China: Are the Stars Aligning?

Timing is of the essence.

Sentiment on China is about as negative as it can get. The only way I can see it being any more negative is if the Hang Seng Index (HSI) drops below zero. This isn’t a call to immediately go full port any China Large Cap- ETF (FXI) calls. However, there seems to be an aligning of the stars here, so to speak.

Asia Genesis, which was a fairly successful macro fund, shut down last night after taking a massive loss in a long China, short Japan trade. This is significant because:

A closure of this proportion can likely signal a trend reversal, i.e., a bottom in this instance.

A colossal stimulus package (market rescue package) was considered almost immediately after the closure of the fund was announced — talk about timing.

HSI is presently at a do or die level.

I know, I know. All the mulling that China has done concerning stimulus packages over the past few months has made the thought of them actually implementing the colossal stimulus inconceivable.

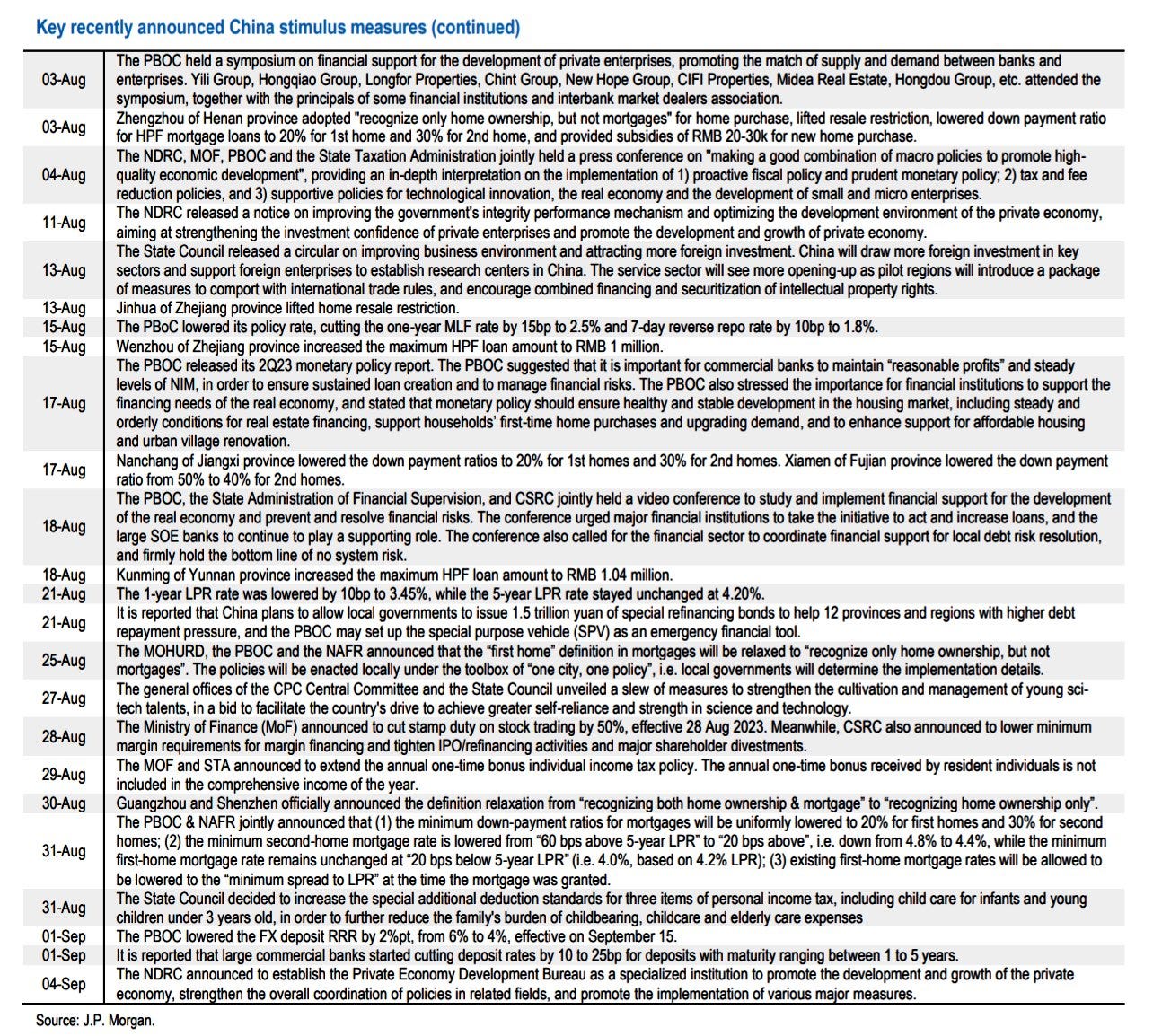

I get it. That stance towards their policymaking is certainly justifiable. But let us not forget that there have been several stimulative policies implemented already.

China hasn’t collapsed like every Western pundit has been forecasting since 1989, and much to my chagrin, evidently much more so recently. In fact, they implemented numerous stimulative measures recently that have unsurprisingly slipped under the radar. —

Let us also not forget that China is strategic & long-termist. Collectivist & keen to learn from history. These are key differences in policymaking that should be noted.

The West’s reopening was accompanied by exceedingly aggressive fiscal & monetary stimulus. So naturally things would appear to be moving smoothly as we reopened. If fiscal & monetary stimulus is a pivotal portion of a DM nation’s reopening process, why wouldn’t it be for China as well?

China will stimulate their economy. They have to. It probably won’t be as aggressive as the West’s stimulus, but it will suffice. This is why I said that they are reopening at a precarious time for the West back in December. Their reopening was always going to be accompanied by stimulus, and there’s probably no better time to stimulate then when the US is approaching the “end” of its hiking cycle. Consequently, commodities will continue their ascent as the 2nd wave of inflation makes its presence felt. —

Lastly, on this note, the stimulus package dropping anytime in the near future would be, in my opinion, impeccably timed since the “transitory” crew is out in droves, rate cut expectations are as high as they’ve been in a while, and inflation in the US looks to have reached a trough.

Here’s where it gets a little more interesting — and sobering. Jumping back to Asia Genesis’ closure. In Chua Soon Hock’s parting note:

I have reached the stage whereby my confidence as a trader is lost. The recent tough trading — October, November, December 2023 followed by a disastrous January 2024 — has proven that my past experience is no longer valid and instead, is working against me. I have lost my knowledge, trading and psychological edge.

I still do not understand the inconsistency of China policy makers not fighting against deflation, leading to the continued loss of market confidence and prolonged bear market.

Chua has done an outstanding job managing money over the course of a few decades. Nonetheless, all it took for him to ultimately decide to close his fund was a disastrous performance over the course of a few weeks. This speaks to not only the key differences in policymaking between China & the US (one is unequivocally more concerned with stock market performance than the other), but also my assertion that only those who remain sagacious & nimble will prevail.

All conditions considered, taking a shot at a long China trade looks more appealing than it has in quite some time. Should this trade materialize, US equities would likely experience a drag as the capital that so speedily & relentlessly rushed out of China and into Japan & US markets decides to park it back home.