The VIX is Not Broken & Oil is Not Dead | 2H Prep pt. 2

Buckle up

So much for that break I was supposed to be taking…

American hegemony was induced by laissez-faire economics and our geopolitical hegemony amongst several other factors. We are currently experiencing a historical geopolitical paradigm shift as we progress further into the stages of multipolarity. It’s paramount to know that multipolarity begets disequilibrium. Consequently, volatility will awaken once again in 2023. Vol will be made great again as the geopolitical climate becomes more turbulent and the current “oversupplied” vol regime is duly replaced. The response lag from a historical pace of rate hikes will also make its presence felt in 2023, and it will augment volatility as well. —

Presently, the “The VIX is broken/wrong” claims are repeated almost endlessly, much to my chagrin. Admittedly, this type of sentiment towards long vol strategies is exactly what you need to see before any material spike in vol, but those claims still have no merit.

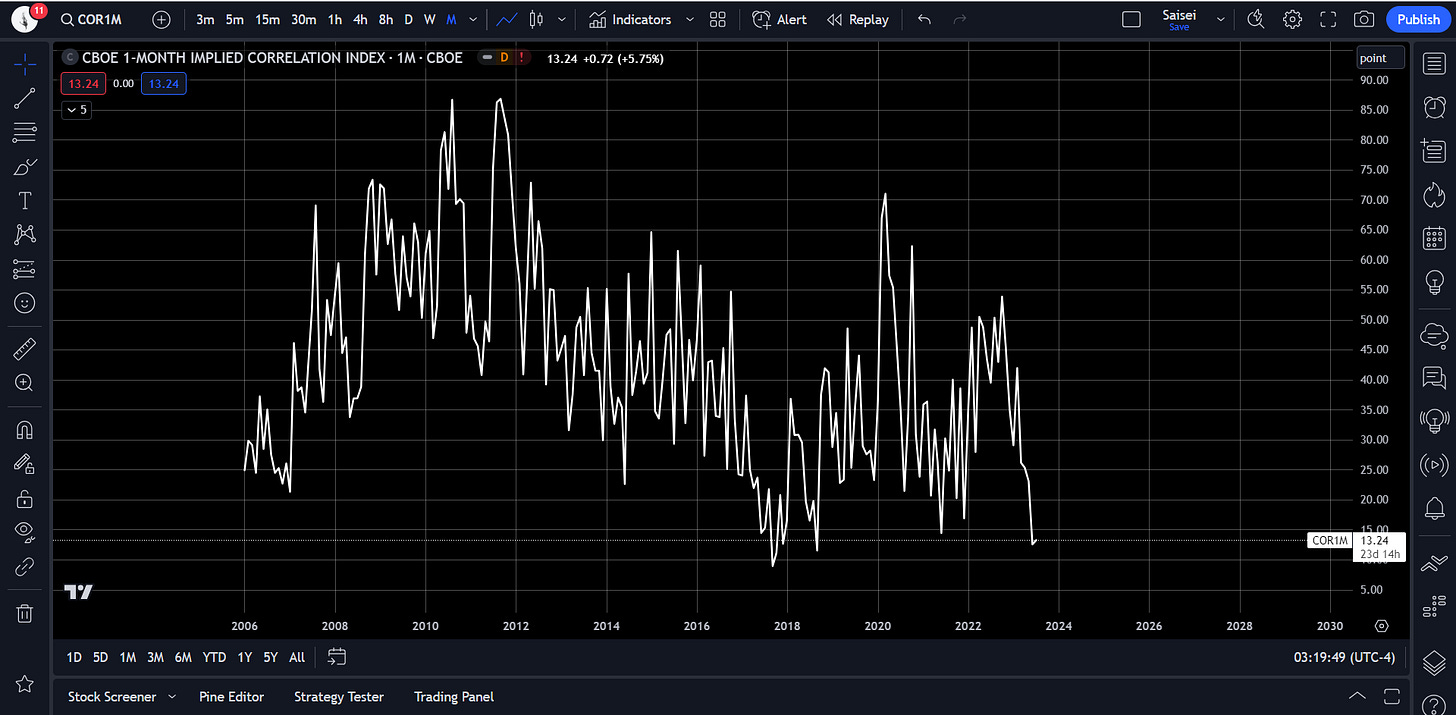

For those who still think the VIX is wrong/broken, look at implied correlations which are currently near ATLs from late ‘17-early ‘18. This is a measure of how many stocks in the S&P are moving in tandem.

