Transitory 2.0

The Fed does not care about any overheating for now, and this is something that has become increasingly clear to me over the past few days.

Truly, this only I have found:

That God made man upright,

But they have sought out many schemes. — Ecclesiastes 7:29

Well, well, well. Powell certainly showed his hand last week. He was admittedly much more dovish than I expected. It is clear that he is ignoring everything inflation related & focusing on unemployment. The Fed does not care about any overheating for now, and this is something that has become increasingly clear to me over the past few days.

Powell’s doubling down with claims that policy is in restrictive territory truly made no sense to me. No measure that the Fed uses to gauge financial conditions shows this to be true, not a single one. I touched on this in my last post already, but financial conditions are as loose/easy as they were before the rate hiking cycle began. That may have been the most intellectually dishonest thing I’ve ever heard him say.

Despite this, I’m not upset at him. I’m not upset at the Fed. It’s been clear to me for a while now that the Fed doesn’t have any credibility to gain or lose. It is simply nonexistent. What this means to me is that commodities/inflation assets will do well over the next few years, while equities & bonds performances pale in comparison. And since that & stagflation’s been my base case since Dec’22, I believe that it’s paramount to take note of the Fed’s preference for unemployment vs. inflation now for a few reasons.

Equities are pricing in perfection — soft landing, inflation comes down without unemployment making things uncomfortable.

