EOY Recap | 2024/5784 & Beyond

Regimes will continue to shift in the blink of an eye, wealth will be transferred in copious amounts, and only those who remain sagacious & nimble will prevail.

“I believe that 2023, as well as the rest of this decade, will be transformative. We are currently dealing with the consequences of a decade of strikingly imprudent monetary policy, a paradigm shifting pandemic, and pervasive moral bankruptcy amidst arguably one of the most volatile geopolitical climates in history. There is no historical precedent that can help to delineate the path the world is currently taking.” —

Looking back, 2023 has been a transformative year to say the least. When I shift my focus from financial markets and place it on much more meaningful things, it’s very clear.

In the year of exposure & prominent volatility, we saw many previously denounced “conspiracy theories” be substantiated publicly. From J6, to COVID “misinformation”, to elections and much more, the veils of deception have been lifted.

Isaiah 8:12 — “Do not say, ‘A conspiracy,’ Concerning all that this people call a conspiracy, Nor be afraid of their threats, nor be troubled.

And although it may not have been expressed entirely in the way that I believed it would, volatility made its presence felt this year as well. We saw nearly historic levels of dispersion in equities, the advent of a black swan in the ME war, and the response lag from monetary policy finally rear its ugly head.

My base case for 2023-2030 remains the same:

“My base case scenario for 2023-2030’s economic outlook is a severe recession with high inflation, the worst of both worlds. Deflation will rear its ugly head eventually, but not before a stagflationary crisis. I believe the West is incognizant of this and will inevitably suffer the consequences of insensitivity to a monumental regime change.” —

One can argue confidently that stagflation is where we presently are, with the final piece of the stagflation puzzle — the unemployment rate — coming into place. I’m not exactly sure what heights the UR will reach, but I believe that because it will coincide with high inflation, the UR won’t go as high (initially) as those who are presently in the deflationary bust camp believe.

The deadly combo of populism, precarious fiscal irresponsibility, a central bank stuck between a rock and a hard place, & an exceedingly volatile geopolitical climate will not only maintain the present sticky inflation but also increase it in the near future.

Reflection

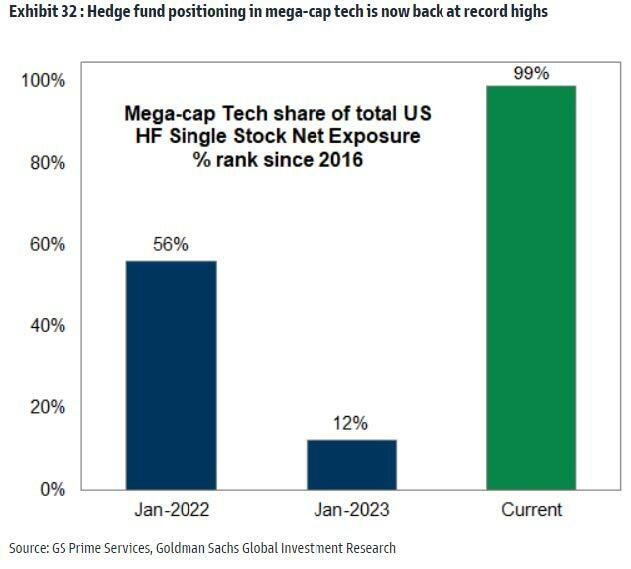

There were a few things that made me pensive at times this year. The first being how strong the indices appeared despite the overwhelming majority of their strength lying in Mag7. The second being how long and variable the “long and variable lags” with regards to monetary policy can be. The third, and final one, being how patient you need to be in order to survive waves of exuberance.

I often recalled how the advent of the dotcom bubble was shortly after the Fed injected substantial liquidity due to fears of a Y2K collapse. And going back even further, in the 1960s & 70s, companies share prices were going vertical simply because of their names. —

What followed each of these instances was not pretty to say the least, and you can be sure that what lies ahead for Mag7 will not be either.

