Tetelestai

It is finished.

What an action-packed year 2025 has been. Given that it’s almost 2026, it’s time for some end-of-year reflection. For me, the most significant element of this year was transition. Whether it be a transition from low vol to high vol, peacetime to wartime, globalization to deglobalization, or fiscal “austerity” to debasing fiscal profligacy, 2025 was full of transitional markers.

Consequently, the rules, conditions, and governing dynamics of markets changed. In other words, the regime has shifted and capital flows, investor behavior, cost of capital, demographics, social dynamics, narratives, inflation, tax rates, valuations, etc., are vulnerable to major changes.

Regime changes or transition periods are notoriously difficult to navigate. One needs to be swift to react to the first signs of them. You cannot afford to get stuck in the previous regime mindset. Adaptation is essential. Anyone who’s been long duration since late 2021 can speak to this. So can those who believed that Trump 2.0 would be similar to Trump 1.0.

Arguably the most significant transition of this year was the transition from a low vol to a high vol regime. The first signs of this regime change were the aftermath of the Aug ‘24 vol shock and the exceedingly likely chances that Trump would win the election.

"Feeling very refreshed coming into this new year. As I was reading through an EOY note from BofA, I found a few gems that were reminiscent of a small thread I wrote in September.

Regarding the fireworks, there may have been some foreshadowing last night lol. To paraphrase one of the gems: Vol shocks like Feb ‘18 & Mar ‘20 reset markets with years between events, but Aug ‘24 left VIX positions intact, signaling another could some sooner than usual.

Cool, cool. Another one: “Fragility + faster reactions + valuations mean no 2017 vol repeat.” Even better. Sounds like fireworks incoming to me.

This is only one of the major differences between a mid & late cycle Trump presidency.” —

And Trump 2.0 was a certainty.

“With the election now in the rear-view mirror, I can confidently say that the result didn’t surprise me. From July, just before Biden’s withdrawal from the race:

After the failed assassination attempt on Trump — which was nothing short of a miracle —, Biden’s departure before the end of this month is even more likely than before. A red wave is to be expected as well.” —

Funnily enough, these two transitional markers complement each other. Trump & friends — being agents of change —, eager to rebalance the global trade system amidst a late cycle environment, and fragile VIX options positioning combined to create a perfect storm which sent vol soaring specifically in the first half of the year. Since July/Aug'24, vol’s floor has slowly crept up.

If that is not convincing enough that we’ve left the old, low vol regime, 2025 has had more big < -1% down days than big > +1% up days. The last two times this happened were 2008 and 2022. Not only was equity vol high during these times, but social and political volatility was as well.

Similarly, it was not just equity vol, nor FX vol, nor any other asset’s vol which increased materially since Trump’s reelection. Political and social volatility has also skyrocketed as a result of this regime shift. This is important to note, because historically this type of vol does not go gentle into that good night.

It also just so happens to have been foreshadowed in financial markets as well.

