Focus

Signal > noise, as usual.

“Let your eyes look straight ahead, and your eyelids look right before you.” — Proverbs 4:25

First & foremost, as always, I’m excited for the opportunities that are not only here presently, but also arriving in the near future. Whether by courtesy of the Fed, the Treasury, or geopolitical factors, this is a cycle that will be pumping out golden opportunities in perpetuity.

Consequently, I make it a focal point to slow down & focus on signal rather than noise. In each asset class that I trade, I regularly map out what I believe to be the signal & the noise in each of them at the moment. Here’s what they are right now:

Equities

Signal:

For the foreseeable future, both the Fed & the Treasury are incredibly dovish.

The adages “Don’t fight the Fed,” and “The market is not the economy” should be adhered to — and for the latter specifically, remember that it goes both ways. 1

Noise:

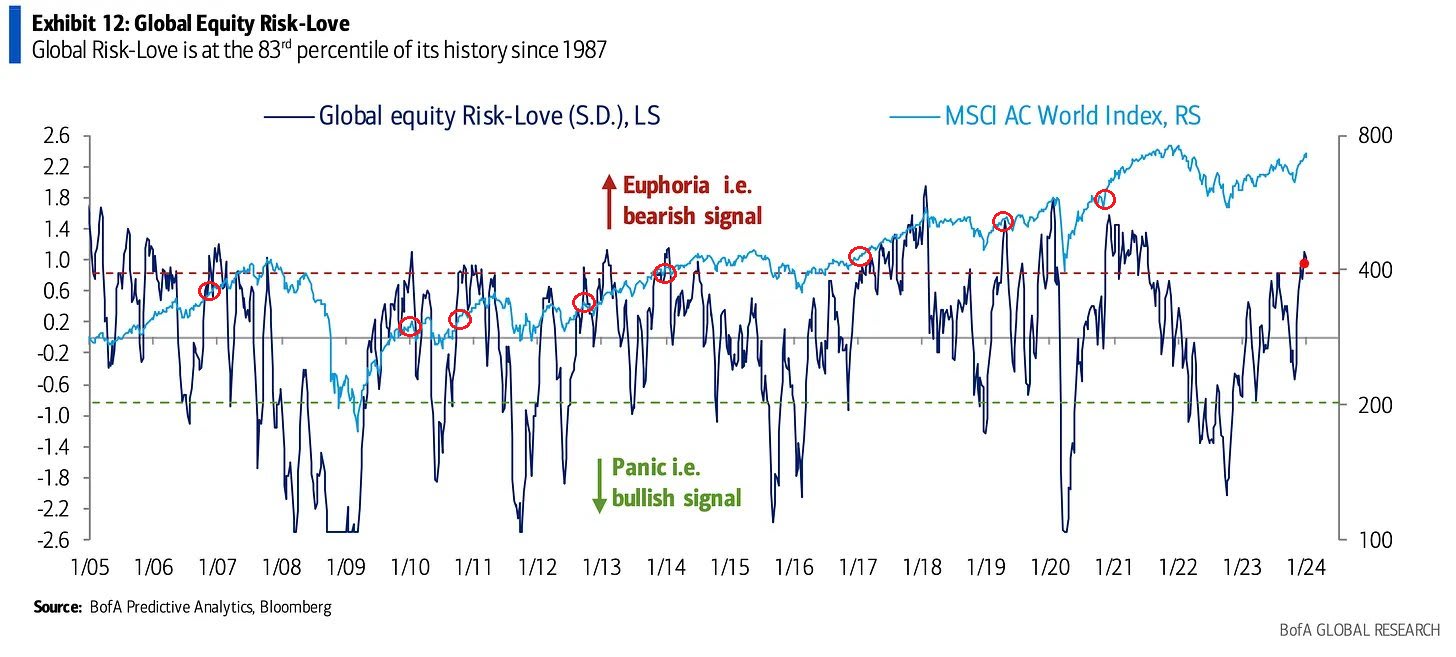

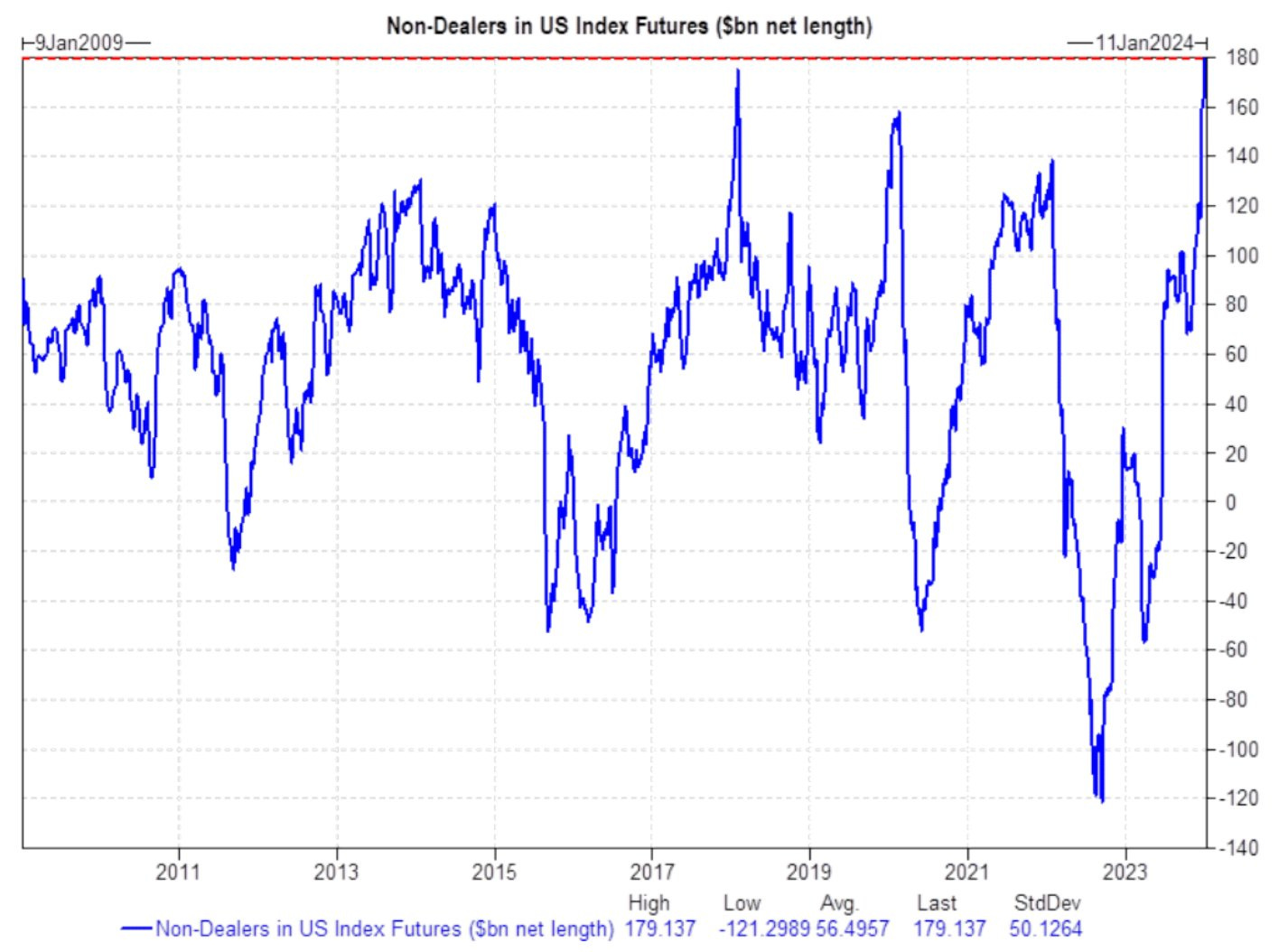

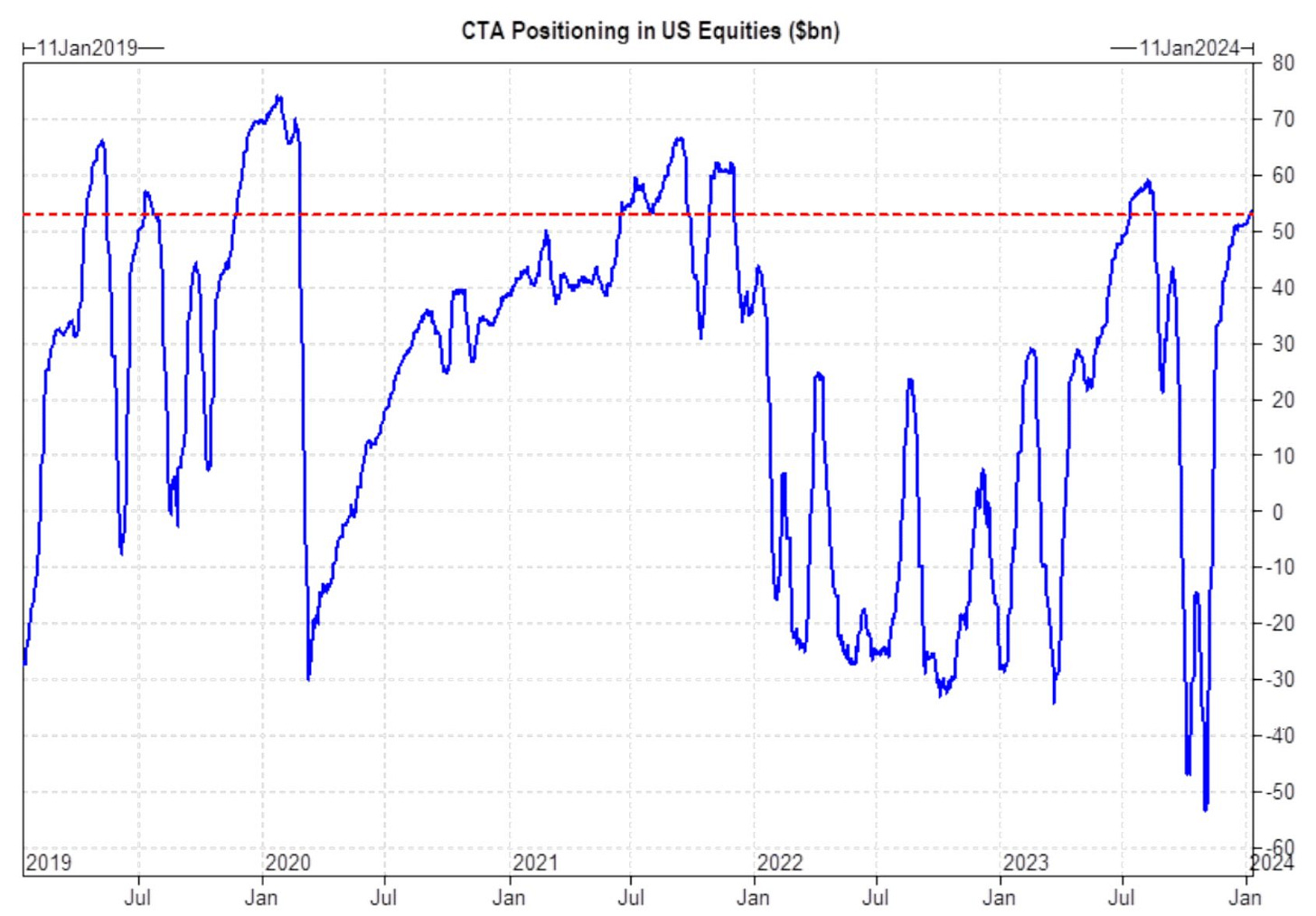