Right now, implied correlation is historically low which means that while index vol looks low (VIX 14), individual stocks in the index are quite volatile. In other words, half of the index can rise while the other half falls — essentially obscuring index level vol. A modest increase in implied correlations will drive index vol higher — so no need for a black swan.

A “low” VIX reading does not mean that there is no fear in the market. There is a very obvious fear of missing out on future returns.

And as I’ve said many times before, it isn’t wise to get complacent & careless shorting vol, especially considering the current state of affairs.

Headline inflation has continued to fall and will likely come in lower for June. Core, which is what the Fed fixates on, is still very persistent and sticky.

A deeply inverted yield curve is still putting pressure on banks. Also worth nothing that YC inversions often precede black swan events. Think Savings & Loans Crisis (1980s), Kuwait Invasion (1990), LTCM collapse (1998), 9/11, Lehman Brothers collapse, & the Covid-19 pandemic.

Global liquidity drain to take place over the 2H— won’t have an immediate effect as stated in previous posts— and coincide with the response lag from monetary policy. My sweet spot here is still Sep-Oct.

Shorting vol has once again become de rigueur for traders. Hence the numerous “The VIX is broken/wrong” claims.

Oil’s 2H Story

Now to oil, which I have held a bullish outlook on since last December.

The FFR went from 0 to 4.5 in 2022 and inflation remains virtually unchanged since Dec ‘21. China knows this, and they have pounced on the opportunity to exacerbate the Fed’s struggle with persistent inflation by reopening at a precarious time for the West. China’s emergence from draconian COVID lockdown rules will prompt a bolstered demand for their oil. China’s oil consumption may be relatively weak in the nascent stage of reopening, but it will pick up later in 2023.

Putin recently signed a decree which comes into force on February 1st, 2023, and remains in place until July 1st, 2023, which bans the supply of oil to clients that comply with the Western price cap. This scenario bears resemblance to the J-curve effect. It is for this reason that I believe that Westerners will claim stagflation is by no means occurring, only to be “shocked” by stagflation later on. —

These factors have been written off by many simply because they didn’t materialize when they wanted or expected them to. The aforementioned J-curve effect for oil prices is exactly why I hadn’t gone long oil — until early Friday morning, and the reasoning for this is simple.

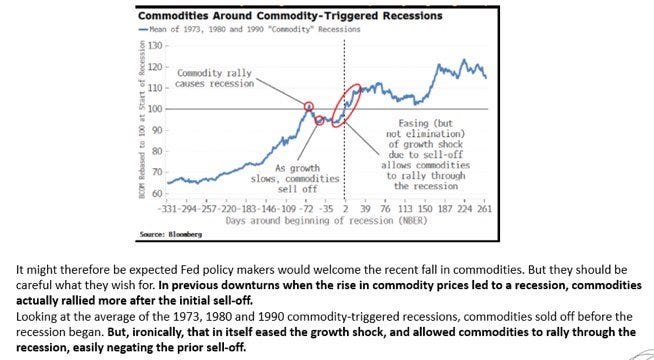

Most investors/traders currently have no vivid memory of inflationary recessions. This is why there are so many people taking victory laps in the commodity space (oil specifically) despite China’s oil demand hitting another all time high in April, speculative positioning being the most bearish since 2011, and most importantly, history being on the commodity bulls side. —

More importantly, as stated by HFI Research:

“U.S. oil demand is starting to fire on all cylinders, U.S. shale oil production is peaking, speculator positioning is close to record bearish, and SPR release is ending. The oil market setup going forward is going to be asymmetrically positioned to the upside.”

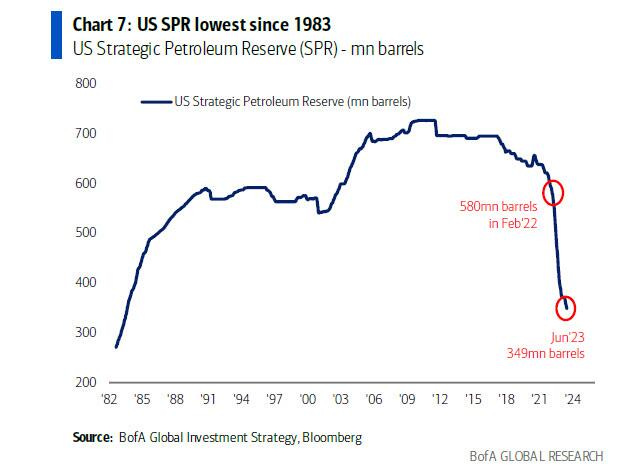

For me, the most salient factor here is that the SPR release is ending. If you remember:

Because you can no longer properly embed tweets in substack, I’ll put what he said in quotes below.

