This Bear is Still a Cub

Don't Blink, Don't Panic

As we head into the new year, I am constantly reminded of how essential discernment is. In this fast-paced environment, you blink twice, and you’ll miss a regime change. I remember late last year when the consensus view was that the Fed could never raise rates again because of a plethora of uncorroborated reasons. “25bps would completely break the system,” is one of my favorites. Now the consensus amongst market participants is that Santa is coming to town. Not only that, but the bear market is approaching its conclusion concurrently.

This narrative is false, and it is often bolstered by pundits who habitually spew out blatant sophistry with no regard for anyone but themselves. Nonetheless, the advent of this narrative serves as an indication of the direction the market is headed for in the near future.

Remember this?

Or this?

The market reached new lows in the subsequent month following the release of the “the bear market is over” narrative. This is a feature of a bear market, not a bug. Both bears & bulls reach certain levels of indignation and exuberance induced by mere numbers on a screen before the continuation of the downtrend.

Amidst this exceedingly turbulent environment, it looks like many are trying to rush the rectification of excess within the system. In order to cater to their confirmation biases, they cling to any information that bolsters their existing opinions, irrespective of facing incontrovertible proof that they are poorly constructed. As I’ve said before, bear markets are a process, and you can’t rush them.

For instance, many were quick to claim the advent of a recession in late July, but there remains a plethora of evidence to negate this claim.

