Summer Madness pt.4

This has unintentionally become a series..

Jumping right into this with a positioning update:

The CL/$CL1! call spreads were up 126% as of 7/1. Cut this position in half Monday night.

TLT 0.00%↑ put spreads were up materially as well with most of the gains coming directly after the presidential debate.

Back in 2021, I told a friend of mine that I believed Biden wouldn’t finish his term as a consequence of his incompetence given that he had done nothing particularly meaningful during his lengthy political career. At the time, it was transpicuous to not only me, but also anybody who had an ounce of discernment that Biden was cognitively lethargic — and that’s putting things lightly. So, naturally, bringing in this “impressive” specimen into such a turbulent, once-in-a-century environment was destined to be painfully unsuccessful. After the recent debate, many Dems have seemingly woken up overnight to the reality of Biden’s cognitive state. Of course, this is intentional, and they were aware of this well before he took office.

In my view, recent developments have all but solidified his departure from office before November. In fact, I’d genuinely be shocked if he was still there by the end of this month. With that being said, it’s time to consider the possible effects that this transition could have on markets.

Cross-Asset Opportunities

Immediately my mind goes to the SPR — formerly known as the Strategic Petroleum Reserve, now known as the Strategic Political Reserve. An overlooked outcome in this scenario is one where, in the face of humiliating defeat, the current admin sees no incentive to tap the SPR anymore. Looking at oil now from both a fundamental and positioning perspective, there may be more upside than previously expected.

