Zig When They Zag

Risk/reward here is stellar

We’re 6 days away from the 1st rate cut and the pictures for oil and equities are becoming increasingly clear. I’ll keep this short and sweet, addressing oil first:

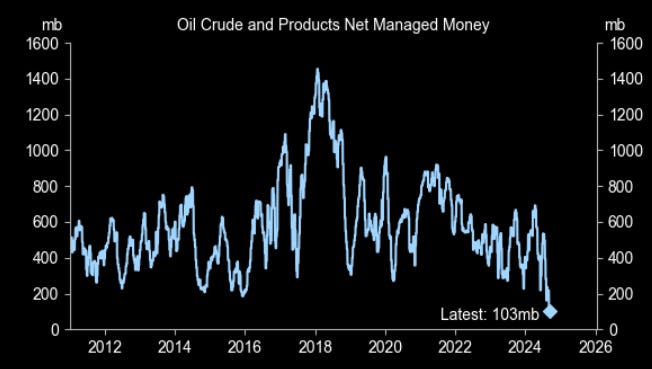

With a beautiful mix of indignation, befuddlement, and (unwarranted) pessimism, positioning and sentiment are perfectly aligned.

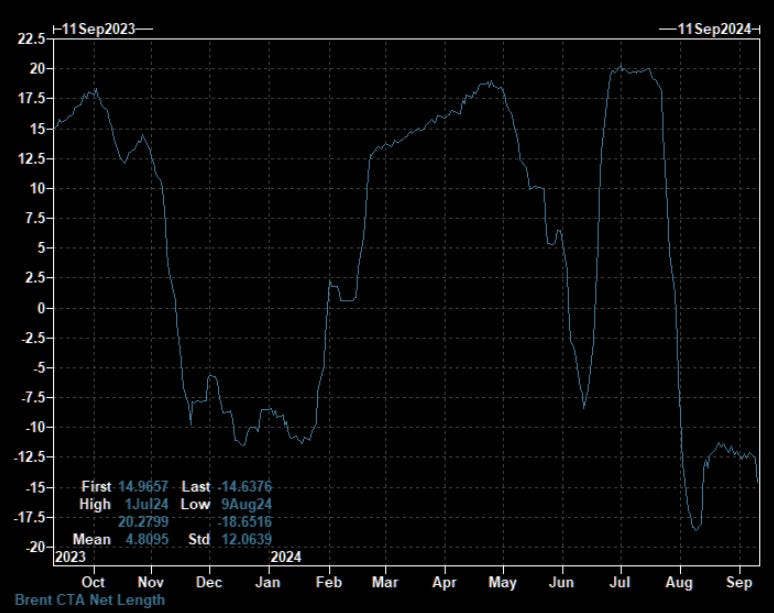

CTAs have served to exacerbate this. The mass deleveraging episode sparked by the violent unwinding of the yen carry trade brought CTAs net length to a notably low point.

