Summer Madness pt. 2

Buying the quiet; selling the riot.

“For God has not given us a spirit of fear, but of power and of love and of a sound mind.” — 2 Timothy 1:7

Positioning is still the same as stated here — once again, cash is not trash.

CNBC seems to vehemently disagree, nonetheless.

Tomorrow is officially the first day of summer. In spirit of the incoming “Summer Madness,” I believe it’s appropriate to reiterate my view coming into this year:

I see a remarkable mix of “there is nothing new under the sun,” and “we’re in uncharted territory” in this cycle that creates generational fat pitches to swing at. Just have to let the others fly by first. Always easier said than done. Always worth it.

Continue to expect the unexpected! —

Echoing the latter portion of this, history has been made recently.

Another one:

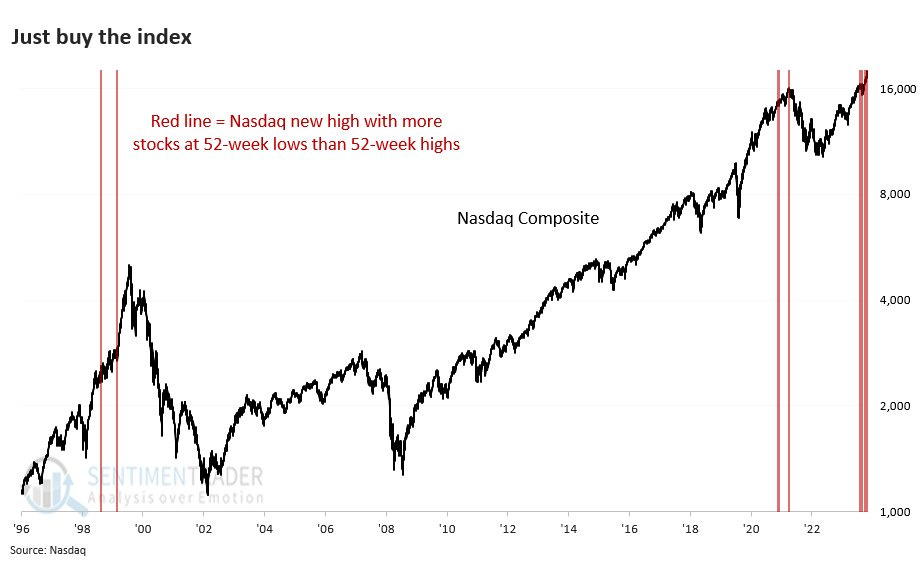

“Here is every time in the past ~30 years the Nasdaq closed at a 3-year high for 7 days in a row. It also shows the number of days there were more stocks at new highs than lows during the streak. Notice anything different about this time? 12/03/96...7 07/11/97...7 07/16/98...7 01/11/99...7 11/08/99...7 12/27/99...7 02/23/15...7 02/15/17...7 12/20/19...7 11/05/21...7 06/18/24...1” — @jasongeopfert

And lastly, but certainly not least:

“Where were the signs?”

This is all fine and dandy, right? After all, it’s an election year and Jerome and Yellen have everything under control. I still share the view that this belief of and in the “almighty JPow & Yellen” duo is dangerous. Why? Because if that was true, the bond market wouldn’t have performed so poorly since 2020. Equities are always late to the party.

I’m sure that if you ask anybody who is still long and strong this market with no stops set, they’d tell you that none of the above is relevant in any way whatsoever. “Markets can’t go down ever” — as if April never happened — and “it’s an election year, they won’t let anything happen” are some of the most common statements this crew loves to make. Such confidence is often misplaced. Hedging is awfully cheap presently and as a general rule, you should always hedge when you can, not when you have to.