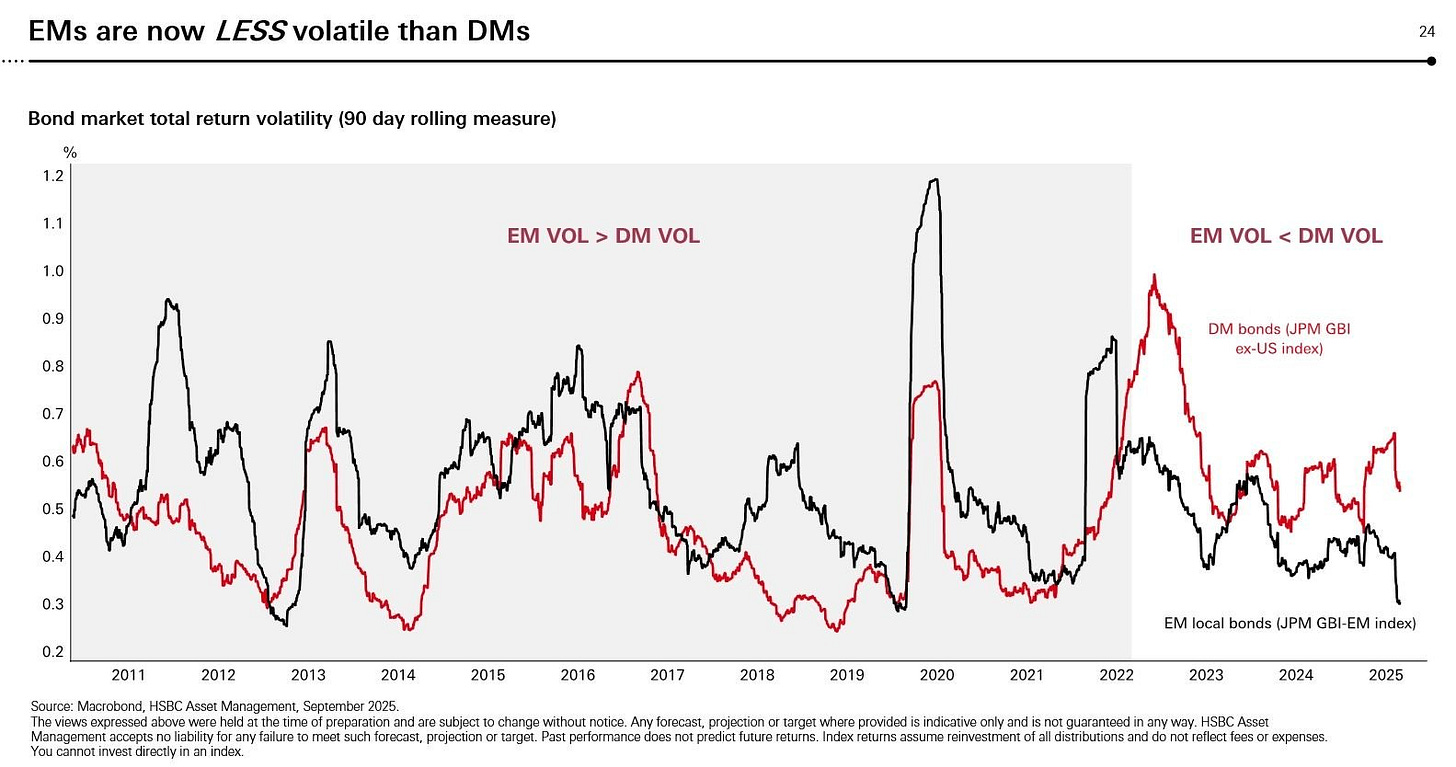

I liked this chart so much that I had to use it again. EMs — which are prone to high & frequent political and social instability, government/institutional distrust, and inflation — have been less volatile than DMs where it matters most. The asset widely known as the safest in the world has experienced uncharacteristic volatility over the past few years. Some may look at this chart and think that we will swiftly return to a relatively lower vol period and stay there, but that era has passed.

VOLATILITY IS HERE TO STAY

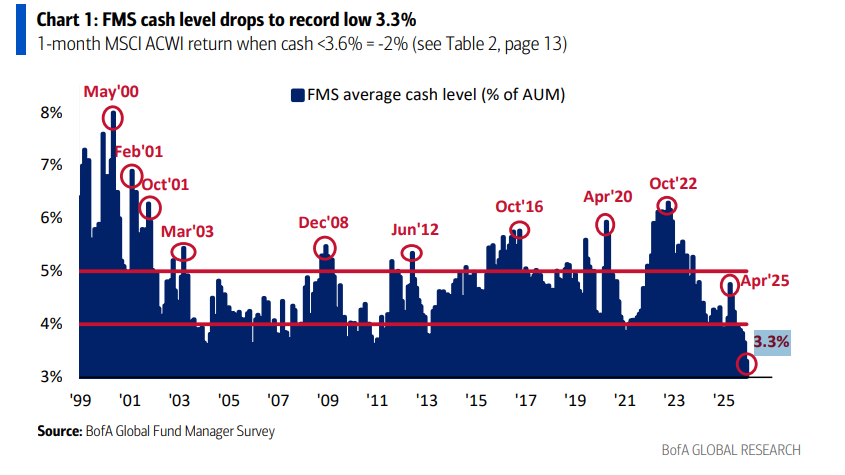

2026 will be another year where volatility — in every corner — is high. For financial markets in particular, it is also a midterm year, and these years tend to be the weakest & most volatile in the presidential cycle. Given current conditions, this is exceedingly important to note. US equities — having staged a powerful and largely mechanical rally after a sharp drawdown earlier in the year — appear to be in distribution.