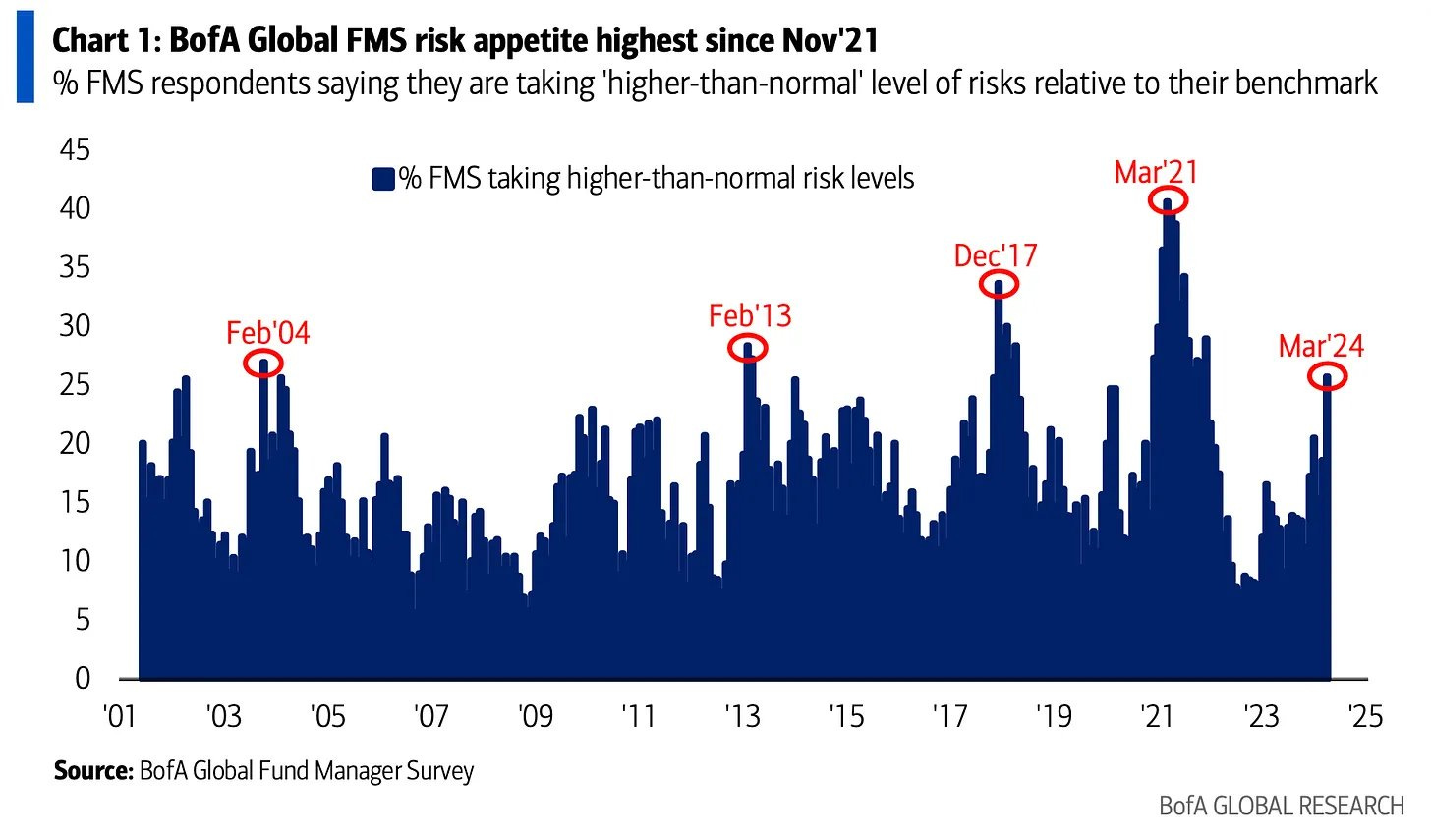

Momo trade is incredibly crowded (99.8%ile relative to history). Momo is waning now.

The Fed’s recent projections showed higher long term inflation expectations, albeit not by much, and no serious job losses over the next 3 years. They are very sanguine to say the least.

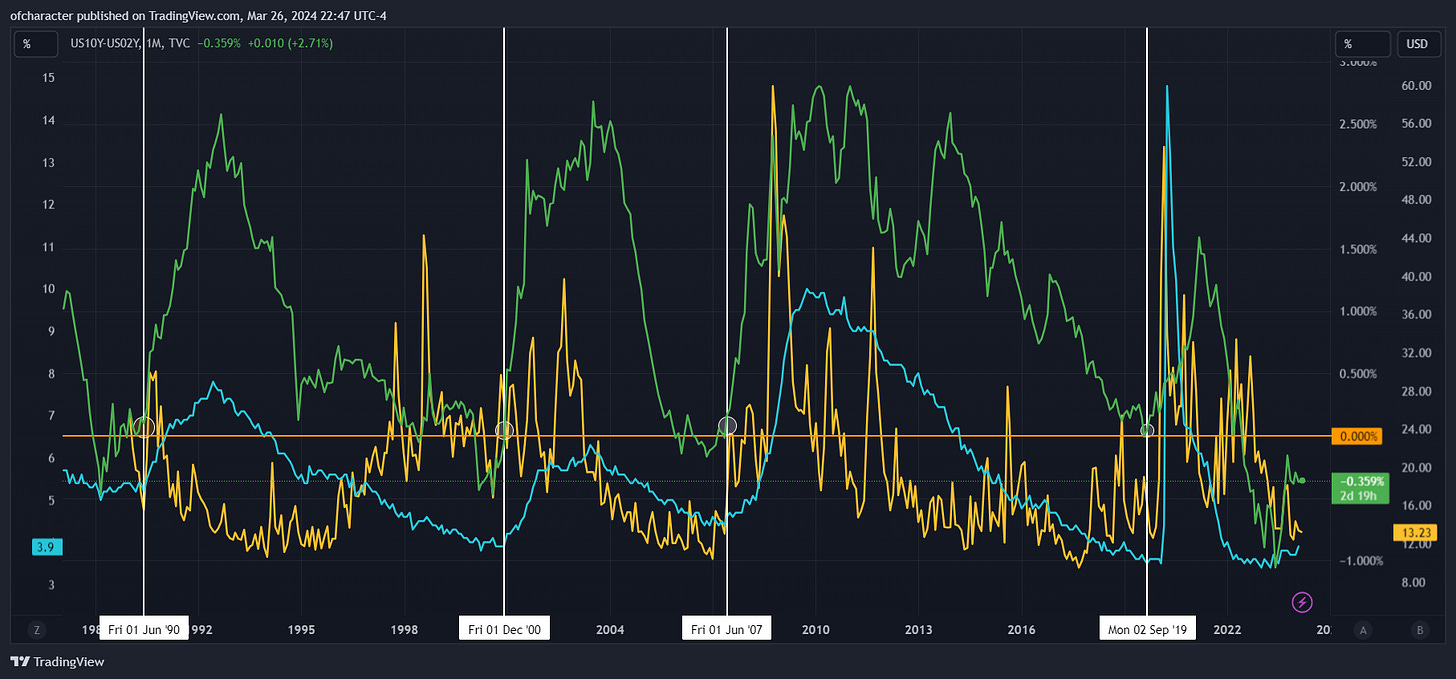

It’s just way too early to be pricing perfection. No room to be having such conflicting views regarding inflation & unemployment. Most importantly, the yield curve, which some “strategists” are now deeming an unreliable indicator for a recession, has yet to resteepen/un-invert. In my This Bear is Still a Cub post, I pointed to the yield curve as an indicator of where we were in this cycle — how early or late we are into it. Here’s an update:

