Summer Madness pt. 6 | Final Edition

Everyone deserves a second chance, right?

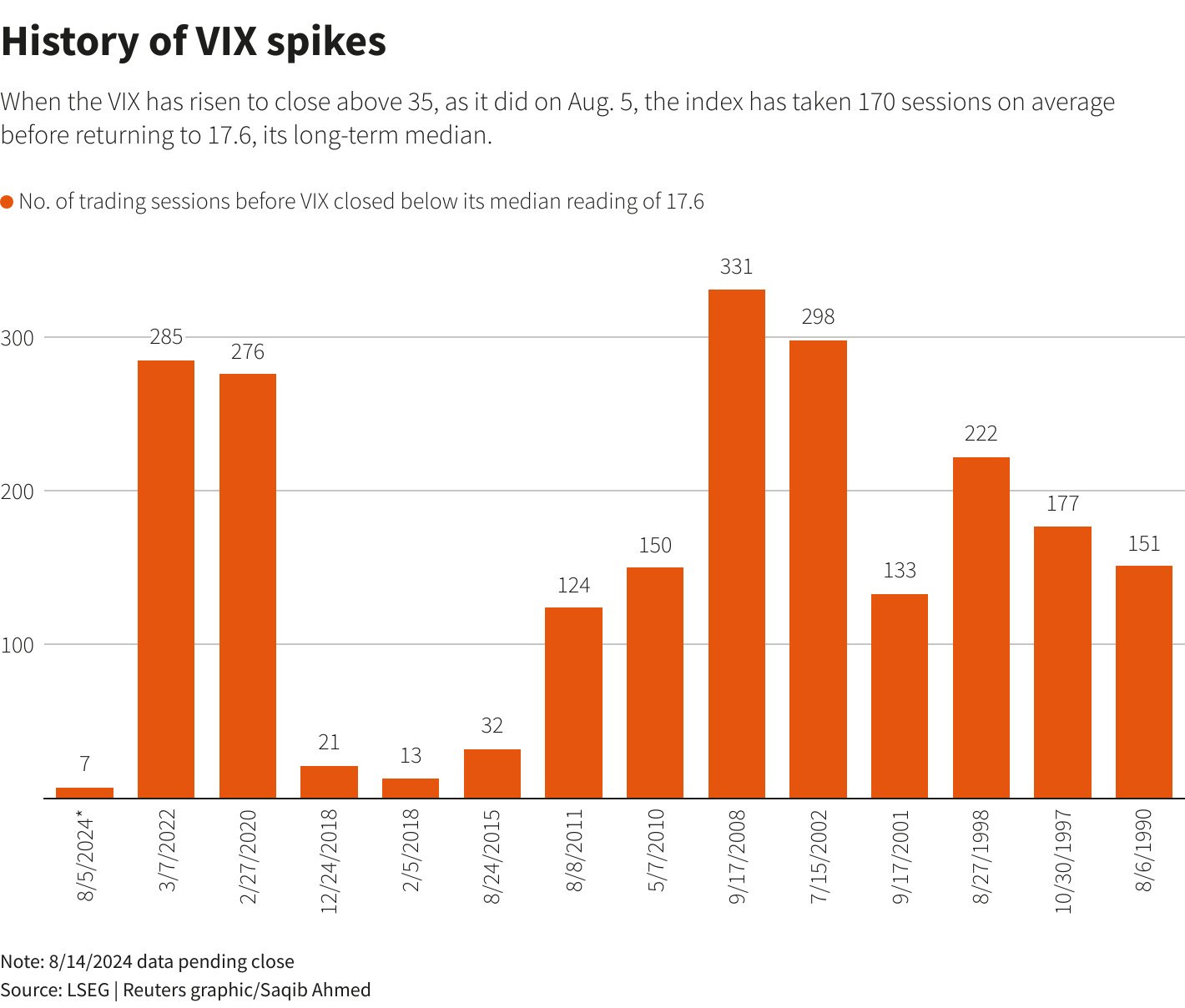

Markets have been very eventful lately. Volatility arrived in a historic way — 3rd highest reading ever — sending short vol strategies into a panic on August 5th. There were a plethora of narratives attempting to explain this sell-off/vol shock that surfaced in the media. However, they were mostly serving to entertain rather than inform.

