Crossing the Rubicon

Much to look forward to.

It’s been a while. So much has transpired after Liberation Day. I’ve done my best to not become a headline junkie — it’s definitely tempting at times — since then. “TACO” has become increasingly prevalent (to my chagrin), social unrest is growing in the US, Powell’s being scolded (by the President) in front of everyone on a weekly basis, and the Middle Eastern tinderbox has ignited. Oh, and the S&P is hovering around 6,000. Truthfully, that’s the least surprising thing to me. We’re sitting near ATHs with most people waiting for the hard & soft data sets to come into alignment before assuming a defensive position in markets. I’m not really a fan of that approach, especially since we’ve already crossed the Rubicon.

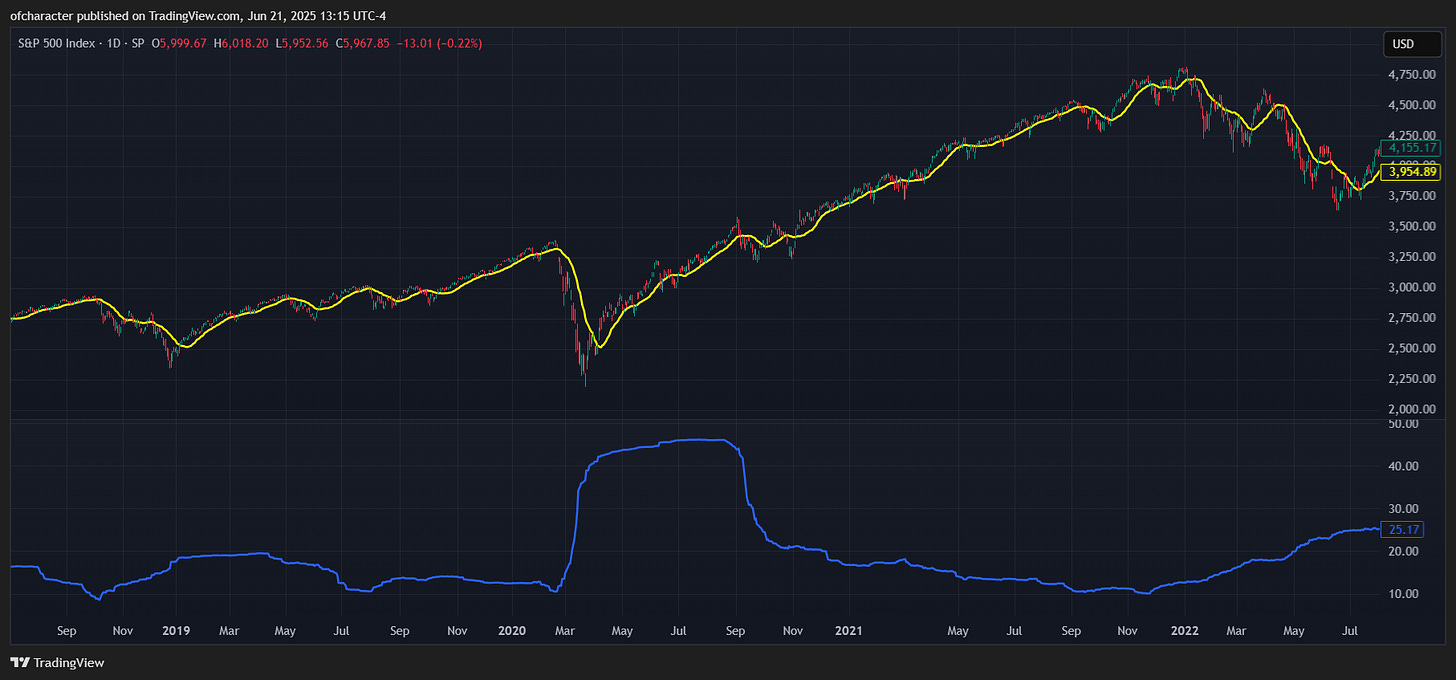

Back in November the market showed signs of exhaustion. It proceeded to undergo a multi-month distribution process which culminated February 19th. The salient detail during this time was that the market did this in spite of countless mentions of tariff implementation. The sell-off from February 19th to April 2nd was largely driven by market imbalances — not macro catalysts. In December, banks and institutions faced balance sheet constraints (limits to the supply of leverage as everyone crowded into the rally) which gave way to leverage constraints shortly thereafter (limits to the demand for leverage via exorbitant funding costs). Implied & realized correlation were near ATLs, and call skew was through the roof. Notably, there was simultaneously substantial demand for protection from institutions — a recipe for a violent sell-off.

