Summer Madness pt. 5

Surely everyone is prepared, right?

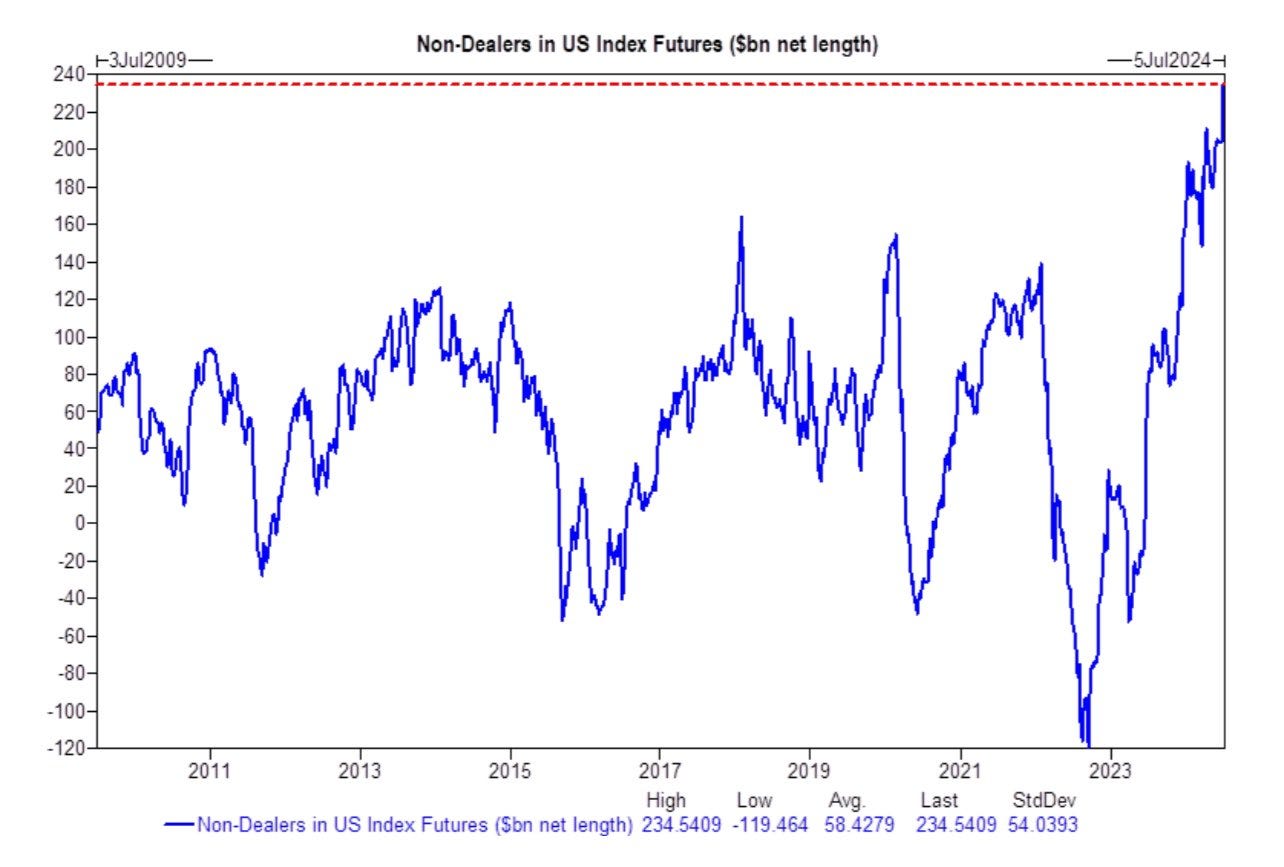

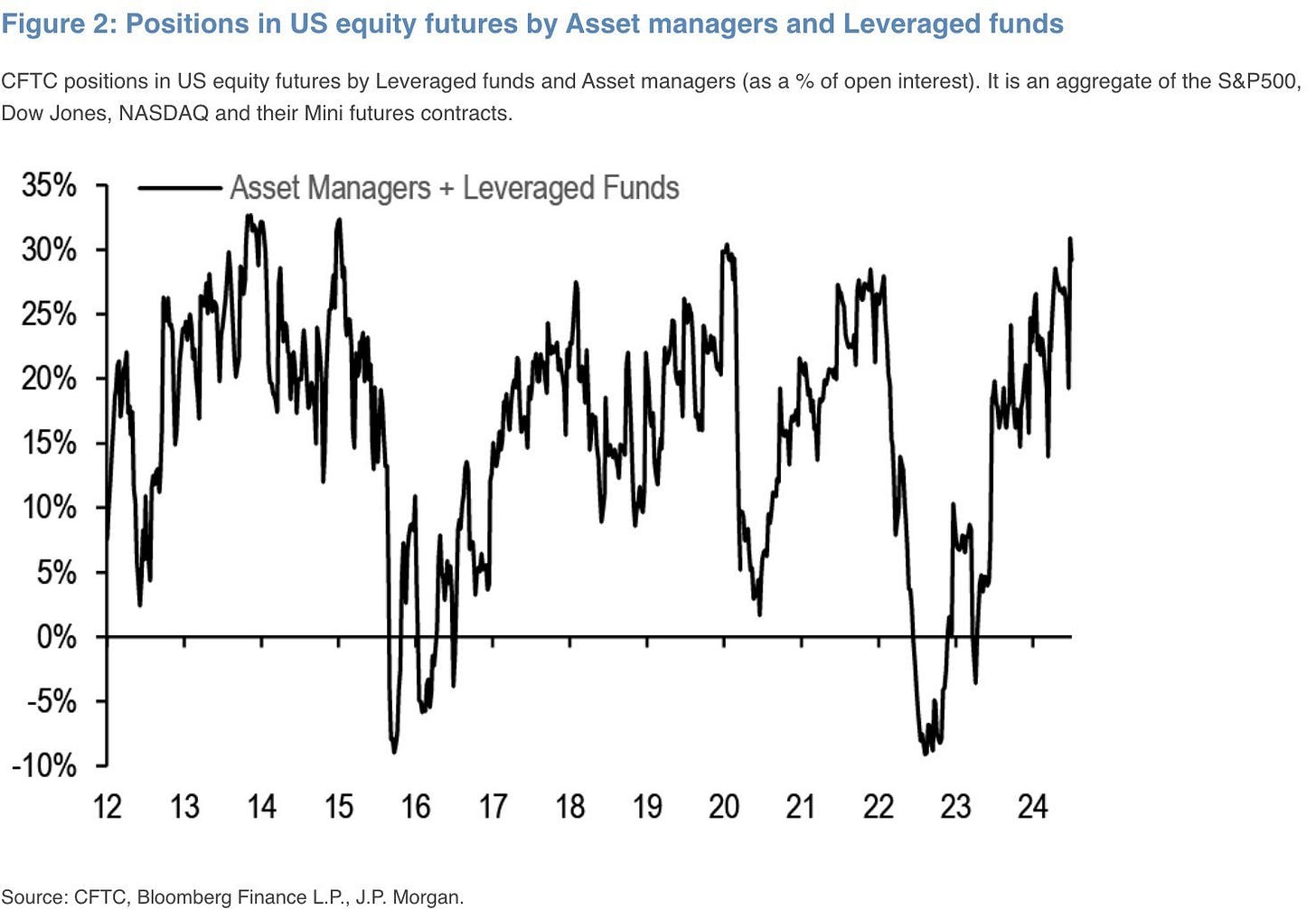

Positioning was stretched ahead of CPI and markets love to shift to wherever the pain trade is.

Not too long ago I briefly went over how 1) the inability of small caps to rally in spite of falling rates was a red flag for the broader market, and 2) the broadening leading to a “blow off top” would prove to be elusive. Well, Thursday saw the biggest daily outperformance of RTY relative to NDX on record. This level of de-grossing is unlikely to end immediately given that funds were complacently shorting