Note the relationship between volatility, unemployment, and the yield curve. Mainstream media will repeatedly tell you that “this time is different.” “The yield curve has lost its predictive power.” That is complete rubbish. Once again, it is the resteepening/uninversion of the yield curve that brings volatility & coincides with recessions/substantial downturns in equities.

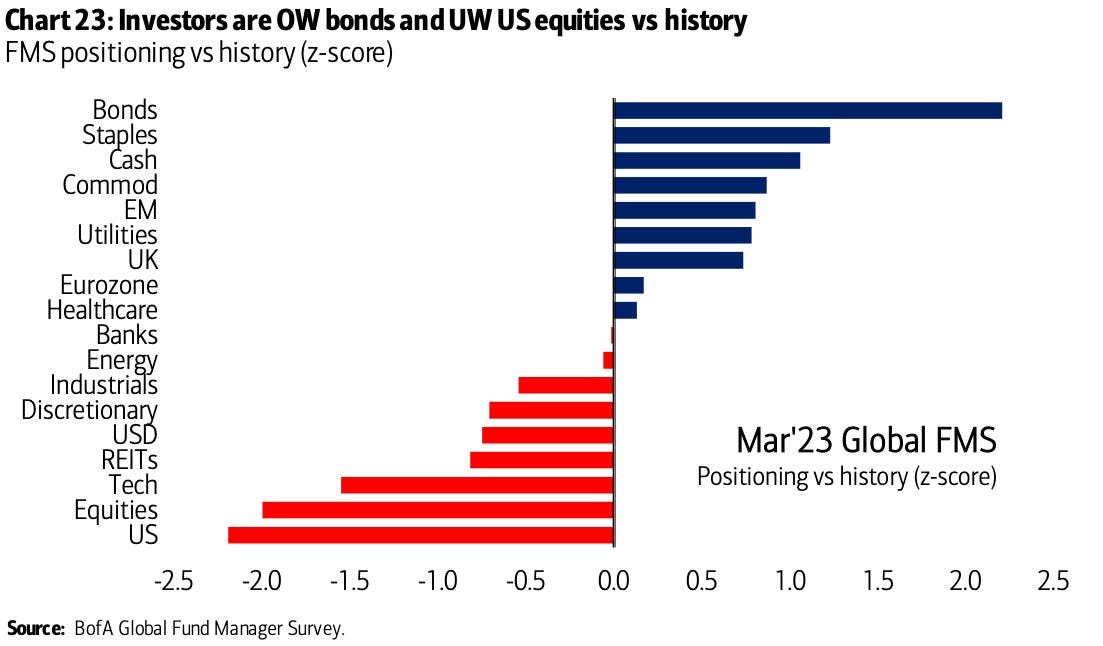

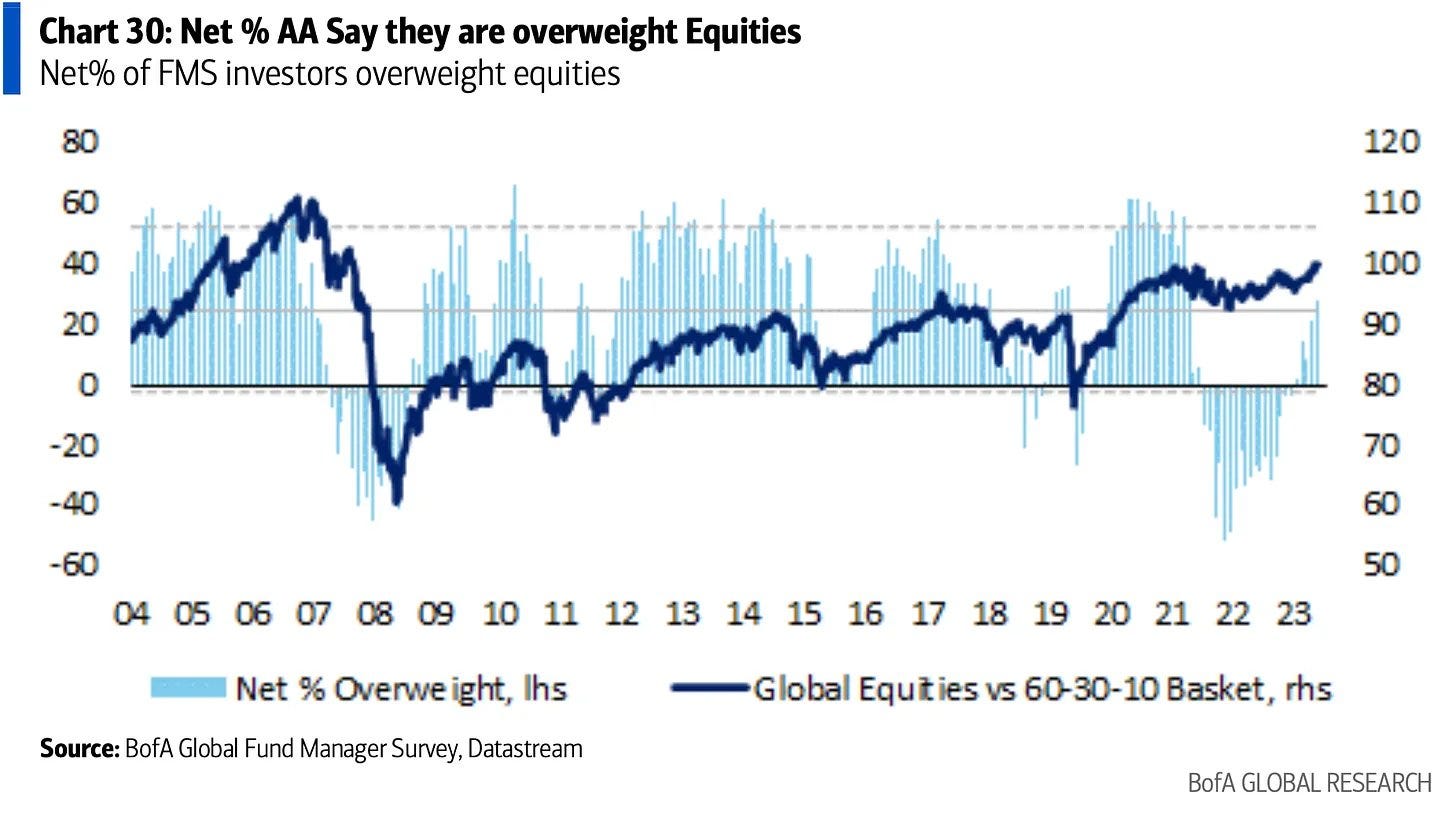

This is why I believe that we are still presently in a secular bear market — especially for bonds. Bonds have struggled over the past few years to say the least. As for equities, early last year, PMs were getting yelled at by their bosses for being UW their benchmarks. Remember, they hated tech coming out of ‘22.

