The Storm Continues Unabated

First slowly, then all at once.

First, a quick positioning update:

TLT puts from 7/19 were closed on 10/11 for over a 200% gain.

Over 70% of my NVDA puts from 8/24 were closed on 9/27. The rest are still on.

Closed my SPX puts from 8/11 completely in the early session of 10/06.

Still long oil since 7/7.

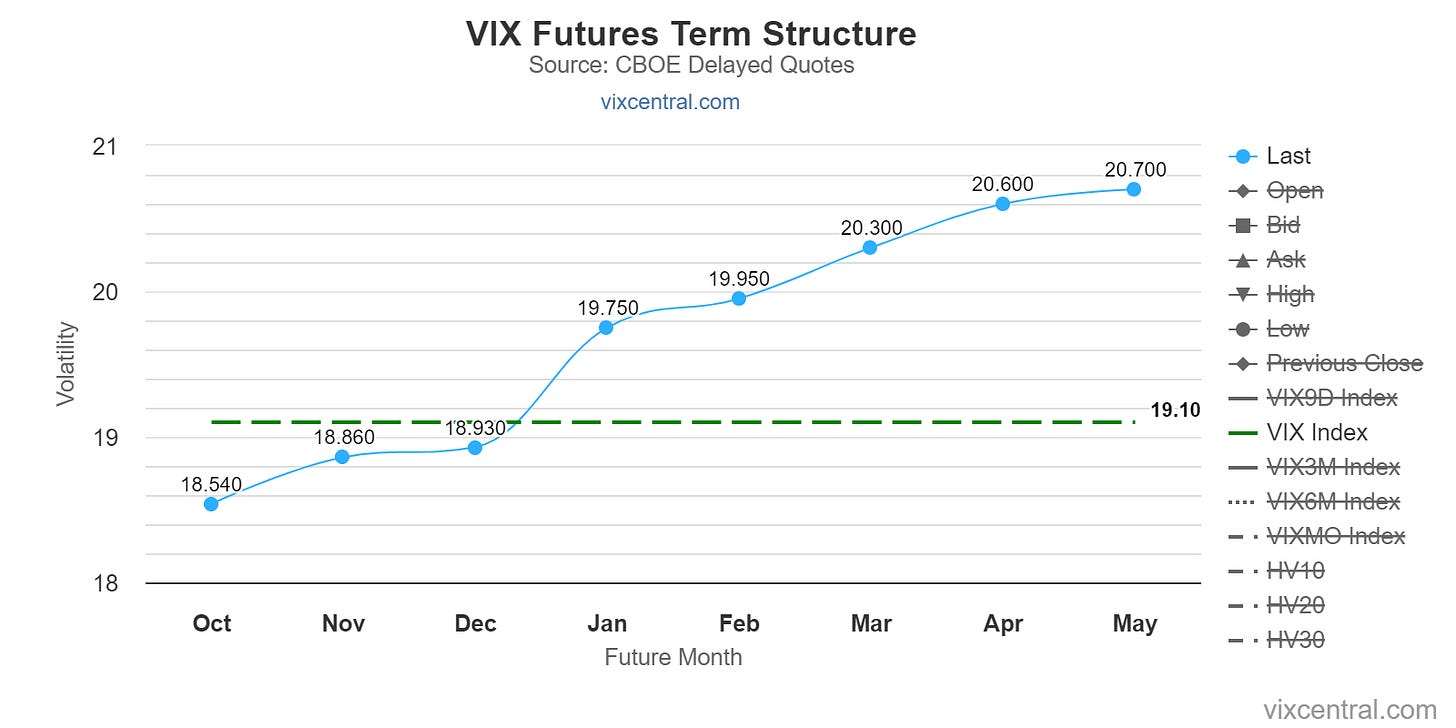

Still long vol as a hedge that gets rolled systematically.

Positioning rationale can be found here:

As I believed it would, the bear steepener has been a dominant force driving both equities and bonds lower since July.

From my first & only published note:

“Quick update on this. Since the close of July 7th:

Dispersion trade still alive — though it appears to be on its last legs —, no material uptick in the space (yet).

Oil up almost 30% in Q3 & was exhibiting a positive correlation with rates & the $ (no bueno for risk).

SPX seems to have topped out in late July.

2s10s has bear steepened by +45.7bps.

From the same post:

“I’ve mentioned the bear steepener a few times since December ‘22 and I believe that the time has finally come for it to transpire. A rise in commodity prices should lead us into this recession while the yield curve re-steepens and serves as a major headwind for equities & bonds.”

Seems to be aging well although some could argue that it hasn’t been a major headwind for equities yet. And to that I say, in due time. First slowly, then all at once.”

If you pay attention closely to the yield curve, once bear steepening stops equities show some relief. This is the regime we’re presently in, and it could certainly change in a heartbeat.

