they have inverted already, but few recognize that this is a testament to how early we are in this bear market. Re-steepening of the yield curve has coincided with the advent of recessions and further continuation of downturns.” —

This Bear is Still a Cub

·As we head into the new year, I am constantly reminded of how essential discernment is. In this fast-paced environment, you blink twice, and you’ll miss a regime change. I remember late last year when the consensus view was that the Fed could never raise rates again because of a plethora of uncorroborated reasons. “25bps would completely break the syste…

Contrary to the increasingly popular belief, this bear is still a cub. A current yield curve update:

Note: Equities rallied while the YC was inverted. They began their descent after a pause in the hiking cycle and subsequent rate cuts.

Once again, equities rallying while the YC is inverted is normal. AI fever pumping up stocks and sending indices higher is normal. The majority believing this is the beginning of a new bull market is normal. Nonetheless, it is ultimately not synonymous with the beginning of a new bull market.

Another prevalent question that stems from the recent rally is “What exactly is going to take the markets/ economy down?”

And to answer this, I’ll venture into the most fun part of this post for me.

“False prophets often speak with great sincerity when they say they foresee great prosperity ahead. Or if that statement seems less than realistic, then it’s a combination of wishful thinking and self-interest that cause them to announce we will have a ‘‘soft landing,’’ that we should be looking for new buying opportunities, that we’ve made a bottom.” — Harry D Schultz - Bear Market Investing Strategies

Nothing Changes Sentiment Like Price

·“False prophets often speak with great sincerity when they say they foresee great prosperity ahead. Or if that statement seems less than realistic, then it’s a combination of wishful thinking and self-interest that cause them to announce we will have a ‘‘soft landing,’’ that we should be looking for new buying opportunities, that we’ve made a bottom.” —…

The question usually alludes to some kind of black swan occurrence. At this point, there is a formidable argument to be made that because of the widespread negligence towards tightening cycle lag, the tightening cycle lag is the black swan. If that isn’t compelling then one could also easily argue that the black swan will arise from the tightening cycle lag. Ultimately, spotting the black swan before it arrives isn’t important; being prepared for its arrival is. This leads me into my next portion of this answer.

Volatility & Complacency

“This lack of breadth into OpEx should be alarming to market participants who are believers in a new bull market. Supportive flows are gone which should allow for the market to move freely to the downside.”

“Short vol is almost always a profitable trade. However, with the above conditions considered & debt ceiling woes that may need to be addressed as early as late May, it doesn’t seem wise to get too comfortable being short vol here.” —

April Recap. Out of Breadth

·April has been a very uneventful month for financial markets. After the emergency liquidity injection from the Fed because of the banking crisis, the market has drifted back above the closely watched trendline and is now very close to where we recorded the highest call volume ever.

First and foremost, the 2nd portion of the 1st quote was completely wrong (in hindsight lol). This stemmed from me not seeing a few things clearly:

Liquidity drain masked by TGA drain.

AI fever & coinciding exuberance will last longer than I expected. These things always do in low liquidity (relatively) environments.

It’s the 2nd quote that is salient here though. Vol didn’t receive a bid during the debt ceiling kabuki. This is not a problem as vol’s seasonality wasn’t conducive for any material rise in volatility. In June it actually was, and vol proceeded to continue its descent in spite of this.

‘With equity euphoria spreading around the globe in January 2018, placing money on another stretch of low volatility looked like a sure thing. The S&P 500 Index had surpassed nearly a quarter of analysts’ year-end price targets and synchronized global growth was the narrative of the day, with enthusiasm about the economic expansion pushing most major indexes into overbought territory. As stocks boomed and the VIX drifted, ‘short volatility’ strategies had become de rigueur for investors. Meanwhile, a new crop of exchange-traded products moving inversely to the Volatility Index meant even mom and pop investors could benefit from the calm – a calm that would soon vanish.”

“Peace would not last, however. U.S. stocks sold off on Friday, Feb. 2 as investors fretted that the economy was overheating and the Federal Reserve might raise rates faster than expected. As traders drifted into their desks on Monday, Feb. 5 – just hours after the Super Bowl ended with the unexpected victory of the Philadelphia Eagles over the New England Patriots – the stock market drubbing intensified. As equities sold off and the VIX began to rise, a snowball effect would begin to grip volatility markets.” — The Day The Vix Doubled: Tales of ‘Volmageddon’ Bloomberg

