The Shmita, a Year of Release: History Has a Tendency to Repeat Itself

In Hebrew, the word “shmita” means “release.” In the Bible, the Shmita year is described as a time of rest and debt release. It is a year…

In Hebrew, the word “shmita” means “release.” In the Bible, the Shmita year is described as a time of rest and debt release. It is a year intended to reflect God’s principle of rest. He established six days of work and one day of rest each week. He did the same with years, a seven-year cycle that reflected the week — work the land for six years and allow it to rest for one.

“At the end of every seven years you shall grant a release of debts. And this is the form of the release: Every creditor who has lent anything to his neighbor shall release it; he shall not require it of his neighbor or his brother, because it is called the Lord’s release.” — Deuteronomy 15:1–2

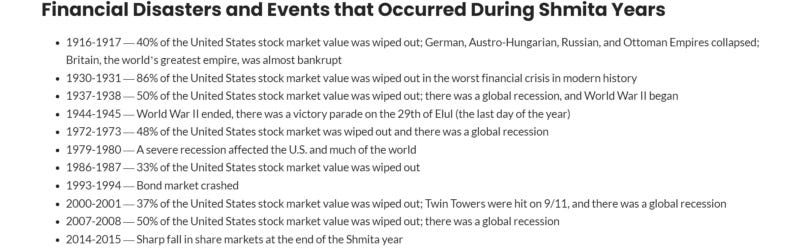

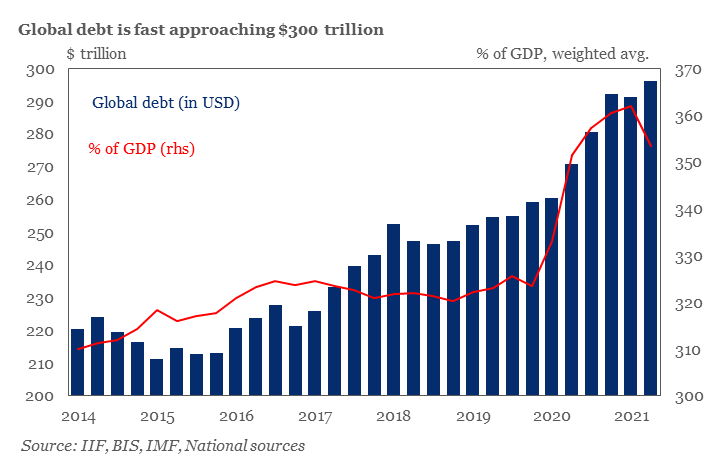

These years are associated with financial hardships because so many people are in immense amounts of debt globally. This appears to be punishment for corrupt leadership and irresponsible policies.

It’s hard to ignore current global economic conditions. They’re chaotic to say the least. I would not be surprised if 2022 is another year for the history books.

I’ve heard plenty of statements comparing 2021 to 2008, 2000, and even the 1930s. There is massive speculative activity occurring throughout financial markets in 2021, similar to the speculative activity seen in 2000 and 2008. It’s unsurprising that this contributed to the speculative bubble we’re currently in. This is a spike in asset values within a particular industry, commodity, or asset class to unsubstantiated levels, fueled by irrational speculative activity that is not supported by the fundamentals. Note that there is also a disparity here. This year's speculative bubble was undoubtedly inflated primarily by the Federal Reserve. You know, the central banking system of the U.S., which supposedly monitors risks to the financial system.

Low interest rates provided by the Fed encourage borrowing, which in turn creates liquidity in the economy. Spending increases, and this creates more revenue and profits for companies. Their relentless purchasing of bonds, which exchange current liquid cash for bonds with future maturity dates, also contribute to a bull market. When both of these processes continue for a prolonged period of time, the result is the creation of massive asset bubbles. The Fed is now trapped after irresponsible monetary policy (QE Infinity) and constant neglect of inflation. Now it’s forced to acknowledge problems publicly and make the necessary decisions to fix them (rate hikes).

Two Wrongs Don’t Make a Right:

