Vicissitudes of Economic Life

2022 - The Calm Before the Storm

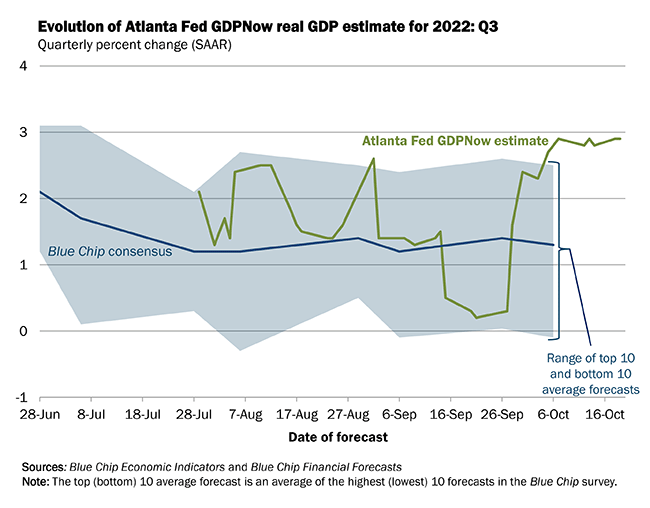

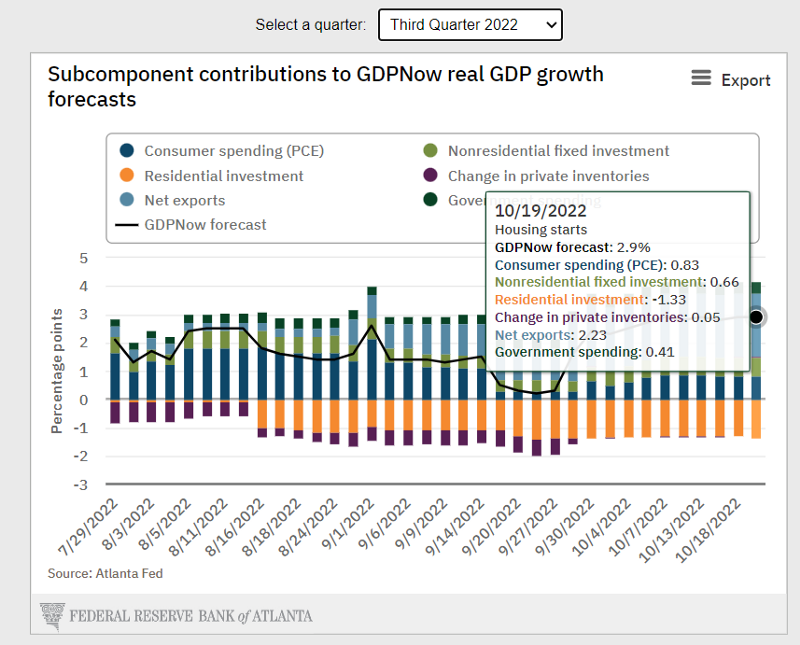

We’re about a week away from the Q3 GDP reading that will put all of those engrossed in recent recession hysteria in a collective stupor. The Atlanta Fed Q3 GDP estimate is currently up .2% from the 2.7% reported on October 5th.

This is not to say that I believe we won’t be in a recession anytime soon. After all, the factors contributing to this positive reading don’t bode well for the future of not only the US economy, but also the global economy.

Import demand is falling while consumer spending and net exports are up considerably in Q3, but this ultimately remains noise. The signal here is that we’re dealing with a robust dollar and persistent inflation that the Fed has promised to tackle with rate hikes. Q3 GDP will likely be another case of “good news is bad news,” followed by an increase in the likeliness of a 100bp hike for November.

Navigating Unprecedented Times

“Remember the old Wall Street adage: “Don’t confuse brains with a bull market.” And don’t imagine that markets turn on dimes and change directions overnight, as the mass media would have you believe.” — Harry D. Schultz

“Most honestly can’t see around the corner. This is no crime. But if one wants to preserve his capital (and perhaps even dare to dream of increasing it) during a sick economy or market period, one must try to see around the corner. An important requirement for investment success is to think ‘‘contra.’’ — Harry D. Schultz

The price action in bonds and equities specifically over the course of 2022 leaves retail investors disoriented. At the close of Q3, the S&P, Dow, and Nasdaq were down 25%, 21%, and 33% respectively. This is mistakenly attributed to the recession that we’re supposedly in now. This lack of discernment has had an unsurprising adverse effect on retail’s portfolios. The inability of the majority to detect the signs of the times and interpret the data that they see or hear about the changing economy is gravely unfortunate.

The truth is that the “everything bubble” has popped. Housing, equities, crypto, bonds, and sovereign debt bubbles have popped, and their year-to-date performances have responded commensurately.

