Trajectory

I’ve had some stellar conversations this year about where we’re potentially headed & how to capitalize given the trajectory. Consequently, I feel as if there are a few areas where you can make good money over the next few years if you’re sagacious & nimble.

The first is understanding the key differences between two prominent nations and their policymakers. America is notoriously impulsive & short-termist. Hyper-individualistic & apathetic towards learning from history. While China is strategic & long-termist. Collectivist & keen to learn from history. Cognizance of the different policymaker styles is paramount.

For example, there have been many American pundits who erroneously deemed China’s reopening a dud. In the 1H of ‘23 commodity prices stalled and China’s property sector woes were constantly brought to the forefront of talking heads conversations. This concern — in my opinion — was always disingenuous in nature, and stemmed from a fundamental misunderstanding of the different policymaking approaches.

“Lastly, I’d like to highlight Powell’s remarks pertaining to China’s reopening from December and March.

December FOMC Presser:

“Weaker output in China will push down on commodity prices, but it could interfere with supply chains ultimately. And that could push inflation up in the West. It’s very hard to say, you know, how much—how those two will offset each other. And it doesn’t seem likely, actually, that the overall net effect would be material on us.”

Powell’s Testimony Before Congress:

“China’s faster reopening could put upward pressure on commodities prices but also quicker healing of supply chains.”

The messages are strikingly similar and seem to be devoid of any concern towards geopolitical induced exogenous shocks to the commodity space. Even with the absence of an exogenous supply shock, the resilience of the labor market coupled with China’s reopening is helping to reignite inflation concerns.

The manufacturing sector saw its biggest improvement in activity in more than a decade in February and consumer activity climbed, the latest purchasing managers’ surveys showed. Chinese housing sales also rose for the first time in 20 months, according to data from the 100 biggest real estate developers.

The economic outlook remains uncertain, though, against the backdrop of weak global growth and rising interest rates. Demand for Chinese exports from some of the country’s biggest markets like the US and Europe have plummeted in recent months and are likely to remain weak this year. US-China tensions over technology and geopolitical matters have also escalated, weighing on business sentiment. —China Leaders Surprised by Pace of Economy’s Rebound - BNN Bloomberg

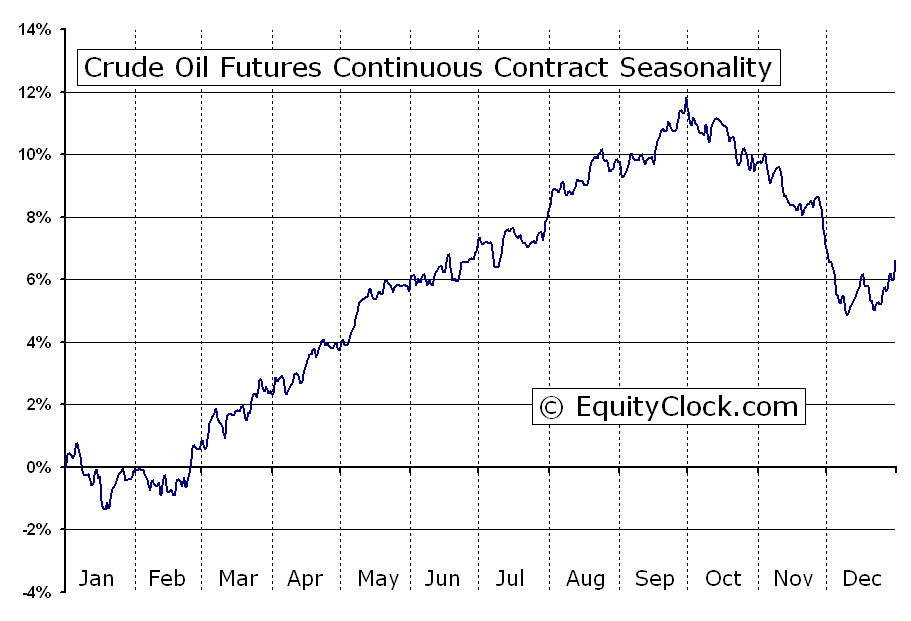

It is true that the economic outlook remains uncertain, but for Powell to trivialize the effect this reopening can have on inflation is incredibly disingenuous. Especially because crude seasonality is on the verge of entering significantly positive territory.