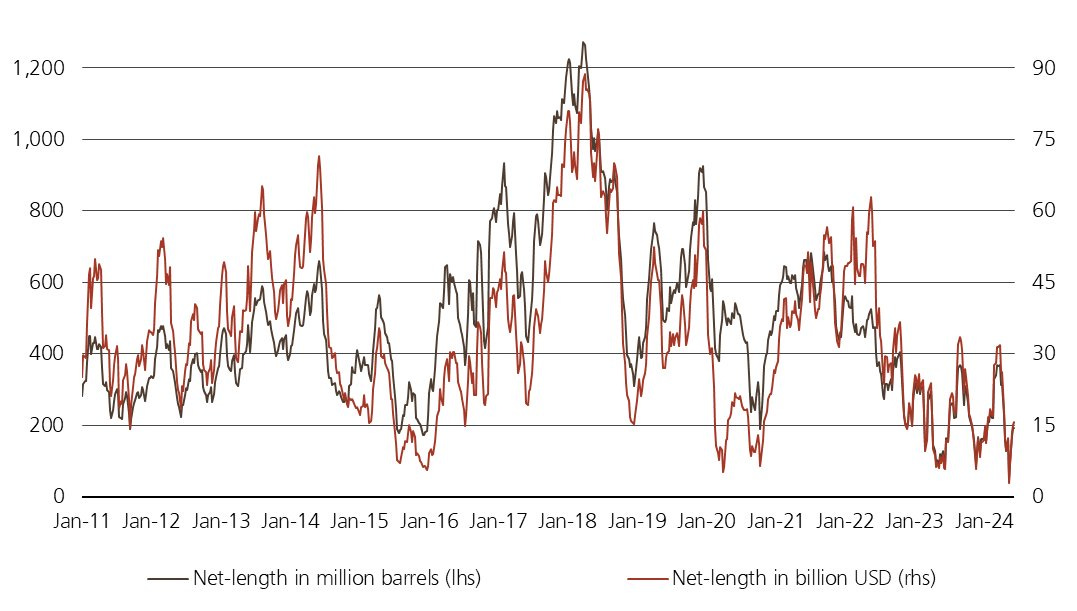

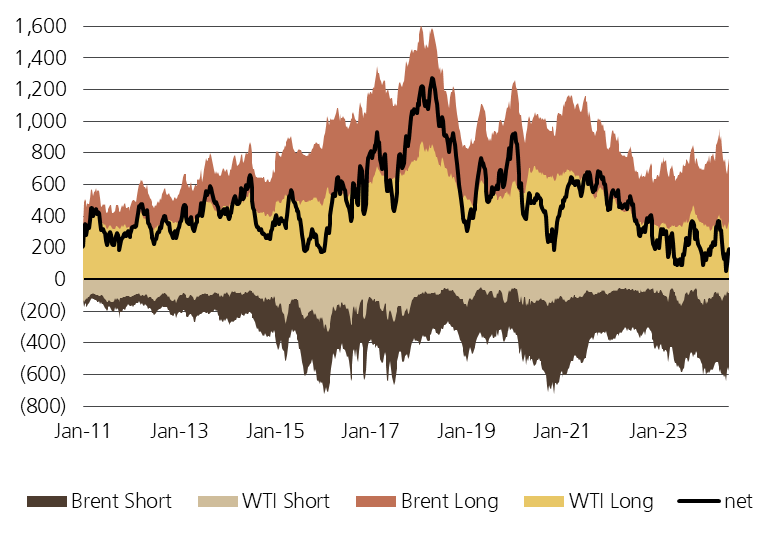

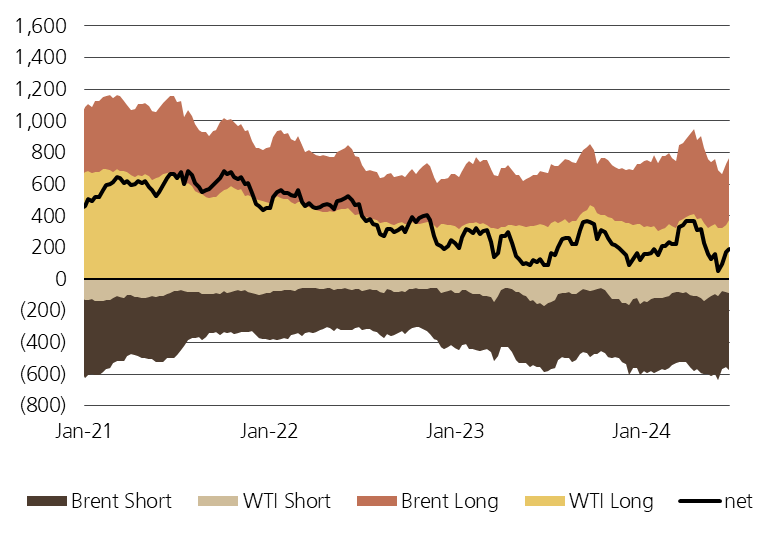

There needs to be more inventory draws to substantiate any further rallying, but net length is still skewed heavy short. Every image below is from @staunovo on Twitter. Last updated June 25th.

The last image makes it clear that despite the recent short covering and substantial rally in crude, net length is still fairly short — notably far from where oil has previously made interim peaks.

Prompt spreads look healthy.

And as far as I’m concerned, taking a shot at oil upside over gold is much more prudent than broadly recognized.

Over in FX land, the yen is still getting hammered.

The beatings will continue until…who knows at this point? There will be lucrative opportunities to both long & short the yen in the foreseeable future. I think it’s safe to say that the longs will be short-lived in comparison — unfortunate for Japan. Something else to note is the correlation between this and rates.

These two have moved in tandem for a while now. Seems like the long end is mispriced. Speaking of which,

rate vol looks to have bottomed late May. I think around 140 on MOVE 0.00%↑ is the area where you start to hear more widespread fears about systemic failure, so no panicking is warranted right now — or ever, but if you’re going to panic, be first.

Lastly, but certainly not least, it’s time to take a look at equity vol — with a twist.

