2023 (5783), The Year of Exposure & Prominent Volatility

Life as we know it before COVID will never return.

Around this same time last year, I posted a piece detailing what I thought 2022 would look like. Thanks to the knowledge bestowed upon me from God, I was able to discern the signs of the times and detect the most important regime change of my life.

“I would not be surprised if 2022 is another year for the history books.”

I believe that 2023, as well as the rest of this decade, will be transformative. We are currently dealing with the consequences of a decade of strikingly imprudent monetary policy, a paradigm shifting pandemic, and pervasive moral bankruptcy amidst arguably one of the most volatile geopolitical climates in history. There is no historical precedent that can help to delineate the path the world is currently taking.

However, since there are obviously glaring similarities between each of the past historical bear markets and this one, we can more easily deduce what the aftermath of the present bear market looks like. There has never been another time in which a bear market exhibited characteristics of *every* severe bear market simultaneously. 1

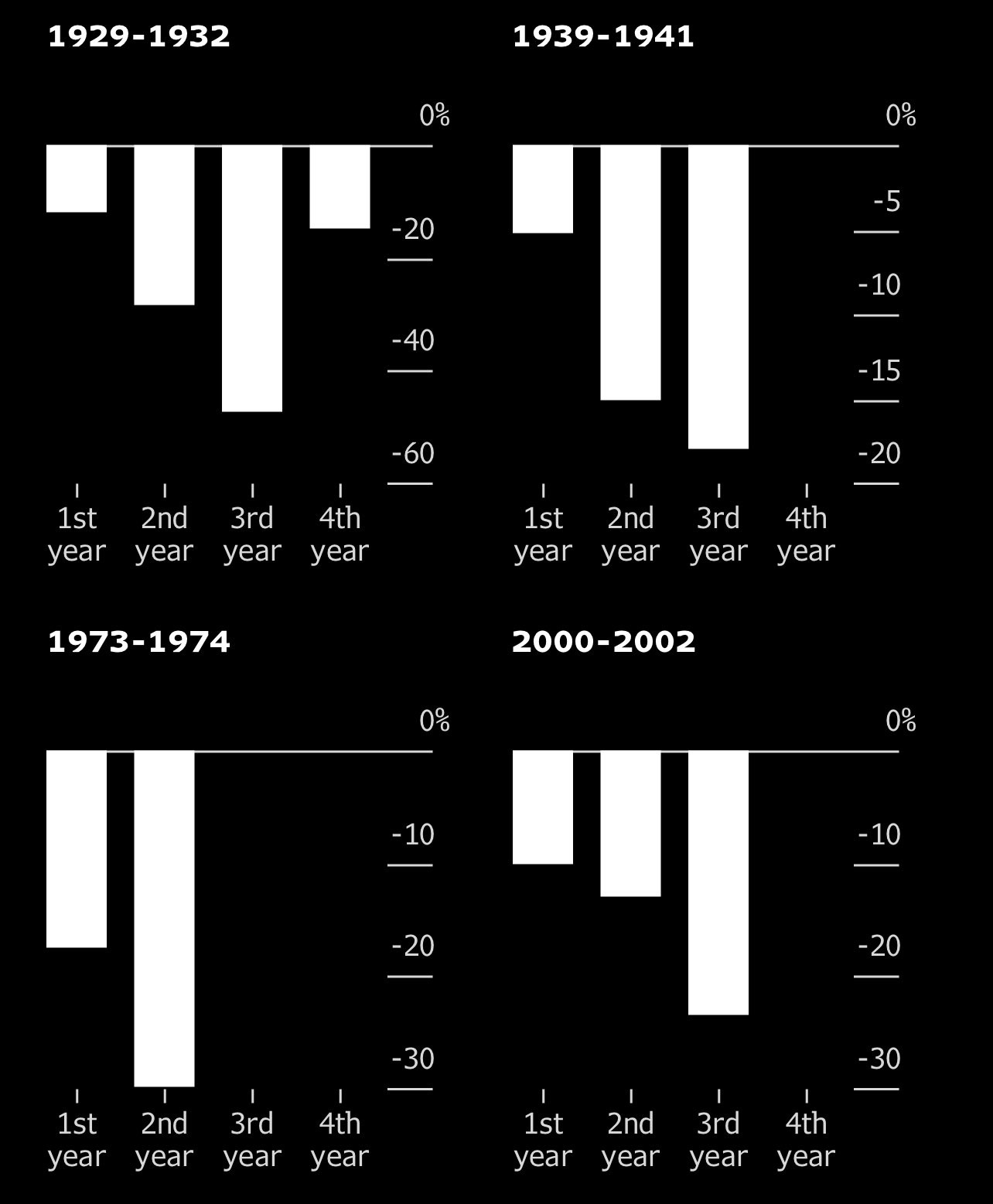

“Since 1928, the S&P 500 Index has only fallen for two straight years on four occasions: The Great Depression, World War II, the 1970s oil crisis and the bursting of the dot-com bubble at the start of this century.