This may be the Fed’s fifth policy error.” —

On a Scale of 1-10, How Much Faith Do You Have in the Federal Reserve?

The credibility of the Fed is a topic often canvassed by many in the finance community. Most believe that the Fed has done a sufficient job given the once-in-a-century pandemic we entered at the start of the decade, while others believe that they’ve continuously committed several policy blunders and are consequently devoid of any credibility. I believe …

The West’s reopening was accompanied by exceedingly aggressive fiscal & monetary stimulus. So naturally things would appear to be moving smoothly as we reopened. If fiscal & monetary stimulus is a pivotal portion of a DM nation’s reopening process, why wouldn’t it be for China as well?

China will stimulate their economy. They have to. It probably won’t be as aggressive as the West’s stimulus, but it will suffice. This is why I said that they are reopening at a precarious time for the West back in December. Their reopening was always going to be accompanied by stimulus, and there’s probably no better time to stimulate then when the US is approaching the “end” of its hiking cycle. Consequently, commodities will continue their ascent as the 2nd wave of inflation makes its presence felt.

The second is knowledge of central banking history. And yes this includes everything before the year 2000. Cognizance of the repercussions from a CB making “price stability” its core mandate helps to block out all of the noise coming from those without this knowledge.

‘The futility of price level stabilization as a goal of credit policy is evidenced by the fact that the end result of what was probably the greatest price stabilization experiment in history proved to be, simply, the greatest and worst depression.’ —Banking and the Business Cycle (1937)

In 1928, incentivized by mass speculation in the stock market, the Fed aggressively raised the discount rate in an attempt to tame the speculation. They also drained hefty amounts of reserves from the banking system. That’s textbook contractionary policy. And because monetary policy was considered to be tight in the US at the time, it would be so globally. Several countries would have to either devalue or completely abandon the gold standard if they didn’t follow the Fed’s lead. The Fed essentially forced other CB’s hands due to the dilemma they’d find themselves in if they didn’t tighten as well. Sound familiar?

The market would continue rising irrespective of this, and many pundits behaved as if bad times would cease to exist. Sound familiar?

‘We are no longer the victims of the vagaries of business cycles. The Federal Reserve System is the antidote for money contraction and credit shortage’ — Andrew Mellon

We know how this ended — in a deflationary bust. This time is not different.

Japan, albeit many years later, would also learn why making price stability a core mandate is a fool’s errand. Monetary policy should always be conducted in a prudent manner.

The third is the ability to sift through the noise and find the signal. I’ve mentioned this a few times in some of my recent posts that signal > noise and there are plenty instances that prove this to be true. To touch on a few:

There is presently an unhealthy obsession with the term ‘recession.’ It’s almost as if the majority has forgotten that you can have a recession with high inflation — or stagflation. Unsurprisingly, the recession that many refer to is almost always the textbook deflationary bust. This lingers in the back of policymakers minds — rightfully so — because of how painful it is. But this is ultimately noise. Stagflation is next on the agenda as the cumulative effects from OPEC+ cuts, Russia & China’s alliance, and response lag from the monetary/fiscal policy make their presence felt. The deflationary bust will arrive, but only after stagflation.