small caps for quite some time. Then came Friday, and what was seemingly a complete undoing of Thursday’s sell-off ended in an unimpressive close for bulls.

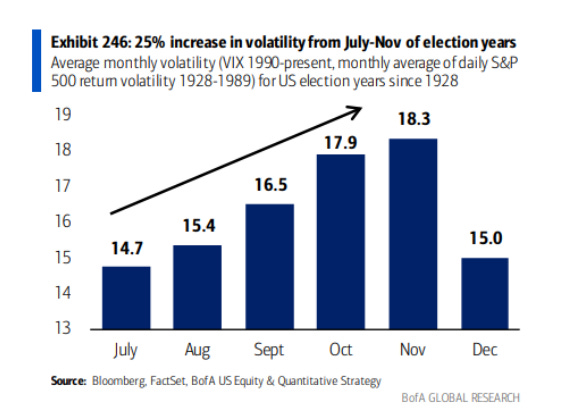

My mind goes back to April now, when the talk of the town was that earnings season would be outstanding and lead to a material continuation of the rally. However, it’s liquidity and positioning that matter — not earnings. For this reason, April’s sell-off caught many off guard. Coming back to the present, July looks and feels similar to me. With earnings on the horizon & positioning stretched, hedging is sensible. Oct/Nov/Dec — take your pick.

