Vol Is Great Again

And we're just getting started

This will be a fairly short update. Jumping right into it with some positioning,

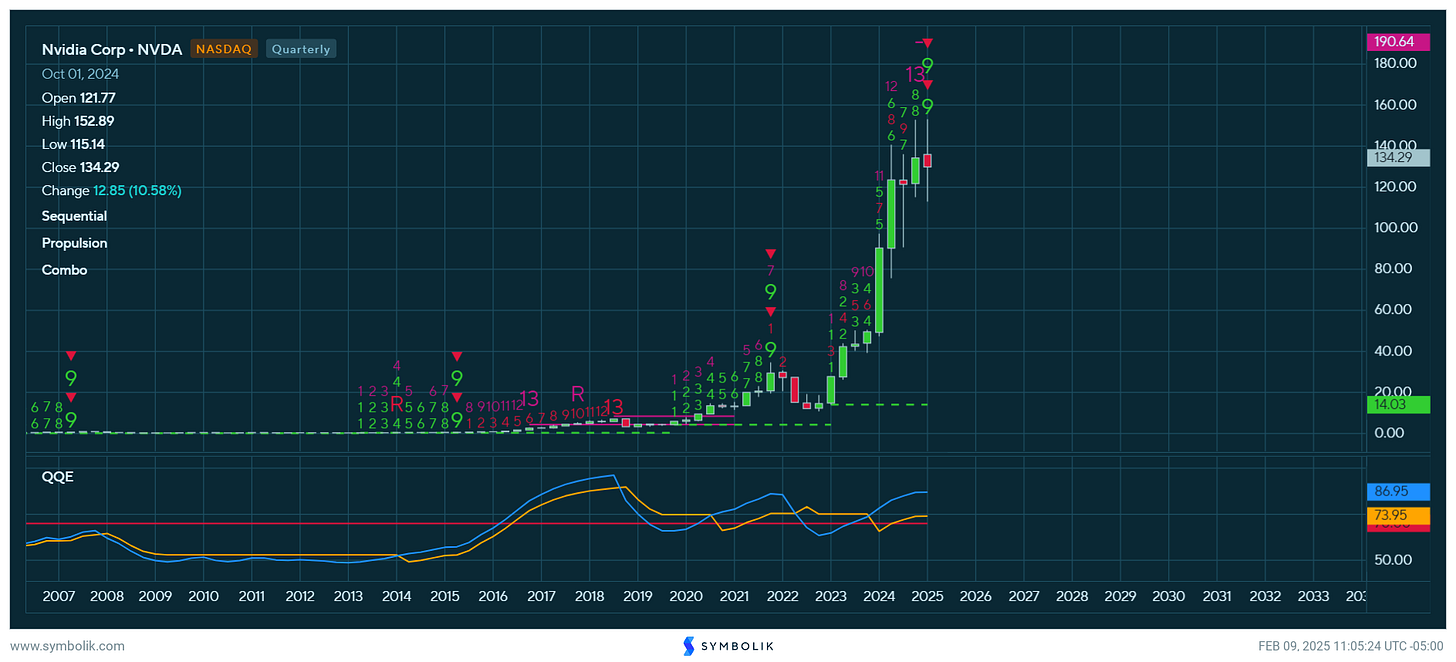

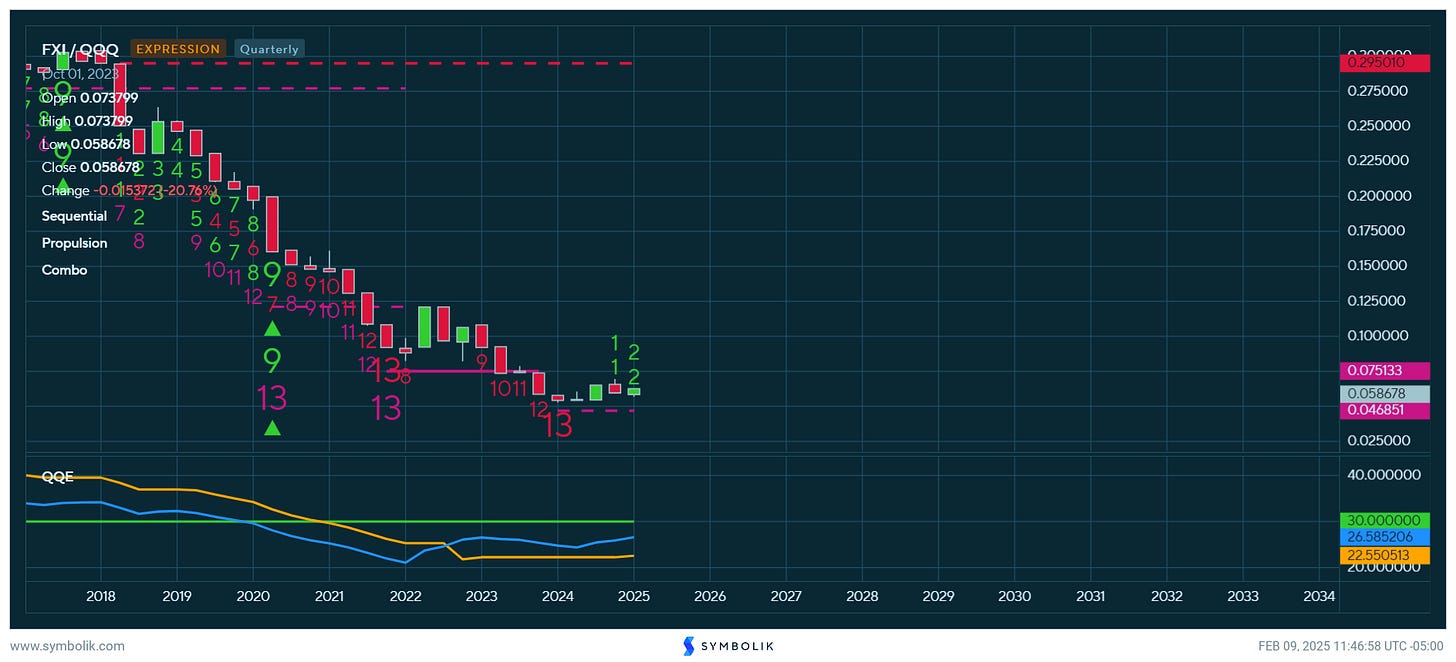

“Going forward, I’m going to find more ways to bet on that unhealthy broadening (RTY/XLE up, NDX down, which can turn into RTY & NDX down, with NDX down more) — saw some of this action to close December, but not enough. XOM longs were slowly added — 12/13, 12/18, 12/23. NVDA short (idea stems from most recent post which I’ll be trading around for the foreseeable future) added 12/6 & 12/10 — trimmed a bit since.5 AAPL short added 12/16 & 12/23. CL long added 12/20 & 12/23. All several months out.” —

NVDA puts increased 1/7, trimmed some 1/27. CL long was initially trimmed 1/13 & completely closed 1/16. Energy longs were trimmed materially the same day. SPX/NDX puts were closed 1/14. AAPL puts closed 1/21. NDX puts added again 1/23 alongside yen longs the same day.

Vol Is Back

Volatility showed signs of its coming resurgence after the July-Aug episode and it’s now back with a vengeance! One of my favorite measures of vol was discontinued as of 1/27 — talk about timing.

