Summer Madness

Fun times ahead.

“My brethren, count it all joy when you fall into various trials, knowing that the testing of your faith produces patience. But let patience have its perfect work, that you may be perfect and complete, lacking nothing. If any of you lacks wisdom, let him ask of God, who gives to all liberally and without reproach, and it will be given to him. But let him ask in faith, with no doubting, for he who doubts is like a wave of the sea driven and tossed by the wind. For let not that man suppose that he will receive anything from the Lord; he is a double-minded man, unstable in all his ways.” — James 1:2-8

It was an eventful week to say the least. I previously mentioned that I entered a starter position in CL as I was slowly building a long oil position ahead of the OPEC+ meeting on June 2nd.

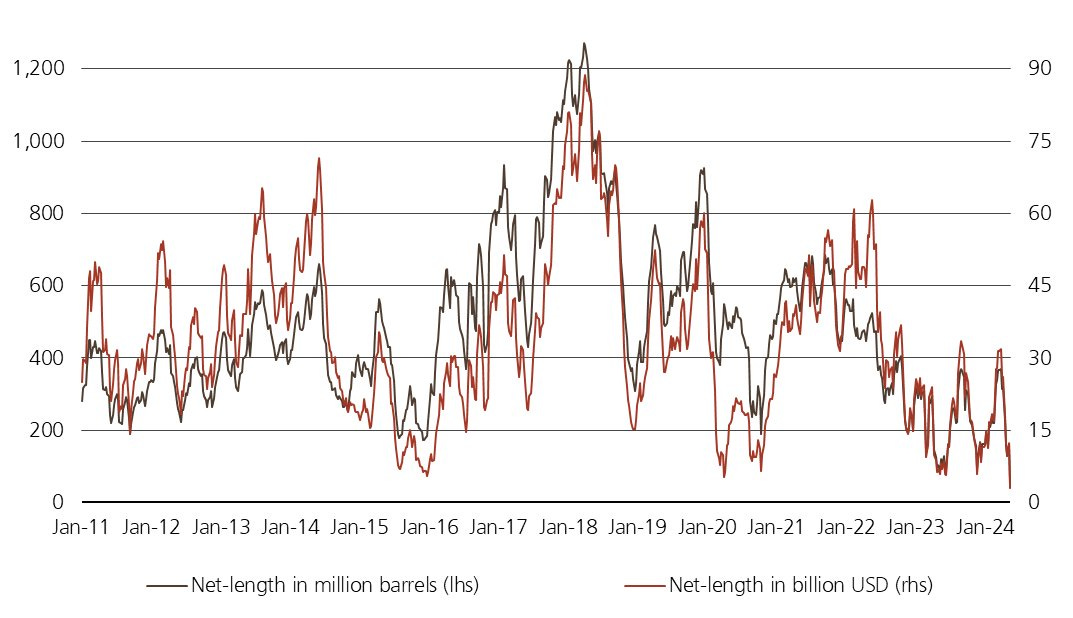

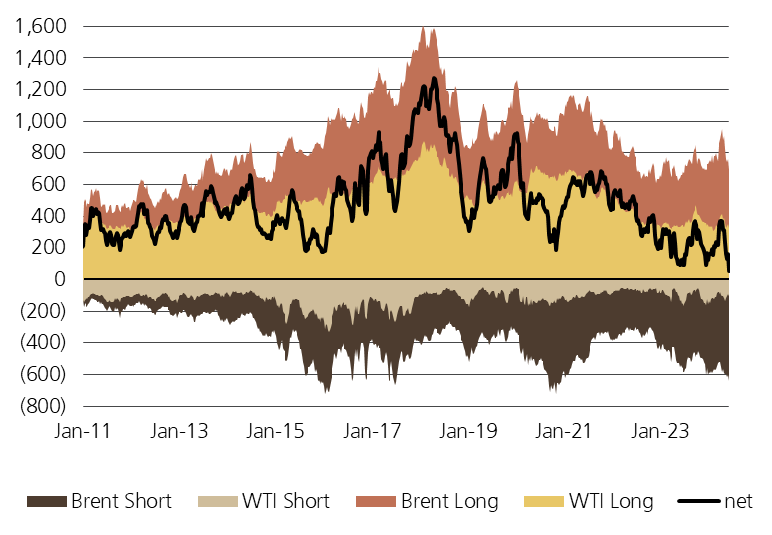

I finished building this position earlier this week (Sept/Oct expiry) and have sized as aggressively as I did last time. Below is net positioning on both Brent & WTI. Notice anything?

Net length in oil is even lower than it was in March/April 2020. Now couple this with the record inflow into commodities in April ‘24 that was highlighted in my “Bells are Ringing at the Top” post. This makes the next few months seem like it will be interesting, right?