This period is what was referred to in this tweet from June 25th with the lyrics hinting to July 17th, which since 1928 has been a turning point seeing equities begin to fade materially into August.

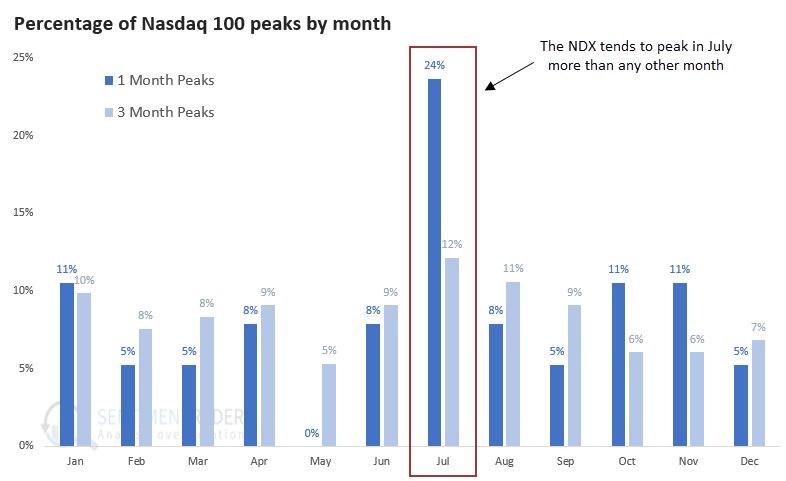

NDX has also put in 1- & 3-month peaks in July more than any other month by a substantial margin.

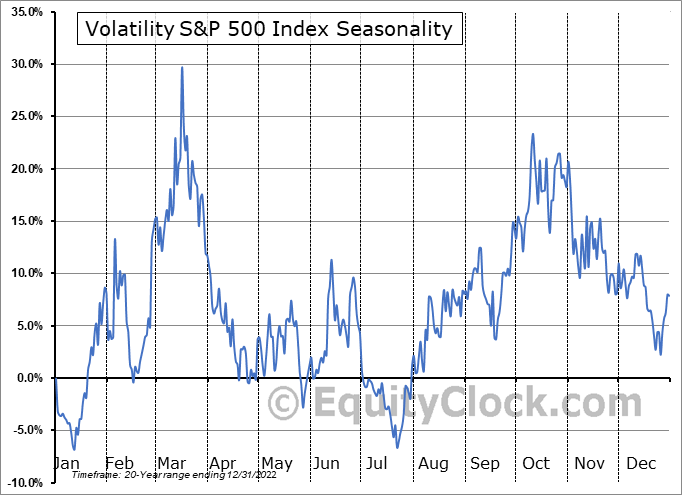

July 17th just so happens to be VIXpiration and index vol is set to put in seasonal lows.

Skew should simultaneously start to drop as we enter this period. It serves as confluence for a correction.