Near-historic levels of dispersion impacted my trading immensely. I trade according to my personality — patient, confident, & nonconformist — and this caused me to “miss out” on gains from this enormous Mag7 rally. Truthfully, I don’t consider it missing out because I had no intention or incentive to join it. I’m not trading for a firm where I have to meet a benchmark (lol), and I prefer to skate to where the puck is going — irrespective of how long it takes to get there.

Now for the things that I actually missed:

No major explosion of index volatility this year. Index volatility was masked due to implied correlation nearing 2017 lows.

SPX didn’t close negative on the year again. Look to number one for the explanation.

Oil’s J-curve effect run didn’t play out the way I believed it would. (But this somehow ended up working in my favor, or so it seems. I’ll explain later.) :)

The Fed’s willingness to intervene immediately & in a big way when something — like regional banks — breaks + “Not QE, QE”’s influence on liquidity.

There’s not much to expound upon pertaining to my misses this year. So, onto the hits of 2023:

Bonds (long end) continued to struggle throughout the year.

Yields rose materially despite headline inflation decreasing.

The advent of a stagflationary scenario is now all but solidified after a rosy year in equities.

2s10s bear steepened from July to October, almost completely uninverting the spread at one point. + short tech/long energy/commodities for a brief period

Geopolitical volatility increased materially.

The biggest lesson I’ve learned this year is that, alongside resurgences of exuberance in financial markets comes this almost overwhelming persistence that makes it feel as if Andrew Mellon’s quote from 1928 is true.1 The “return to normal” stage that so many point out is both invigorating & enervating simultaneously. It’s as Warren Buffet said best:

“Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well.”

And as previously stated, doing well is not, at least to me, about having one or two good years.

Chiefly playing defensively and occasionally striking when I saw a fat pitch lead to a stellar performance this year. I’m eternally grateful for having the opportunity to do this. However, I’m not impressed or content with my performance. What matters most is what I take with me whenever I’m done trading, so there is much more work to be done — physically, spiritually, mentally, and emotionally. Balance is paramount & conducive to success in all your endeavors.

2024 & Beyond

Coming into an election year, many are highlighting election year seasonality. It makes sense when you look at how closely indices followed pre-election year seasonality. I’m also hearing that the markets have to rise a ton solely because it is an election year, as if they have never seen precipitous declines amidst them before.

This also makes sense once you look at where indices are currently. SPX & the Nasdaq are the closest to breaking ATHs since the beginning of the rate hiking cycle, while the Dow made new highs recently.

From August 2nd:

“The indices are approaching their respective ATHs, but it’s also the cheapest to hedge for downside on record…. Could they breach ATHs? Bitcoin’s dull price action throughout the tail end of this rally makes me believe ATHs won’t be eclipsed, but since we’re so close to them it’s certainly possible. Will that void the bear market thesis? Absolutely not. This was the most accommodative fiscal + monetary policy the US has ever administered; so again, the resurging distortions and exuberance now seen in equities aren’t synonymous with a bull market.” —

Now, Bitcoin — which is seen as a liquidity indicator — has rallied aggressively. It’s still very cheap to hedge for downside, index vol is considerably low, and market breadth has moderately improved. But that still isn’t enough for me to want to get short SPX again yet. Thus, the fat pitch to short indices has not yet been presented, so I’ll continue to look for other opportunities as I’d prefer not to be long indices near ATHs. Some persistent spot up, vol up action will definitely entice me to swing big for that fat pitch.

As for the current state of the bear market, I’m still a believer that we’re in one right now. This was the most profligate monetary & fiscal policy in US history and as a result, it’s putting some dents into the rules of finance. That’s about the only thing that I agree with the soft landing crew — which is out in droves — on. Some of the tools we’ve used for a while to analyze the economy/markets no longer work. They’ve been rendered useless because of our policymaker’s propensity for myopic policy. Nonetheless, from a technical standpoint, one can argue that it is over. But from a fundamental standpoint it’s definitely far from over.

‘‘To cure the exaggerations and extravagances of the preceding period of speculation is the function of a bear market. The difference between a technical reaction and a bear market is that the first is a purging of the market’s internal position, while the second is a thoroughgoing rectification of all excesses that have crept into the ensemble economic structure. When contraction has proceeded far enough to remove the distortion and restore the balance, the bear market, from a fundamental standpoint, has ended.’’ “It has fulfilled its function.”2

Bonds

My views on bonds have not changed at all. They are the same as they were in early November after I exited all of my equity positions.