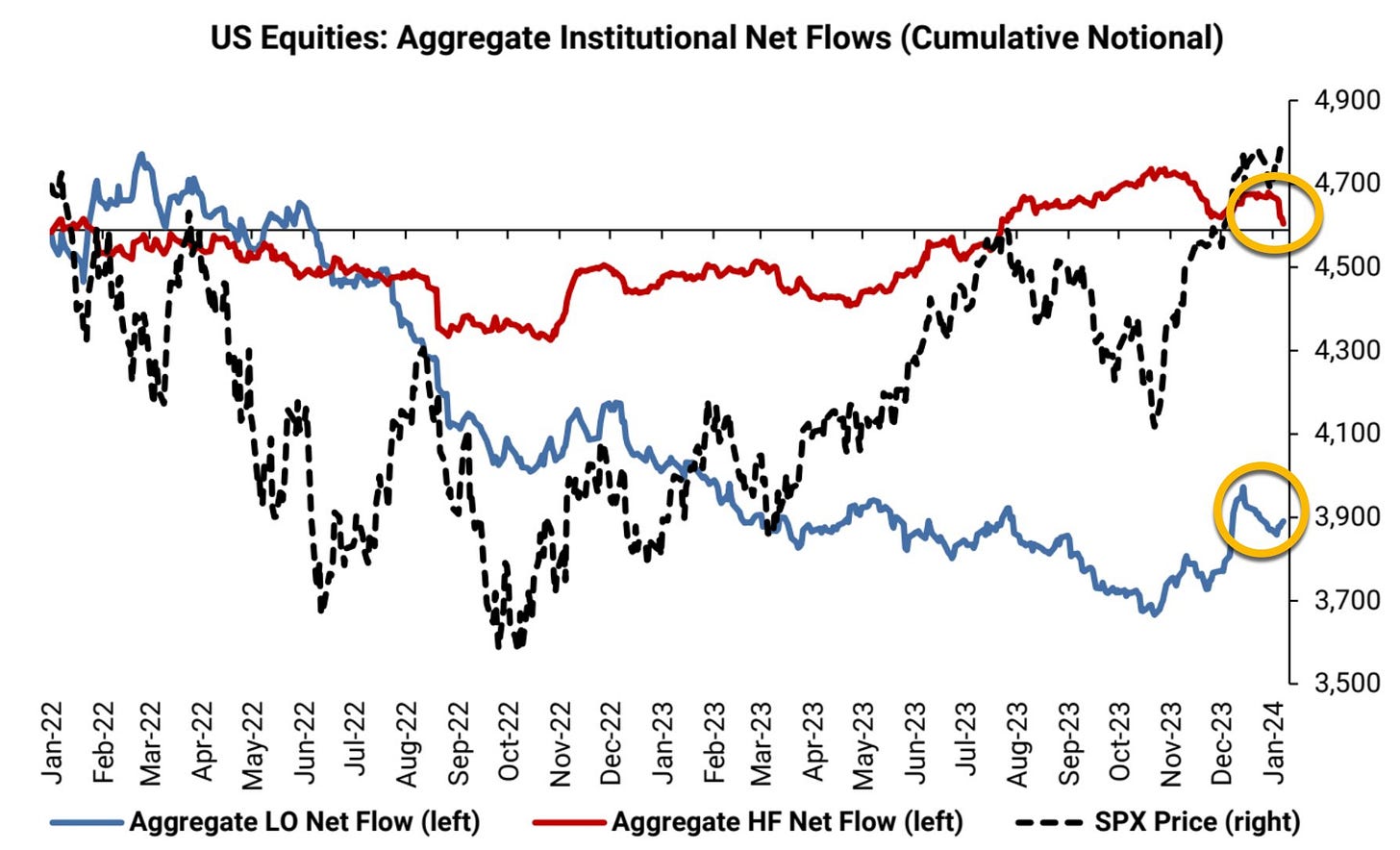

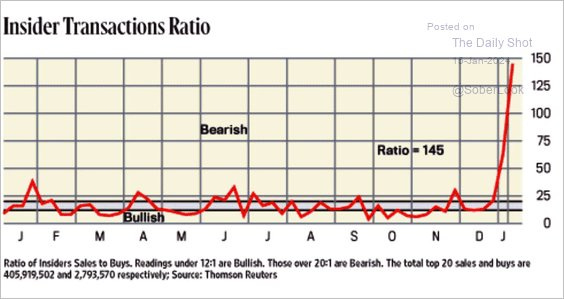

Market breadth improving is a call to disregard overcrowded positioning.

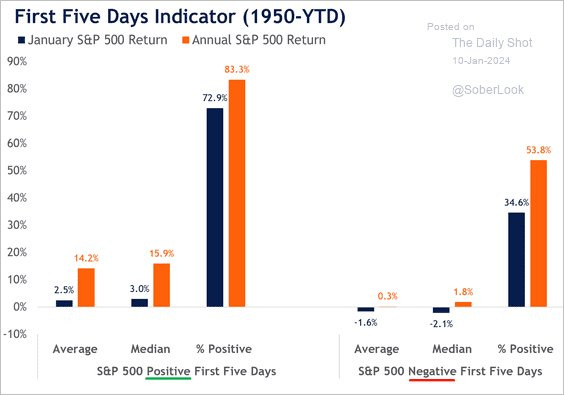

Soft landing is all but inevitable, throw all caution to the wind because the Fed has already landed/is gracefully landing the plane.

Bonds

Signal:

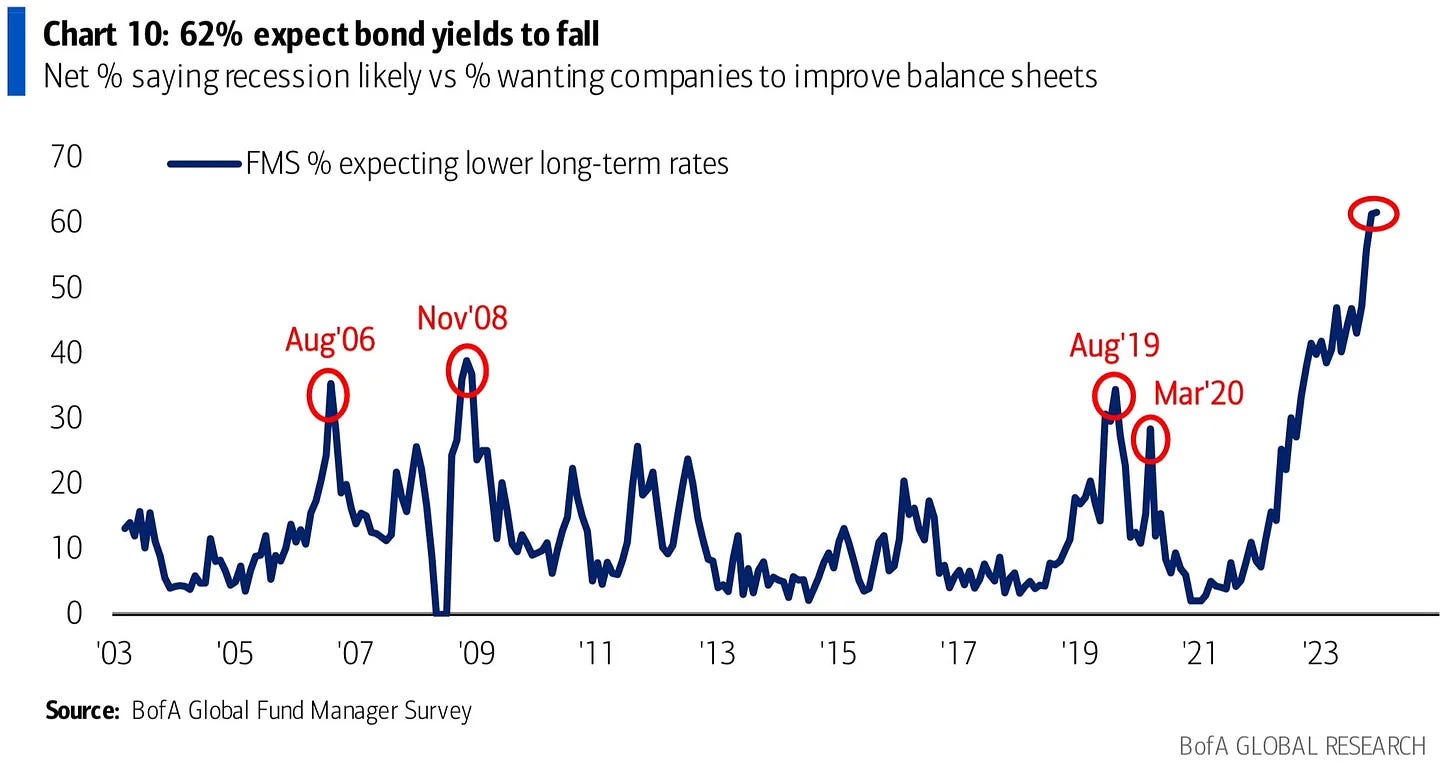

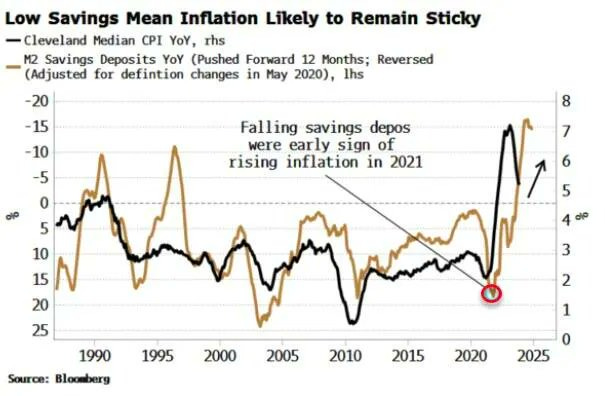

Inflation looks to have hit its trough in July (June inflation report).

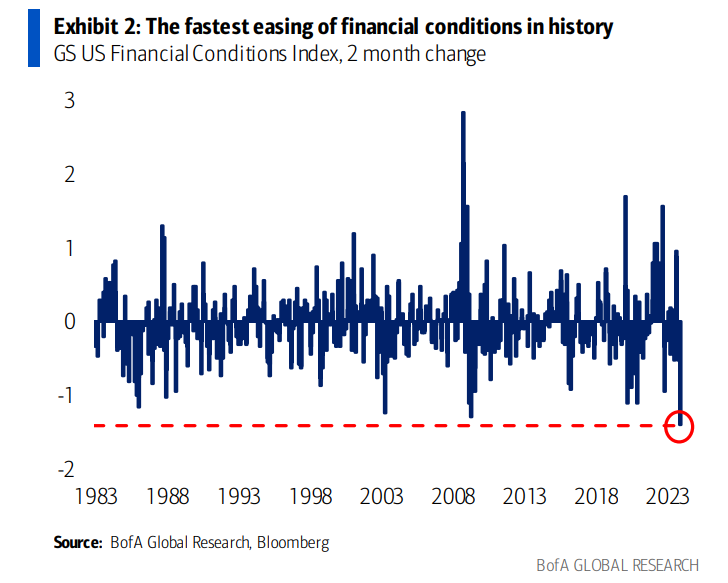

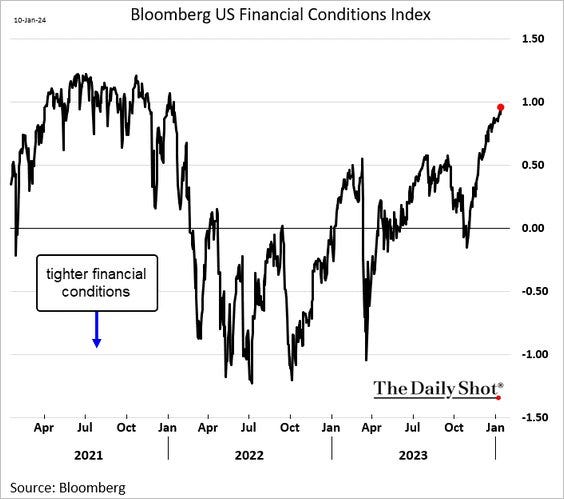

Yellen & Co have to flood the bond market with supply while geopolitical tensions, a historic easing of FCI, & a high fiscal deficit work against them and their job of getting inflation under control.

Yield curve has yet to fully resteepen, signifying how early we are in this cycle. 2

Noise:

The aggressive bond bid was due to an imminent deep recession (deflationary bust).