Each time RVOL6M crossed above 14 (going back to 2007), trading exited “easy” mode, ultimately venturing into “veteran” difficulty. Whether a persistent or transient veteran mode ensues is dependent upon several factors, most of which I’ve written about extensively. I’ll briefly touch on arguably the most important — positioning.

Positioning

Indices have lost the fuel required to do what the consensus expected. Consequently, SPX and NDX have experienced nothing but volatile chop since the Trump-bump.

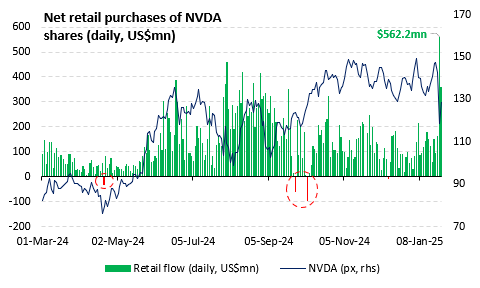

In other words, this has been a lengthy distribution process. This is not your typical distribution either. On 1/27, when NVDA dropped precipitously due to the swift arrival of DeepSeek, it was very clear to me that that was institutional selling. My suspicions were confirmed shortly after that day:

Some more color from Vanda (source ZeroHedge) : According to Vanda, discretionary institutional investors were the most likely culprits of Monday’s tech rout. Here's why:

First, systematic investors (CTAs) sold only a fraction of what they sold during the August or post-Dec FOMC sell-offs.