Upon recognizing this disparity between fundamentals, positioning, and geopolitical tensions, I was left scratching my head a bit. Although I was aware that the OPEC+ meeting would be digested asymmetrically, admittedly, I was not aware that it would be seen as something worthy of the sixth largest weekly drop in non-commercial accounts since 2011. Consequently, it’s safe to say that oil has bottomed out here for the foreseeable future.

The closer I look at this situation, the more interesting it becomes. Remember the 10y (the long end specifically) and it’s correlation with oil that was highlighted in the aforementioned post above? Well, feast your eyes on this:

We now have a golden cross on the monthly timeframe for WTI. This comes relatively shortly after the golden cross on the monthly timeframe for the 10y. Barring any exogenous events, it’s highly probable that the 10y will trade north of 5% this year — obviously not in a straight line. Once again, this is a monumental regime change that I believe many are incognizant of and consequently unprepared for, which is why I added some Sept TLT put spreads a few days ago (it was overextended to the upside as well).

For clarification, the primary justification for this belief is not technical. It’s a confluence of techincals, fundamentals, & positioning. The Fed claiming to be serious about taking inflation to 2% while simultaneously tapering QT after 3 consecutive hot inflation prints really tells you all you need to know about owning the long end. If you trade it — e.g., for a countertrend rally — that’s perfectly fine. But ultimately, fiscal profligacy, monetary policy neglect (s/o to Edward Nelson), & a reluctance to accept the end of a 40yr bond bull market make the case for higher long end bond yields. Barring any serious exogenous event, the long end is going higher for the foreseeable future.

The Wrecking Ball

Now that I’ve already covered 2/3 of the components of the wrecking ball, it’s time to take a quick look at the last one.

To be quite honest, I’m torn here. I’m not as confident that the USD will play ball. We’ve got a few bills auctions on Monday, a 10yr auction on Tuesday, CPI & FOMC on Wednesday, a 30yr auction, PPI & jobless claims on Thursday, and a relatively calm Friday. So, whether it will or not will be heavily dependent on how this next week resolves.

A Swing and a Miss, but Wait…

After tweeting and calling for a bounce in equities on April 17th, I attempted to short equities again mid May on the basis of a weak breadth, exceedingly low volume rally ahead of CPI. That clearly did not work well and not only was I out of the position quickly, but also saw equities make new ATHs — a swing and a miss on the highs of the year call.

But wait, are we really out of the woods now? I still don’t believe so. I’m going to re-introduce almost the entirety of the last post because it’s that important.

Transports

While re-reading one of my favorite books from Harry D Schultz — Bear Market Investing Strategies — I stumbled upon some pertinent information.

“Dow Theory was seen as a bellwether indicator of economic direction, rather than a stock market predictor. But, over the 100 plus years it has been in existence, it has forecast most major bull and bear markets…Dow Theory holds that whenever the DJIA moves to a new rally high (or low), the Dow Jones transportation average must do the same (thus “confirming the move”) shortly thereafter, or else the move is false and cannot long be sustained and a reversal will follow.”

Below I have marked periods where transports topped while the indices rallied higher — SPX specifically in these images (the same is true with the Dow as well).

And, drumroll please…

You are seeing this correctly. Transports have not made a new high since November 2021. This is the longest this divergence has held.

They can do one of two things here:

Catch up.

Signal a substantial decline.

I believe that they will choose the latter.

Transports to the broader market:

Dow Theory isn’t new & has a verifiable track record. However, with so many traders concerned with missing out on upside, it’s certainly trivialized & overlooked. This isn’t atypical behavior. It’s as Ecclesiastes 1:9 says “That which has been is what will be, that which is done is what will be done, and there is nothing new under the sun.”

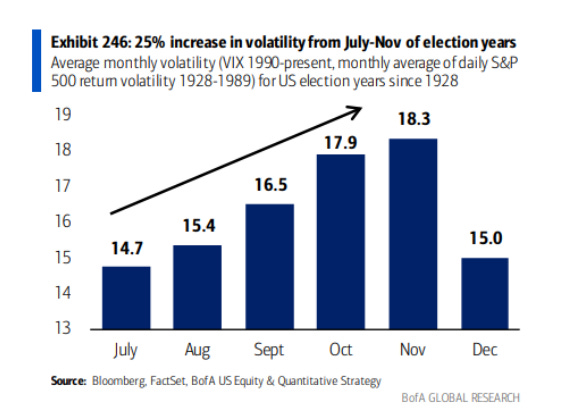

While most expect a summer with muted cross-asset volatility, and a “crash-up” scenario for equities (as if we didn’t already get that lol), I believe they will be in for an unpleasant surprise. I still have no position in equities, but admittedly, I am tempted to grab some cheap put spreads several months out soon.

To add perspective, this is really what that cohort is betting stays muted/goes lower throughout the summer:

Honorable mention: FX vol. To top this off, let us not forget that we’re in an election year.

To the cohort expecting a boring summer, good luck to you. I mean that sincerely given current conditions. Lastly, reiterating the pertinent message from April: cash is not trash!

Until next time,

Pierre.