Transitory Disinflation? Hard Landing Secured

"We now understand better how little we understand about inflation." -- Jerome Powell

February kicked off with a bang at the FOMC meeting. Powell’s willful negligence of FCI easing since Oct & failure to swiftly refute the erroneous claim that inflation would be sitting at 2% by June with rate cuts following shortly after leaves the Fed even further behind the curve. The Fed made another major policy mistake and put their tenuous grasp of inflation on display. The following day, we recorded the highest call option volume ever. Talk about FOMO.

We saw NFP come in extraordinarily hot in the same week. This data was certainly not what pivot enthusiasts wanted to see.

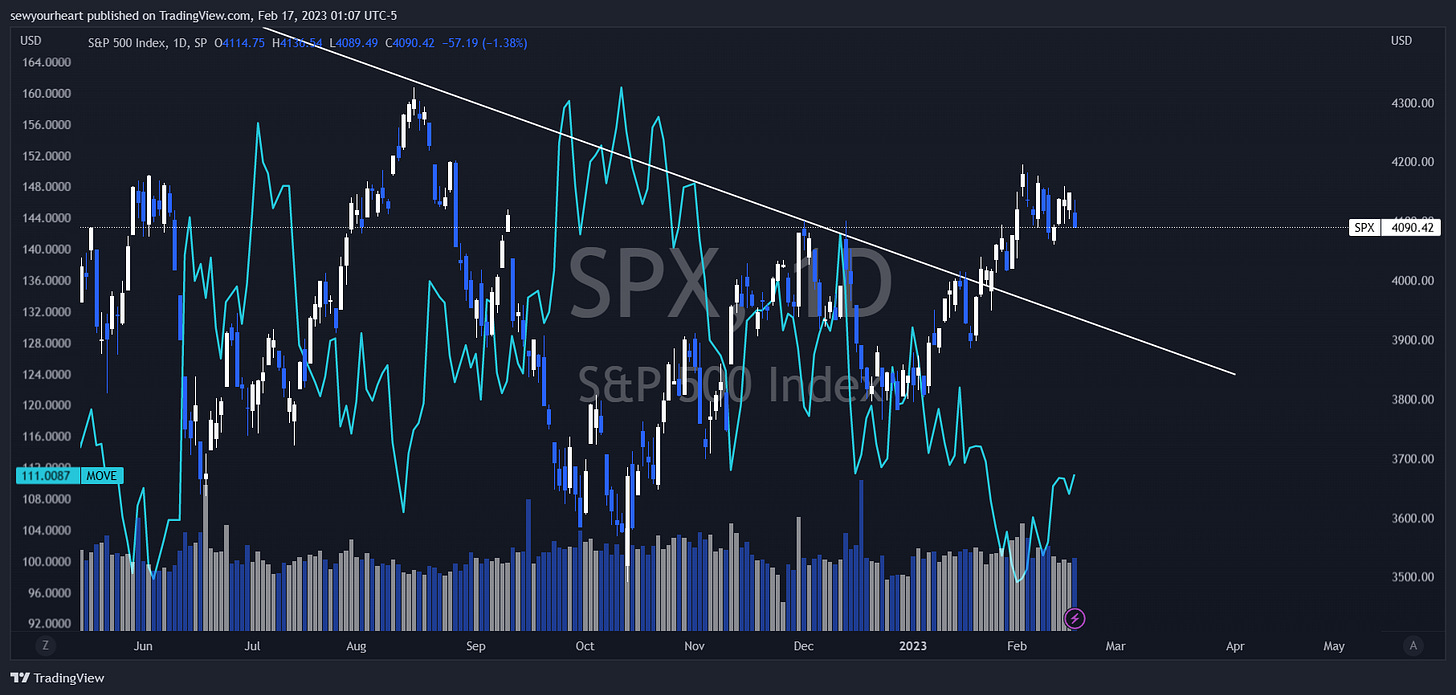

Relevant data for Jan. and revised data from Nov/Dec has confirmed that disinflation was transitory, and inflation is about to accelerate given the economies resiliency and labor market tightness. For equities, the salient recent development is the $ bottoming while rate vol is creeping up.