It was ultimately a matter of massive de-grossing coupled with record high dispersion. This unwinding of several majorly crowded trades (short vol, carry trade, long Mag7/short IWM/RTY) into a seasonally weak period while positioning was stretched produced this vol market shock. Talk about a perfect storm.

This evidently caught many people off guard, but what if I told you that this was relatively easy to see ahead of time?

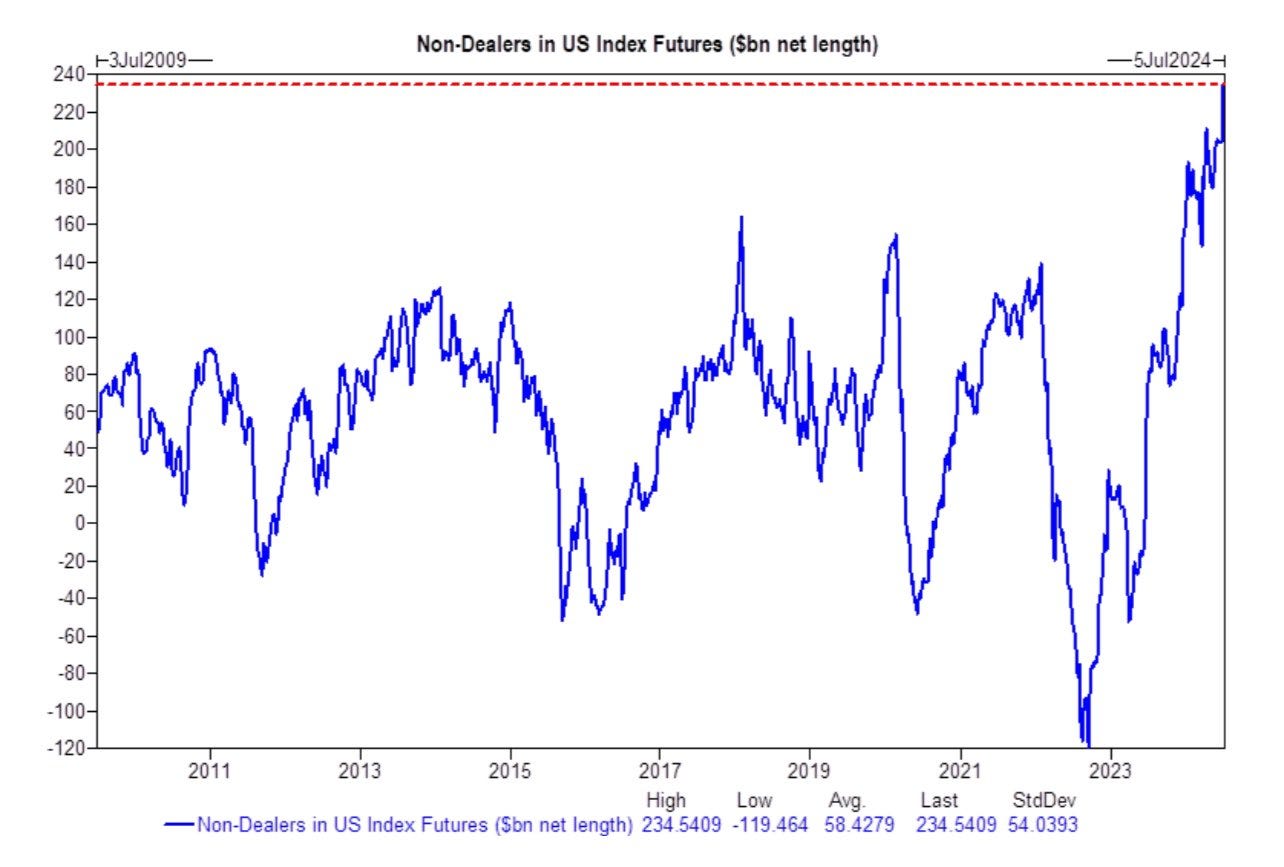

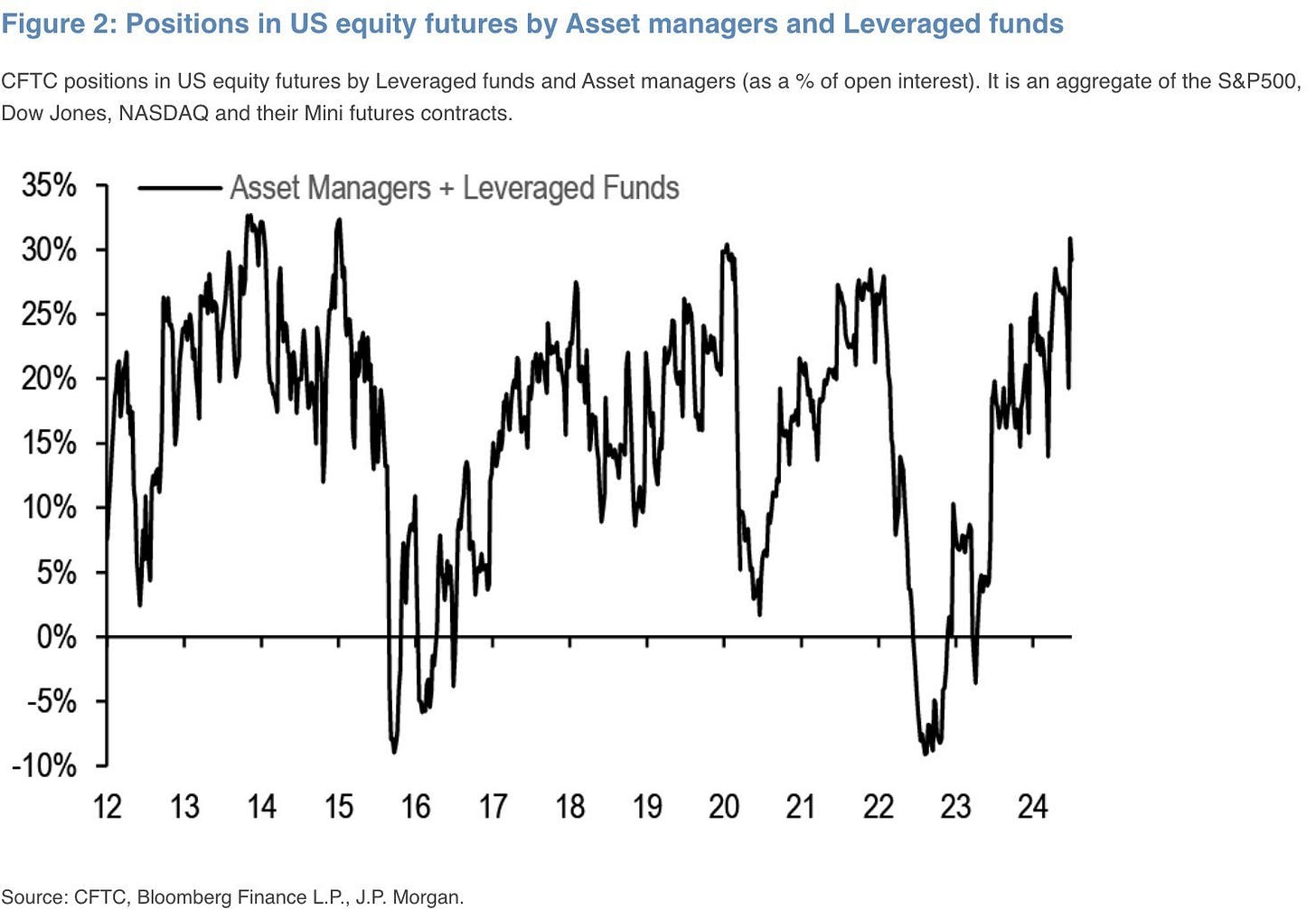

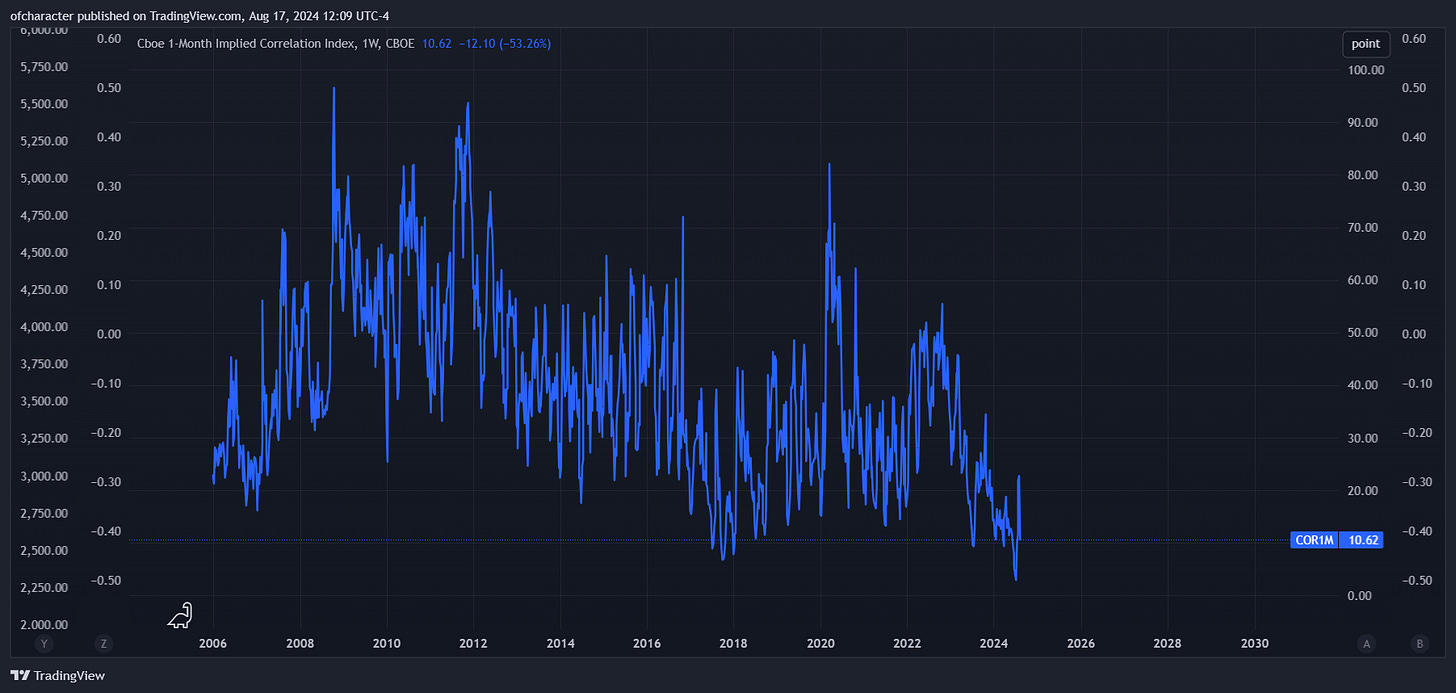

You can find a plethora of these signs under the “Summer Madness” tab of this publication. If there were only two signs that I could point to, they would definitely be implied correlation and positioning. This is what those looked like ahead of this historic vol market shock:

Positioning was stretched ahead of CPI and markets love to shift to wherever the pain trade is.