Since “The Fool Moon is Waning” in late September, indices have gone nowhere fast.

The FMS cash level hit a record low.

Demand for levered equity exposure hit a wall once again.

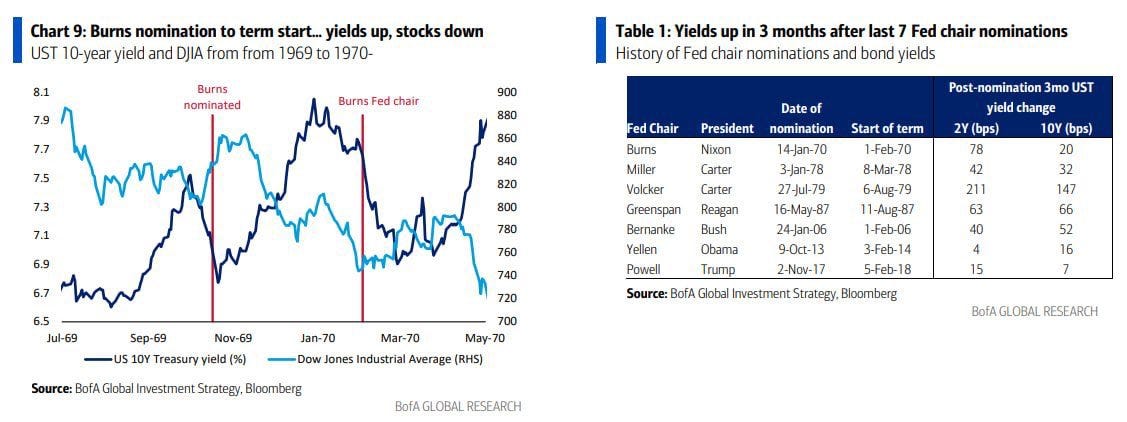

And with Trump (or Nixon 2.0) in position to nominate a new Fed chair next year, it’s pivotal to note that Nixon once deemed an outgoing Fed chair — William McChesney Martin — as “too late” and replaced him with his trusted economic advisor, Arthur Burns.

“I respect his independence. However, I hope that independently he will conclude that my views are the ones that should be followed.” — Nixon

Remarks at the Swearing In of Dr. Arthur F. Burns as Chairman of the Board of Governors of the Federal Reserve System. | The American Presidency Project

Sound familiar? Whether the new Fed chair is Hassett, Waller, or whoever, you can be sure that they will do whatever it takes to meet Trump’s needs — lower rates at all costs.

Thus, the “endgame” quickly approaches: dollar down, stocks down, yields up, commodities up, with a monetary regime change to boot.

“Furthermore, due to the embedded asymmetry in monetary & fiscal policy, the current regime shift will likely bring about an environment where we see dollar down, stocks down, yields up action amidst stagflation, assets that have been systematically starved of capital outperform as the hyper-financialization lever gets turned off, and the shift from fiat to digital currency is ushered in — for what it’s worth, I don’t think Bitcoin solves this ;)”

Currently bonds are barely down YTD while the dollar has maintained a precipitous drawdown. Stocks, on the other hand, have had quite a positive year. But let us not forget, right before the 20% drawdown in Q1 there was a record percentage of US consumers that expected higher stock prices over the next 12 months:

“To drive home my point, in late October, 51.4% of US consumers expected higher stock prices over the next 12 months. After Trump’s victory, this shot up to over 56%. I understand the sentiment, but I don’t share it.”1

And, as usual, they were not very optimistic about stocks after they dropped:

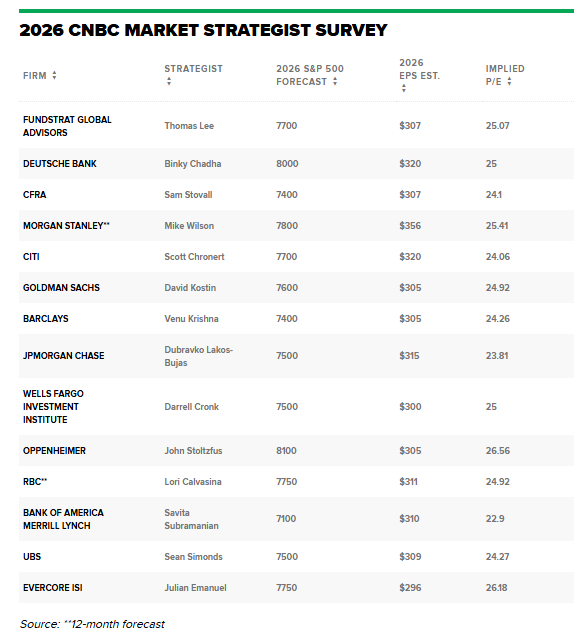

One can easily tell how they currently feel, as there is not a soul on Wall Street that sees a down year for the S&P in 2026:

We shall see about that.

OIL & ENERGY

I have not forgotten about my beloved (and largely forgotten by most) space. Initially, I thought that this would be a great year for this space — FWIW, energy was the best performing sector of Q1 —, but it was not. Energy is up about 6% YTD while oil is down about 16% despite “drill, baby, drill” not coming to fruition. So, what gives?

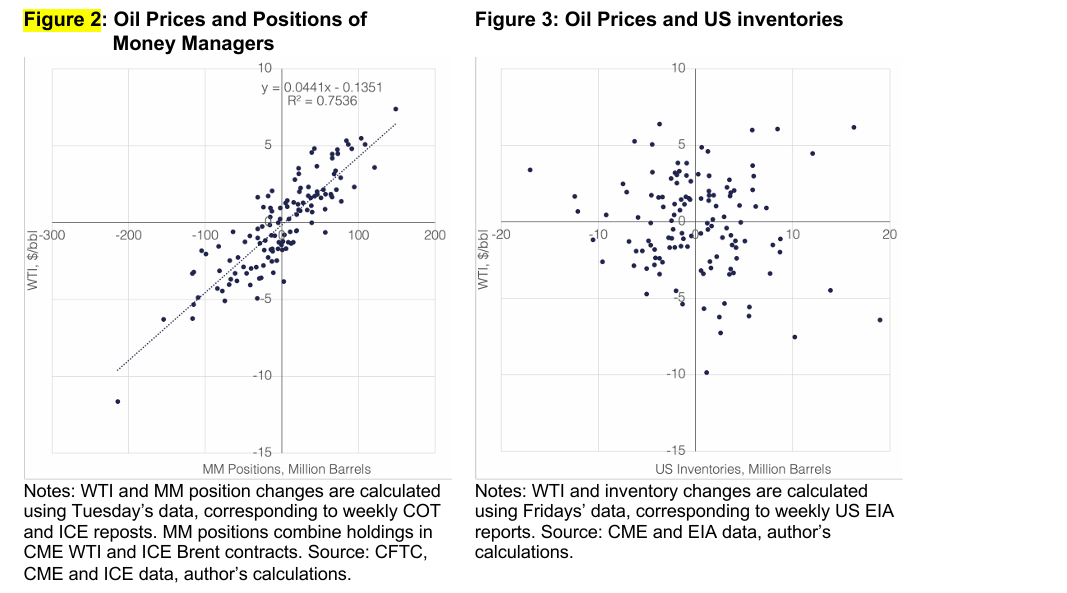

There is a paper I read a few months back, titled Energy Quantamentals: A Tale of Two Algorithms and OPEC+ by Dr. Ilia Bouchouev. It is an excellent read that displays the two algos in control: 1) one designed to buy oil as an inflation/geopolitical hedge and 2) another designed to sell oil futures as a form of portfolio insurance against risks of a global recession and argues that the current market climate is essentially the tug-of-war between the two.