“That being said, the ATH crew has come out to play once again. The bear steepener — which has been the main driver of bonds + stocks since the July top — is presently on pause after Yellen’s stick save (QRA issuance), & the weak growth/labor market data. Bonds + stocks are still positively correlated (no bueno for risk), and FOMO is rising as the market looks past every mounting risk.

To clarify the Yellen stick save bit, the issuance was below expectations when the market was expecting more, resulting in a rally sparked by rates falling materially. So in an “unforeseen turn of events,” it was rates — yes the same rates that so many said didn’t matter for the first half of the year — that ignited this rally. This means that the long-term outlook has not changed at all whatsoever, while the short-term did so drastically.

Thus, equities and bonds (long end) will head lower longer-term, and as always it will be important to be patient & nimble if you are planning to short either of them. FWIW, I am still not on the Santa Rally sleigh.” —

However, I am now open to a Santa Rally.

Commodities

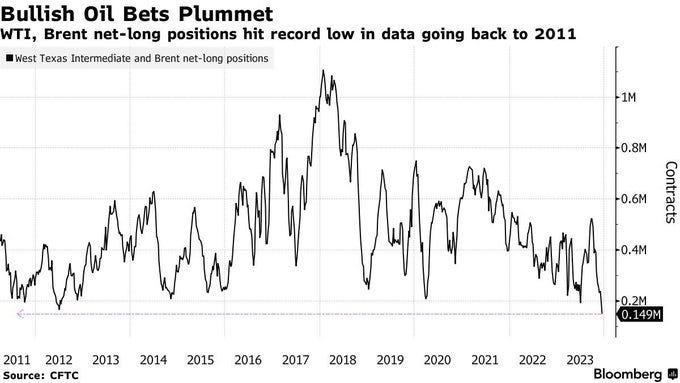

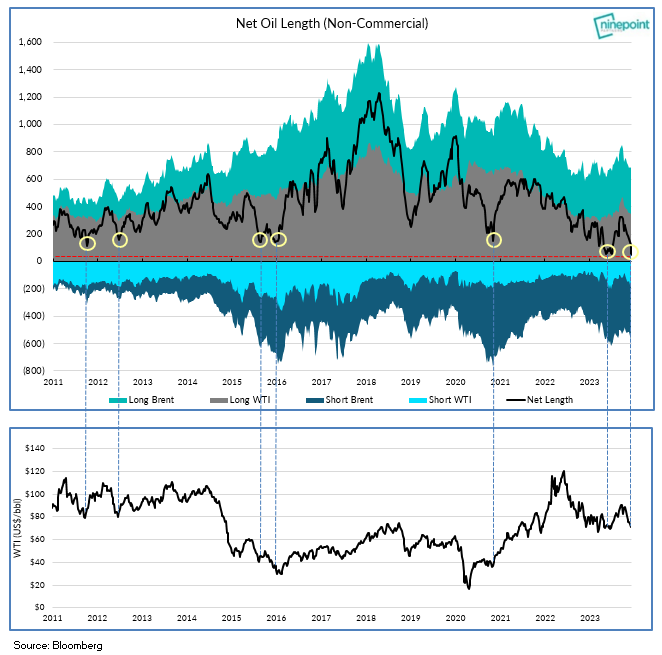

Firstly, I’ll address how oil’s 7-week consecutive rout may have ended up working out in my favor. As previously stated, I went long oil on July 7th, after being patient for quite some time. Oil surged from July to late Sept/early Oct, then proceeded to drop for what seemed like an eternity. But why? Why would oil drop considering that supply & demand, geopolitical risk, & positioning were all conducive for a continuation of oil’s surge? Truthfully, I’m not sure that I know why. I know that there were a plethora of narratives that derived from oil’s price action during that stretch. From “oil’s sniffing out a recession” to “deflation is right around the corner,” the narratives were surely entertaining. Though few were true.

