The Perfect Storm

Signal > Noise

There is currently much deliberation about whether or not the bear market is over. 1AI has become the new buzzword while asinine EOY targets cloud the airways & substance is generally overlooked. So it’s time to focus on the signal instead of the noise.2

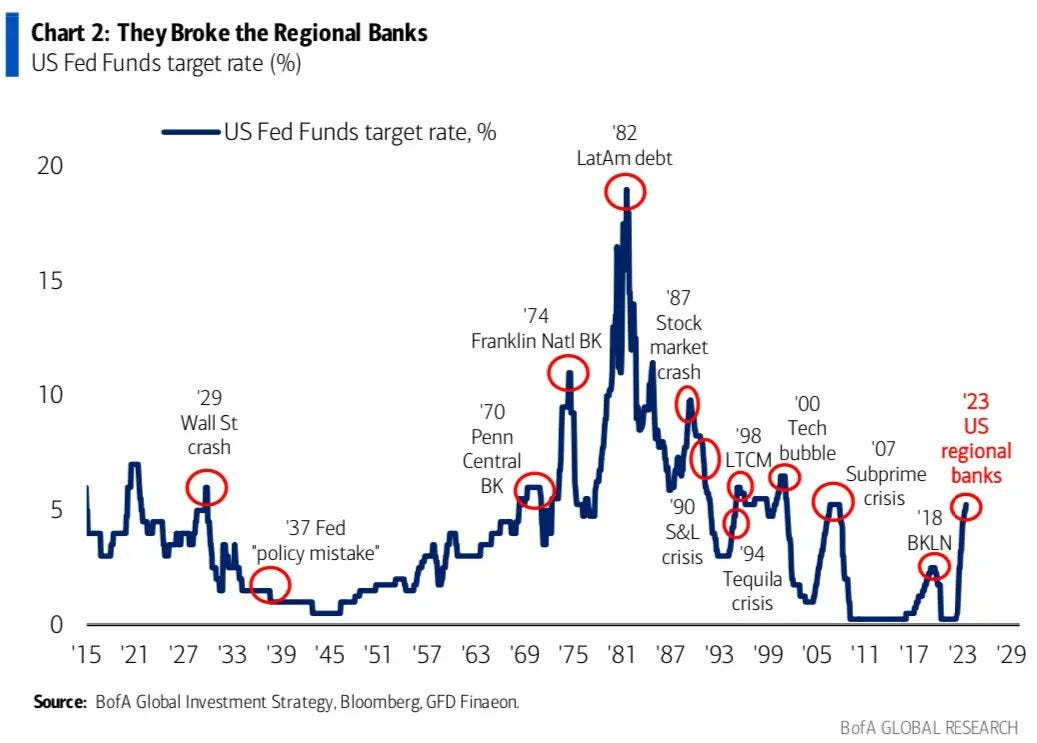

It takes about 12-18 months to begin to see the effects of monetary policy on the economy. Exactly 12 months after the initial rate hike in this cycle, the banking crisis began.

In fact, SVB collapsed around the same week that Bear Sterns did in 2008, and the market proceeded to rally into May. 18 months would put us at September — the worst month historically for markets — and we’re starting to see many bears capitulate along the way.