I am not an expert. I don’t really want to be one either. However, I am (and have been) a believer that algos have trumped fundamentals in the oil market for quite some time, and now I have evidence other than my eyes to bolster this claim.

Some of the most notable portions of the paper:

“To see this relationship more clearly, Figure 2 presents the same data in the form of a scatterplot for weekly changes in prices and MM positions. It highlights the remarkably strong co-movement between the two. The slope of this graph provides us with a useful rule of thumb that 100,000 contracts (100 million barrels) of buying or selling futures by MM trades, causes oil price to change, on average, by approximately $4 5/bbl. We will use this rule of thumb later to assess the impact of future potential buying and selling on prices.”

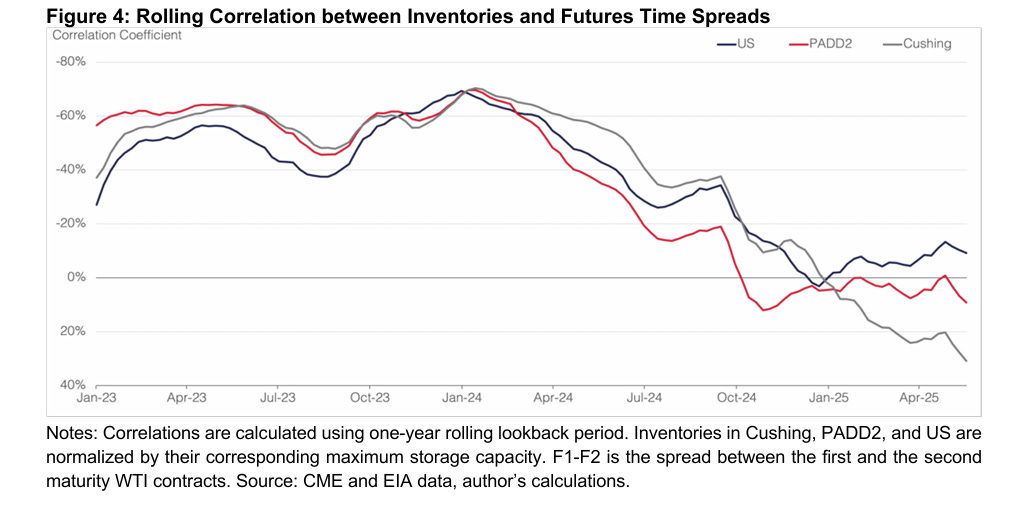

“Figure 4 addresses these challenges at once and confirms our previous observation that the conventional fundamental modelling framework no longer holds and as of recent, it can no longer explain oil price movements…..One can see, however, that all of these correlations started to break down in the middle of the last year. More recently, they completely fell apart, fluctuating around zero. This confirms that even the most reliable fundamental relationship between inventories and time spreads is now failing to explain the behavior of oil prices.”

“It turns out that statistically oil has been the best hedge against inflation. Historically, it has outperformed gold, real estate, and even inflation-protected bonds by a significant margin during the times when inflation spiked.5 It should be noted, however, that the relationship between oil and inflation is quite complicated, as it is driven by multiple feedback loops often going in opposite directions.6 In this article, we avoid making any statements about the causality, but in general higher inflation expectations result in stronger demand for oil futures.”

