Time Stands Silent and Still

I'm Still Waiting...

“Perhaps the most important aspect of secondaries is their ‘‘average size.’’ This is a facet few in the market today understand. Ask anyone you know how much a secondary reaction can be and they will likely reply: ‘‘one-third to two-thirds’’ of the ground lost.

This generalization can be very useful, but those who try to place an exact limit on secondary reactions are as doomed to failure as the weatherman who forecasts rainfall will be precisely one inch in the next 24 hours.

When a secondary goes beyond 66%, virtually everyone throws in the sponge, claiming loudly that the secondary is now a bull market. But history shows otherwise. A secondary can be as little as 10% and as much as 99.9%. As Robert Rhea defined it:

‘‘If we could say that the great majority of secondaries terminated around the 50% recovery point, speculation would be easy. Unfortunately, careful analysis shows that 7% of all reactions terminate after retracing 40–55%, 27% after retracing 55 to 70%, 8% after retracing 70 to 85%, with 14% of all secondary movements extending beyond 85% retracement.’’

Those percentages have probably not changed much in the 70 years since Rhea observed this.

Inflection Points

“I Saw a New Heaven and a New Earth…and the Former Things Were Unremembered.’’

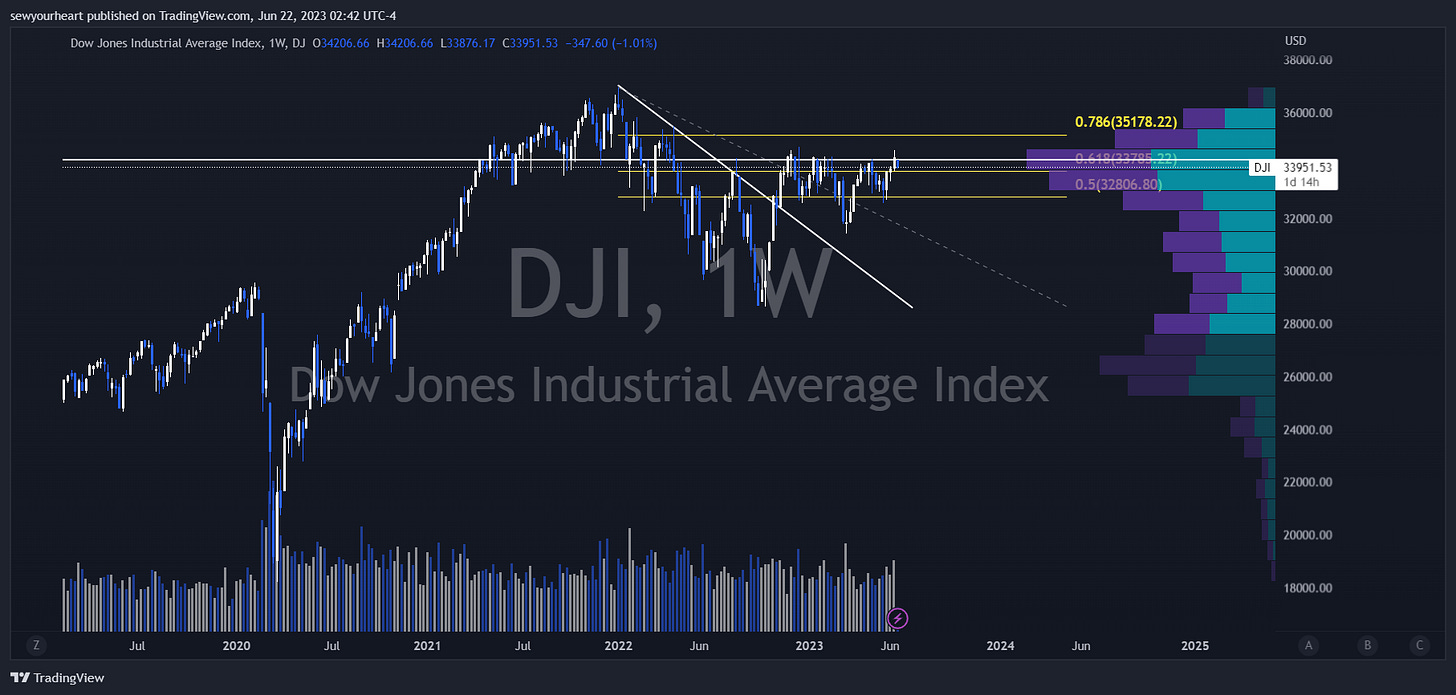

Each of the major indexes have yet to make new ATHs irrespective of the 2021 exuberance-like price action seen in big tech. Contrary to popular belief, this is normal bear market behavior.

‘‘I can remember having shorted stocks in early December 1929 after having completed a satisfactory short position in October. When the slow steady advance of January and February (1930) carried above previous intermediate highs, I became panicky and covered at considerable loss. With losses piling up every day, I forgot that the rally might normally be expected to retrace possibly 66% or more of the 1929 downswing. Nearly everyone was proclaiming a new bull market. Services were extremely bullish, and the upside volume was running higher than at the peak in 1929.”

This present AI fever was induced by the liquidity injection (“Not QE, QE”) in March and the TGA drawdown because of debt ceiling concerns. What most people forget is that the advent of the dotcom bubble was shortly after the Fed injected substantial liquidity due to fears of a Y2K collapse. And going back even further, in the 1960s & 70s companies share prices were going vertical simply because of their names.