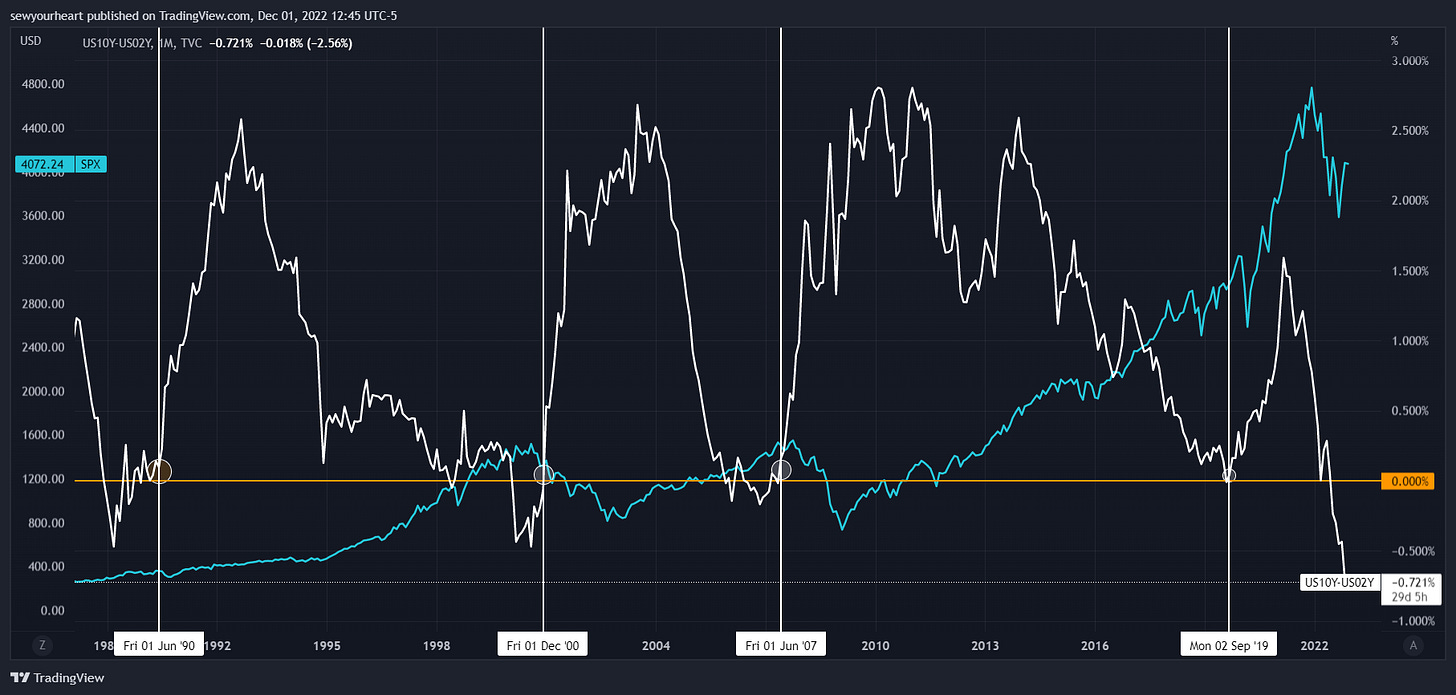

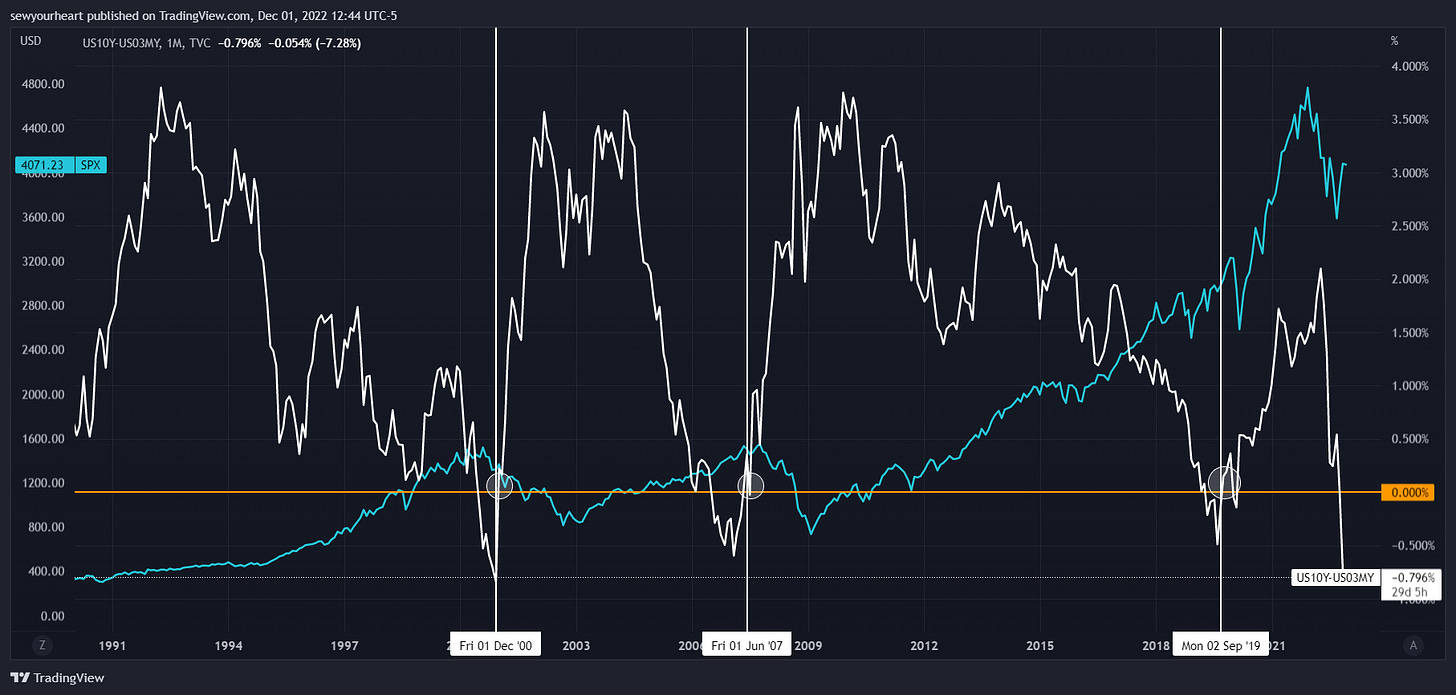

Neither of the closely watched spreads of the yield curve have re-steepened yet. Everyone knows that they have inverted already, but few recognize that this is a testament to how early we are in this bear market. Re-steepening of the yield curve has coincided with the advent of recessions and further continuation of downturns.

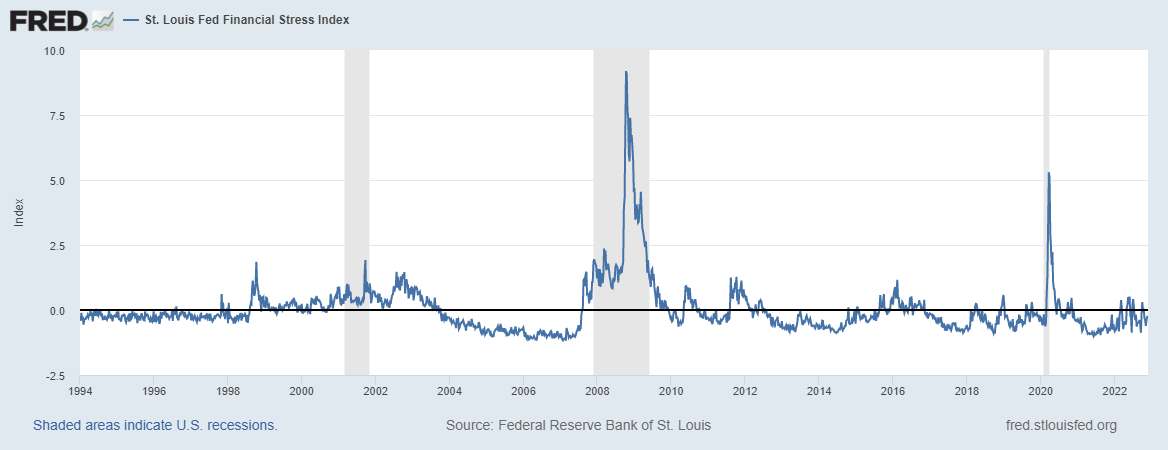

The recently updated Fed Stress Index also conveys that this bear is in the nascent stage.

With the labor market still considerably tight, and GDP, albeit entirely trade driven, coming in hot as well, it’s ultimately nonsensical to call for the cessation of this bear market right now.

Lastly, the prevailing opinion of market participants is that a recession is all but inevitable for 2023. This has led some to believe that it can’t possibly happen this way since the majority is often wrong. However, a major caveat lies here, which I pointed out a few days ago. There is no unanimity on the salient details which are length & magnitude.

Several hours later, I saw that Michael Burry seemed to be on the same page.

Irrespective of when the recession commences, it looks like we’re in for a protracted period of economic malaise.

This bear is still a cub so don’t blink and don’t panic. But definitely don’t panic. You may just end up falling for the trap door if you do.