Post-Election Thoughts

With the election now in the rear-view mirror, I can confidently say that the result didn’t surprise me.

Jumping right into this with some key points:

The long-end has, contrary to popular belief, already affected equities.

A red wave isn’t enough to stop the business cycle from transpiring.

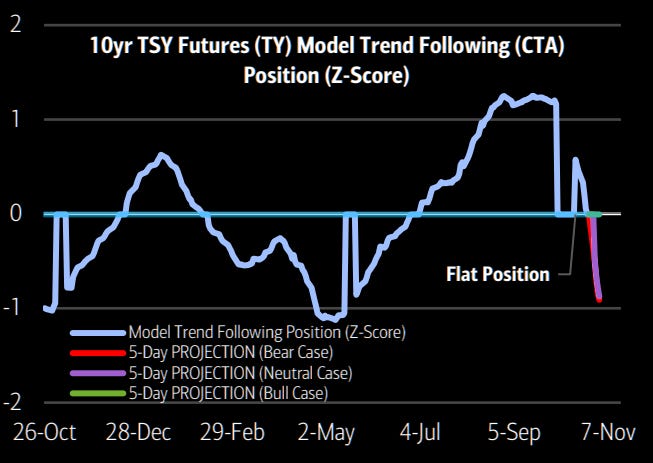

Positioning is everything, and even more so at inflection points.

With the election now in the rear-view mirror, I can confidently say that the result didn’t surprise me. From July, just before Biden’s withdrawal from the race:

After the failed assassination attempt on Trump — which was nothing short of a miracle —, Biden’s departure before the end of this month is even more likely than before. A red wave is to be expected as well.

What did surprise me is how smoothly the election went. Who knows, maybe I’m speaking too soon. Either way, the market had been pricing in a decisive win for Trump for quite some time, and assets have made some very interesting moves post-election.

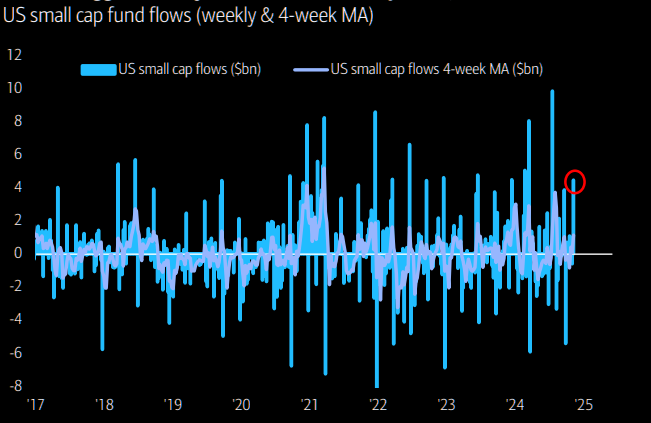

The long-end sold-off viciously, small caps absolutely soared, large caps rallied, and financials and energy surged higher coming directly off of a red wave. There’s been so much chatter about how equities are almost incessantly ignoring rising rates, but I beg to differ. Equities have trudged forward, essentially going nowhere for a month and some change. It took the best post-election day performance to get indices (NDX/SPX)…slightly above July highs. So, the 10y rising may have not produced any material downside yet, but it clearly has kept a lid on momentum.

Arguably the best comments pertaining to rates came from the one and only, Jerome Powell at FOMC:

“We’ve watched the run up in bond rates and it’s nowhere near where it was a year ago.”

Narrator: The 10y was quite literally 10bps from where it was at the same time last year.

“We don’t know if recent increase in long-term rates will last.”

Well, what do you know?

“Even with today’s cut, policy is still restrictive.”

Narrator: The lie detector determined that that was a lie.

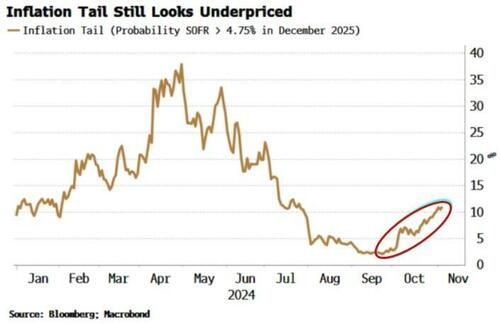

There’s no ambiguity here. The Fed is decidedly saying “there is no inflation tail whatsoever.” Or maybe they did indirectly acknowledge the possibility of it when JPow mentioned that both core inflation & geopolitical risks are elevated. I’ll come back to that later.

