Positioning Update | Patience Pays

Hi.

Checking in quickly.

Long end bonds are still getting crushed, oil’s surging, the labor market is starting to soften, and the $ is rising as we reach the 18 month response lag period from this rate hiking cycle.

Positions & Rationale:

Oil:

Still long oil for several aforementioned reasons.

Global oil demand is at record highs in spite of widespread investor pessimism.

SPR release has ended.

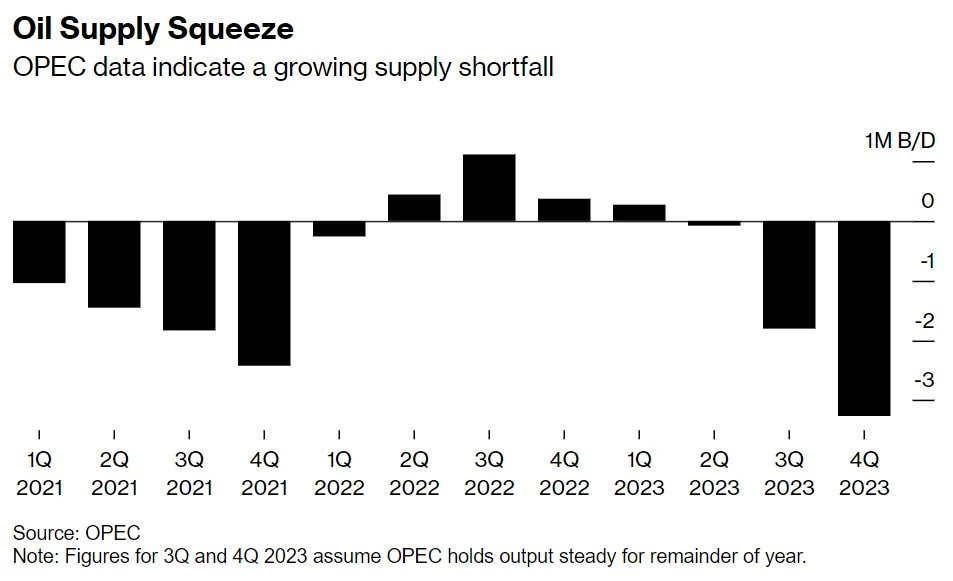

Q3 & Q4 show a substantial supply shortfall and for Q4 specifically — about 3 million b/d. This rivals the biggest deficit in more than a decade while OPEC+ extends its production cuts simultaneously.