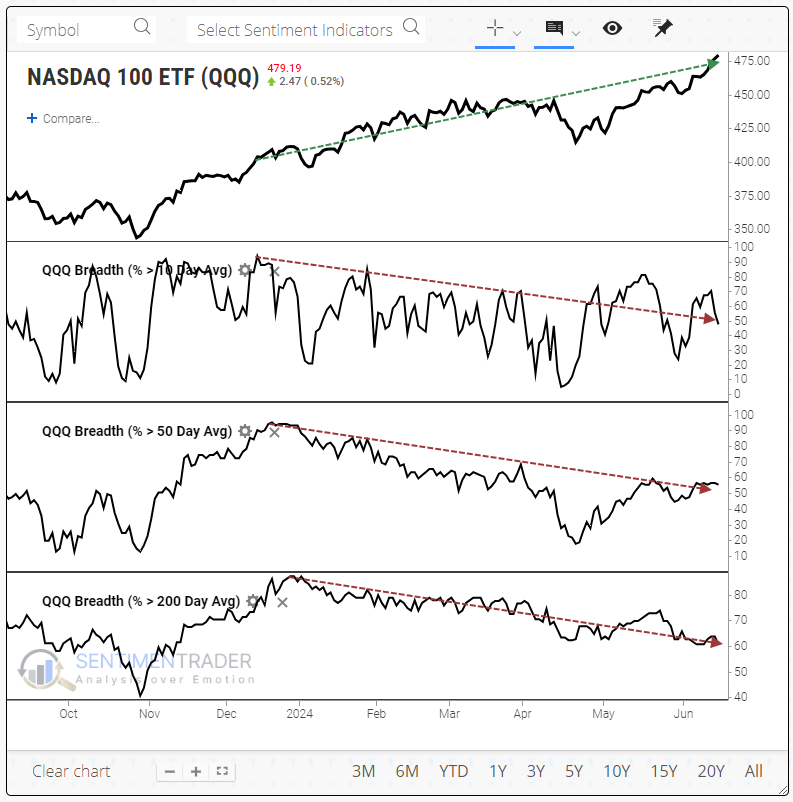

Market breadth is currently horrendous, and many are betting that small caps catch up, breadth expands, and the blow off top rally commences. I was reassured that this would occur by this same crew every single month of this year so far, but to no avail.

I know I probably sound like a broken record by now, but I need to allude to the Dow Theory again — with a twist. You can get the full Dow Theory picture here.

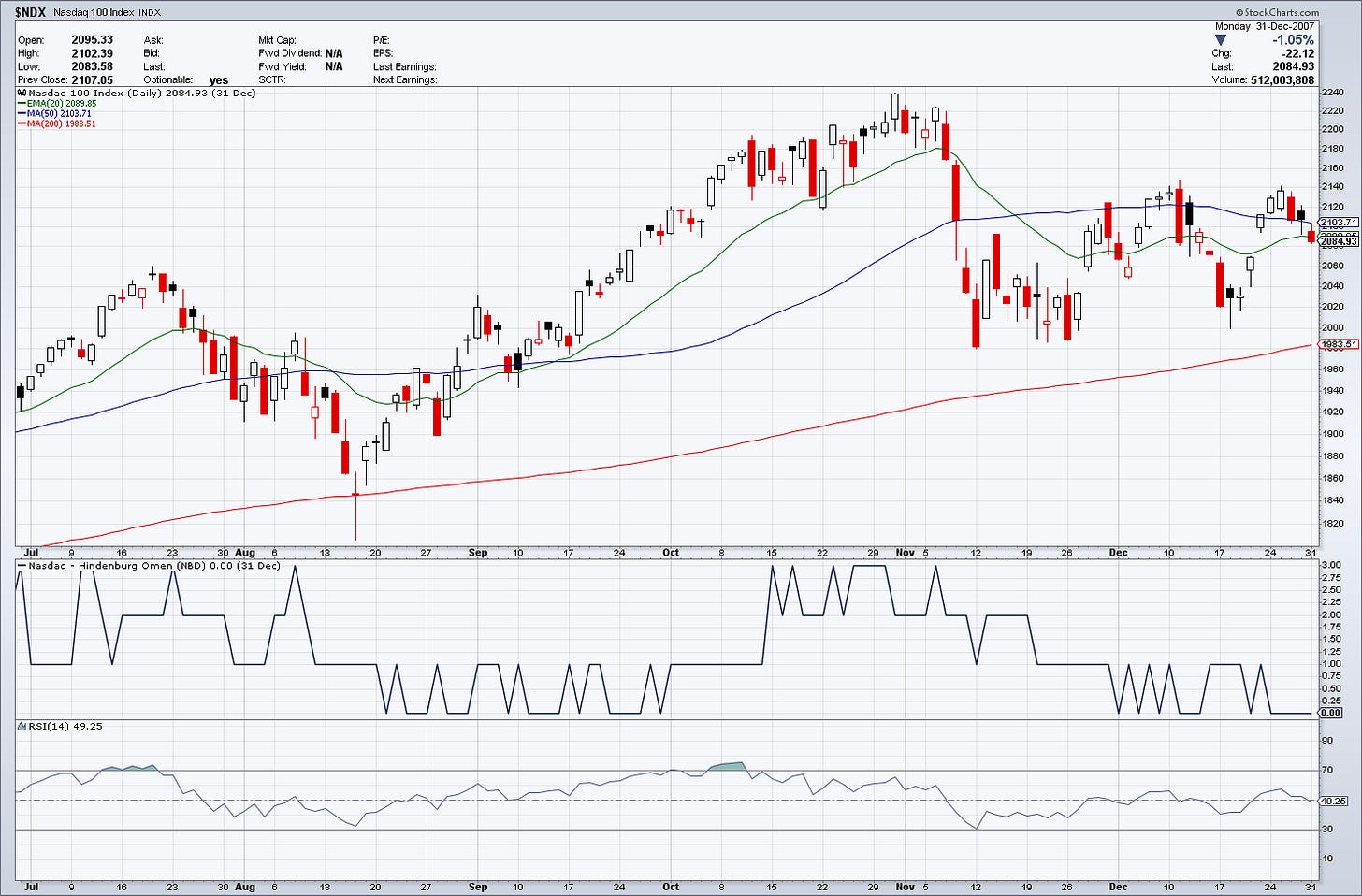

In blue & red are the weekly 50 & 200MAs respectively. Notice anything about this chart? If not, let me add some color.