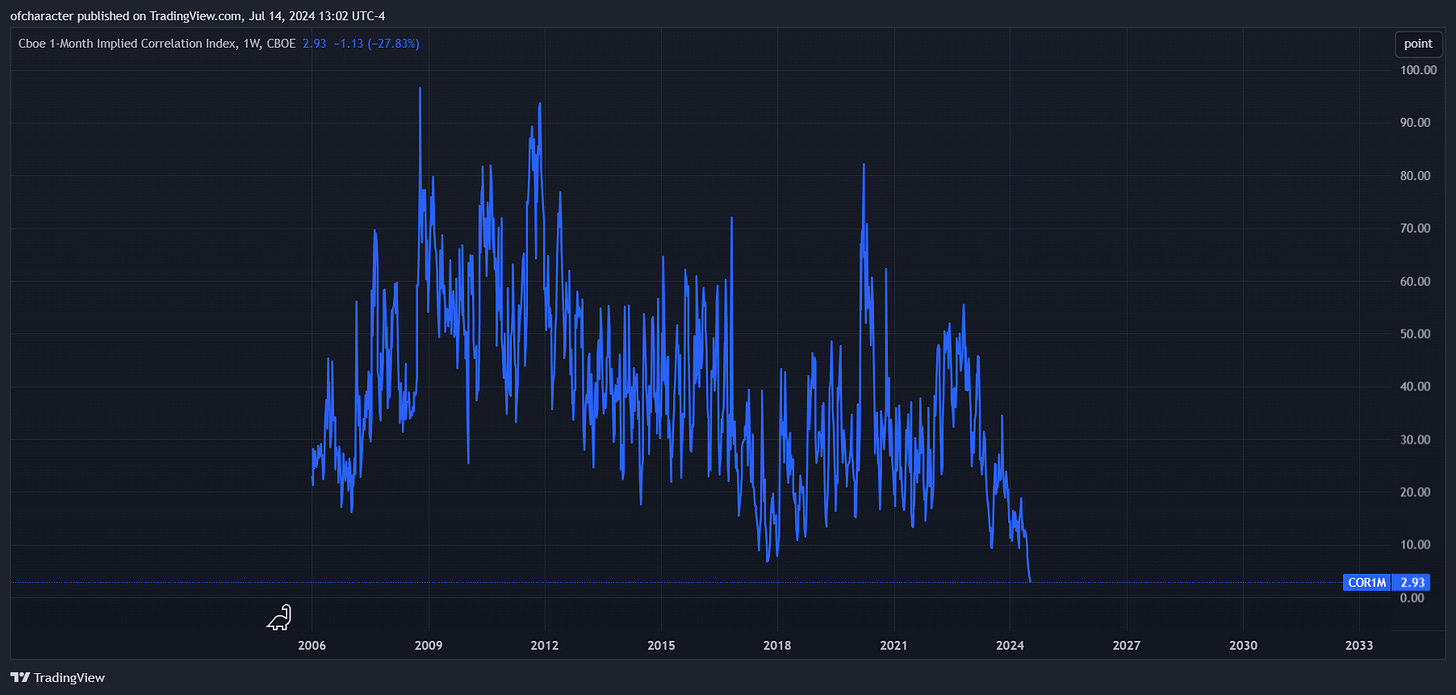

And implied correlation is at levels where VIX reached single digits in 2017. New record lows in COR1M showing that everyone is prepared for the continuation of summer madness…

Summer Madness pt. 5

Positioning was stretched ahead of CPI and markets love to shift to wherever the pain trade is.

The most astonishing thing to me about this event is unequivocally how quickly vol has retreated.

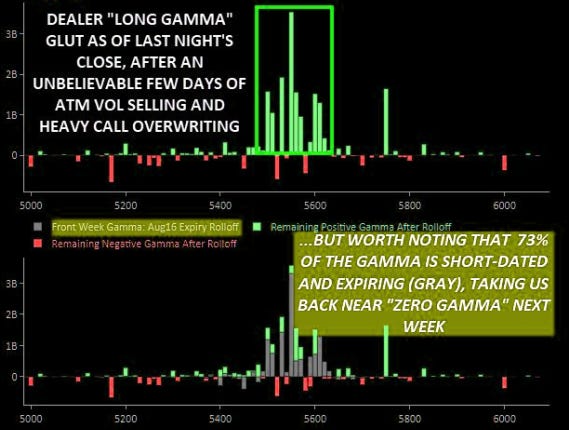

After having their YTD gains swiftly erased, short vol has evidently doubled down.

1M implied correlation (COR1M) is historically low again as well.

It is truly astonishing.

Seasonality says that only the first half of August is poor but given that this rally looks a bit long in the tooth with VIXpiration coming on August 21st, the market looks to be giving those who have missed the opportunity to take advantage of unjustifiably low cross-asset vol a second chance. Note that I don’t believe VIX will go to 65 again this time around and that the window to catch this is relatively small.

