February Blues

No Shortage of Volatility

February blues, otherwise known as winter blues, is a phrase that refers to the consistent short, dark days which invoke “the blues.” In the volatility realm there is a seasonal effect in February that creates a vacuum and can prove to be dangerous, particularly for vol sellers if accompanied by complacency. This concept is eloquently elucidated by Cem Karsan, an expert on volatility. See 5:27 to 6:17 below.

Cem’s mention of complacency is the salient detail here. Complacency has plagued US financial markets for years. Once it is embedded into the minds of market participants it is not easily uprooted. One look at how desperate traders were for a Fed pivot throughout 2022 and this is transpicuous.

Bonds have been pricing in a recession while the market continues to believe that a soft landing is all but inevitable.1 I believe that Dec & Jan CPI should show signs of inflation abating. However, this will by no means signify that the mission is accomplished. Irrespective of a lack of substantiating data for the pivot crew, complacency in its most unbridled form will accompany back-to-back lower CPI readings despite a prevailing resilient labor market.

Some critical elements to take note of prior to the incoming complacency:

Russia, the world’s second largest oil exporter, will not sell oil that’s subject to a Western price cap even if it has to cut production.

From February 1st to July 1st the supply of oil is banned to clients who comply with the Western price cap.

The largest commodity consumer in the world and largest oil importer in the world (China) is set to rebound significantly in the first half of ‘23. February is supposed to be a watershed moment of China’s reopening process.2

The US has drained the SPR to historically low levels for shortsighted reasons and is consequently vulnerable to long-term supply disruptions/emergencies.

I’m aware of the recent disappointing price action in Brent crude and the subsequent premature victory lapping by China reopening deniers. Focus on the rebound, not the reopening. In my last post I mentioned how the J-curve effect most accurately describes this scenario. It will get worse before it gets better. I expect this J-curve to be exceptionally steep. The Saudi Arabian energy minister seems to agree as well.

When this clip initially circulated Twitter, there were a few posts I saw referring to OPEC+ as “the captain now.” I vehemently agree. The brazen formation of multipolarity is enabling more of us to recognize this.

Regardless of whether or not we get a Volmageddonesque move in late Feb-March, pivot enthusiasts have to live with the fact that China’s COVID pivot arrived before the Fed pivot. Yes, I know. Life is not fair.

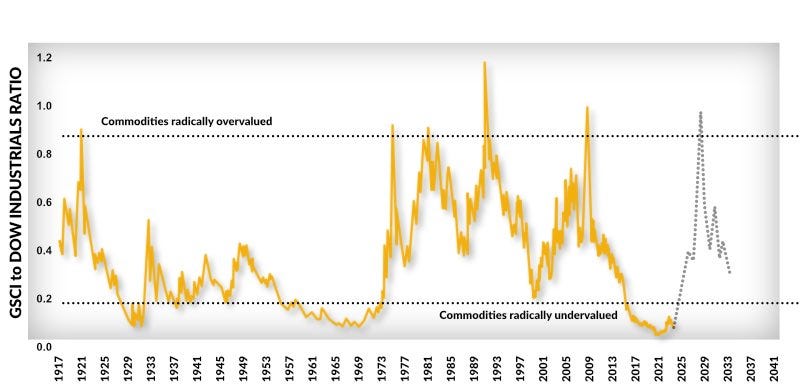

Bonds are erroneously pricing a recession right now. This is an inflationary bear market therefore going long bonds is nonsensical. There will obviously be countertrend rallies but long commodities, short bonds & equities is the name of the game for 2023. I’ll sporadically take advantage of this new vol regime as well with some VIX calls.

Will remain entirely cognizant of factors that could put a damper on Chinese demand. The most notable being the new and improved COVID variant that first emerged in New York and is now found in China. Will adjust if/when necessary because making money > being right.