“People are depleting their emergency stocks, had depleted it, used it as a mechanism to manipulate markets while its profound purpose was to mitigate the shortage of supply. Be that as it may, it’s everybody’s choice. However, it is my profound duty to make it clear to the world that losing emergency stock may become painful in the months to come.”

In the end, the unmerited SPR drain is just another ignominious policy blunder. Consequently, we remain perilously vulnerable to supply shocks/disruptions/emergencies.

SPX Positioning

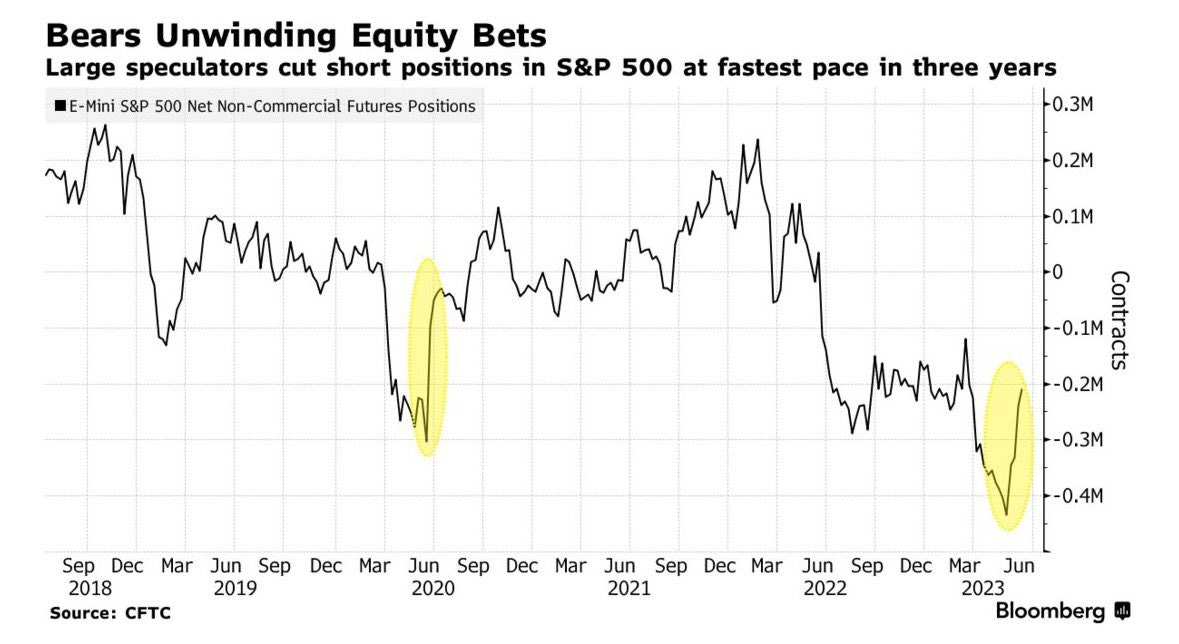

Note that in this instance, the Fed isn’t administering the QE Infinity drug and fiscal profligacy isn’t here to support financial markets and spur spending. Also, there does seem to be room for more capitulation from shorts in the near future, so markets can head a bit higher.

Most importantly, this capitulation is coming at crucial period as the narrative shifts again. This is not only what you want to see if you’re bearish longer term but also what you need to see.

2s10s Bear Steepener

I’ve mentioned the bear steepener a few times since December ‘22 and I believe that the time has finally come for it to transpire. A rise in commodity prices should lead us into this recession while the yield curve re-steepens and serves as a major headwind for equites & bonds.

2H Story/Conclusion

To sum this all up, there are 4 areas that currently sit at inflection points.

Overcrowded short vol trade — Will eventually unwind and be explosive when it does.

Oil — Which is now the most primed for upside as it’s been all year.

SPX — Shorts beginning to throw in the towel at the perfect time. Coincides with the narrative shift.

2s10s spread of the yield curve — Bear steepener incoming

Positioning

I’m long oil as of 7/7/23 and still long vol as a hedge that gets rolled systematically. I may try and play the 2s10s steepener and SPX shorts as well (probably not until after July OpEx). These are subject to change without any update and are obviously not financial advice.