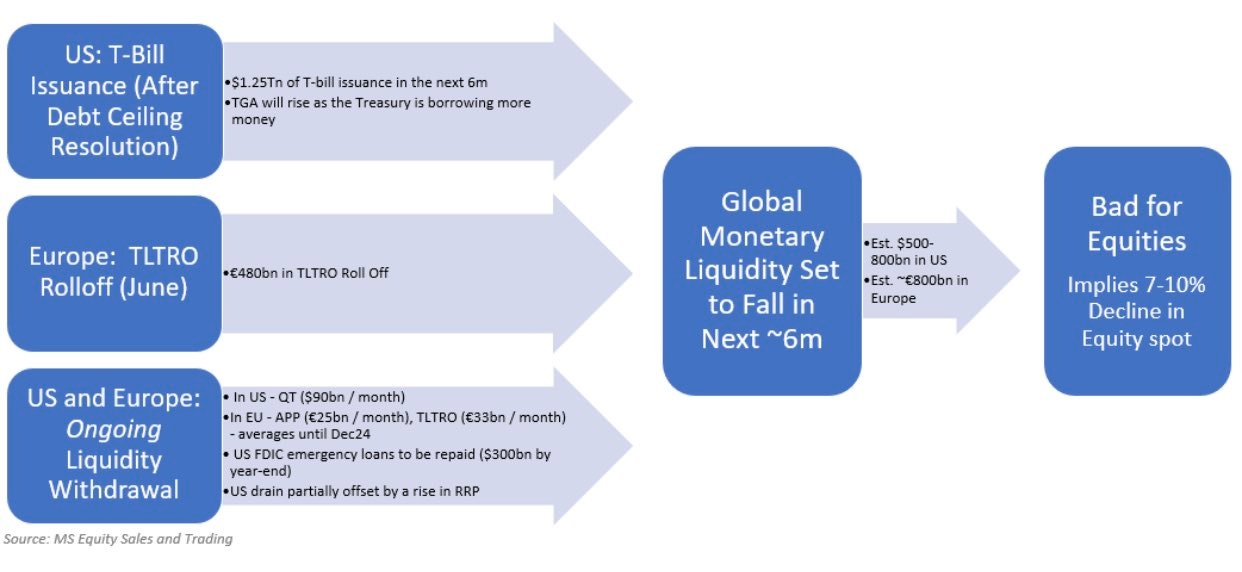

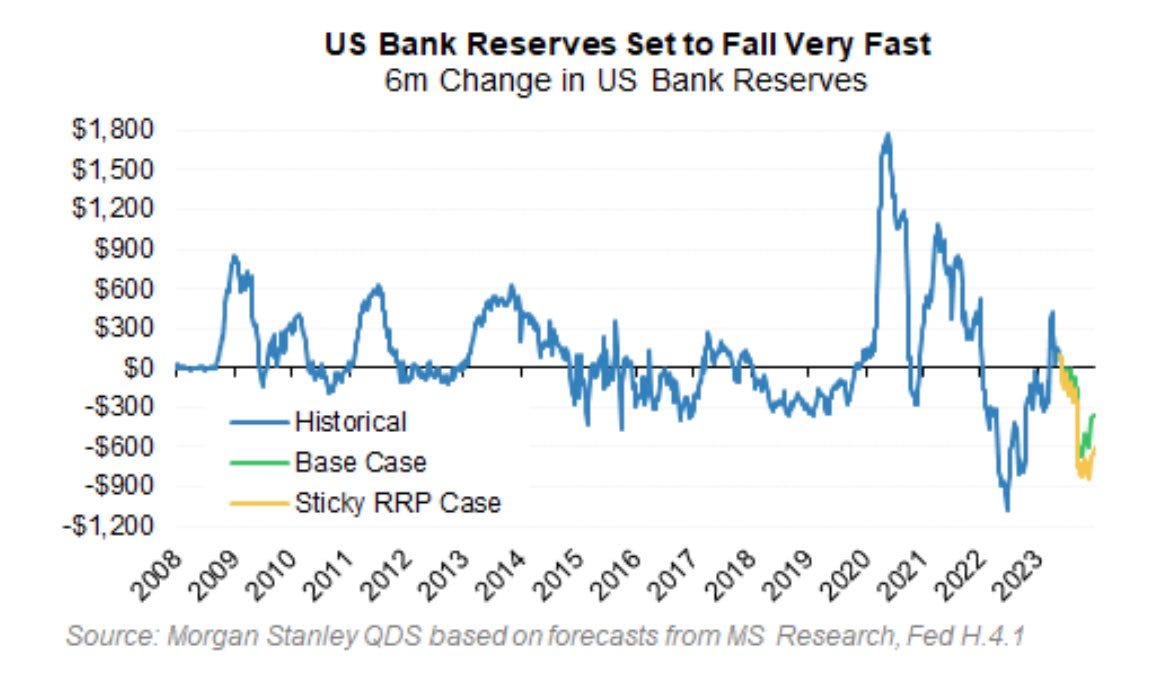

Couple this with the fact that QT has been masked so far because of the TGA drain due to the debt ceiling. New debt will be issued after a resolution and the TGA will be refilled — essentially draining market liquidity.

And bank reserves will continue to fall as QT is uncovered.