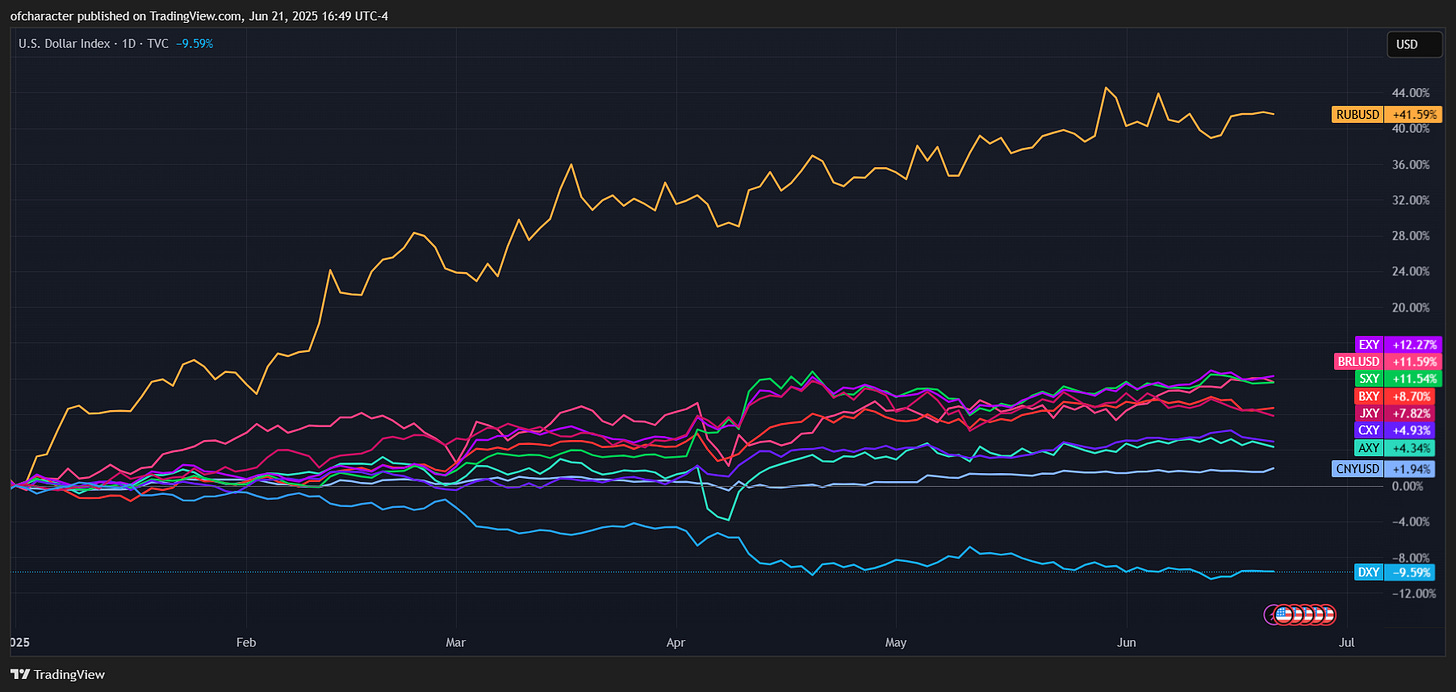

Of course, there were macro drivers as well. Fiscal divergence (being arguably the most important) alongside a structurally overvalued dollar were by no means supportive for markets. Fast forward to Liberation Day, which the majority were evidently incredibly unprepared for given the accompanying VaR shock. That’s another leverage constraint, realized vol was no longer a risk manager’s friend. The end result was a tumultuous period that induced historic moves in the dollar, rates, and equities. Markedly, neither rates (which were going the wrong way in this admin’s eyes) nor the dollar exhibited safe haven-like performances at a time when they were widely expected to. This seems to have forced Trump to initiate a 90-day pause on tariffs. Consequently, Schrodinger’s tariff deals laid the foundation for a breathtaking, volatile rally.