Remember how awful market breadth is as of late, and the collection of the aforementioned “first evers” above. Time to add some more color.

You can use your imagination for 1972/1973.

The message I’m trying to convey is that it’s transpicuous — in many areas — that we’re in uncharted territory. However, the underlying cause of these divergences, record dispersion/correlation, & historically bad breadth is human nature — which never changes. Most investors/traders don’t want to miss out on any upside, and thus they remain perilously incognizant of the warning signs the market is showing. Good ole FOMO.

One of my favorite signs, in conjunction with those previously mentioned, is this:

That’s 6 hindenburg omens in less than a month with an RSI approaching *checks notes* 82. They are significant only when appearing in clusters.

Some other pertinent, noteworthy charts with HOs:

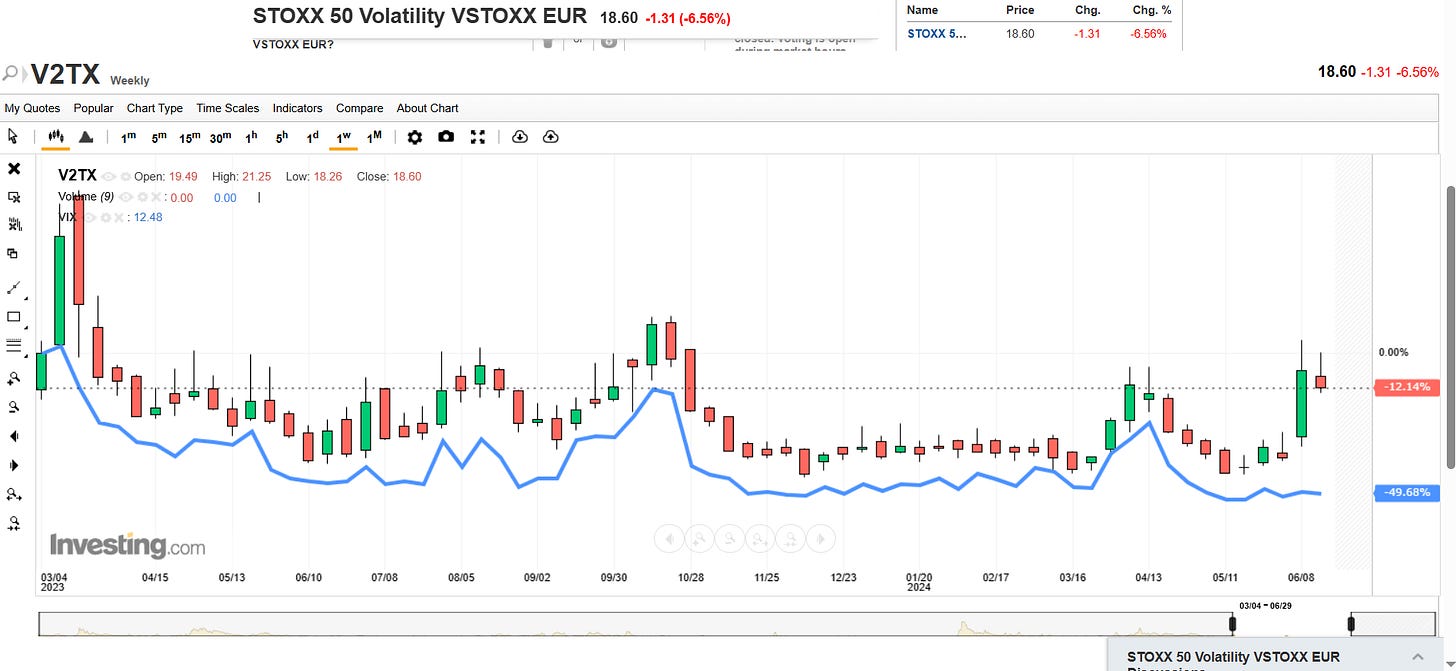

Cross-Asset Vol

As for cross-asset vol, my stance hasn’t changed. To believe that it will be muted/lower for the rest of the year will prove to be a fatal mistake.

Things have been heating up in Europe with their political fiasco transpiring. Consequently, there was a flight-to-safety bid.

Oil vol is historically low with positioning at historic lows as well. Not necessarily the best combination for those who are betting on substantial downside here.

And rate vol is well off the highs made in March ‘23 and looks to be pricing in perfection.

I’ll stop there.

Note that this is not a call to sell everything and go into a bunker. It’s simply a call to remember that 1) solvency is entirely a matter of temperament, and 2) buying the quiet and selling the riot is the name of the game.

Until next time,

Pierre.