“With the dawn of the space age, every electronics stock suddenly took off like a rocket on Wall Street, reaching valuation levels not unlike Internet stocks today. And just like a "dot com" can help an obscure offering surge into the stratosphere today, the key to a stocks success could often be found in its name in the 1960s as well.”

"I call it the tronics boom because these soaring stocks usually had some form of tron or tronics in their name," says Malkiel, citing such "trons" as Astron, Dutron, Vulcatron and Transitron and "onics" like Circuitronics, Supronics and Videotronics, as well as one company that, for good measure, put together the winning combination Powertron Ultrasonics.

Investors argued that "tronics" stocks couldnt be valued according to traditional methods because they represented a whole new era of the economy that was nothing like the past. Promoters entered the stage to talk the stocks up further. As a result, stocks soared to multiples of 50, 100 or even 200 times earnings.

But in late 1962, "tronics" stocks and other growth issues came crashing down in a massive sell-off.”

And in the 70s..

“In the 1970s, Wall Street took a hard look at stocks and decided that blue chips

were singularly exempted from the laws of gravity in the sense that they could only go up, not down.

While small-capitalization stocks may fluctuate with the winds of market sentiment, the markets heavyweights were shielded from these swings because they were seen as safe havens that people would never sell off, the theory went.”

If you were to disregard all market wisdom older than 10 years — as most do — you would be doing so at the peril of your own portfolio and future.

Patience and Positioning

“Waiting patiently and doing nothing is the most important skill in investing

Second is being able to say that’s ENOUGH in a boom and happily sit on the sidelines watching others get richer (for a while)” — Ferg

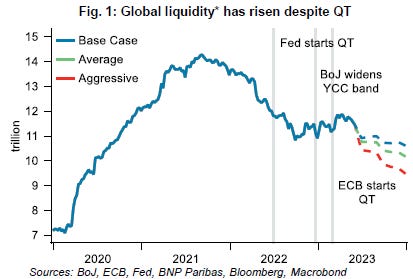

In my previous post I mentioned that liquidity is set to wane and is a significant headwind. This is partly why I still am confident in my long vol position despite the innumerable “VIX is broken” claims. A few other noteworthy headwinds:

Hiking cycle has produced only the first tremor which was the regional banking fiasco. There is much more to come. Hence the “banking system is sound and resilient” ad infinitum.

Liquidity is set to wane globally over the 2H of this year (US,EU, and maybe Japan) & coincide with lag from rate hikes.

Despite Powell’s recent claims that he doesn’t see rate cuts for a few years out, history doesn’t support this. And this time is not different.