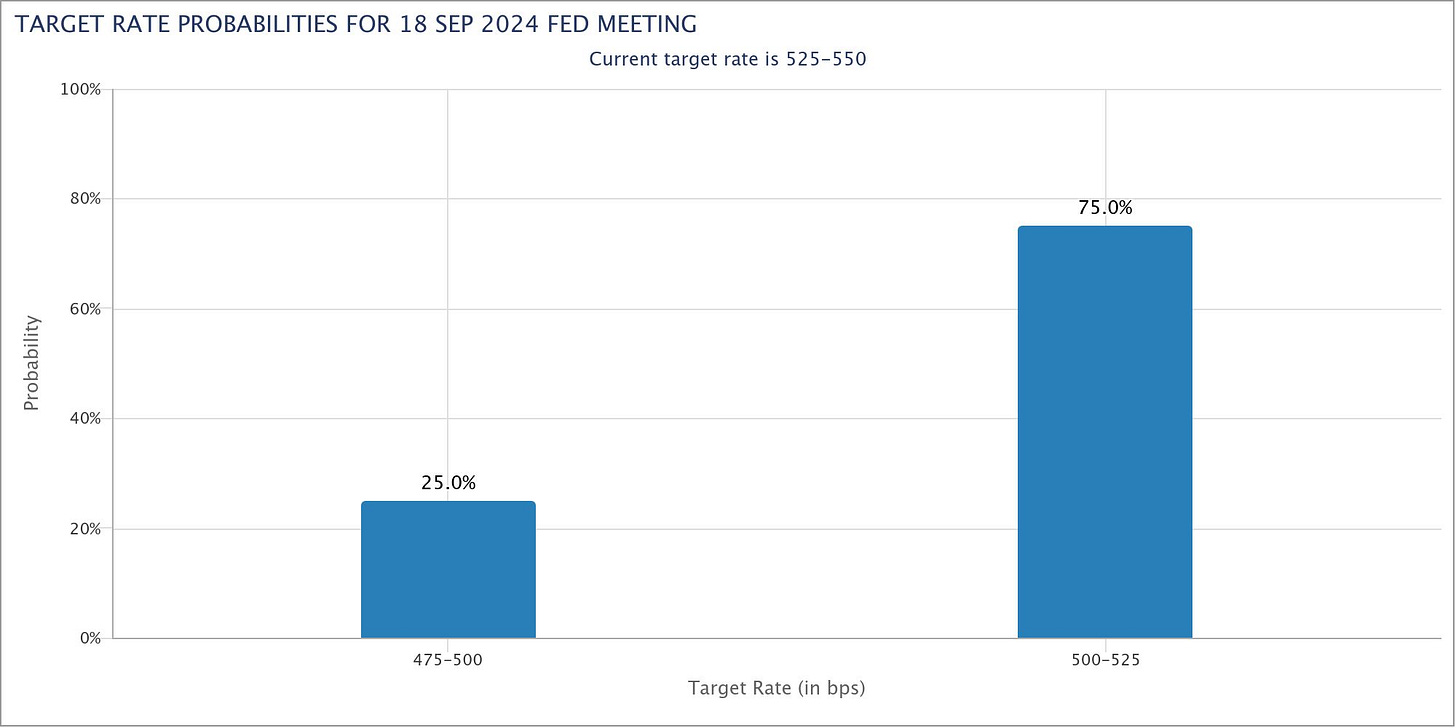

Since there is also an upcoming FOMC meeting next month where the Fed is expected to cut rates, it is exceedingly important to pay close attention to how equities react to this.

IMV, we have essentially front ran the rate cuts the entire year. Majority of market participants have been salivating at the mere mention of rate cuts since Mar ‘22, and we’re finally about to get one. This leads me to believe that equities & bonds (long end) reactions will be less than stellar — contrary to popular belief. All things considered; I expect cross-asset vol to remain elevated for the rest of the year and into 2026.