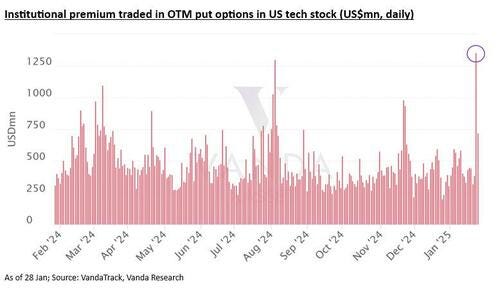

Secondly, as noted above, retail investors bought the tech dip in huge size. Here Vanda leverages institutional flow proxies from its VandaXasset platform to confirm the above – i.e., institutional OTM put option premium traded in tech stocks.

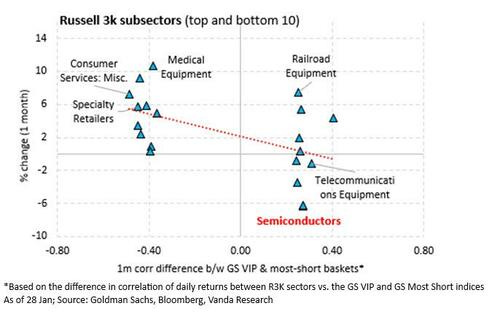

Third, Russell 3K correlations with Goldman Sach’s Hedge Fund VIP and Most Short indices suggest that semiconductor and telecom equipment stocks remained among the more widely held sub-sectors inside hedge funds’ long books. Given these institutions' tight risk limits, the chart below further corroborates the view that selling pressure among semis/tech stemmed entirely from the institutional crowd... with retails buying the dip in record amounts.

This all checks out, especially when accounting for the continuous reluctance from institutions to add leverage since Dec 18th.

More perspective on this:

There was a divergence b/w the two coming out of 2021 as well. However the present divergence is much more pronounced. Caution is warranted.