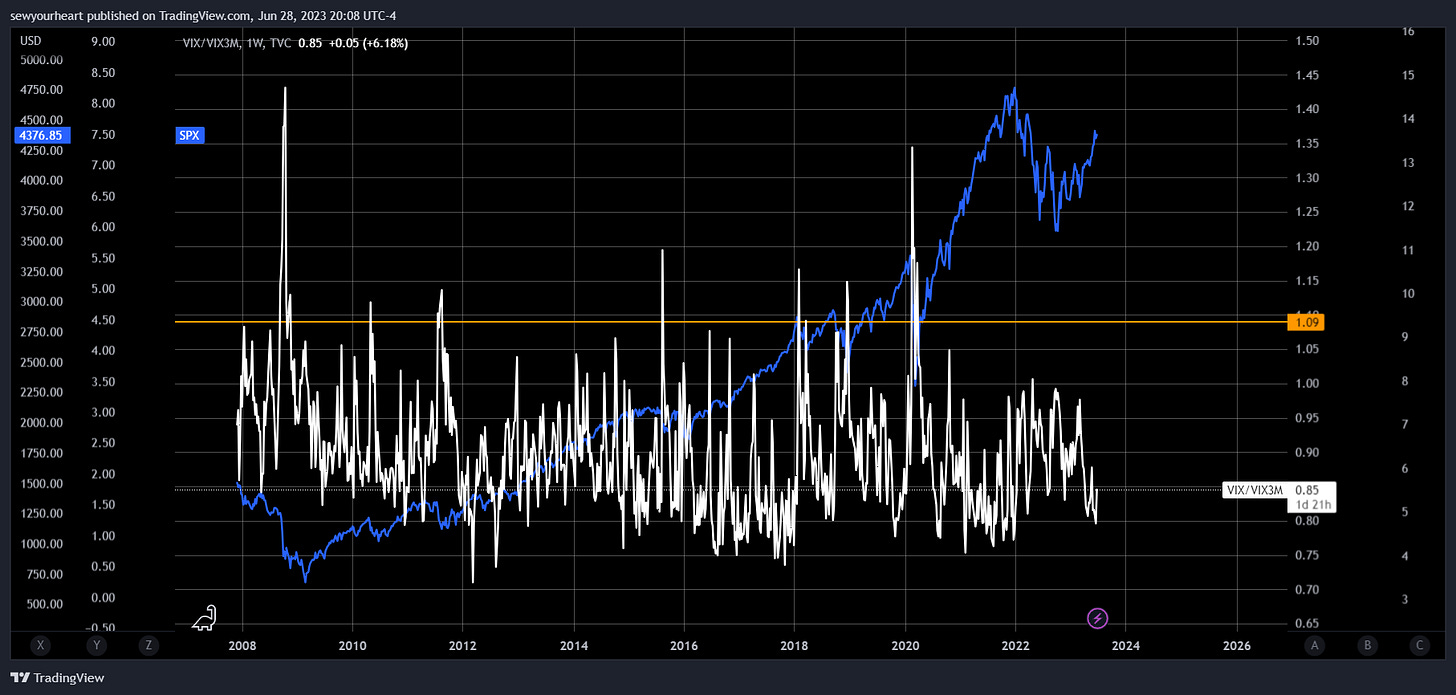

As vol continues to drift lower amidst this AI fever induced equity exuberance, I believe that another Volmaggedon lies not too far out. Only this time around, it will coincide with tightening cycle lag from the exit of the ZIRP era.

“The VIX/VIX3M ratio is a great risk-off indicator. When it’s above 1.09, the chances that there will be a major selloff in equities increase, leading to an explosion in volatility. In this chart above I circled the times when the ratio crossed above 1.09 and coincided with a weekly sell signal on SVXY.

From left to right the dates and events that correspond with the readings:

August 17th, 2015 — Flash crash (spillover from China meltdown).

January 29th, 2018 — Volmaggedon.

December 17th, 2018 — No weekly sell signal, but ratio was over 1.09 and VIX rose considerably due to fears from overtightening and the China-US trade war.

February 24th, 2020 — COVID crash.

? ?, 2023? — Not guaranteed but looking more likely by the day.” —

Risk Happens Fast

·"There are decades where nothing happens; and there are weeks where decades happen"—Vladimir Ilyich Lenin. This’ll be a very short post as I’m going to refrain from behaving like an expert on the current banking fiasco. In my 2023 outlook post I mentioned that “The response lag from a historical pace of rate hikes will also make its presence felt in 2023…

Current VIX/VIX3M ratio check:

“The VIX isn’t broken. Massive liquidity was added in March and short vol is still a very crowded trade.

It started to unwind due to the regional banking crisis but clearly it didn’t do so fully. When it does unwind completely — I believe it will before the EOY — I want to make sure that I catch the meat of the move. The objective is never to find the exact bottom or top.” —

Time Stands Silent and Still

·“Perhaps the most important aspect of secondaries is their ‘‘average size.’’ This is a facet few in the market today understand. Ask anyone you know how much a secondary reaction can be and they will likely reply: ‘‘one-third to two-thirds’’ of the ground lost.

You never really blow up being long vol. Instead, you die a death of a thousand cuts. But you certainly can blow up being short vol, as where complacency thrives, financial ruin lies.

Au Revoir

I started off posting on medium and transferred my posts to substack in December ‘22. It feels like I’ve said everything that I needed to with regards to the macro space since late ‘21. So barring any exogenous shock or black swan event, it’s time to say au revoir to the macro related posts for now.