Many deals were guaranteed since then, but unsurprisingly very few have materialized. Tariffs on China are still relatively high. We’ve backtracked on fiscal policy (shocker) — a headwind for US assets, particularly for bonds & the dollar (equities are notoriously late to the party):

“Furthermore, due to the embedded asymmetry in monetary & fiscal policy, the current regime shift will likely bring about an environment where we see dollar down, stocks down, yields up action amidst stagflation, assets that have been systematically starved of capital outperform as the hyper-financialization lever gets turned off, and the shift from fiat to digital currency is ushered in — for what it’s worth, I don’t think Bitcoin solves this ;)”

Most importantly, amid the abundance of headlines, the goal of reducing our trade deficit remains. There will be brief periods where the dollar is bid, but the path of least resistance is downward. It has not yet reclaimed Liberation Day highs despite the violent equity rally. If there was truly meaningful demand for US assets it would have eclipsed them already. Similarly, there will be brief periods where long end bonds are bid, so trading it is more prudent than owning it. Ergo, the path of least resistance for long end bonds is lower.

The RoW is still massively outperforming US equities YTD. Our balance of payments (BoP) vulnerabilities are apparent to all — running persistent and sizeable twin deficits led to a structural vulnerability which is now shifting capital flows. A structural dependency on foreign capital to fund said twin deficits, a deteriorating income balance with rising payments to foreign holders of US assets, and an overreliance on portfolio flows (not foreign direct investment) makes us more sensitive to shifts in global risk sentiment. Lastly, on the macro front there is the increasing probability of further escalation in the Middle East. A stretch of oil/energy outperformance would be unkind to equities, bonds, or the dollar, but it may just be what gives the dollar and bonds a meaningful (and transient) bid.

On the positioning front, due to the aforementioned market imbalances and the leverage constraints which they produced, “real” money hasn’t been as sanguine as others have about US equities. Amidst the earlier distribution process, it was clear that the lack of risk appetite warranted caution at the very least:

“More perspective on this:

There was a divergence b/w the two coming out of 2021 as well. However, the present divergence is much more pronounced. Caution is warranted.”

One would think that after such a material decline that this cohort would be eager to gain exposure, but 1) nothing’s really improved macrowise and 2) they’ve been further disincentivized to do so by volatility.

This sign was largely ignored then and is largely ignored now despite conditions being demonstrably worse, and cross asset volatility is moving higher as this bifurcated market attempts to sort itself out. SPX has gone nowhere for a little over a month now and as of May 19th, SPX skew was reflecting both long-term concern and tactical upside chasing — but all in all, the options market agrees that there have been no substantial improvements.

The list of risks to the disruption of these inherently supportive mechanical moves in indices at the tail end of this rally is lengthy, but without the necessary positioning, downside outcomes are likely capped. Fittingly, we’re currently seeing significant institutional demand for protection which is a key prerequisite for any “crashy” scenario.

Steep skew reflects this strong demand for downside protection. This can lead to a scenario where a subsequent sell-off is exacerbated by dealers since they are increasingly short gamma & short vega if/when spot decreases. As shown in the above charts, this dynamic was present in February as well. VVIX creeping higher with equities at ATHs and a relatively bid front month VX warrant some caution.