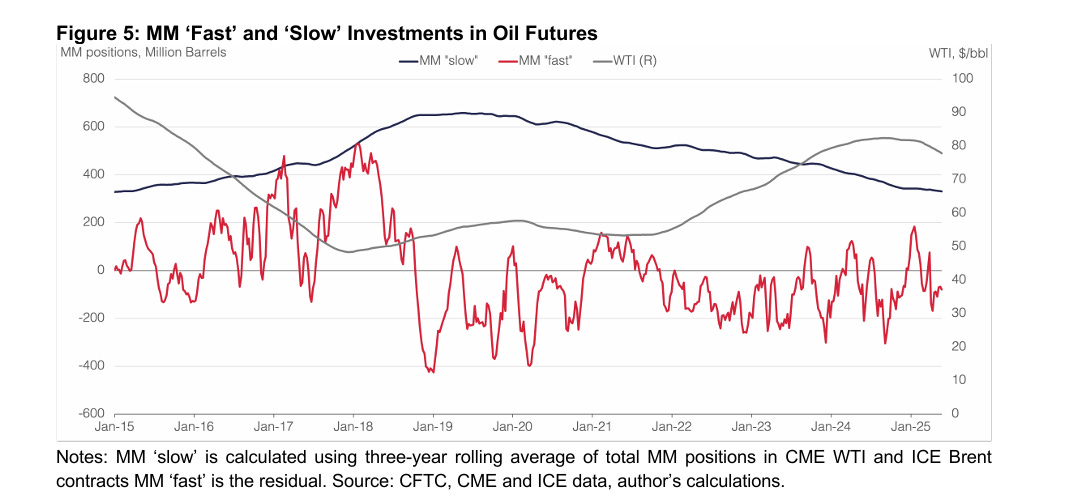

“As already mentioned, the structural demand from buyers for oil as an inflation hedge is rather cyclical. As shown in Figure 5, it is currently close to multi year lows. As such, it is difficult to see that this demand can fall much further from already depressed levels, especially in the current environment of heightened geopolitical risks.

Furthermore, comparing the latest positions held by ‘slow’ money to their long-term average, one could argue that the pent-up demand for inflation hedging could be at least 100 million barrels. This, if executed over the remainder of this year, could easily amount to more than a half-million of financial barrels per day, largely negating an oversupply in a physical market of a similar magnitude. This structural demand for oil futures could spike rather quickly at any sign of further military escalation in the Middle East.

In contrast, as shown in Figure 5, the demand for recession hedging via oil momentum strategies is already highly elevated. In other words, the CTAs’ positions are not too far from their maximum historical shorts. Such demand also tend to be rather cyclical and their futures holdings tend to mean-revert over time. Obviously, mean-reversion is a relatively slow moving process which does not have to start immediately, and in the short-term the financial demand for inflation hedging could decrease further and financial demand for recession hedging could increase.”

A personal favorite:

“So the question is how much more can the financial demand for recession hedging rise from currently elevated levels, if it is measured by net short positions held by the CTAs? By comparing current short positions to their historical lows, it appears that these funds could plausibly sell another 125-150 million barrels of futures. Using the correlation-based rule of thumb from our Figure 2, it is estimated that 125-150 million barrels of futures selling can move the price down by additional $5-7/bbl. In other words, from the perspective of financial supply and demand for oil futures, one could argue that the floor for Brent should be around $55/bbl, as at this price level there will be very few new oil sellers left.”

Lastly, but certainly not least:

“While the demand for inflation and geopolitical hedging can only increase from currently low levels, the demand for recession hedging is already nearly capped. In other words, the lower the oil price goes, the faster the pendulum could swing towards stronger financial demand and weaker financial supply for futures. This de facto supports the risk-reward behind some of OPEC+ members’ decision to increase production. The market could find support from financial buyers, regardless of marginal imbalances in fundamentals. Given highly elevated geopolitical risks today, it is hard to see many new discretionary short positions to be established at such low price levels. At the same time, the positions held by ‘crisis alpha’ funds appear to be not too far from reaching their maximum allocations. From this perspective, increasing oil production when the price is already low appears to present a reasonable risk-reward. The market seems to have agreed with this logic.”

Back in September, positioning in Brent crude went net short for the first time ever. In mid-August, positioning in WTI was net short for the first time ever. It has been quite a lucrative strategy to fade extreme positioning in this space, mainly because of the dynamic displayed above.

Nonetheless, my biggest takeaway from this was that the floor for oil prices is not far.

Ultimately, inventories remain low relative to long-term levels, non-OPEC supply growth is set to fade, demand is still solid, oil is historically cheap relative to precious metals, US shale oil production has turned negative YoY for the first time in history, and the geopolitical climate is not cooling anytime soon. Energy — currently under 3% of the S&P — made up approximately 30% of the S&P in 1980 due to similar conditions that presently exist. It will not remain unloved forever.

So long 2025, it was a pleasure.

Tetelestai.

It is finished.