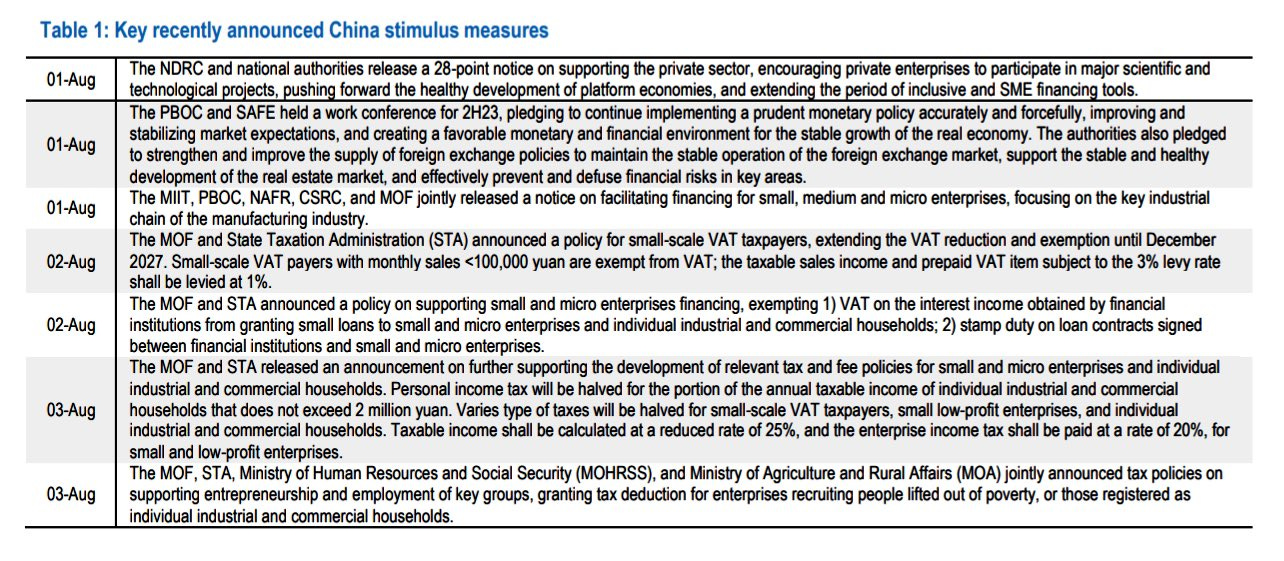

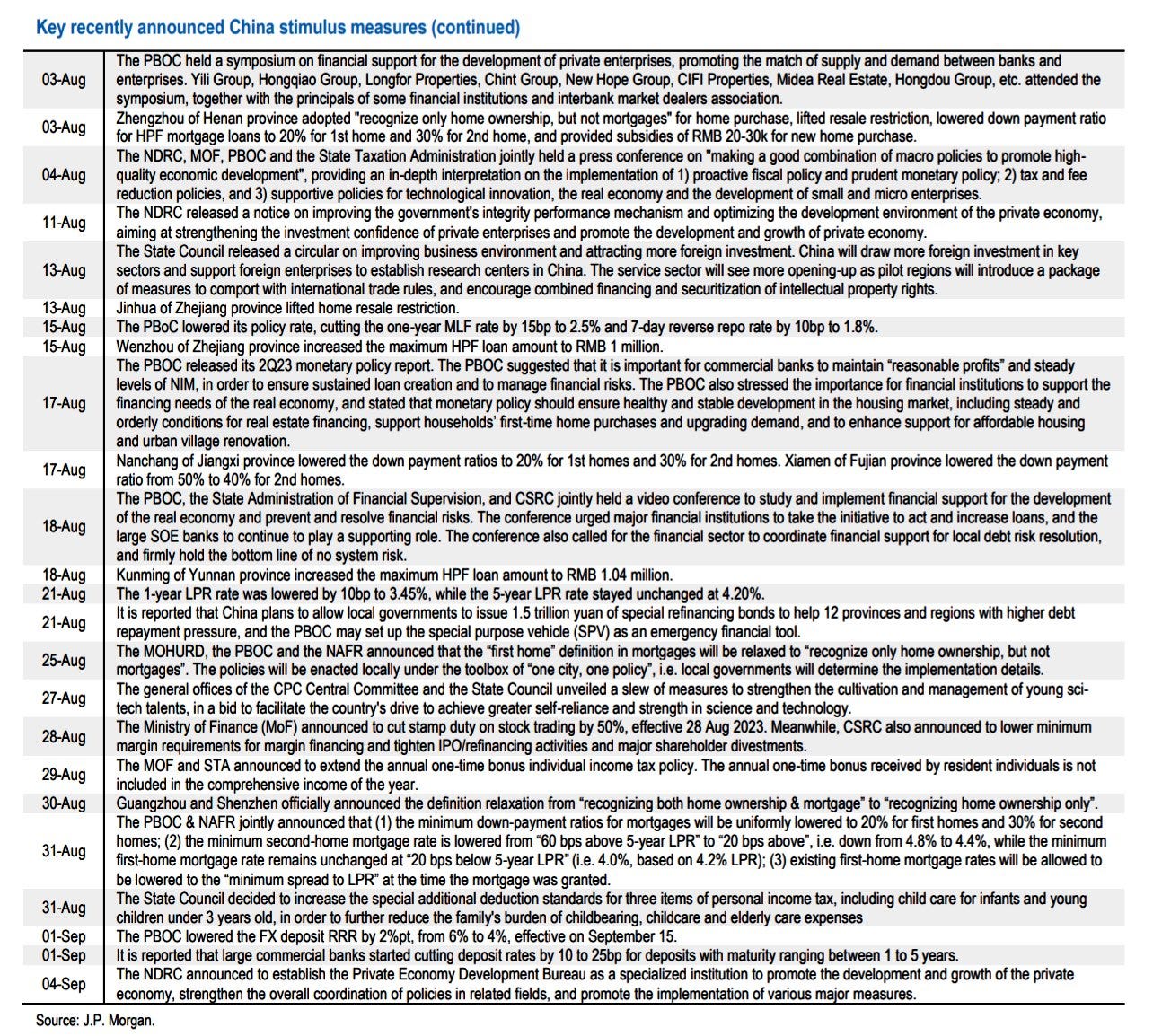

China hasn’t collapsed like every Western pundit has been forecasting since 1989, and much to my chagrin, evidently much more so recently. In fact, they implemented numerous stimulative measures recently that have unsurprisingly slipped under the radar.

This was a key factor for my positioning because China couldn’t collapse while commodities rallied; “The West’s reopening was accompanied by exceedingly aggressive fiscal & monetary stimulus. So naturally things would appear to be moving smoothly as we reopened. If fiscal & monetary stimulus is a pivotal portion of a DM nation’s reopening process, why wouldn’t it be for China as well?

China will stimulate their economy. They have to. It probably won’t be as aggressive as the West’s stimulus, but it will suffice… consequently, commodities will continue their ascent as the 2nd wave of inflation makes its presence felt.” —

Energy is still an exceedingly hated sector.

TLT:

Not much has changed here.

“Positioning in the long end of the curve is implying that inflation — core & headline — will swiftly and safely return to 2%. This is simply not happening. Commodities (oil specifically) are rising swiftly and this will beget higher inflation expectations.” —

Due to the policy errors of ‘20-’21, inflation has become entrenched/sticky.

We’ve entered a new regime in which the old 40yr bond bull market tactics won’t work.

Vol:

Once again, not much has changed here.

Short vol seems compulsory.

Dispersion is high; Mag7 volatility is ultimately obscuring index volatility.

We’re still seeing shades of the late ‘17 vol regime but we presently live in a turbulent world & the YC’s still deeply inverted — which historically precedes black swans. This is an unprecedented combo and the perfect storm.

I simply sleep better at night knowing I have some protection for when things go awry…

SPX:

Combination of bad breadth (as shown by historically low implied correlations), surging oil, ascending $ & rates. “Whenever the dollar is up, interest rates are up, and oil is up, historically that is not good looking forward.” — Stanley Druckenmiller.

I want to skate where the puck is going, not to where it’s already at.

NVDA:

To be completely transparent, I have the least confidence in this trade right now.

Vanna and charm/supportive flows will dissipate after this week, allowing for a window after OpEx to see some substantial downside here.

Positioning is very one-sided coming into a window of vulnerability.

Short tech/long energy.

Positions can change without notice and are not financial advice.