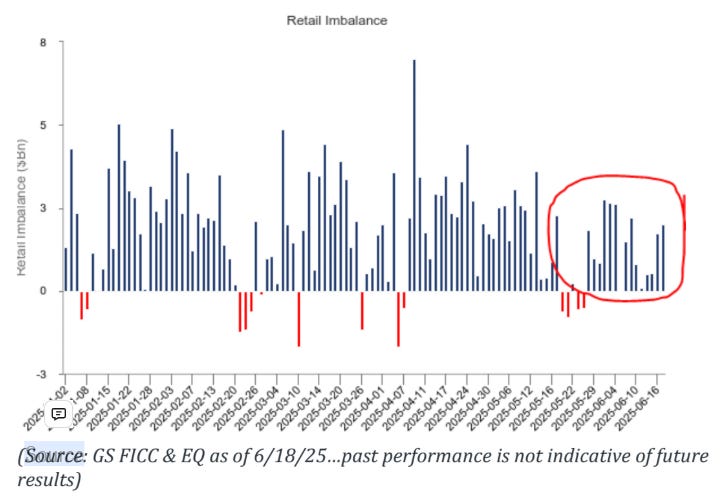

Conversely, an insatiable demand for upside exposure from retail persists despite the relative reluctance of institutions to join the party. Sound familiar?

While there is much more empirical evidence of retail’s fervor, the gist is clear. Lastly, in my view, there are some intriguing signs that longer-dated tenors of realized vol are sending — particularly 6-month. As previously mentioned, 6-month realized vol bottomed last July and served as somewhat of a warning shot via a disruption in the VIX options complex and overstretched long NDX/short RTY positioning. Historically, it increases as equity downside materializes and decreases commensurately after markets find their footing.

The important question for me is now: Is longer-dated realized vol (3m/6m) set to substantially decline? To which my answer in almost every scenario I can think of is a resounding no. Implied vol looks extremely mispriced.

Switching gears, positioning in the dollar looks conducive for a huge short covering rally.

The catalyst needed to trigger said rally may very well be escalation in the Middle East. I don’t say this vindictively, but signs that escalation was on the agenda despite Trump’s election were both glaring and plentiful. The pervasive expectation that he would completely eliminate the possibility of any geopolitical flare-up was evidently uncorroborated. While there is a non-zero chance that the situation de-escalates significantly, it’s not an outcome I’m assigning much probability to at this point — though it’s probably important to note Trump’s strong aversion toward higher oil prices, so further escalation is not ideal for him.

Speaking of which, oil shorts have naturally felt some pain as oil is +20% from its June bottom. It’s difficult to say in absence of updated data how much of that has come off but it’s safe to assume that it’s not a copious amount. Call skew is through the roof lately as an extension of the geopolitical-driven caution, but the consensus fundamental story for oil is still negative. War aside: US crude oil production has clearly plateaued (this situation is exacerbated by unjustifiably low ($60/bbl) oil prices as producers are disincentived to “drill, baby, drill”), rigs are falling, and inventories (globally at multi-year lows) are decreasing alongside them — now roughly 10% below the 5yr seasonal average. Then there is the reality of 1) how cheap oil still is relative to gold, 2) OPEC regaining market share as the US is the largest contributor to non-OPEC supply growth in recent years, and 3) a monumental realignment in pricing power, supply, and demand that’s soon approaching.

Nonetheless, as cliche as it may sound, the fundamentals don’t matter until they do. The oil market has become almost entirely driven by algorithms which have proven rather obstinate in the face of improving fundamentals. Thus, I reiterate —it’s noteworthy that energy was the best performing sector before Liberation Day. Is the ignition of the Middle Eastern tinderbox the event which removes the algorithms from their throne? Maybe, it seems more likely the longer the conflict continues. Regardless of its outcome, lower oil prices aren’t supportive of higher US crude oil production, and energy is a good diversifier considering the current macro backdrop.

As for rates, there is really not much to say. Between the public ridiculing of Powell by Trump & friends for not yet cutting rates, the absence of any significant, long-lasting bid in USTs since Liberation Day, the looming threat of a continued, increasingly widespread foreign exodus from USTs, and the inflation story not being close to finished, there is no scenario in which the long end is safe to own.

2H trading and investment opportunities abound, and the perceived bull is much stronger than the actual bull. We’ve crossed the point of no return — it’s all about capital flows from here on out. Significant regime shifts such as the present one often become self-reinforcing as capital takes time to change hands. Since this process has already begun, there is consequently — contrary to popular belief — an alternative. In fact, there seem to be plenty of them:

Much to look forward to.