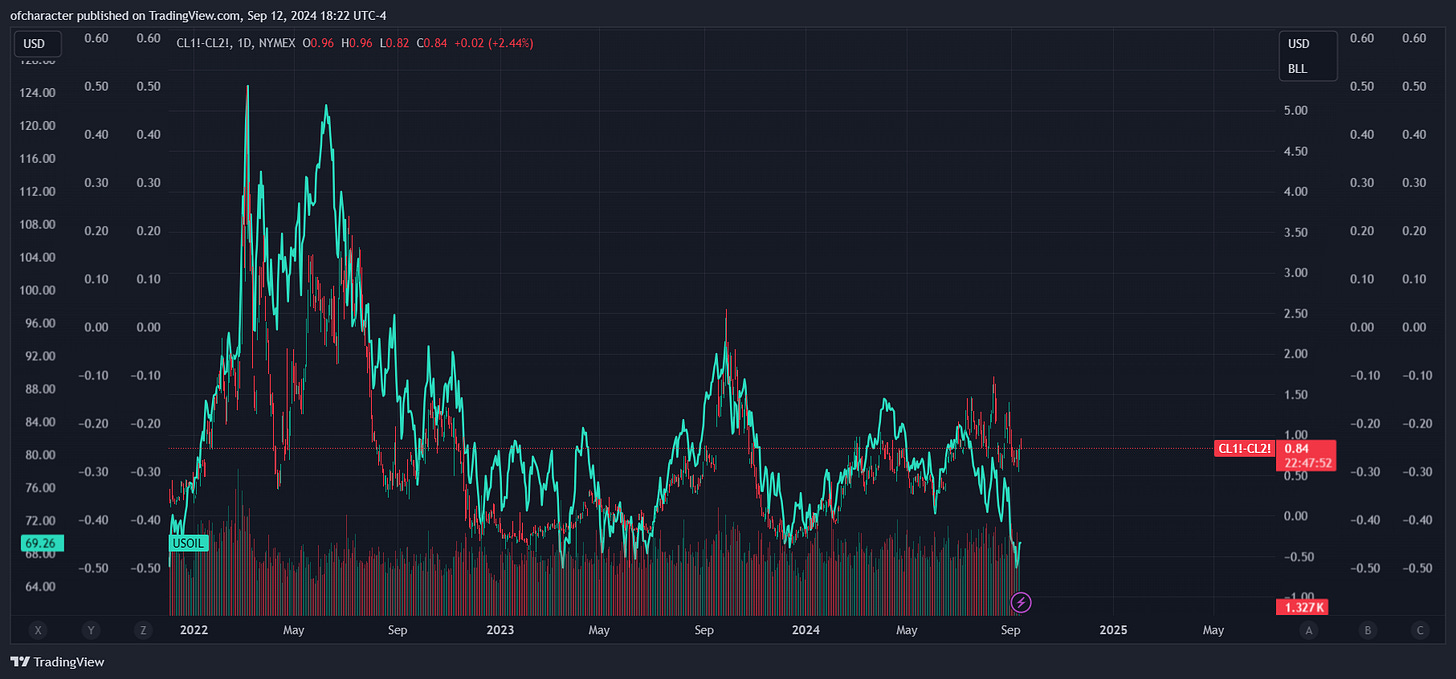

Prompt spreads held up quite well amidst the recent sell-off. They’re looking relatively healthy in spite of current pessimism.

Inventories have drawn consistently — almost every week since the beginning of July —, cushing is pushing tank bottoms, and we’re about to get a rate cut (which should be generally supportive of commodities). The disconnect between the paper & physical market is presently gargantuan, but it can’t last forever.

Oil is primed for a short squeeze, but a catalyst is needed to induce a long-lasting rally. I still believe that October is a sweet spot for this catalyst (increasing geopol. tensions) to transpire, so I went long oil through CL call spreads (several months out) earlier today.

An important caveat here to note is that there is, of course, a possibility that the yen wreaks havoc on markets again, causing a massive deleveraging (exacerbating the main issue) where correlations go to 1 — everything gets sold except vol. So, I’m prepared to take some pain here.

This leads me to the picture for equities:

Since my last post on 8/25, cash proved to be a solid position. The unhealthy RTY > NDX action led to some downside for the indices into 9/6. I didn’t end up catching the entire downside move, but I got a straddle on 9/4 to cover NFP and monetized 80% of it by the close on 9/6. By 9/9 in the morning, 100% had been monetized.

Tomorrow, the buyback bid starts to wane substantially ahead of a market that has front-run rate cuts all year.

The yen carry trade isn’t as important as most believe it is right now. It doesn’t matter what level USDJPY is at. The magnitude of the move is what’s important. RTY outperforming NDX is the main issue still — saw some of this today but NVDA’s bid dampened the issue (& vol ofc). For small caps to perform well alongside large caps going forward, you’ll need large caps to have a blow off top. Which leads to my next point…

A blow off top is very unlikely right now as positioning is stretched & market fragility has greatly increased since mid-July.

Still expecting to see an explosive downside move from mid/late-Sept into late Oct. It will be very important to see how explosive this move is, as that can determine if we get a year end rally or not, and how strong/weak it’ll be. Not currently positioned for it yet, but I will be 9/18 by EOD. FWIW, vol looks like its approaching its (higher) floor right now.