Now they love it.

A little too much…

This is the funny thing about dispersion being so high right now. A handful of stocks (Mag7) are responsible for a majority of the indices gains, and if you’re a PM and you don’t own those, well you’re straight up not having a good time. Missing upside is far more important to them than deteriorating macro. So the chase will continue, but I will not take part in it anymore — says the man who simply went long NVDA calls sparingly to hedge his shorts.

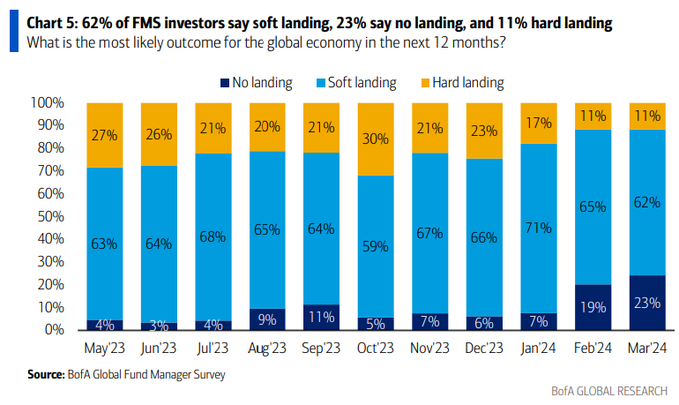

Hard landing bets are also declining while “no landing” bets increase — whatever that is lol.