Late Cycle

Amidst all of the euphoria, I remember that 1) Trump winning is objectively positive for this nation (& world), and 2) he is not God. Therefore, he is incapable of doing some of the things that his overzealous supporters expect him to do — namely, immediately bringing peace to the globe in a period marked by heightened geopolitical tensions. He is also unfortunately inheriting an economy in the late stage of an unprecedented business cycle. The next few years will unequivocally be difficult.

Nonetheless, none of this should read as “the world is literally ending, it’s over.” Not a soul on this planet is qualified to tell you when that would happen, and I’ve made myself as clear as I possibly can be several times over on this matter — the rough times do not truly begin until we’ve seen a substantial resteepening in the yield curve. That being said, YC check:

This has been a mean bear steepening.

Positioning at Inflection Points

I’ve made several changes to my positioning since mid-October. Namely (none of these positions have/had a delta of less than 30 upon entry):

Closed all of the Nov VIX call spreads by 11/4. The underlying was above the short call so there was really no need to hold this longer since I’d entered this on 9/26 with VIX in the 15s.

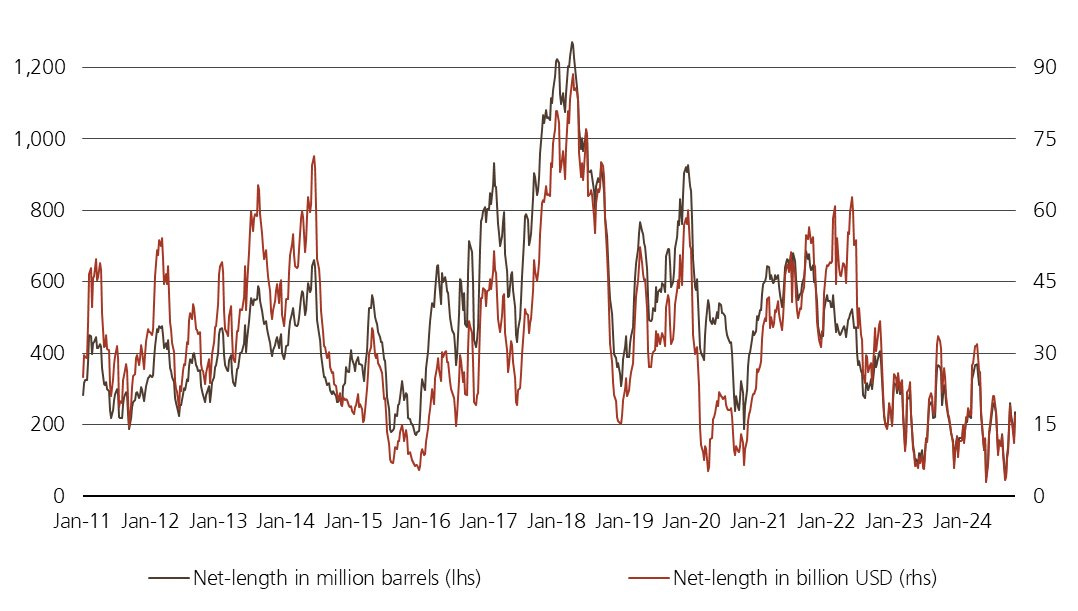

Been in and out of CL longs since original entry on 9/12. Most recent long entry on 10/28 with CL in the 67s via March CL call spreads. The huge surge in IV during the rally from the 9/10 lows to early Oct was a sneak peek into what’s coming sooner than later. Initially cut the XLE/energy long (@ 92) for a loss and re-entered on 10/28 in the 88 —also via March call spreads. Fundamentals have remained solid here, but it’s important to be cognizant of entering negative seasonality as well.