Bond supply doesn’t matter.

Rates don’t matter in general.

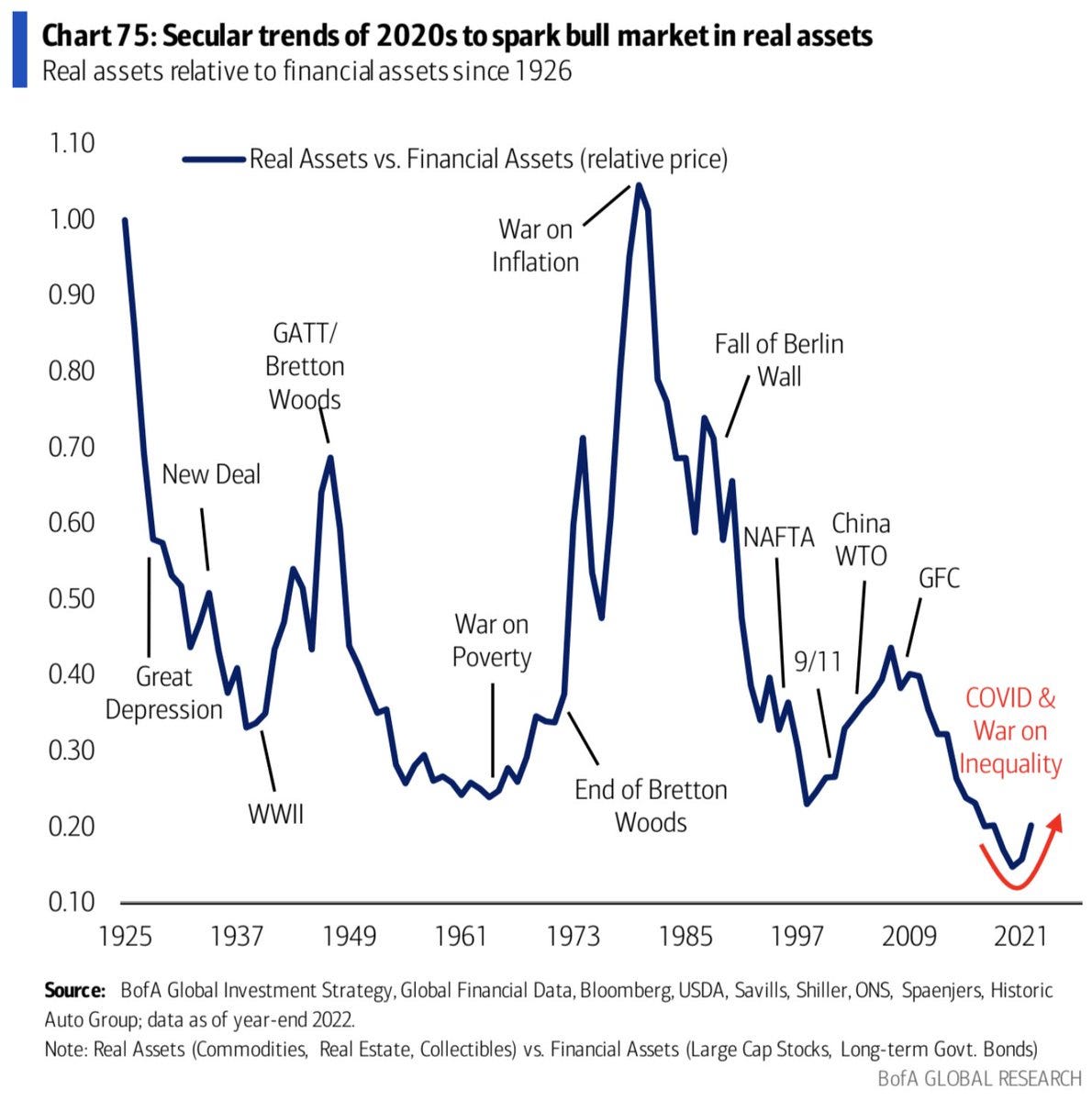

Commodities (GC, CL)

Signal:

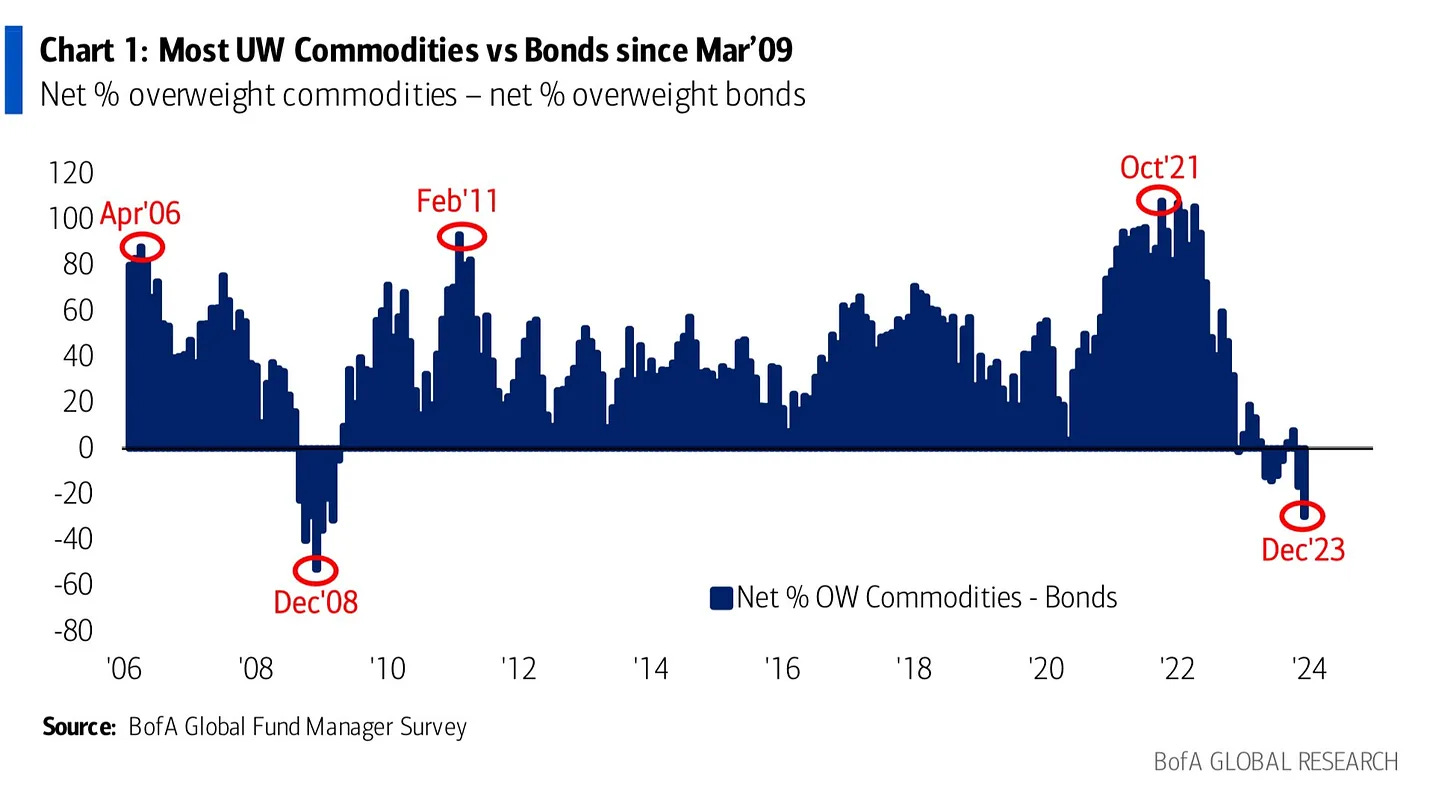

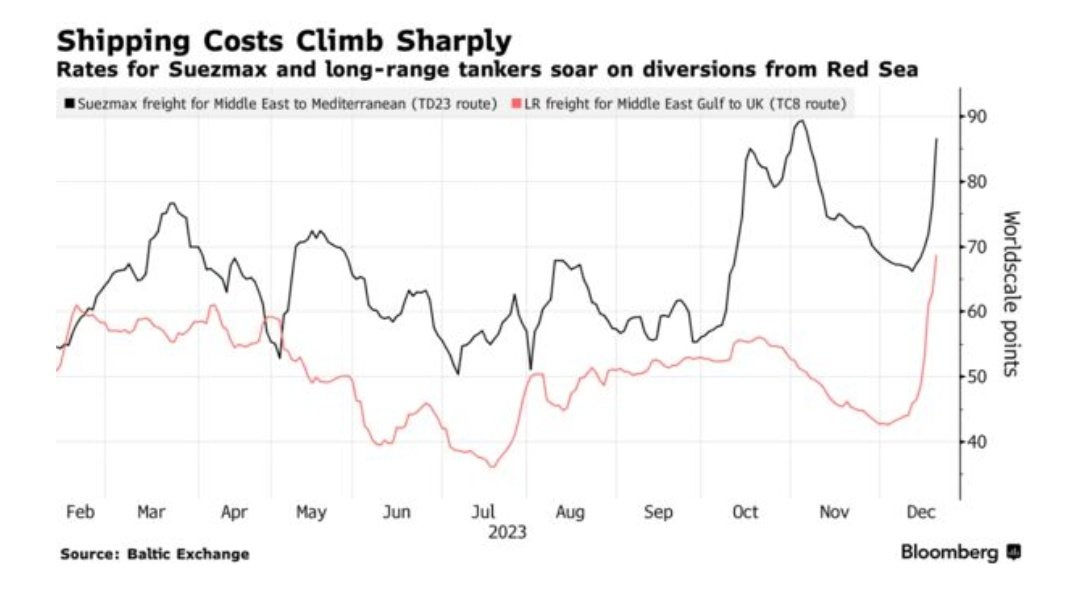

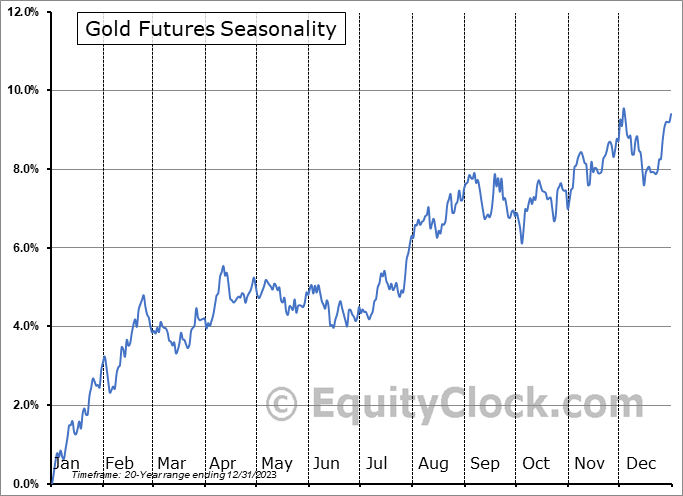

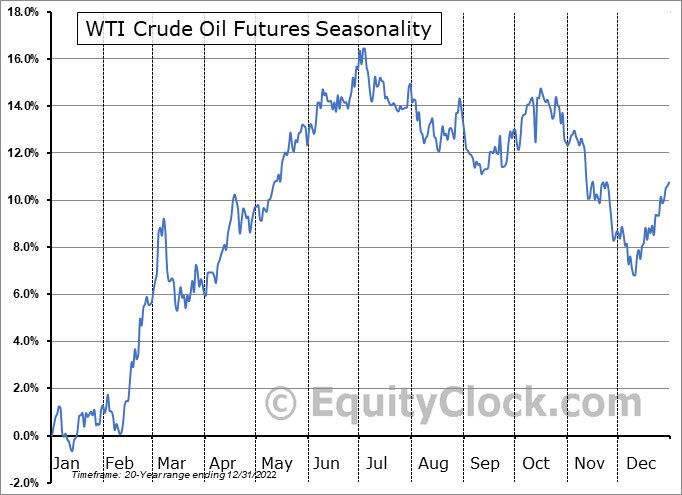

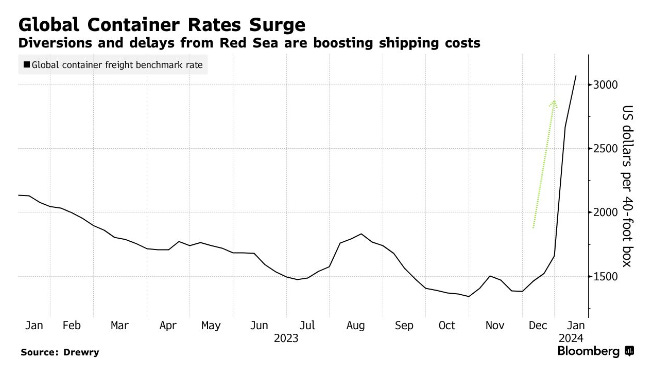

The combination of escalation in the Middle East, the Fed ushering in a Goldilocks regime, and overcrowded positioning makes both gold and oil — oil more so than gold — powder kegs.3

Seasonality looks conducive for a healthy run in each commodity.

Noise:

There will be no escalation in the Middle East whatsoever. 4

Bonds & equities are the only games in town.

Positioning is the same; long gold & oil from 2021 and 69.80 since Dec 13th.

Some pertinent charts:

Lastly, in spirit of the golden opportunities ahead, here is one of my favorite songs which beautifully encapsulates the feeling of positivity towards the future.

Thanks for reading.

Until next time.

For clarification purposes, think back to my “fade the recession hysteria” call from late July ‘22. Pessimism was through the roof, reflected by positioning; but the economy was not yet entering a recession despite the consensus being that a recession had been declared at the time. Now optimism is through the roof, reflected by positioning; but one can make strong arguments that a recession (inflationary/stagflation) has just started despite the consensus being that a soft landing is all but inevitable.

The 3m10y spread has been inverted for the longest period in history. This is a process. Never forget that it cannot be rushed by any of us.

See positioning in commodities relative to big tech. That’s all you need to know. Timing is paramount still.

This statement and mindset were brought to you by the same people who downplayed and/or trivialized the Russia/Ukraine war when it commenced. “It’ll be over within 30 days.” And by no means do I encourage war. I simply can’t help but point out the clear regime change and signs of the times. There’s more war in the pipeline.