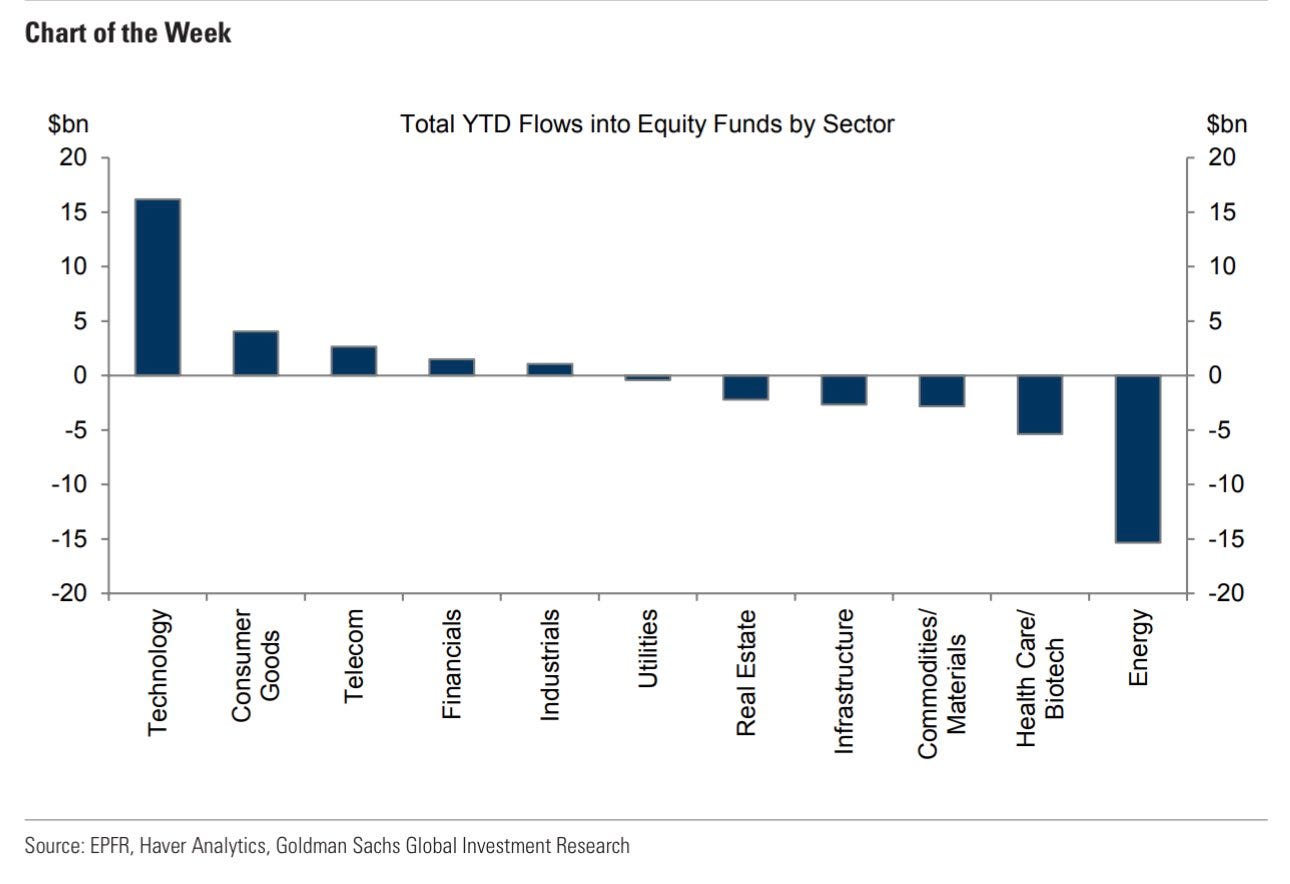

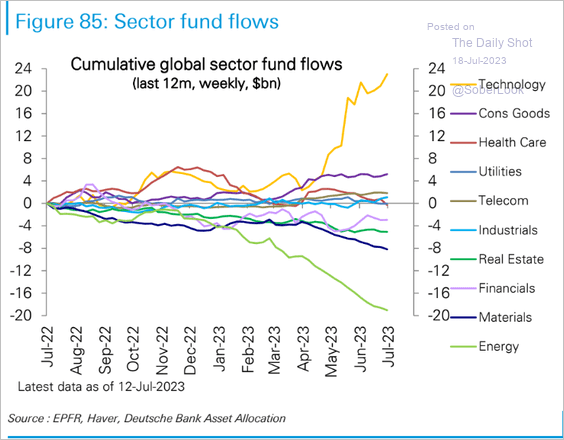

Commodities are receiving no love currently while tech is getting a little too much love. AI fever is hindering investors from seeing reality; in order to accomplish some of the goals the tech industry wishes to, they need commodities, which are in scarce supply. This lead to investors being massively overweight tech and massively underweight energy/commodities.