Transitioning Out of Summer Madness

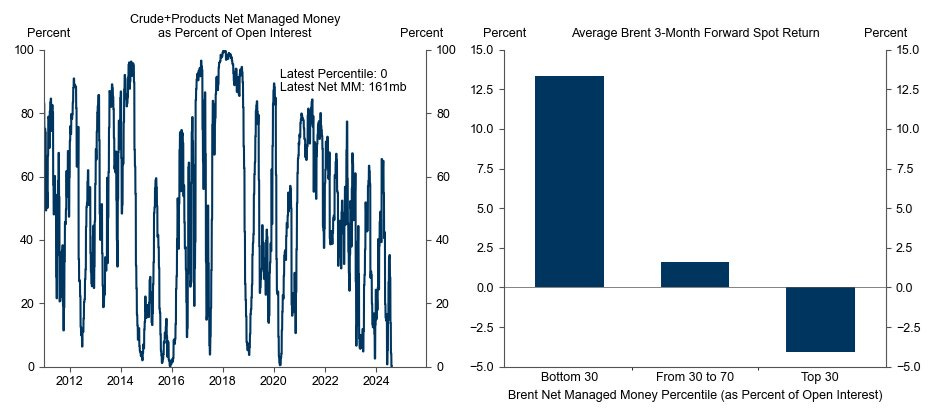

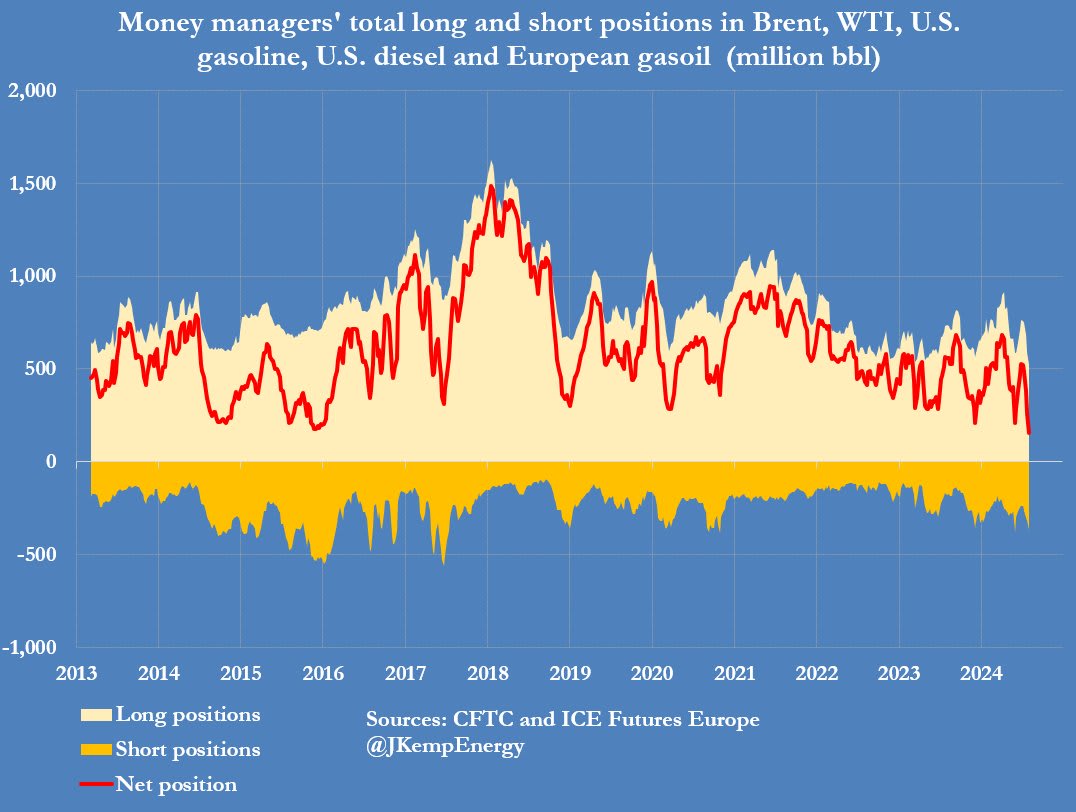

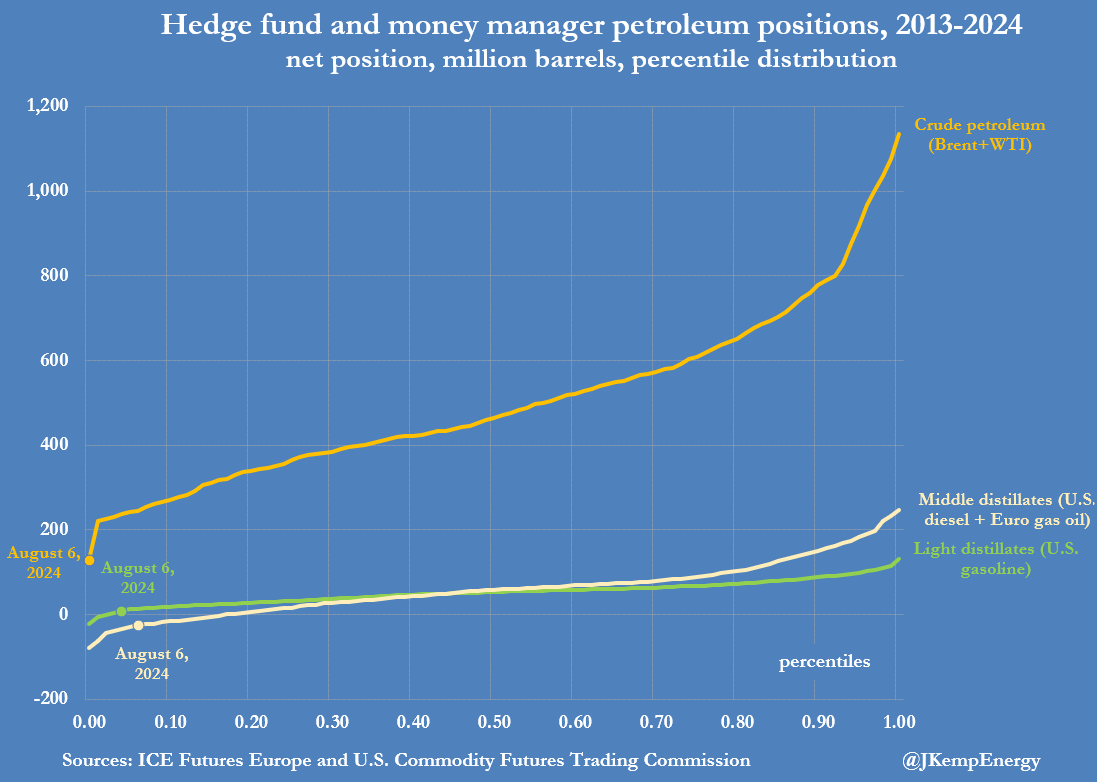

There is an incredibly lucrative setup in another market right now. Commodities are being bet against at an extreme rate. A rate at which I believe is unjustified.

My favorite commodity is hated too — just how I like it.

These images instantly remind me of the concept in equity markets where no market crashes/vol events happen when everybody is prepared for them. They occur whenever the majority is on one side of the boat. In a similar manner, I believe this lopsided positioning in commodities is signaling some major escalation of geopolitical tensions fairly soon. October is a sweet spot for me there.

I checked the other times where correlations went to 1 & vol rose materially (above 45) in equity sell-offs and noticed that LMT 0.00%↑ held up relatively well in this circumstance. LMT 0.00%↑ seems to be trading like it was shortly before Russia’s invasion of Ukraine.

The broader market was selling off aggressively early ‘22 while LMT quietly outperformed. Needless to say, the present resemblance is uncanny.

My short-term views are as stated above and as for the long-term, they remain the same:

To put it simply:

Equities: The longest divergence ever between transports and the indices will lead to substantial downside over the next year.

Bonds: Thinking bear steepener un-inverts the curve. Inflation will be a problem for a few more years and consequently the long end will continue struggling.

Commodities: They will continue to shine. One of the best performing assets in the 1H of this year was silver. Expecting gold and oil specifically to perform well over the next few years. —

Summer Madness pt. 5

·Positioning was stretched ahead of CPI and markets love to shift to wherever the pain trade is.

In conclusion, “Nothing ever happens” bros will have a very rough time over the next few years because playtime is over, and it’s time to get your house in order.

Until next time,

Pierre