Good Breadth is Bad | The 1st Rate Cut

So long "small cap summer." A key inflection point is here.

While observing the price action after VIXpiration, particularly Friday’s following a remarkably dovish Powell, I’ve gained some clarity. However, it’s not enough to position myself in equities yet. I need to see more.

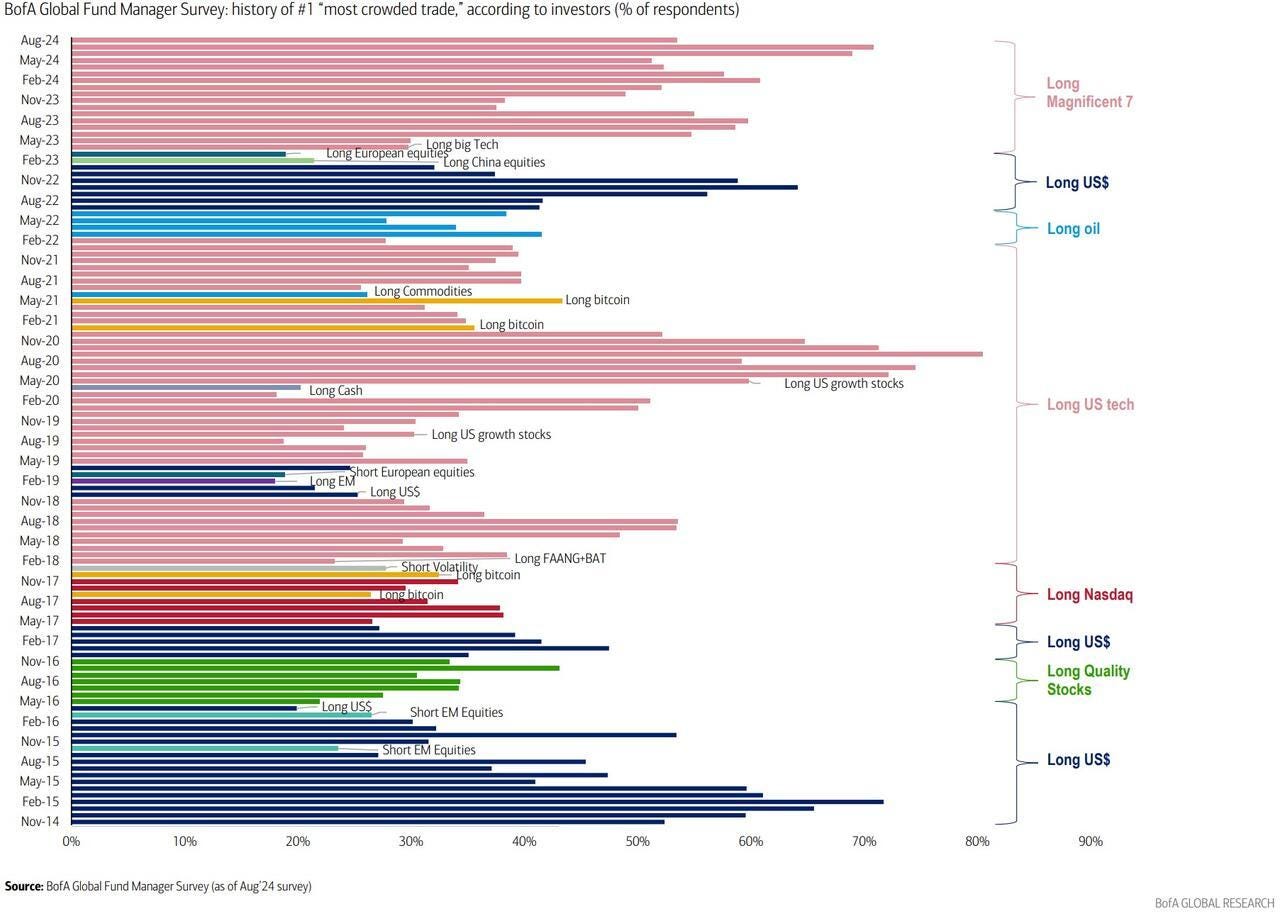

I saw more of the unhealthy broadening which reared its ugly head in mid/late July. In fact, NDX momentarily went red while small caps materially outperformed. No bueno. Bulls don’t want to see this again while dispersion is this high.

It was for this very reason that I poked fun at the cohort responsible for creating the “small cap summer into blow off top” narrative. This is also what gave me the conviction to aggressively hedge with QQQ puts/put spreads & VIX call spreads mid-July.

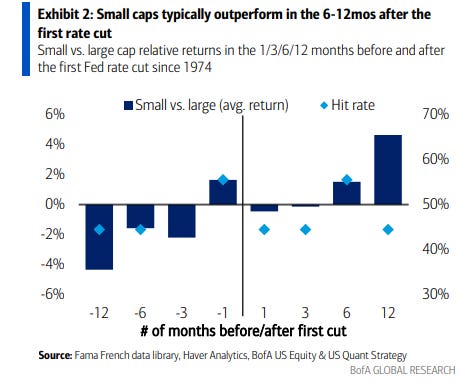

After the close, the gears started to turn more. This long-awaited rate cut has been confirmed to take place next month, but what does that really mean for assets? For starters, small caps should begin to outperform large caps.