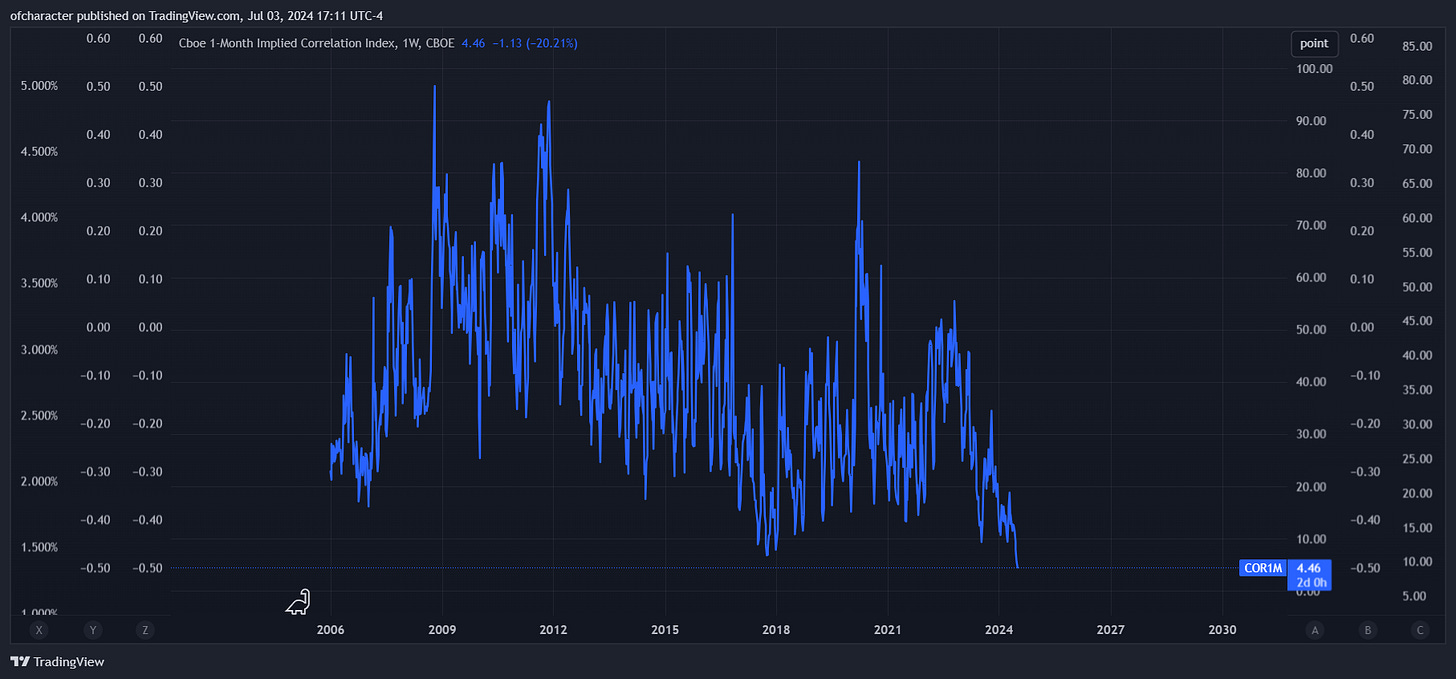

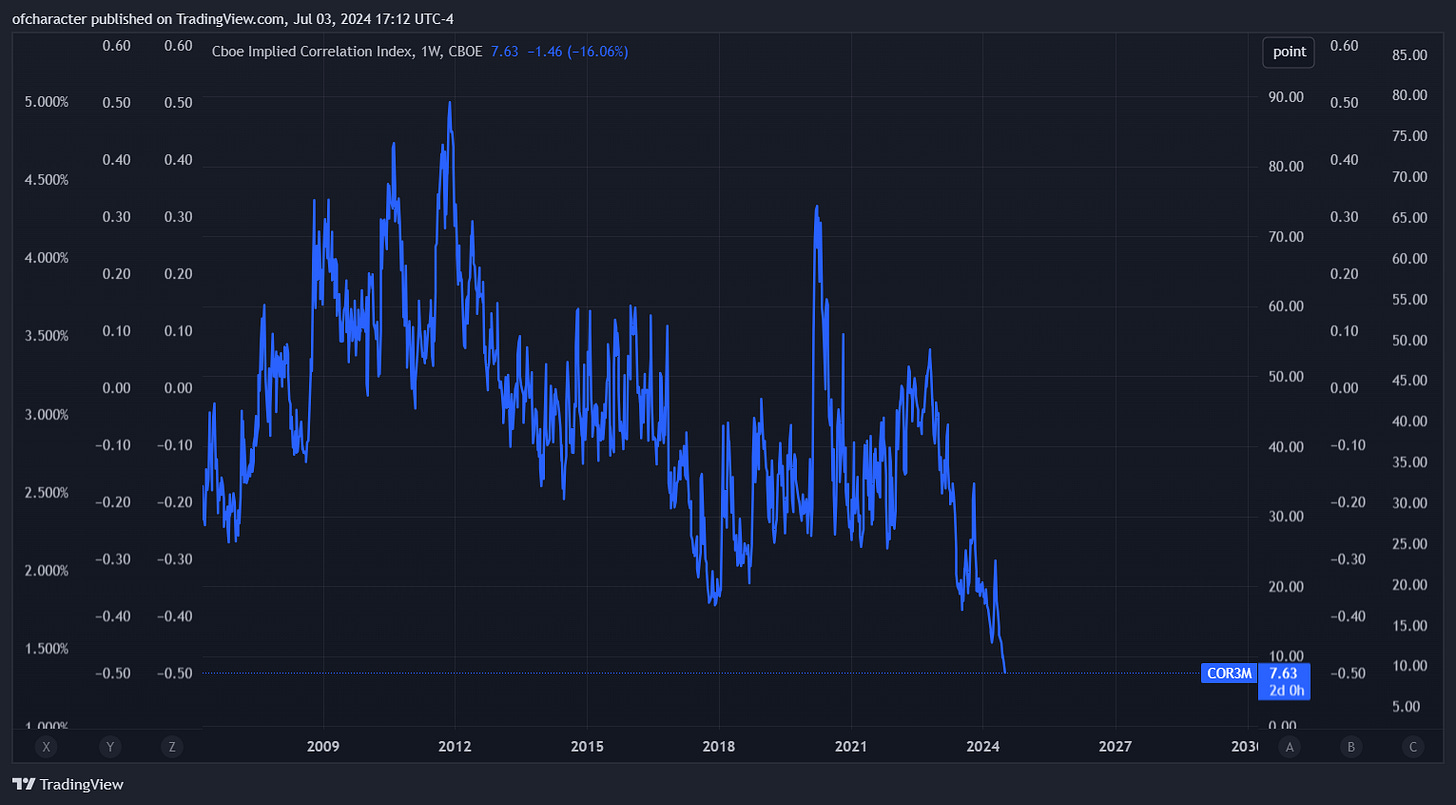

Implied correlation made new lows again.

