Nothing Changes Sentiment Like Price

Eyes Up

“False prophets often speak with great sincerity when they say they foresee great prosperity ahead. Or if that statement seems less than realistic, then it’s a combination of wishful thinking and self-interest that cause them to announce we will have a ‘‘soft landing,’’ that we should be looking for new buying opportunities, that we’ve made a bottom.” — Harry D Schultz - Bear Market Investing Strategies

In light of the recent price action and “soft landing” discourse, I feel that now is an ideal time to do a reality check. While there is much to say to refute the “soft landing” claims, I’ll let the data speak for itself.

We’ve yet to see the bear steepener transpire because the market resides in fool’s paradise. To the market, inflation has basically disappeared. Once again, this is a fallacious assumption. Recall Powell’s FOMC presser in December. He mentioned that China’s reopening is not likely to have material effects. This is the new “inflation is transitory.”1

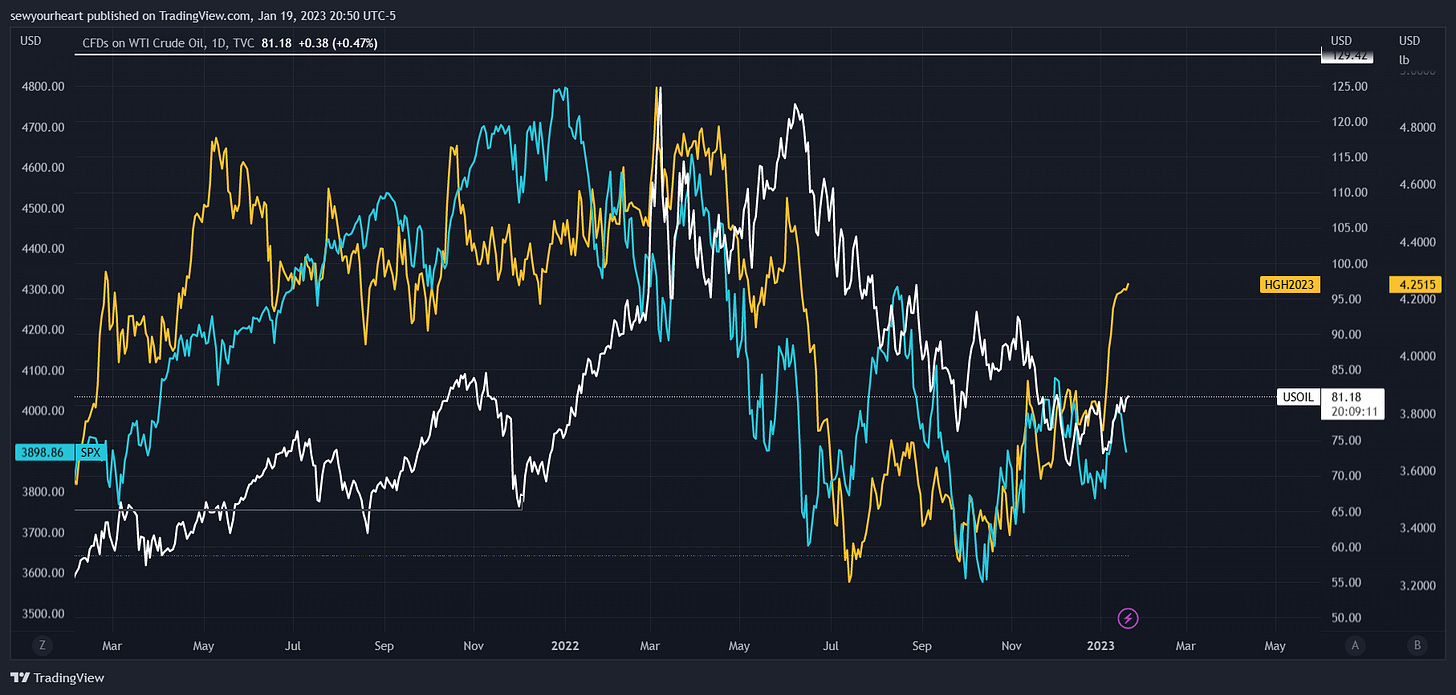

Commodities like copper & oil have seen notable increases recently while equities seem to have lost their mojo. Don’t think that Powell & friends haven’t noticed this. Fed members can do all the jawboning they want, but ultimately what Powell does (and says unfortunately) is the only thing that matters.