Aside from that, I wanted to also expound upon on the end of my note. “First slowly, then all at once.” Given current conditions, one might be confused about how equities are performing. The storm continues unabated, but equities climb the wall of worry. However, this is not new. Supportive options flows have trumped macro/geopolitical headwinds until OpEx in the past. Think ‘87, ‘08, and ‘20. In each instance markets remained sanguine for quite some time despite obvious headwinds.

In ‘87, the Fed had been tightening aggressively for a bit, breadth waned with most of the markets strength in large cap stocks, and most of the issues lagged as the market continued climbing the walls of worry. Sound familiar? Only after OpEx in October did the market come to a screeching halt.

In ‘08, the week of Lehman’s bankruptcy the market closed higher. This was also OpEx week. We know what came shortly after.

In ‘20, the market firmly held a sanguine outlook despite having been cognizant of the severity of COVID. It was only after OpEx that the severity of the situation was realized by equities.

I have previously mentioned that using the past as a roadmap for the future is a sure-fire way to lose in markets. So note that the only thing I am doing here is giving prominence to the concept of flows trumping significant headwinds — until they no longer can, leaving the majority offsides. A major sell-off does not have to happen, but I believe it will. There is as much Q4 optimism as there was Q1 pessimism, so I am happy to fade consensus.

That being said, I’m looking to re-enter SPX puts around OpEx (might get in earlier depending on price action).

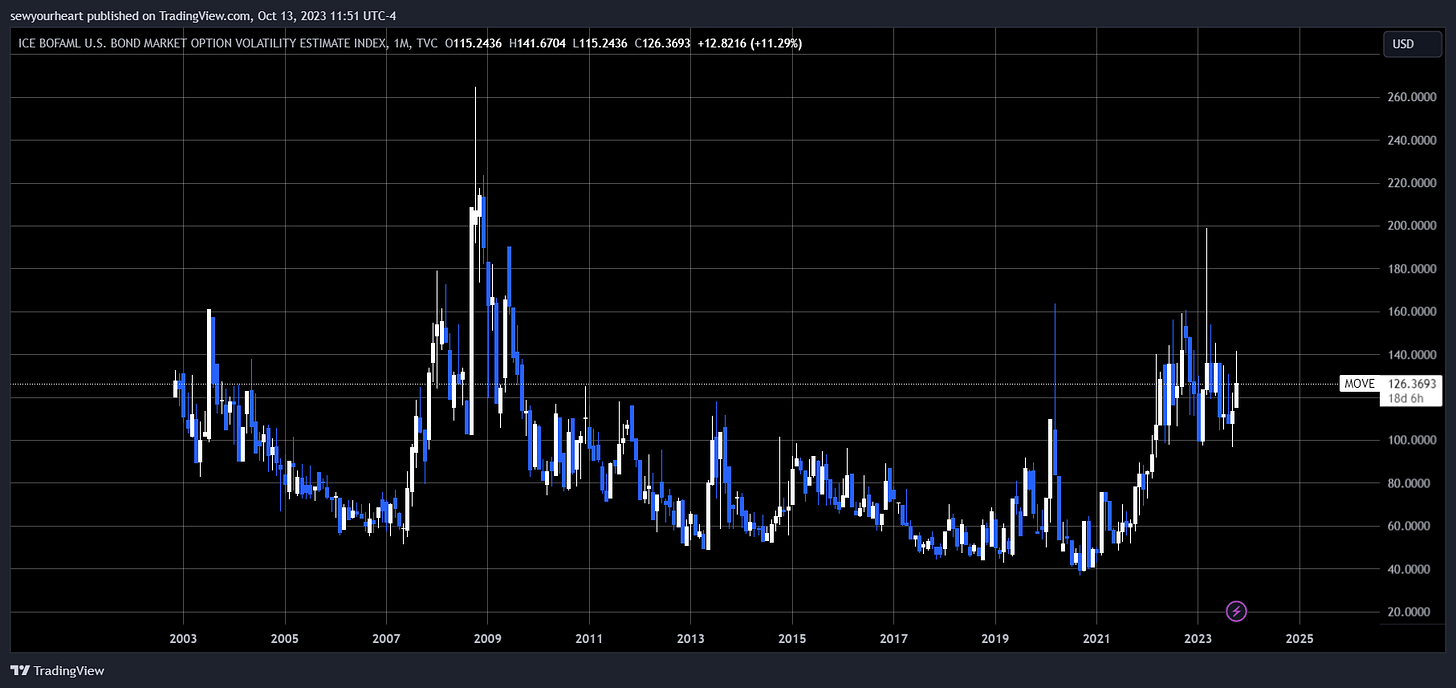

Here are a couple charts that I’ll be keeping an eye on besides the ones directly pertaining to my positions:

Lastly, some pertinent verses for today’s times.

Ecclesiastes 3:1-8

Job 5:20-22

HAGW!