As inflation expectations begin correcting in response to recent & upcoming data the $ and yields will continue to rise while bonds respond commensurately. Equities are late to the party, as is customary.

The unbridled complacency permeating the market during a period of dullness after what appears to be the peak of this bear market rally is also important to note.

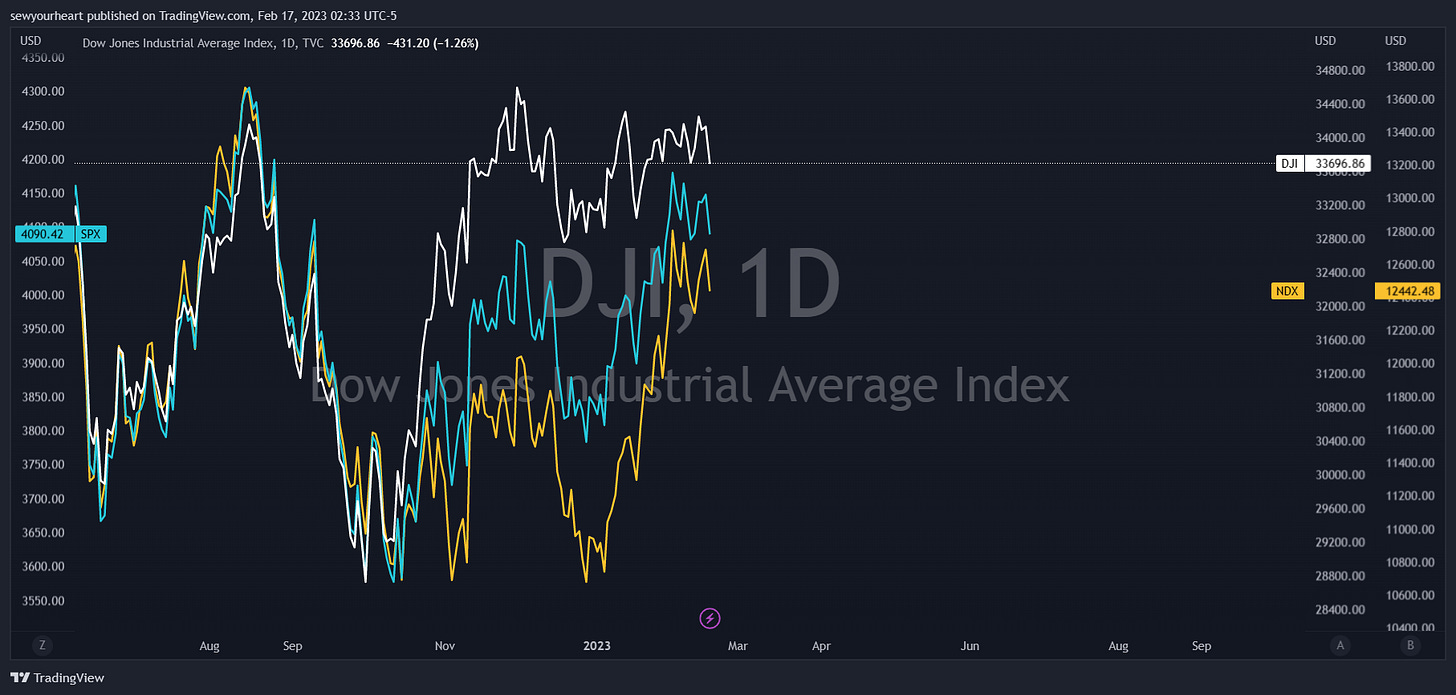

“Dullness following the peak of a bear market rally is a common danger sign. However, it is often confused by the average investor who fails to realize that the old adage, ‘‘Never sell a dull market,’’ does not apply when the primary trend is down. Dow was the first to recognize the implications of dullness. In 1902, he wrote, ‘‘... the action of the market after dullness depends chiefly upon whether a bull or bear market is in progress. In a bull market dullness is generally followed by advances, in a bear market by declines.’’ He adds that, in bear markets, ‘‘... prices fall because values are falling, and dullness merely allows the fall in values to get ahead of the fall in prices.’’ — Harry D. Schultz

The Dow is first to recognize the implications of dullness once again in 2023.

With all current conditions considered, it appears that the February blues are about to hit some market participants where it hurts.