Back to my long vol position. Admittedly, this time around it isn’t performing as well as my first. I initially entered on 4/21 and added C’s on 6/7. Not adding more here *yet* but if we move considerably lower in vol then I will. Here’s how this works:

Long VIX C’s with at least a .30 delta.

4-6 months out (or a bit longer if you can afford it).

When approaching the last 2 months left in the position, roll options out for another 4-6 months. The theta decay is much faster during the last 2 months so always roll before the last 2 months.

The VIX isn’t broken. Massive liquidity was added in March and short vol is still a very crowded trade.

It started to unwind due to the regional banking crisis but clearly it didn’t do so fully. When it does unwind completely — I believe it will before the EOY — I want to make sure that I catch the meat of the move. The objective is never to find the exact bottom or top.

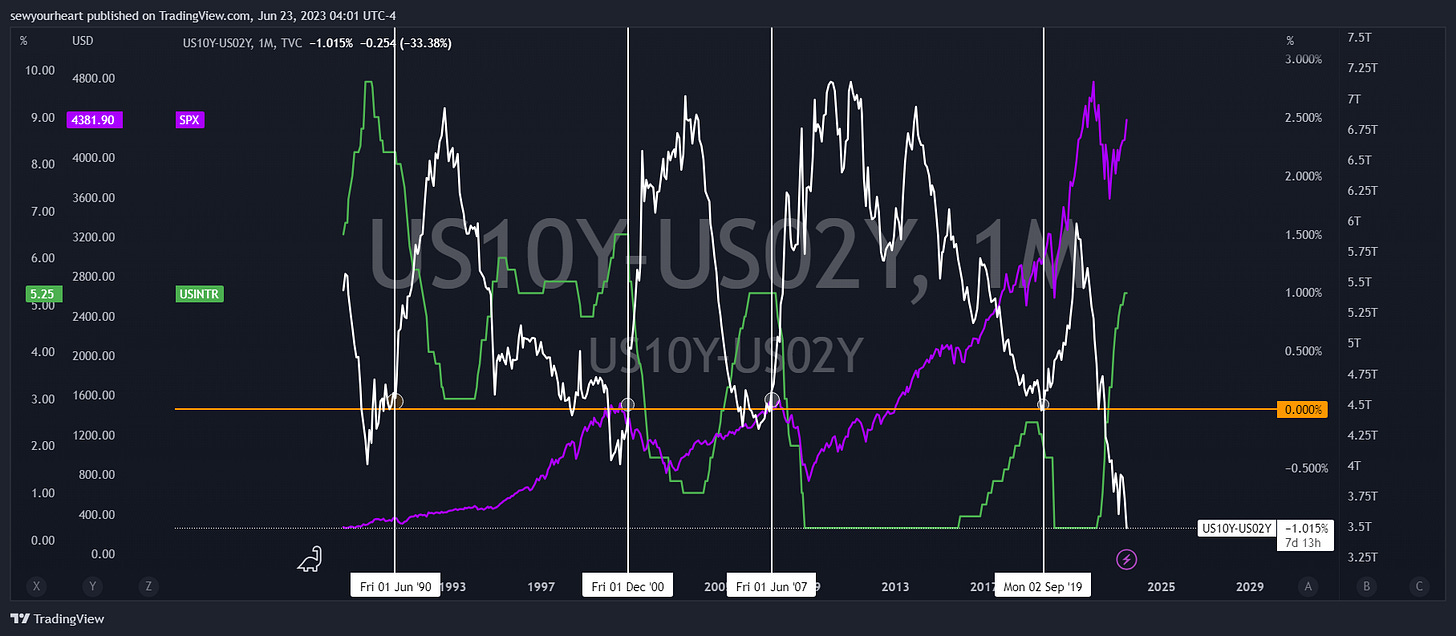

YC Steepening Check

The long inverted yield curve has yet to re-steepen and leaves many scratching their heads. In previous cycles, the re-steepening did not occur until after a Fed pause.

With all conditions considered, the only thing left to do is wait patiently.