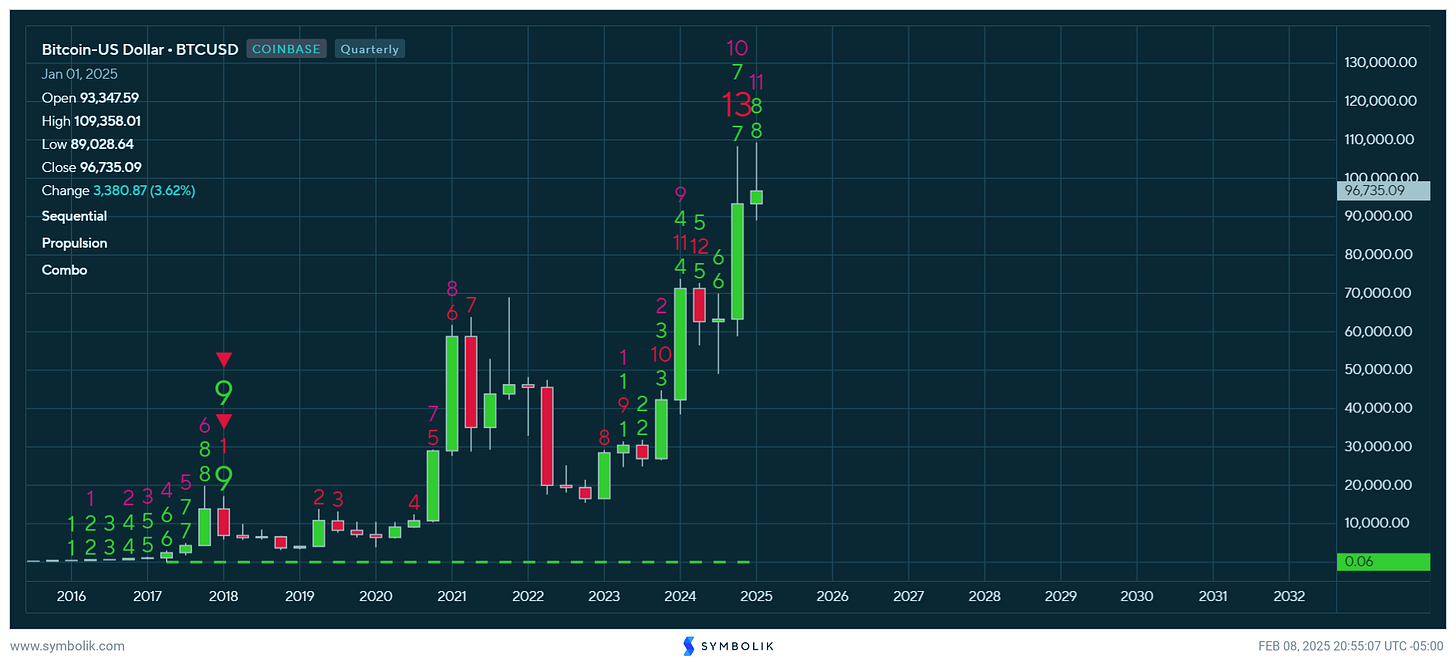

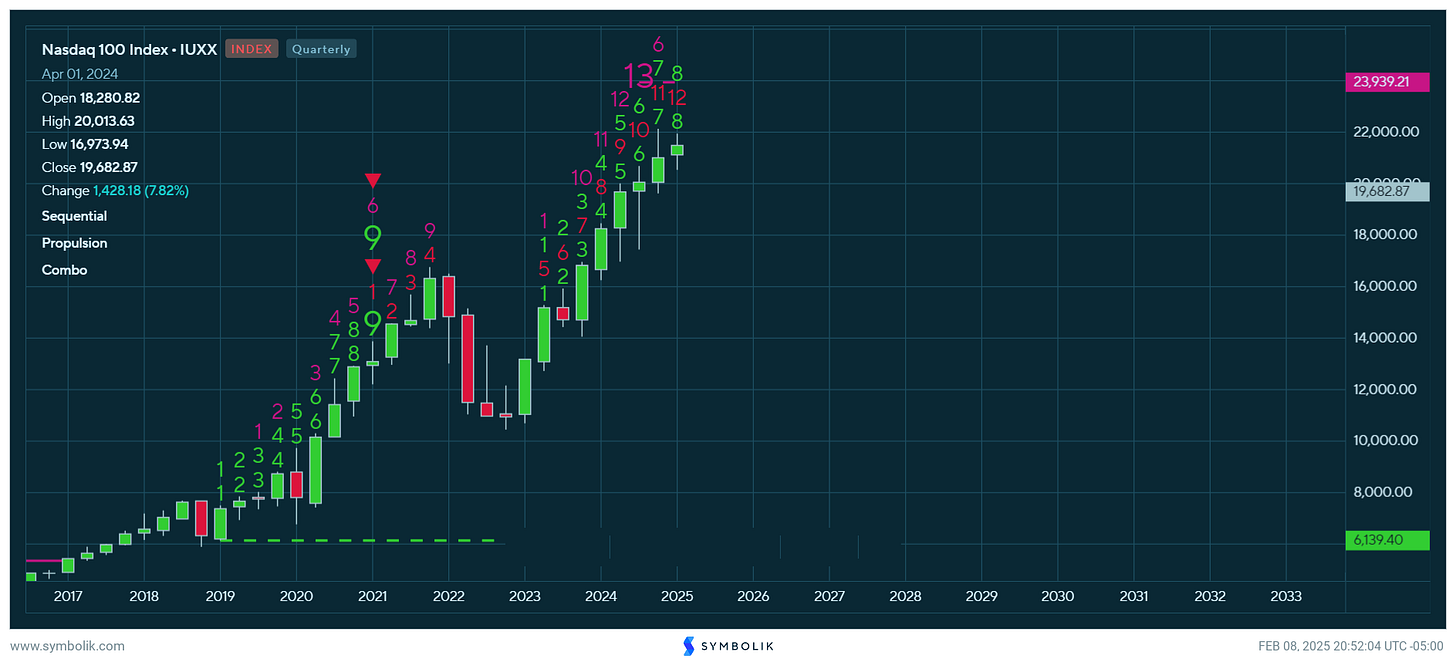

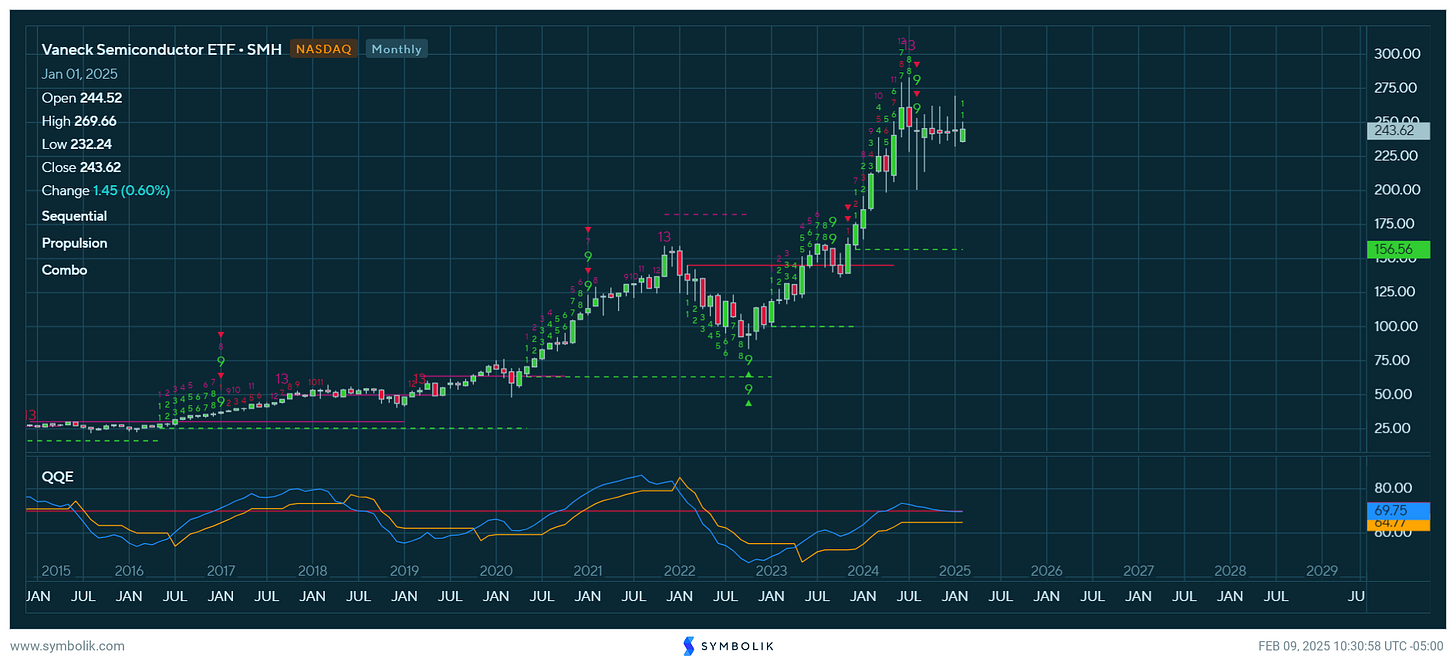

