Fragility, It's All One Trade pt. 2

Monumental change is afoot.

Last post covered the connection between US growth, AI/semis, and the yen carry trade. This will briefly cover the most significant carry trade there is, the USD carry trade.

The US has long since run a large trade deficit to supply the world with dollars in order to maintain world reserve currency status. Foreigners (CBs, SWFs, etc) hold an ample amount of USD-denominated assets (stocks, bonds, credit), which reinforces demand for the dollar. Not only does the dollar consistently strengthen versus foreigners local currencies (a profit for them), but our stocks also perform well (more profit for them).

Now, envisage a world in which the US decides to stop running trade deficits, implement fiscal austerity, and prioritize short-term pain for long-term gain while other nations go into fiscal expansion. This is already happening and it creates a picture where a US-specific negative shock incentivizes foreign investors to diversify away from USD-denominated assets.

In a previous note, I suggested that because of crowded positioning and no real catalyst to bolster the dollar much further, it likely had a date with gravity.

King $

Coming into the election, it was clear that the $ was on a path to rise substantially. I flagged the short-skewed positioning here back in mid-October when DXY was 102. Positioning slowly but surely went from net-short to a crowded long when DXY was in the 106s. At 108, with positioning still crowded and no real catalyst (that I can see) to bolster the $ much further, it likely has a date with gravity.

The dollar has since retreated materially, but in eye-popping, nontraditional fashion, so have stocks. It is this action which has garnered the attention of many, and rightfully so.

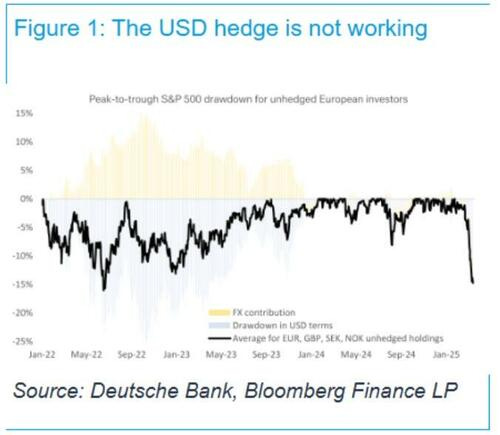

Per Deutsche Bank: “European investors are currently losing as much money on their S&P 500 holdings as they did during the ~30% inflation-driven sell-off in 2022 (Figure 1).”

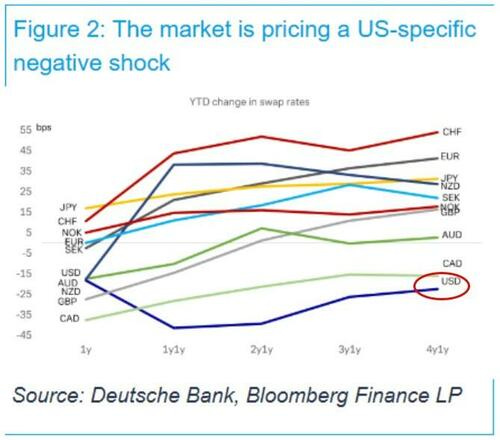

Per Deutsche Bank, again: “It is the idiosyncratic downward repricing of US fiscal, growth, and Fed expectations (Figure 2) that is causing the dollar to weaken alongside US equities.”

To elaborate, bear in mind:

The difference in fiscal policies (and AI competition) — Europe and China are in fiscal expansion while the US attempts fiscal austerity. I know it’s only Q1, but compare market performances, the message is clear.

Peak in semis (SOX,SMH) last year alluding to a peak and cyclical downturn in US growth.

Central bank policy differences are self explanatory.

Unhedged FX investors banking on the dollar to offset losses as the dollar typically strengthens in risk-off scenarios have seen losses compound substantially.

These factors incentivize foreigners to sell USD-denominated assets and either rotate capital elsewhere or repatriate, which can serve to exacerbate dollar down, stocks down action. To go a bit more in-depth, since early March there has been dollar down, stocks down, yields up action — a sign of more aggressive foreign capital rotation. This is arguably the most important dynamic to watch this year. Monumental change is afoot.

Visuals always help.

A Perfect Storm

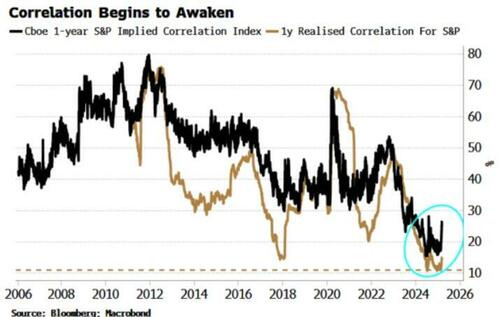

Per Simon White of BBG: “Rapid outflows are always a risk factor for a market, but in the US it’s happening when valuations are still near all-time highs, and volatility and index correlation threaten to exacerbate the downturn. The VIX has been rising but has remained surprisingly contained given the fall in prices. Disquietingly, index correlation has also been rising off virtual all-time lows.”

Sums things up perfectly. Correlation has stayed on my mind for a while now.

Speaking of which, ahead of Feb VIXperation, I found myself referring to the July/Aug episode almost non-stop. Implied correlation was flirting with 0 again as positioning became increasingly stretched into a period of seasonal weakness. Most notably, distribution had been transpiring for months. This is the biggest difference between the two periods. Now it’s time to put the pieces of the puzzle together.

Which reminds me, some dispersion bros have felt some pain lately:

Multistrategy hedge funds, long considered havens of consistent returns, are facing their biggest challenge since the early days of the pandemic. A fierce market selloff, fueled by President Trump’s trade war and persistent inflation, has forced major players like Citadel and Millennium Management to unwind crowded trades at an alarming pace. These so-called pod shops, which parcel out billions across multiple teams, are seeing several of those teams stopped out, underscoring the inherent vulnerabilities of their highly leveraged strategies.

Change

I still don’t believe that multi-month distribution has transpired only to quickly surge back through ATHs. There will be counter-trend rallies, but until further notice, they should be tactfully sold — Pavlov’s crew will need to adjust. Lastly, change is good — even if painful. Don’t resist it, embrace it.