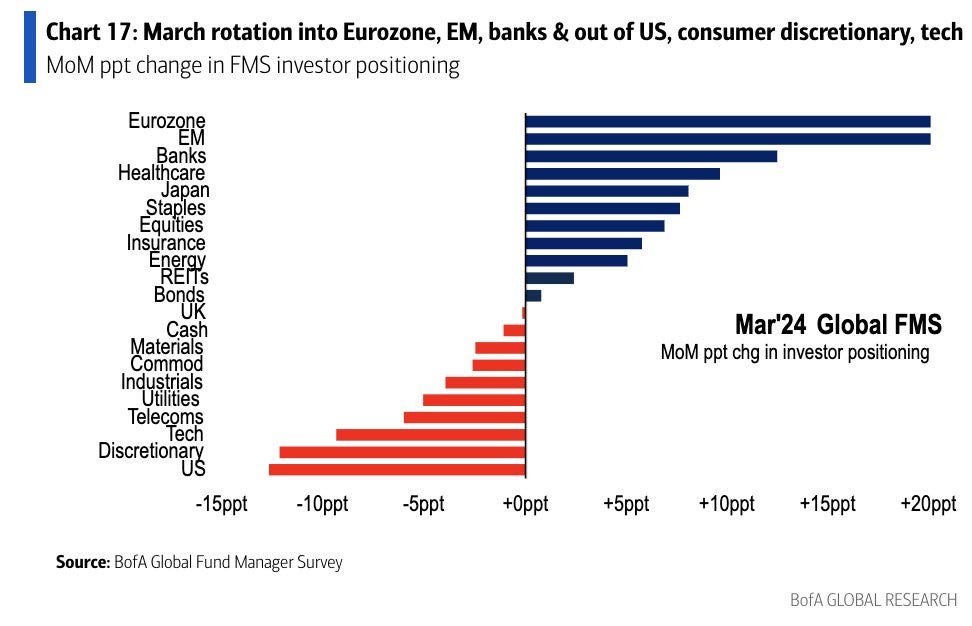

I say all of this to say, the Fed being super dovish right now is not as bullish as some think. The momo trade that’s carried this market recently is losing steam. Bitcoin’s momentum is clearly waning. The Nasdaq is notably weaker than SPX is, and there is still a rotation (energy & consumer staples) happening underneath the hood that I mentioned in my most recent post.

So, this market is clearly on fumes. The usual suspects are out in droves declaring victory of all sorts, soft landings, no landings (lol). The yield curve is no longer useful. It’s getting good out there. I’m excited to see what else they have up their sleeves.

I’m still expecting equities to see a healthy correction before a resumption of the uptrend. A break of the trendline on SPX would give me confidence to pull that trigger on shorts again. I’d be happy to go long after the correction for a bit, but can’t see myself being comfortably long equities now unless they correct.

A quick positioning update/recap:

Initially in at CL 69.80. Added May call spreads at CL 75.57.

For shorts, initially in at SPX 5028.80. Added Apr/June puts/put spreads at 4969.73 & 5188.63.

Energy/oil was 30% of my port.

Shorts were a bit less than half of that.

I’ve taken some off of oil now though I still think it has some room to run into mid/late April. The entire position will be sold before the end of May — will probably sell before then — regardless of how high the price goes.

Shorts gone now. Risk/reward was solid so I can’t be upset. I’m still looking to get short but will be more patient here. I’ll be short NDX this time around as I think SPX will hold up better during a correction.

Another short candidate for me is MSTR. I’ve briefly talked about their CEO, Michael Saylor, in the past. Put simply, he is a fraud who has worked his way back into the public eye and is doing what he does best again— taking advantage of unsuspecting people.

As for bonds, I prefer to wait for the countertrend rallies to play out before shorting the long end. The long end is doomed in my opinion, much more so than equities.

That’s all for now.

Until next time,

Pierre.