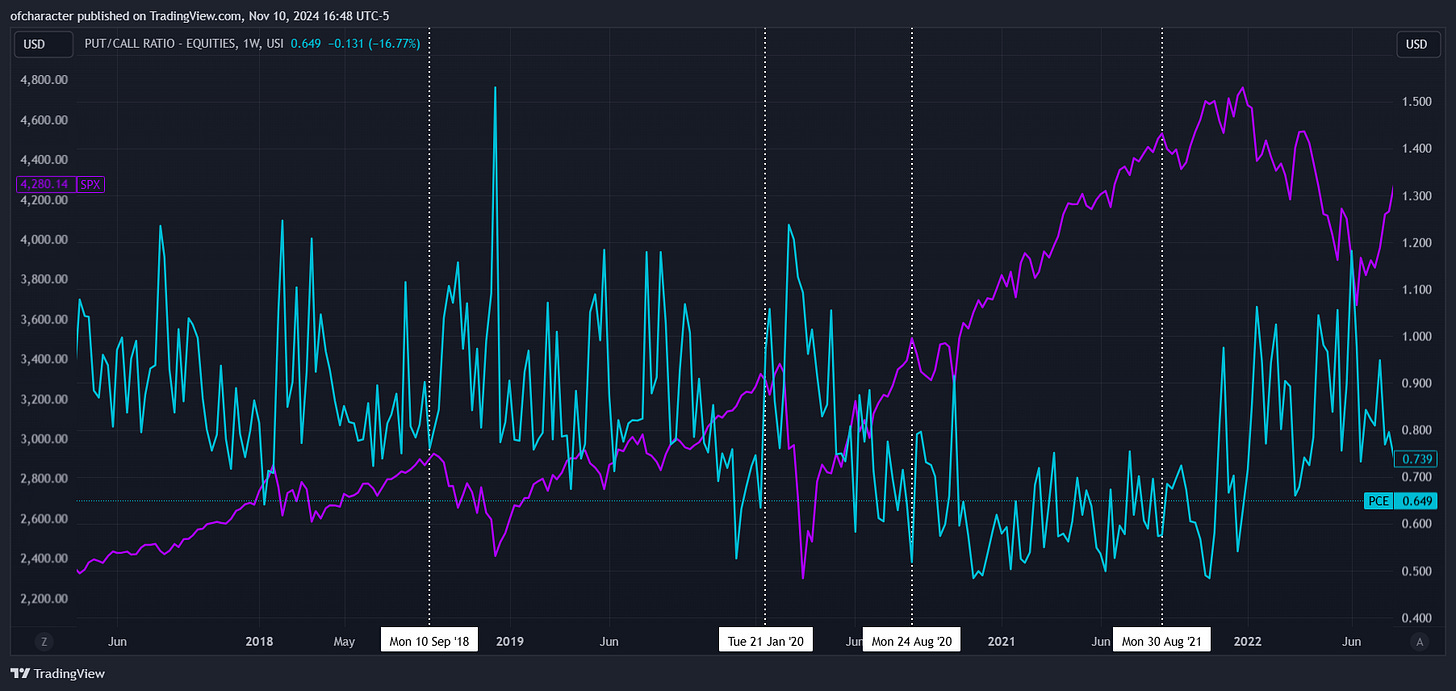

Entered Feb QQQ put spreads on 10/23 and closed 50% of them by the eod. Trimmed 75% of this by the close on 11/1 and left the rest on into election day and took a loss on the last bit of them after that historic post-election trading day. Got modestly short via March SPX put spreads on 11/8 since upside vol is still vol, I can’t remember a post-election VIX crush of this proportion, and SKEW’s still falling (more on this later). This is, of course, still a rental and I expect to take some pain.

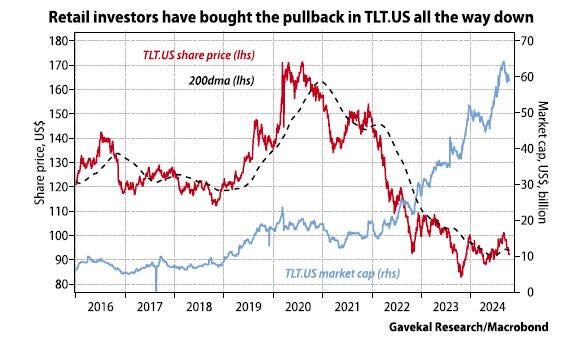

Grabbed some Jan TLT put spreads on 10/1 & 10/16 and closed 50% of them by 11/1 (NFP). 75% of these were sold by the close on 11/6, and I’m leaving the rest on for the foreseeable future. Will likely add to this if long-end rates continue rising.

Added modest upside exposure to China again, slightly ahead of schedule on 11/5 via March FXI call spreads. Recent stimulus announcements have disappointed the public so I wouldn’t be surprised to see China sell-off in the near-term.

Looking for an entry in PMs.

The main theme here — which is the return of the wrecking ball — remains the same in spite of recent post-election developments.