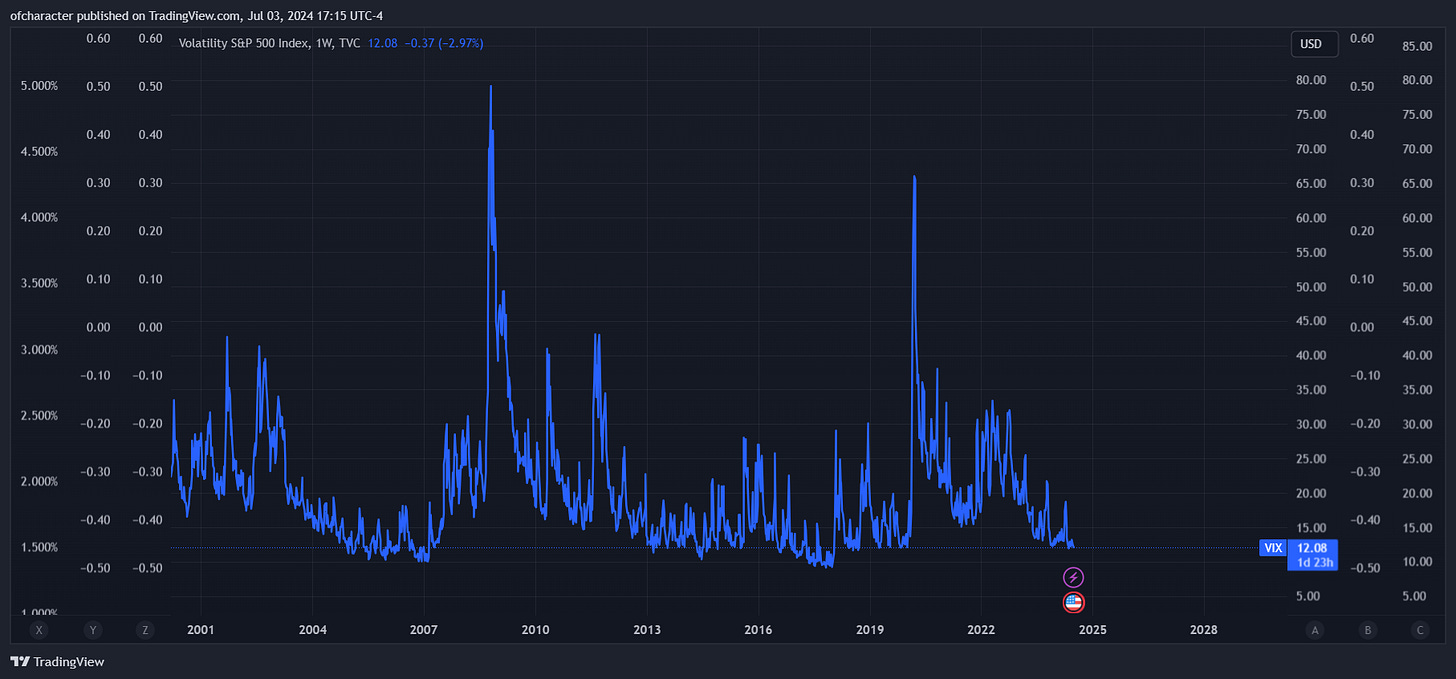

Naturally, the VIX has been relatively muted.

It is no longer solely NVDA 0.00%↑ that is allowing this market to trudge forward — emphasis on trudge. The rest of Mag7 has joined the party, even TSLA 0.00%↑. This is paramount to note because it’s what is driving such high dispersion in the market. If you look in other areas…