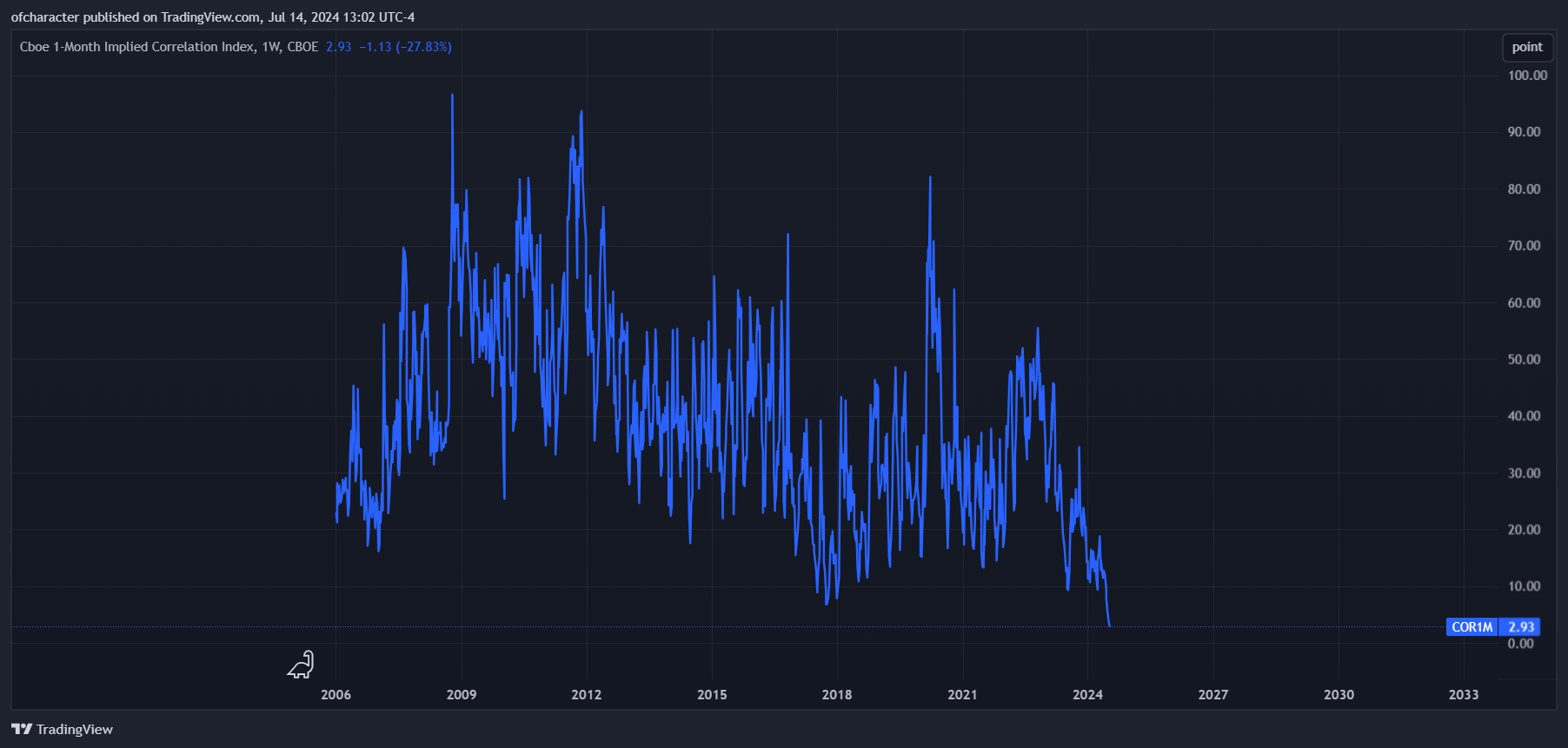

And implied correlation is at levels where VIX reached single digits in 2017. New record lows in COR1M showing that everyone is prepared for the continuation of summer madness…

Before I get into the next portion of this, I want to make myself clear: I’m physically incapable of having any less of a desire to align with any political party or label. I’m not a Republican or a Democrat. I’m not a Conservative or a Liberal. I’m not left-wing, right-wing, or center. None of these things actually matter. I simply align myself with God. Now, time to dig in.

I began writing this post early Saturday morning, and by the end of the night a historic event had transpired. It promptly reminded me of what I said in my last post:

Back in 2021, I told a friend of mine that I believed Biden wouldn’t finish his term as a consequence of his incompetence given that he had done nothing particularly meaningful during his lengthy political career. At the time, it was transpicuous to not only me, but also anybody who had an ounce of discernment that Biden was cognitively lethargic — and that’s putting things lightly. So, naturally, bringing in this “impressive” specimen into such a turbulent, once-in-a-century environment was destined to be painfully unsuccessful. After the recent debate, many Dems have seemingly woken up overnight to the reality of Biden’s cognitive state. Of course, this is intentional, and they were aware of this well before he took office.

In my view, recent developments have all but solidified his departure from office before November. In fact, I’d genuinely be shocked if he was still there by the end of this month. With that being said, it’s time to consider the possible effects that this transition could have on markets.

After the failed assassination attempt on Trump — which was nothing short of a miracle —, Biden’s departure before the end of this month is even more likely than before. A red wave is to be expected as well. Over the last four years, countless attempts to sabotage him have backfired and inadvertently served to further bolster his popularity and support. Needless to say, supporting Trump (especially after last night) is a no-brainer.

So, where does that leave markets? In the same position long-term with potential to shake up the short-term cross-asset path. The long-term outlook was covered in my last post. To put it simply:

Equities: The longest divergence ever between transports and the indices will lead to substantial downside over the next year.

Bonds: Thinking bear steepener un-inverts the curve. Inflation will be a problem for a few more years and consequently the long end will continue struggling.

Commodities: They will continue to shine. One of the best performing assets in the 1H of this year was silver. Expecting gold and oil specifically to perform well over the next few years.

In the short-term, I’ll be watching closely to see what trends develop.

Most importantly, the fate of the nation should be at the forefront of Americans’ minds. To close, I’ll reiterate a combination of two of my favorite mantras: don’t blink, don’t panic because playtime is over. It’s time to get your house in order.

“Let us hear the conclusion of this whole matter:

Fear God and keep his commandments, for this is man’s all. For God will bring every work into judgment, including every secret thing, whether good or evil.” — Ecclesiastes 12:13-14