An Asymmetric Fed Provides Asymmetric Payouts

Positioning in each component of the wrecking ball suggests that there is zero concern for upside inflation risks while a global cutting cycle (most cuts since Mar’ 20) is underway, and the Middle East is a tinderbox that’s about to ignite very soon — this was the first time since 1973 that Israel was involved in an active war on Yom Kippur.

There are several ways to take advantage of this setup:

Long oil, energy, and vol. This is my current positioning. (CL 67s, XLE 92s, spot VIX 15s). Notably, USO roll ends on Monday and this “unusually high” VIX is indicative of stress inside the vol realm.

The long-end is a rental. Trade it tactically while being mindful of surprising econ data. This becomes a major short when the Middle Eastern tinderbox ignites — 10y could be at 5% by year-end in a flash.

Short equities. This is also a rental but subject to change. I planned to be short via QQQ put spreads last week, but after watching my open positions do so well, I decided to be more patient. Realized vol is low as indices have been stuck in mud over the past month. Things have seemed nasty underneath the hood and VIXpiration this week could mark a turning point.

Long China. No need to rush to add/gain exposure here. Post-election is an ideal time to do either of those. China will continue to gradually reveal and implement stimulative measures, but they won’t be able to meet majority of US investors’ expectations given that they have permanent QE brain.

https://www.pierreaddo.com/p/watch-out-for-the-wrecking-ball-pt

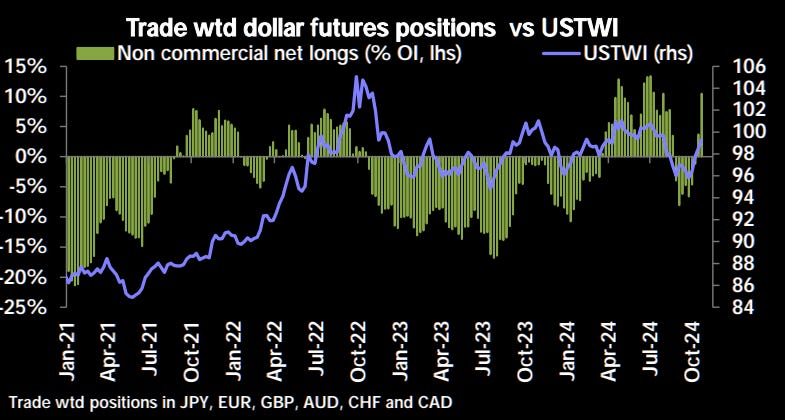

Since the last wrecking ball update, positioning in two of its components has changed substantially. For starters, the USD has seen a notable increase in longs.

And lastly, but certainly not least, net positioning on Brent & WTI futures & options per staunovo:

Positioning in rates & the USD has changed significantly since mid-October while crude’s has barely changed. In spite of that, volatility in this space has been high. There is a lot to say about this volatility.

Notably, headline risk here is huge — always has been. This is unsurprising, but the rate at which this has occurred since September was amusing. From KSA apparently abandoning its $100 crude target that they never actually had, to the Saudi oil minister purportedly saying prices may fall to $50/bbl if others cheat (which OPEC swiftly refuted and deemed wholly inaccurate and misleading), to Israel apparently leaking plans to the US about its strike on Iran’s military infrastructure, headline risk has been no stranger to crude.

The best (worst) part about all of this is that price immediately retreats fast & hard upon these headlines, allowing you (if you’re tethered to reality) to enter at more favorable prices. However, it also adds superfluous volatility which serves to push others away from the sector and shape uncorroborated consensus opinions. For example, I’ve watched consensus pertaining to the Middle East evolve from “Iran won’t do anything to garner a response from Israel” to “Israel won’t respond before elections” to “See, no nuclear or oil facilities were targeted, just the air defenses which guard them. It’s over.” Think it’s very clear that this is far from over.