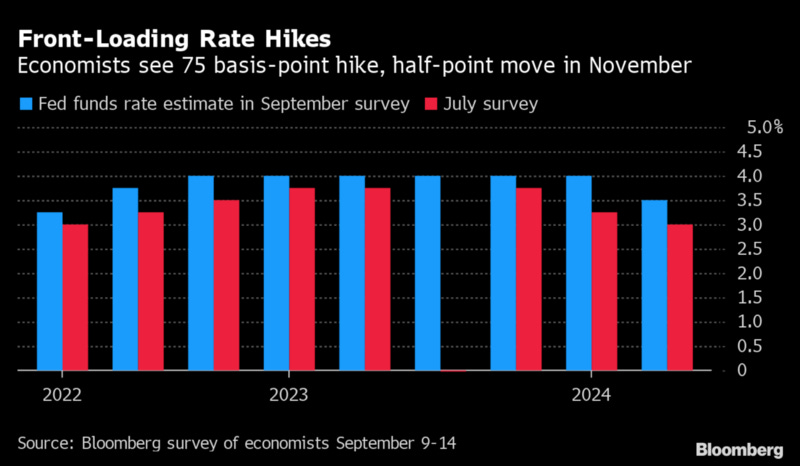

The bond bubble, in particular, leaves both retail and institutional investors befuddled and indignant. When equities fall, bonds are supposed to be a safe haven. In 2022, bonds have failed miserably to live up to their potential. This performance is in large part due to persistent inflation and the transition from the ZIRP/QE era to “higher for longer.” This transition cannot be undermined or trivialized if one wants to succeed in this environment.

Higher for Longer

Where do we go from here? Consensus believes this to be an exceedingly difficult question to answer but the answer is simple, as all good things are. The point is not to attempt to answer this question by prognosticating the future with pinpoint accuracy.

Look no further than the Fed’s current mandate. I’m well aware of how this approach can be perceived to be quite paradoxical, primarily because of the Fed’s recent transitory inflation “mishap.” “Why should we listen to the Fed now when they tell us they’re raising rates?”, is a respectable question here. Below are a few appropriate responses.

This is the end of the ZIRP/QE era for the foreseeable future thanks to profligate fiscal and monetary policy

Fixate on policymaker constraints instead of preferences

Inflation should remain persistent for the next few months, which means all Fed pivot hopes for the foreseeable future are premature/gratuitous

Remember that profligacy is an invariable aspect of the Fed’s monetary policy. They were too loose for too long and now they will likely overtighten

Brimming With Headwinds

Aside from the other aforementioned headwinds for the economy and financial markets, there are currently several geopolitical issues that appear to be escalating every week. In addition to the ongoing Russia-Ukraine war, the severity of the China-Taiwan conflict rears its ugly head once again.

“It’s not just what President Xi says, it’s how the Chinese behave and what they do,” Admiral Gilday told the Atlantic Council.

“And what we’ve seen over the past 20 years is that they have delivered on every promise they’ve made earlier than they said they were going to deliver on it. So when we talk about the 2027 window in my mind, that has to be a 2022 window or potentially a 2023 window. I can’t rule that out. I don’t mean at all to be alarmist by saying that. It’s just that we can’t wish that away.” — China could invade Taiwan before 2024, US admiral warns | Herald Sun

China remains imperturbable despite the US’s blatant provocations. Should China attack in either of these windows, the US would not be in an ideal position. We’d either be approaching the advent of a recession or be well into one with persistent inflation.

Other noteworthy headwinds:

Any future strategic move from BRICS to further the decline of US hegemony

A Necessary Evil

Contrary to the popular belief that the Fed is solely destroying immense wealth, this transition to “higher for longer” is a necessary evil. The “wealth” they are erasing wasn’t authentic to begin with.

The Fed is delighted to see equities fall if it means that inflation is correctly dealt with. This means that equities have not only not bottomed yet in 2022, but they also haven’t for the foreseeable future.

Bear markets are a process, you can’t rush them. They are natural and inevitable. Knowledge of this is essential, especially after over a decade of artificial growth.

The end of the ZIRP/QE era also begets the exposure of several prominent charlatans, snake oil salesmen, and grifters whose success is primarily attributable to that era. Elon Musk and Michael Saylor immediately come to mind here.

Despite the current outlook, there is always light at the end of the tunnel. The market will bounce back eventually, and a bull market will commence once again. It would be beneficial to refrain from attempting to mark the bottom of this bear market with pinpoint accuracy. If you remain sharp-eyed in the midst of this unprecedented environment, you’ll do well enough in that regard.

Lastly, for any bond aficionados in particular, the time for bonds to behave as a safe haven again is coming. It will likely be when the Fed decides to pivot, and the economy is actually in a recession.

“Patience is power.

Patience is not an absence of action;

rather it is “timing”

it waits on the right time to act,

for the right principles

and in the right way. — Fulton J. Sheen