What I believe to be true is that the recent oil rout was strikingly similar to the mispricing of bonds that I pointed out early in the year.

“Rates are going higher despite the prevailing opinion of an imminent Fed pivot and recession. The US economy is surprisingly resilient because of the unprecedented profligate fiscal and monetary policy in 2020-2021, and another wave of inflation is lying in the shadows. Bonds are still erroneously pricing in an imminent recession (deflation). It looks like its advent will be later than expected by most.” —

And when you consider present positioning, geopolitical risk, and supply/demand, oil looks more primed for upside then it did in early July.

There’s even less length then when oil went negative during COVID!

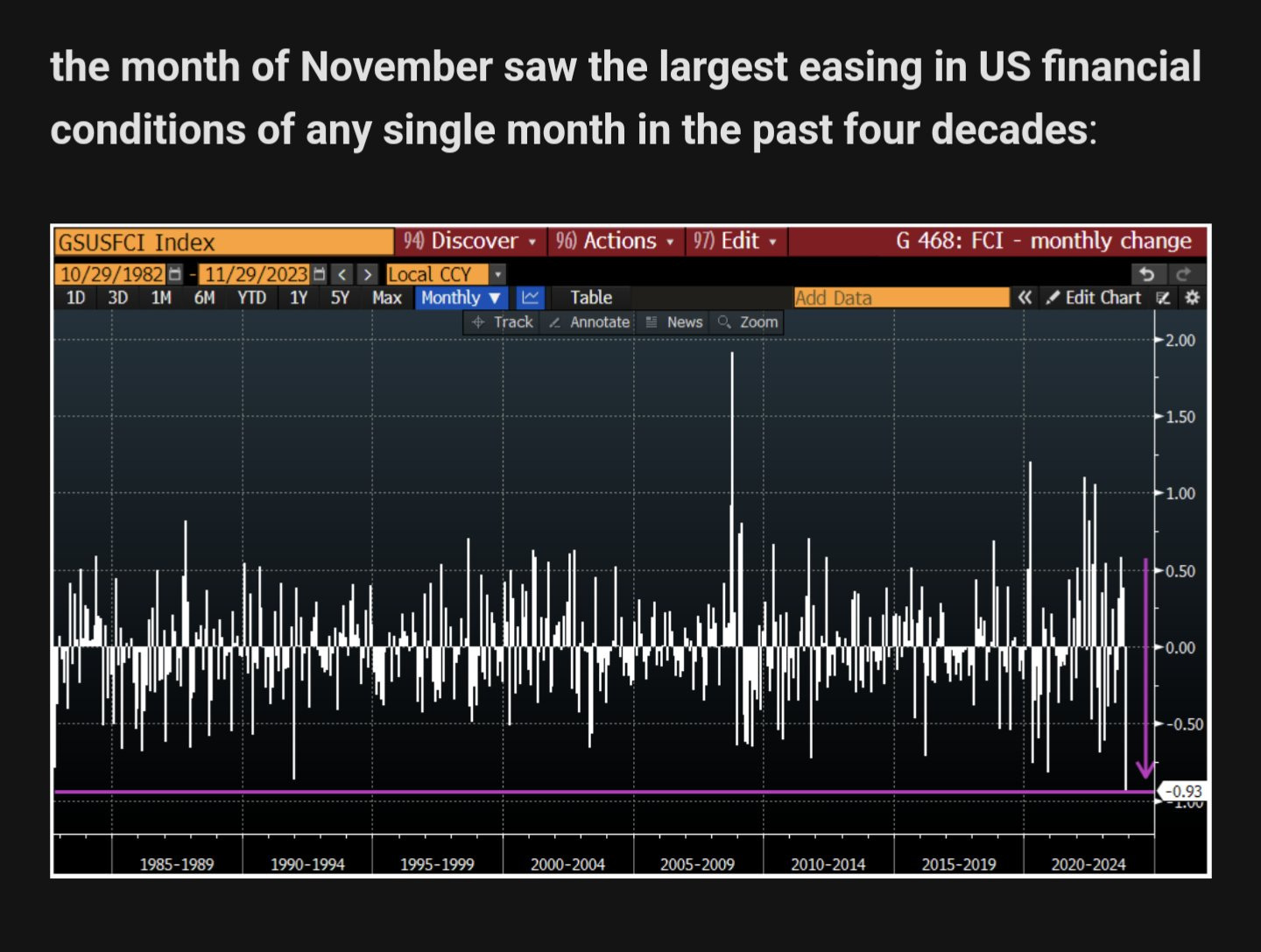

To top it off, at the last FOMC, Powell gave commodities — and equities — the greenlight to run. In what was a disastrous display of indecisiveness — and dare I say, a lack of credibility — the Fed released the animal spirits. And you know what they say, “Don’t fight the Fed.” Powell previously stated that the material rise of yields was welcomed, as it behaved like rate hikes/implicit tightening — making their job easier. But yields had dropped considerably since he said that. In fact…

It wouldn’t be farfetched to consider this development as rate cuts given what Powell said about implicit tightening. Despite this, Powell came out singing a surprisingly dovish tune.

Mission accomplished? Not even close. These recent remarks from the Fed give credence to my earlier assertion that the Fed has absolutely no credibility.

“All things considered, it’s safe to say that the Fed’s credibility simply doesn’t exist.” —

On a Scale of 1-10, How Much Faith Do You Have in the Federal Reserve?

·The credibility of the Fed is a topic often canvassed by many in the finance community. Most believe that the Fed has done a sufficient job given the once-in-a-century pandemic we entered at the start of the decade, while others believe that they’ve continuously committed several policy blunders and are consequently devoid of any credibility. I believe …

To be clear, I’m not complaining. Admittedly, I do feel that amongst other important factors, the Fed’s recent fiasco is the key to ignite the 2nd wave of inflation that I’ve mentioned several times in the past. I’m going to do my best to take advantage of this regardless of how I feel about central banker’s behavior. After all, Burns said it best:

“What is unique about our inflation is its stubborn persistence, not the behavior of central bankers….My conclusion that it is illusory to expect central banks to put an end to the inflation that now afflicts the industrial democracies does not mean that central banks are incapable of stabilizing actions; it simply means that their practical capacity for curbing an inflation that is continually driven by political forces is very limited.”3

So, after entering a fairly small position in oil since the bulk of my portfolio was in SPX, NVDA, and TLT puts at the time, I got aggressively long oil and moderately long gold shortly after FOMC on Dec. 13th.4 It looks I’ve been granted a second chance.

Also, the reasoning for the gold long is not only due to the release of animal spirits by JP, but also because I believe that stagflation is here. And gold performs exceptionally well in this environment. I’ll likely be short bonds (long end) soon as well.

The Journey is Far From Over

With peak growth in the rear-view mirror, the presence of high, embedded inflation, historic fiscal imprudence, & an exceedingly volatile geopolitical climate — this won’t be your textbook recession.

Regimes will continue to shift in the blink of an eye, wealth will be transferred in copious amounts, and only those who remain sagacious & nimble will prevail.

Commodities will shine.

There are waves of opportunity coming.

I see a remarkable mix of “there is nothing new under the sun,” and “we’re in uncharted territory” in this cycle that creates generational fat pitches to swing at. Just have to let the others fly by first. Always easier said than done. Always worth it.

Continue to expect the unexpected!

I hope everyone enjoys the holidays and finishes out the year strong! Until next time.

Job 5:20-22 “In famine He shall redeem you from death, and in war from the power of the sword. You shall be hidden from the scourge of the tongue, and you shall not be afraid of destruction when it comes. You shall laugh at destruction and famine, and you shall not be afraid of the beasts of the earth.”

“We are no longer the victims of the vagaries of business cycles. The Federal Reserve System is the antidote for money contraction and credit shortage.” — Andrew Mellon

Harry D Schultz - Bear Market Investing Strategies.pdf

The Anguish of Central Banking- Arthur Burns.pdf

$69.80 and $2021 for entry on oil & gold positions respectively