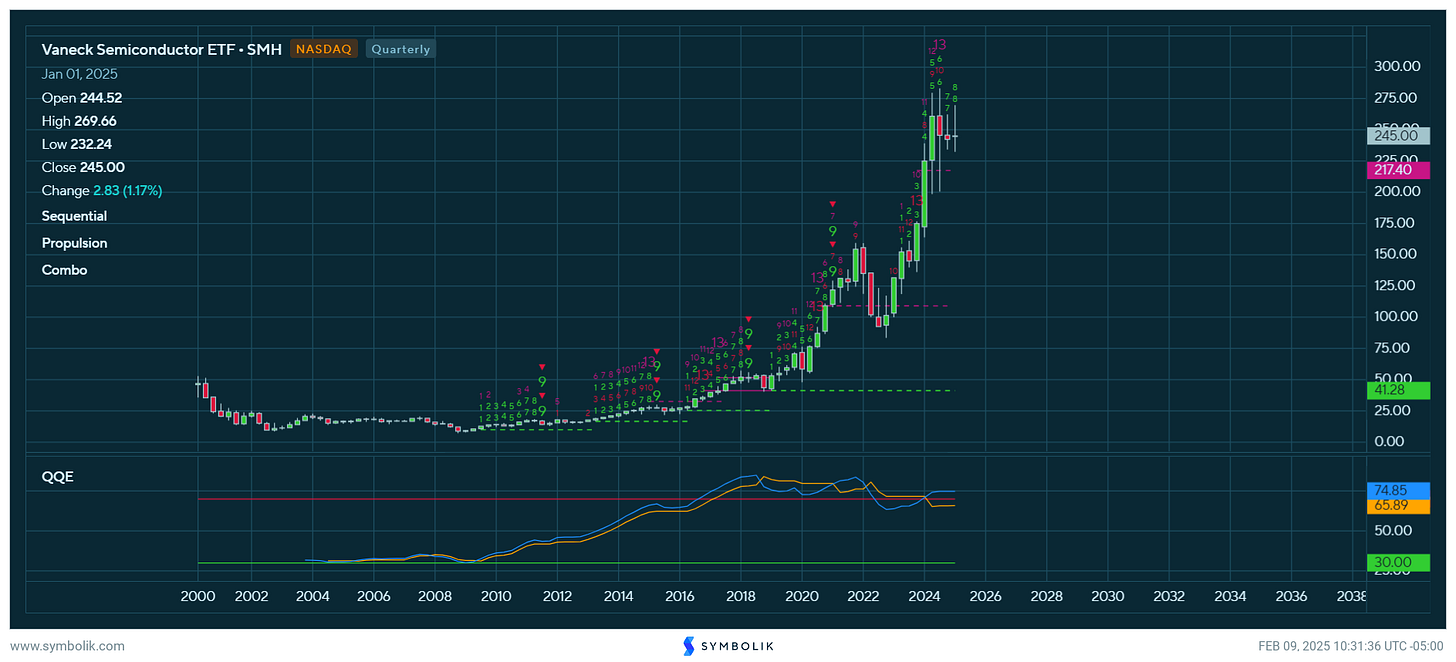

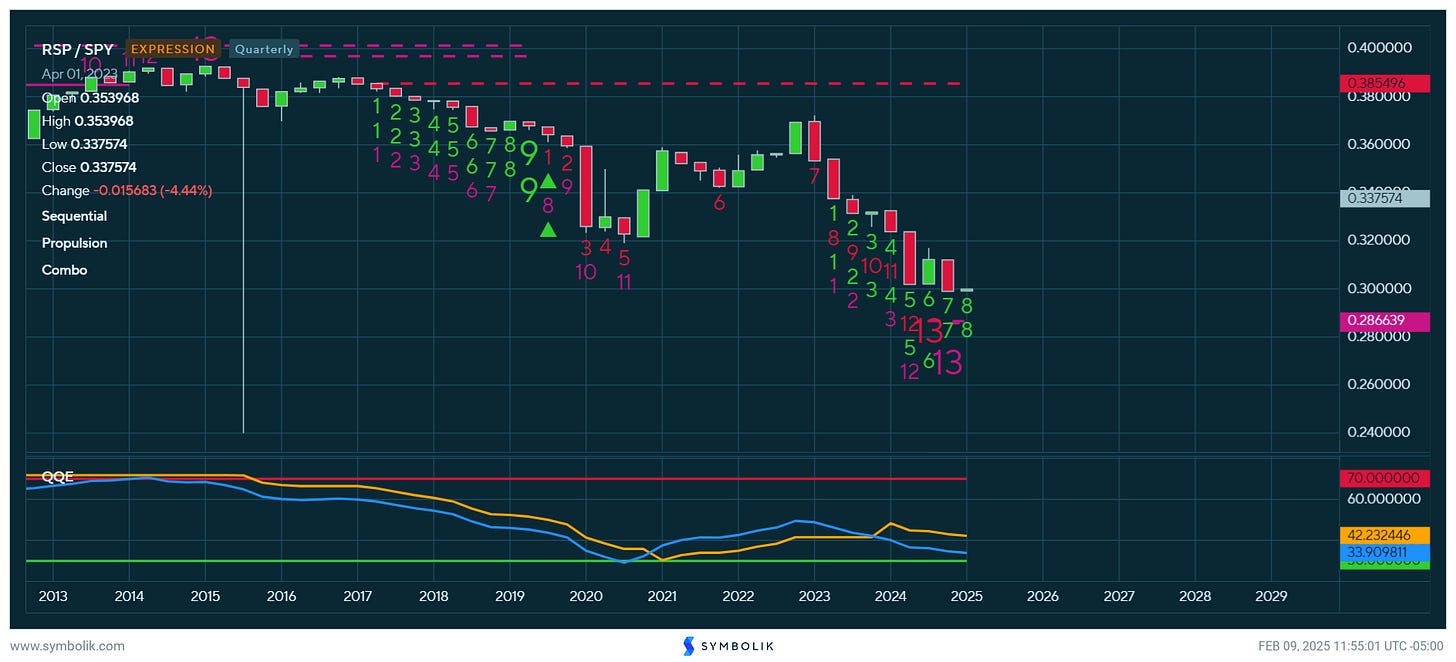

TD Sequential/Combo Fun

Concluding this with some TD fun. These are best used in combination with positioning, sentiment & current macro backdrop.