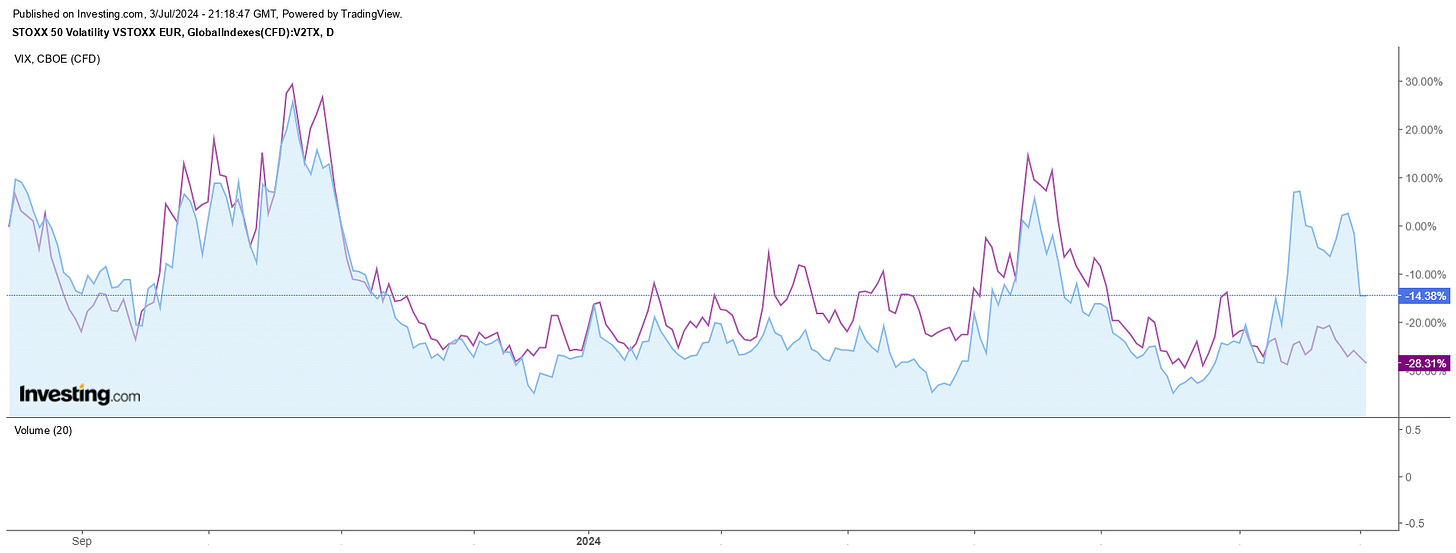

you’ll see that index vol is undoubtedly muted. One more for good measure.

A slight disconnect here, nothing major. Where I believe lies a considerable disconnect is in bitcoin. I’ve been asking myself constantly why bitcoin still hasn’t made a new high since March 14th while high beta tech — which has been highly correlated to bitcoin for a while — has made new highs since then. Since I see bitcoin as a measure/leading indicator of liquidity, my best guess is that due to the abysmal breadth in equities — apologies in advance, but this time the breadth really is abysmal lol — this disconnect is transpiring.

By itself, bitcoin looks likely to breakdown further in the near future. However, when you overlay NDX or QQQ 0.00%↑ on this, you get a much different picture.

Back in November 2021, the consensus was that bitcoin was going straight to 100k. This clearly didn’t happen, and if you look closely, you’ll see that bitcoin topped earlier than NDX did — and much earlier than SPX. This time around, both SPX and NDX have well eclipsed their ATHs while bitcoin’s performance has been lackluster, failing to make new ATHs. Nonetheless, 100k is the consensus again, and I’ll happily take the other side of this. Why? Because it’s time for summer madness. Aside from what I’ve written about in the last 3 editions of this, this is what that summer madness looks like for equities. Along with this…

Dow Theory, which I’ve mentioned plenty of times since late May, is still signaling major weakness for the indices in the future. Notably, the Dow hasn’t made new highs after the weakness in April like the other indices.

By now most know that breadth is poor, so that alone is not enough to derive any actionable value. Knowing what consensus is, and how to 1) take advantage of going against it and 2) figure out if consensus is consensus for good reason is of the utmost importance. Judging by the widespread lack of desire to hedge/go to cash given current circumstances, the current consensus (up only forever) is unequivocally uncorroborated.

With many comparisons of this present market to the dot-com bubble due to concentration levels, you’ll more than likely make more money on the short side of NDX than any other index.

NDX didn’t make new highs for over a decade after the bubble popped. Don’t think it can’t happen again.

Playtime is Over/Joever

This has been a recurring theme of this series. Because playtime is both over and now joever, it’s time to get your house in order. I will borrow another mantra I used back in December 2022 to close: don’t blink, don’t panic.

Have a great 4th of July!

Until next time,

Pierre.

“For God has not given us a spirit of fear, but of power and of love and of a sound mind.” — 2 Timothy 1:7