In the benchmark’s almost 100-year history, such occasions are clear outliers. Yet when they have occurred, drops in the second year have always been deeper than in the first, with an average decline of 24%. That would exceed this year’s slide of about 20% to date.

More than two back-to-back years in the red are even rarer. The S&P 500 tumbled for three straight years from 2000 to 2002 and from 1939 to 1941, while the longest losing streak remains the aftermath of the infamous Wall Street crash, when stocks fell for four years from 1929 to 1932.”—Bloomberg

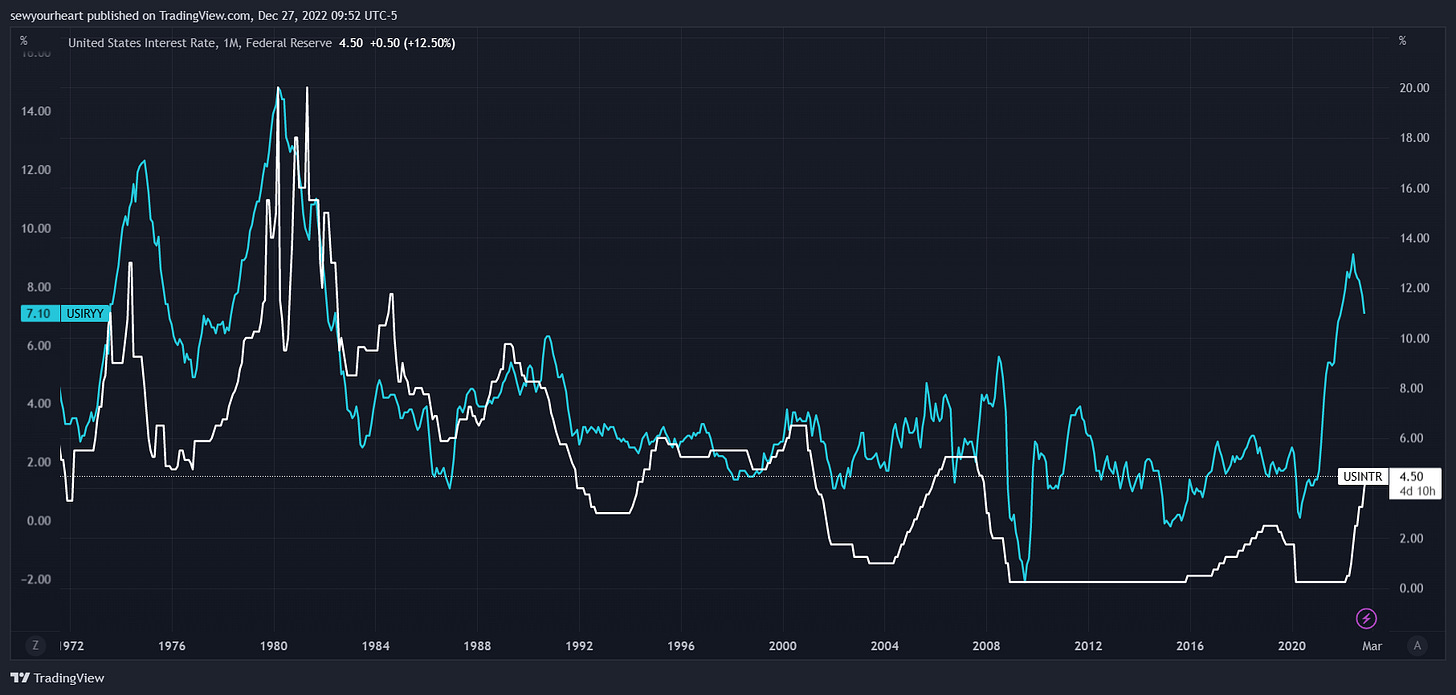

2023 will undoubtedly be another back-to-back year in the red for the S&P 500. Bonds will continue to struggle as well, as our friends from the East (China & Russia in particular) continue waging economic war on the West. Yields will move higher as investors realize that a stagflationary scenario has developed, and panic will ensue subsequently. The Fed lost control of inflation the moment it decided to neglect its presence. This is something that the majority haven’t understood yet. Consequently, rates rose at a historic pace because of their willful negligence of inflation that proved to be painfully persistent.