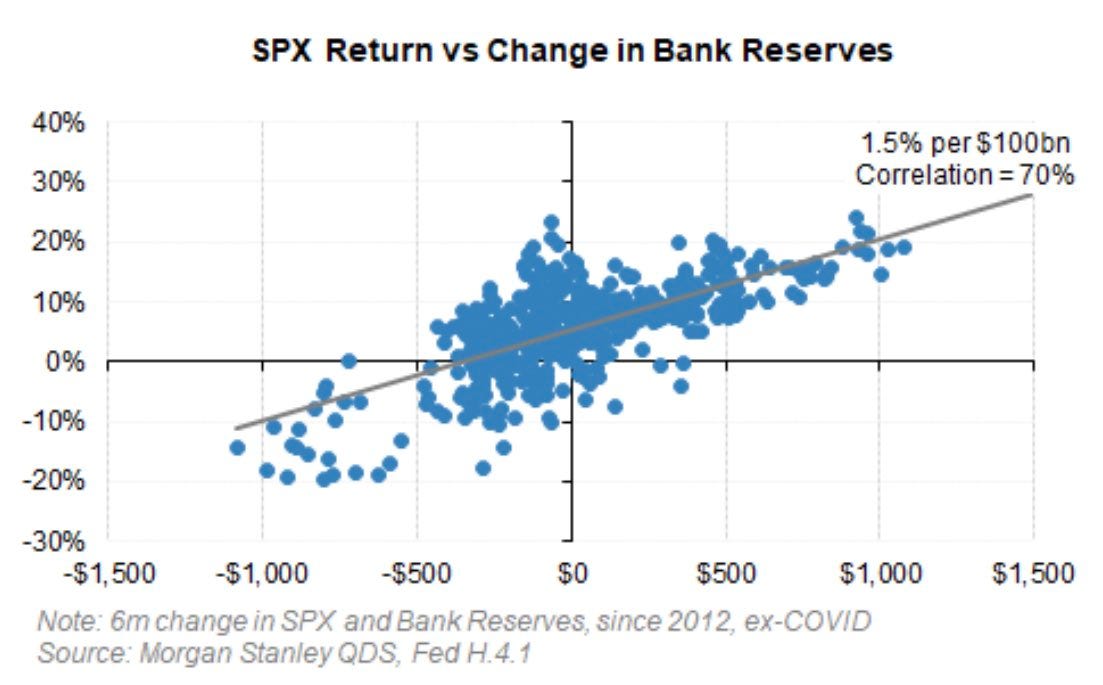

Declining bank reserves are not conducive to positive returns in SPX.

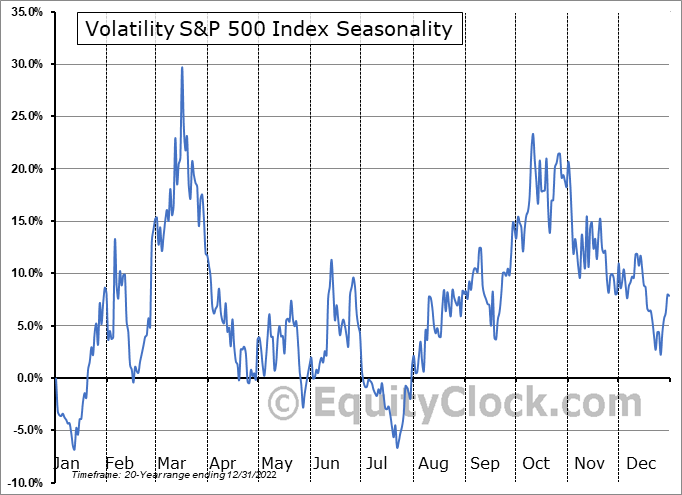

There is also a positive seasonal effect in the vol space from late Sept through October in which this perfect storm of response lag from monetary policy and a liquidity drain coincide.

Commodities Not Dead Yet

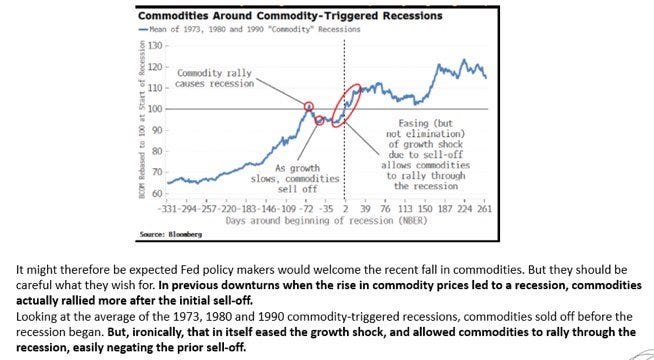

Most investors/traders currently have no vivid memory of inflationary recessions. This is why there are so many people taking victory laps in the commodity space (oil specifically) despite China’s oil demand hitting another all time high in April, speculative positioning being the most bearish since 2011, and most importantly, history being on the commodity bulls side.

All current conditions considered, it might be time to start building a long commodities —especially oil— position.

For clarification, an out of breadth market with thin/waning liquidity doesn’t mean that the market will automatically plunge into the abyss. Moves to the downside and upside stretch further than normal in this type of environment. Hence the fact that the biggest rallies transpire in bear markets. And despite AI being the main attraction, there are legitimate headwinds that the market is facing in the 2H of this year, creating the perfect storm. 3

Market breadth is still horrendous, and the bear market will not be over until this occurs —‘‘To cure the exaggerations and extravagances of the preceding period of speculation is the function of a bear market. The difference between a technical reaction and a bear market is that the first is a purging of the market’s internal position, while the second is a thoroughgoing rectification of all excesses that have crept into the ensemble economic structure. When contraction has proceeded far enough to remove the distortion and restore the balance, the bear market, from a fundamental standpoint, has ended.’’

Not referring to the market rallying as noise as there is always money to be made on both sides. The narratives explaining pa —whether up or down— are often noise.

Although the AI hype is greatly contributing to the tail end of this market rally, it will subside eventually. However, AI is certainly still useful and will not be like the Metaverse or Bitcoin hypes.