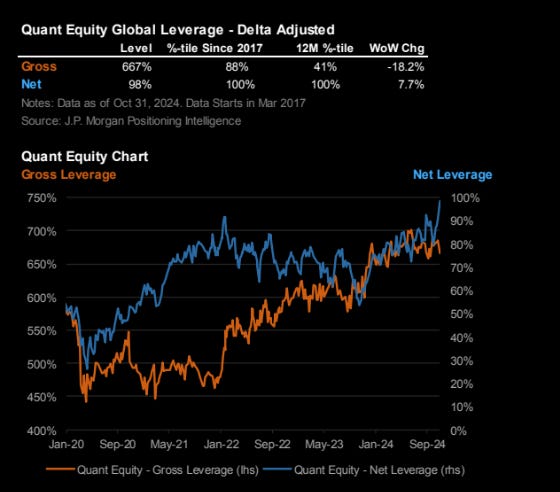

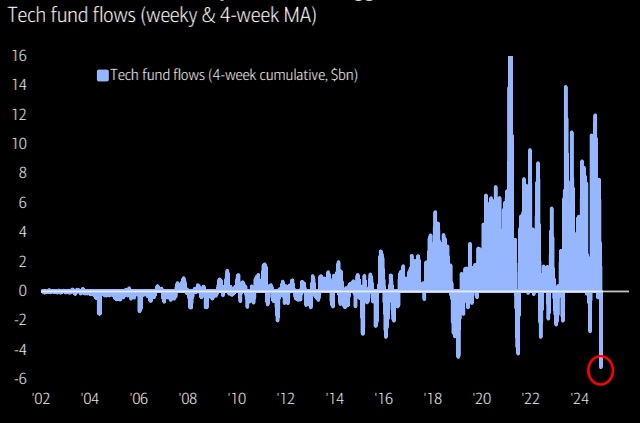

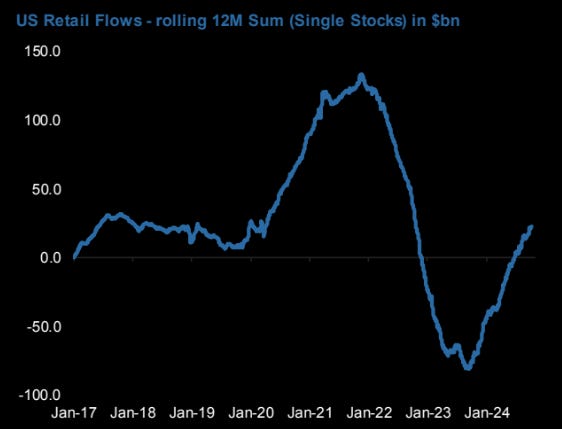

Non-wrecking ball positioning is indicative of equities nearing an inflection point.

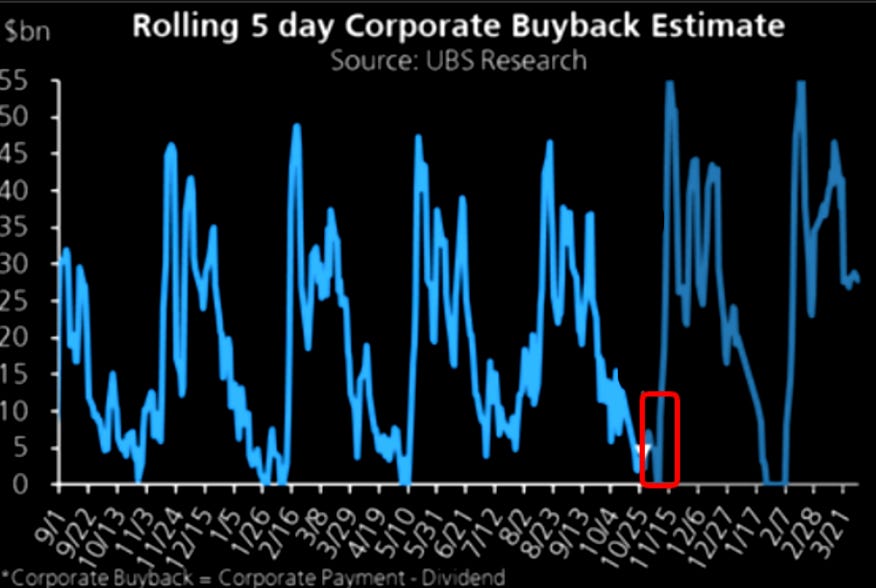

On the flip side, buybacks are set to start rolling in through year-end, seasonality is positive, & the chase is on should volatility cooperate and fall.

As far as favorable seasonality goes, I’m not really confident that it will be so for November. After all, this was not the case this year for April, or July. And September and October didn’t follow seasonality either. It may seem crazy to be short equities in any form right now, but aside from counter-seasonal performance & positioning, SKEW & PCE falling (ofc it can go lower) makes it feel prudent to hedge.