The FFR went from 0 to 4.5 in 2022 and inflation remains virtually unchanged since Dec ‘21. China knows this, and they have pounced on the opportunity to exacerbate the Fed’s struggle with persistent inflation by reopening at a precarious time for the West. China’s emergence from draconian COVID lockdown rules will prompt a bolstered demand for their oil. China’s oil consumption may be relatively weak in the nascent stage of reopening, but it will pick up later in 2023.

“Russian Deputy Prime Minister Alexander Novak said on Sunday the move by the West was a gross interference which contradicted the rules of free trade and would destabilise global energy markets by triggering a shortage of supply.

"We are working on mechanisms to prohibit the use of a price cap instrument, regardless of what level is set, because such interference could further destabilise the market," said Novak, who is the Russian government official in charge of the country's oil, gas, atomic energy and coal.”— Reuters

Putin recently signed a decree which comes into force on February 1st, 2023, and remains in place until July 1st, 2023, which bans the supply of oil to clients that comply with the Western price cap. This scenario bears resemblance to the J-curve effect. It is for this reason that I believe that Westerners will claim stagflation is by no means occurring, only to be “shocked” by stagflation later on.

The bear steepener transpiring while two Eastern powerhouses work in tandem to ultimately terminate US hegemony is not what you want to see if you are of the “soft landing” crowd. This is a testament to heightened inflation expectations. Pay close attention to what the bond market does, not what people say it does/will do.

My base case scenario for 2023-2030’s economic outlook is a severe recession with high inflation, the worst of both worlds. Deflation will rear its ugly head eventually, but not before a stagflationary crisis. I believe the West is incognizant of this and will inevitably suffer the consequences of insensitivity to a monumental regime change.

Exposure

My first post on substack gives prominence to the Shemitah (Shmita), which is a year that occurs every 7 years, in which the remission of debts and sins transpire. It is also commonly known as the year of release. However, in modern times this translates into economic downturns, dissipation of employment, trade, etc. I wrote about why this occurs now 2 times already. The most recent being in August ‘22. Irrespective of your faith or lack thereof, the Shemitah’s presence cannot be undermined or trivialized. Believe it or not, Wall St is also privy to Jewish customs and traditions. This is because some of them apply to Gentiles (non-Jews) as well.

“To everything there is a season, A time for every purpose under heaven: — Ecclesiastes 3:1

On September 26th, 2022, the Shemitah year 5782 concluded. On the Hebrew calendar, we are now in the year 5783, the year of exposure. This commenced on September 26th, 2022. Almost immediately after this, we saw FTX’s implosion and its ties to the Democratic party. We’re currently witnessing evidence of Twitter’s censorship ahead of the election and manipulation of what was deemed as “COVID misinformation”, along with several other things. We will continue to see conspiracy theories that were once denounced publicly be substantiated publicly.

“For there is nothing hidden which will not be revealed, nor has anything been kept secret but that it should come to light.”— Mark 4:22

Focus Amidst Volatility

American hegemony was induced by laissez-faire economics and our geopolitical hegemony amongst several other factors. We are currently experiencing a historical geopolitical paradigm shift as we progress further into the stages of multipolarity. It’s paramount to know that multipolarity begets disequilibrium. Consequently, volatility will awaken once again in 2023. Vol will be made great again as the geopolitical climate becomes more turbulent and the current “oversupplied” vol regime is duly replaced. The response lag from a historical pace of rate hikes will also make its presence felt in 2023, and it will augment volatility as well.

Despite the existing state of affairs, there is absolutely no reason to be discouraged or fearful. One should be seeking wisdom and discernment first and foremost. Money will not only come with wisdom and discernment, but it will also last longer.

“Happy is the man who finds wisdom, And the man who gains understanding; For her proceeds are better than the profits of silver, And her gain than fine gold. She is more precious than rubies, And all the things you may desire cannot compare with her.”— Proverbs 3:13-15

Note that the most notable bear markets & most turbulent geopolitical climates in history commenced in the midst of a Shemitah year. The effect of the Shemitah can continue for years, and for a decade in extreme cases.