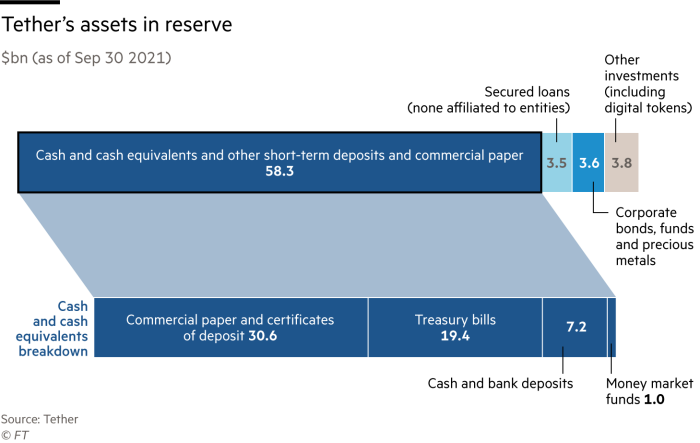

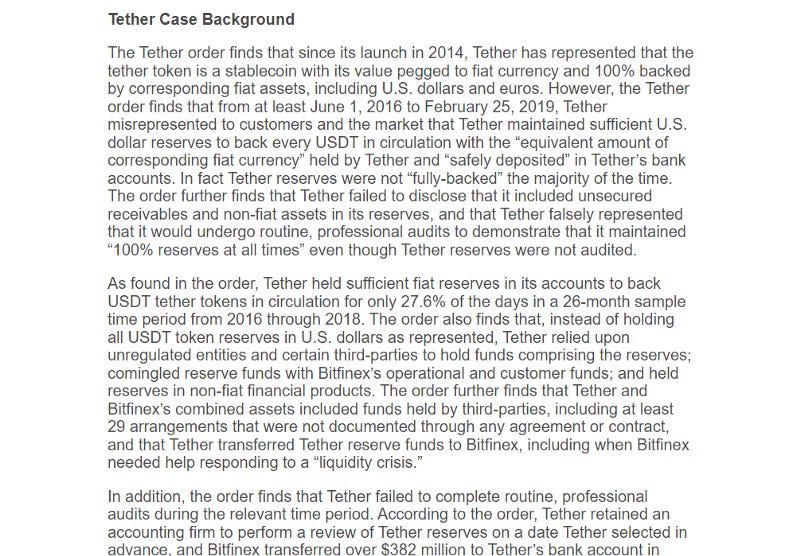

Despite numerous claims that Bitcoin is an escape from the Federal Reserve, I could never seem to find that even slightly true. The existence of Tether, which is a “stablecoin” proves this claim to be incorrect. Stablecoins are digital currencies that are tied to real-world assets — the U.S. dollar, for example — to maintain a stable value, unlike most cryptocurrencies which are known to experience volatility.

There is already evidence that Tether has been artificially pumping the price of Bitcoin. — Is Bitcoin Really Un-Tethered? by John M. Griffin, Amin Shams :: SSRN — There isn’t a representation of authentic demand from investors here, yet people like Michael Saylor tell you that Bitcoin is an “oxygen mask.” This artificial pumping is similar to how QE Infinity works.

A major problem with Tether is that it claimed to be fully backed by USD when it wasn’t.

The crypto realm is massively artificially inflated, and crypto maximalists continuously deny this. The realm is marked by innovation, excessive speculation, misinformation, price manipulation, false accounting, and fraud. What makes speculative bubbles so tricky sometimes is that they always provide opportunities to make massive gains quickly. The people at the forefront of the bubbles and schemes, (e.g., Michael Saylor, 100trillionusd) happily lead sheeple to their impending doom. If you only tell people what they want to hear, you are not helping them at all. One who speaks mere portions of truth is a craftsman of destruction.

There’s also another major problem with Tether. They are backed primarily by Chinese commercial paper. They have denied owning any of Evergrande’s commercial paper. Tether is a Chinese company. Evergrande is the number one issuer of commercial paper in the Chinese real estate market. Tether has proven to be habitual liars over the years. They also lack basic transparency. I’m going to assume that they do hold Evergrande’s commercial paper. Put simply, a collapse of Evergrande results in a collapse in the commercial paper markets. Tether likely collapses next and as a result, crypto does too. It’s a classic domino effect.

“There is the stark reality that [a possible collapse] will have a huge impact on the commercial paper markets. Regardless of what commercial paper you hold, bonds and commercial paper would take a hit and some issuers may even fold,” tweeted Adam Cochran, partner at Cinneamhain Ventures. — Tether says it doesn’t hold any commercial paper issued by Evergrande (theblockcrypto.com)

I believe we’ve seen something like this already in a previous Shmita year. In a short paper titled “When Safe Proved Risky: Commercial Paper During the Financial Crisis of 2007–2009” by Marcin Kacperczyk and Philipp Schnabl, they highlight a very important part of the 2008 financial crisis.

The comparison I’m trying to make here is that the RPM in 2021 is Tether, and the issuer of commercial paper (likely Evergrande) is Lehman. Tether behaves as a money market fund, and they manage over $60 billion of assets, half of which is in Chinese commercial paper.

It looks like history may repeat itself here, and I don’t believe the PBOC is looking to bail any of them out.

In conclusion, we’ve entered a Shmita year and the global economy is debt-ridden, and the stock market and crypto realm are both massively artificially inflated. I do believe that when frauds such as Tether, and Michael Saylor are ousted from the crypto realm, the true legitimacy of crypto will shine through. Nonetheless, 2022 will be an eventful year filled with learning experiences for us all. Stay patient and vigilant. Proper preparation prevents poor performance.

Disclaimer: None of this is financial advice. These views are my own.