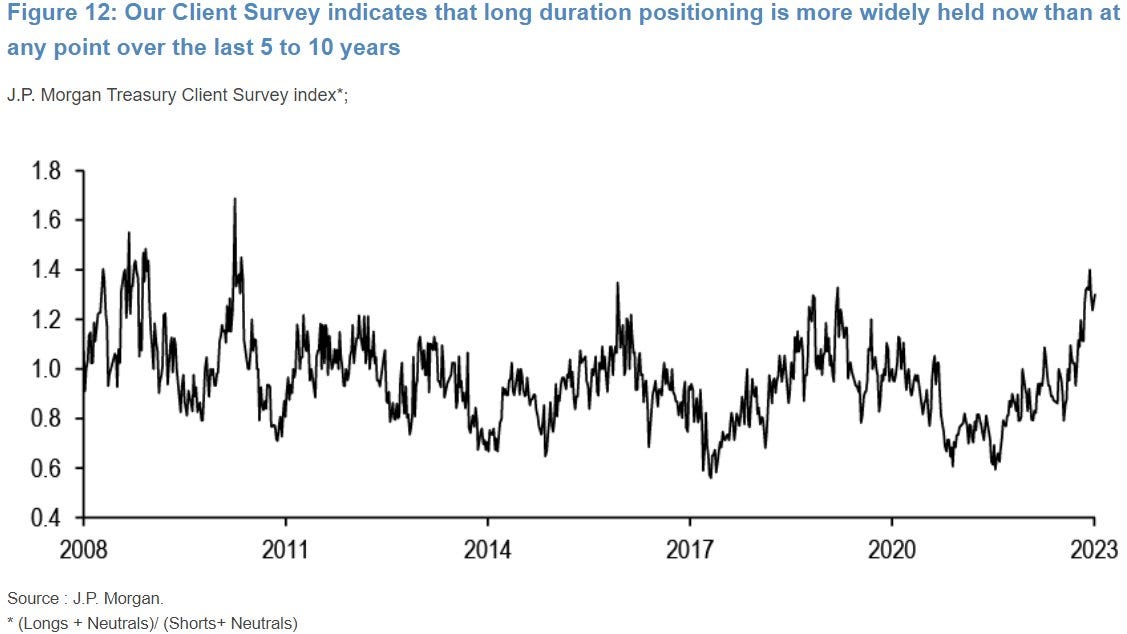

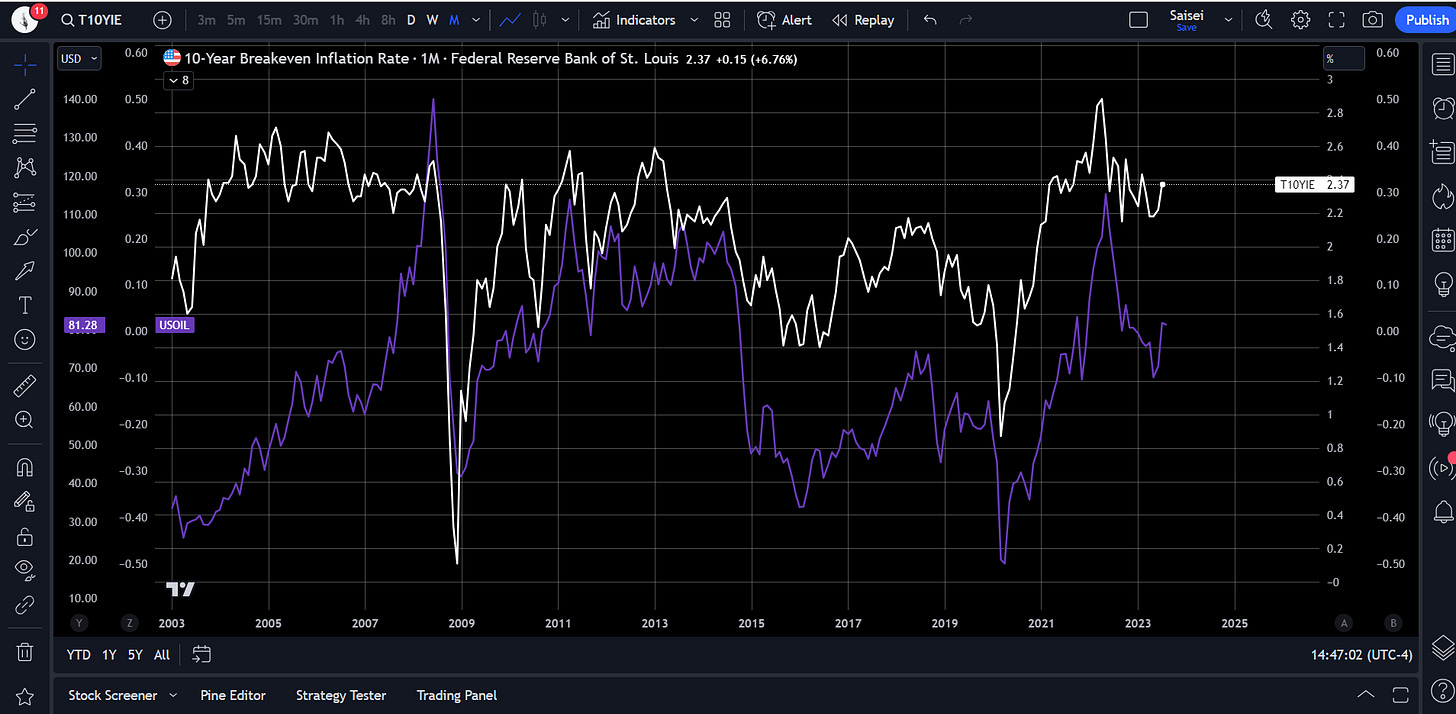

Positioning in the long end of the curve is implying that inflation — core & headline — will swiftly and safely return to 2%. This is simply not happening.

Commodities (oil specifically) are rising swiftly and this will beget higher inflation expectations.

This is the complete opposite of what Jerome Powell wants to see, which is a routing of inflationary psychology in consumers.

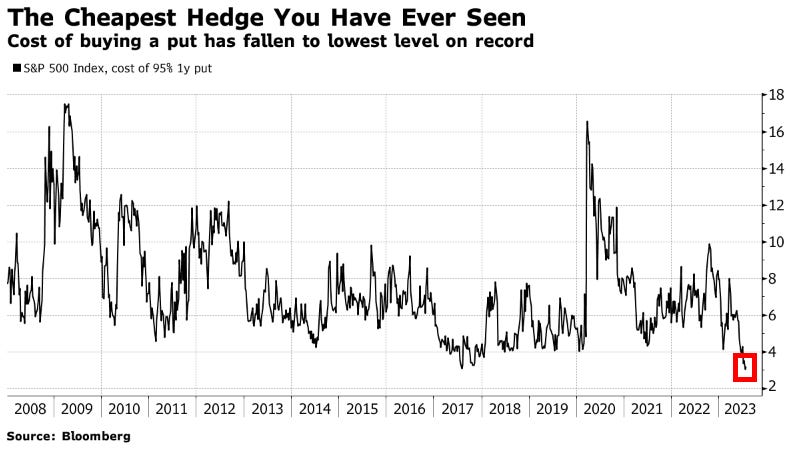

The indices are approaching their respective ATHs, but it’s also the cheapest to hedge for downside on record.

Could they breach ATHs? Bitcoin’s dull price action throughout the tail end of this rally makes me believe ATHs won’t be eclipsed, but since we’re so close to them it’s certainly possible. Will that void the bear market thesis? Absolutely not. This was the most accommodative fiscal + monetary policy the US has ever administered; so again, the resurging distortions and exuberance now seen in equities aren’t synonymous with a bull market.

The fourth is knowledge of commodity supercycles & how they are induced. They coincide with monumental changes in the monetary system and rapid industrialization periods. Namely:

1899-1932: US industrialization & beginning of gold standard in the US in 1900.

1933-1961: Global rearmament. Britain stops usage of gold standard in 1931, US in 1933.

1962-1995: Europe/Japan/US industrialization. US complete abandonment of gold standard in 1971.

1996-2014: EM uprising (China specifically). Beginning of de-dollarization process.

We’re presently in the latter stages of de-dollarization and in the early stages of a tech revolution. I believe we are also in the nascent stage of a new commodity supercycle that started in 2020 and I expect the de-dollarization process to mature significantly before the end of this decade.

Lastly, positioning is still the same as stated in my most recent post.

“I’m long oil as of 7/7/23 and still long vol as a hedge that gets rolled systematically. I may try and play the 2s10s steepener and SPX shorts as well (probably not until after July OpEx). These are subject to change without any update and are obviously not financial advice.” —

The VIX is Not Broken & Oil is Not Dead | 2H Prep pt. 2

So much for that break I was supposed to be taking… American hegemony was induced by laissez-faire economics and our geopolitical hegemony amongst several other factors. We are currently experiencing a historical geopolitical paradigm shift as we progress further into the stages of multipolarity. It’s paramount to know that multipolarity begets disequili…

Short bonds (long end), short equities (soon) & long commodities is the plan. Stagflation is coming.