Financial conditions are at May levels when the FFR was 1%. Powell & friends are obviously aware of this, and this occurs much to their chagrin.2

SPX has also gone nowhere since May. Couple this with disinflation and you receive complacency that permeates the market as if we’re genuinely about to enter a new bull market.

Some critical elements to take note of:

The $ has been hammered recently and those in bearish positioning in this space should proceed with the utmost caution. Overzealous shorts will be punished.

Commodities can roll over as this occurs and resume their rally after the washout has been completed.

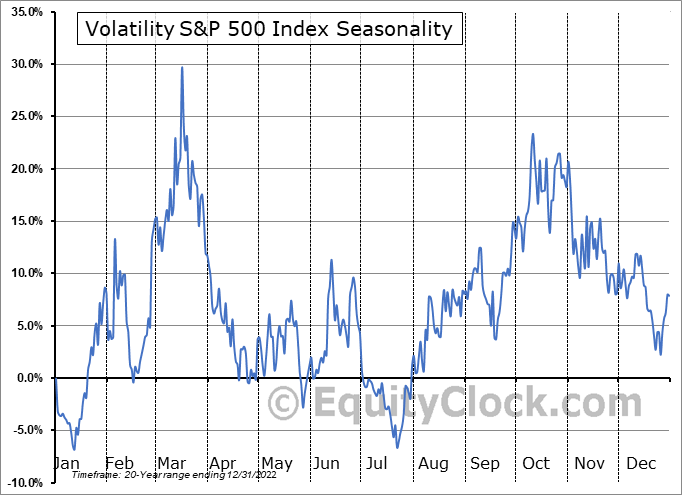

Vol remains very cheap here and can definitely bid in the short term if we see some liquidation of both overzealous shorts (in $) and bulls in equities.

Lastly, I don’t expect this (if it does transpire) to be the selloff. I’m still looking for that big selloff to be in the late Feb-March window and I’m currently long May VIX Cs which I bought on 1/17 when VIX was 19.

Update after January 20th close

Markets aren’t efficient in any way whatsoever and these 2 scenarios below are based on this premise.

I see 2 possible scenarios playing out in the short term. SPX can break this closely watched trendline (it’s done so in previous bear markets) and invoke FOMO like you’ve never seen before ultimately breaking down when the market realizes that the Fed won’t pivot yet (a pause is not a pivot). The VIX can increase as SPX increases because call demand (for SPX) will likely respond commensurately to the FOMO.

The 2nd scenario is that the trendline is not broken until after a further selloff which sees sentiment become exceedingly bearish. Bulls would then attempt to short the hole and get washed out before SPX rallied into mid-February (expect to see unbridled FOMO here as well).

It will certainly be much more challenging to pull the trigger on shorts for those who allow FOMO to blind them.

Rates are going higher despite the prevailing opinion of an imminent Fed pivot and recession. The US economy is surprisingly resilient because of the unprecedented profligate fiscal and monetary policy in 2020-2021, and another wave of inflation is lying in the shadows. Bonds are still erroneously pricing in an imminent recession (deflation). It looks like its advent will be later than expected by most.

Powell & friends have ostensibly made another major policy blunder by deeming the China reopening a nonfactor. It’s surely difficult for some to trust the Fed now given their transitory inflation mishap, so I’ll reiterate this. Fixate on policymaker constraints instead of preferences. They may not have wanted to raise rates in ‘22 but they had to because inflation became a persistent problem and still is. They will value constraints (no 70s repeat) over preferences here again. No pivot is coming unless SPX is much lower than it is currently. However, a pause may come before a considerable drop. I believe that would be a grave mistake and if it does come, it’s a sell the news event.