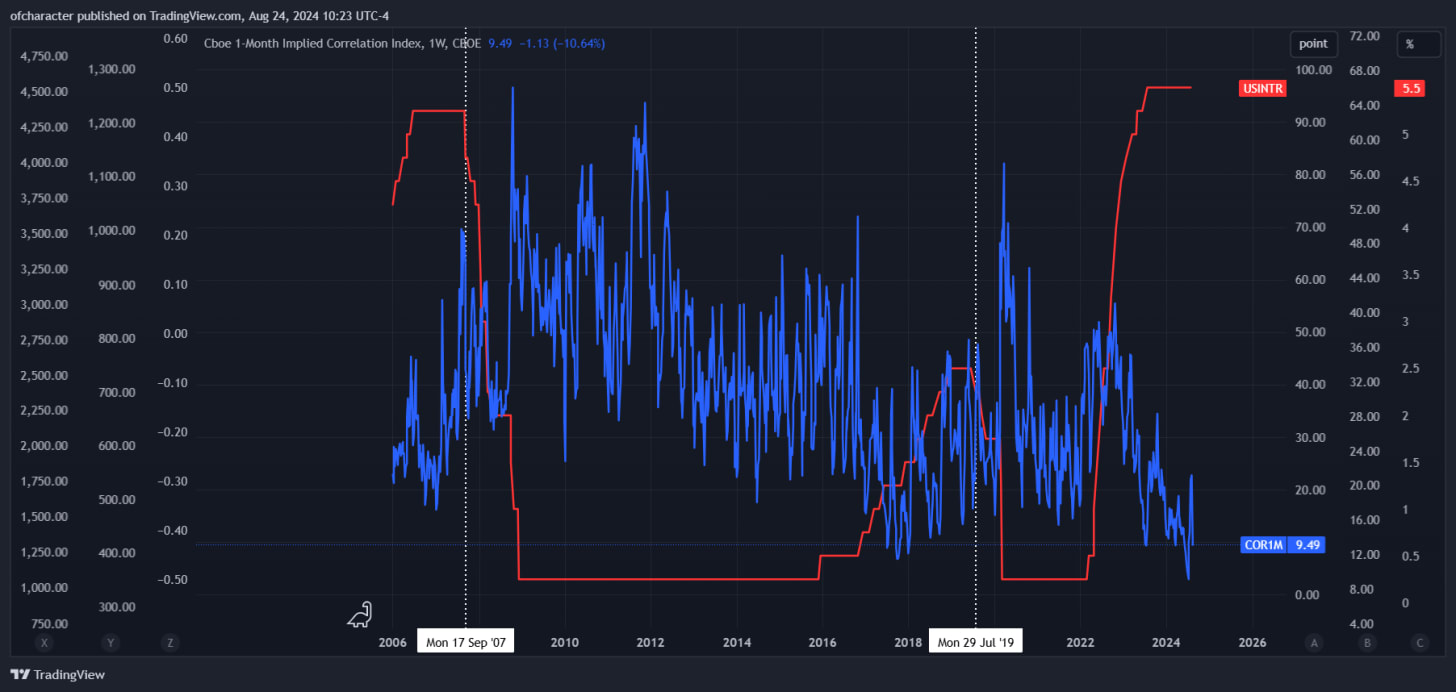

Though, considering positioning, they may start their outperformance ahead of schedule. We have never received the first rate cut while 1M implied correlation was this low.

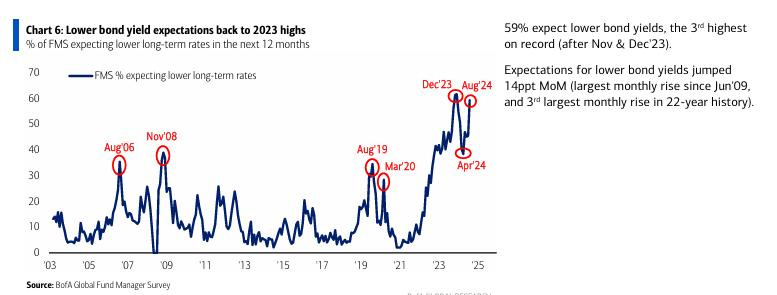

Of course, there is almost a month until the first rate cut, in which this picture could change drastically. I presently believe that if we can get through NVDA earnings, NFP, & CPI unscathed (no recession scares), we’ll see a return to regularly scheduled programming — Mag7/semis outperforming small caps. This scenario would lead to a rise in dispersion into the first rate cut and has been the memo since March ‘23 as BofA highlights:

Naturally, the first rate cut is not so kind to large caps. Given current conditions — stocks up 32% past 9 months vs. average of 2% in run-up to 12 occasions since 1970 of the 1st rate cut (source = Hartnett/BofA) — I still think that the reaction from equities will be less-than-stellar. With VIXpiration & the rate decision both transpiring on the same day (September 18th), you have a potentially explosive setup for a downside move into October.

Nonetheless, election vol/overhang, ever-increasing geopol. tensions, & stretched positioning make it quite unlikely that spot VIX retreats to levels seen before this unhealthy broadening action presented itself.

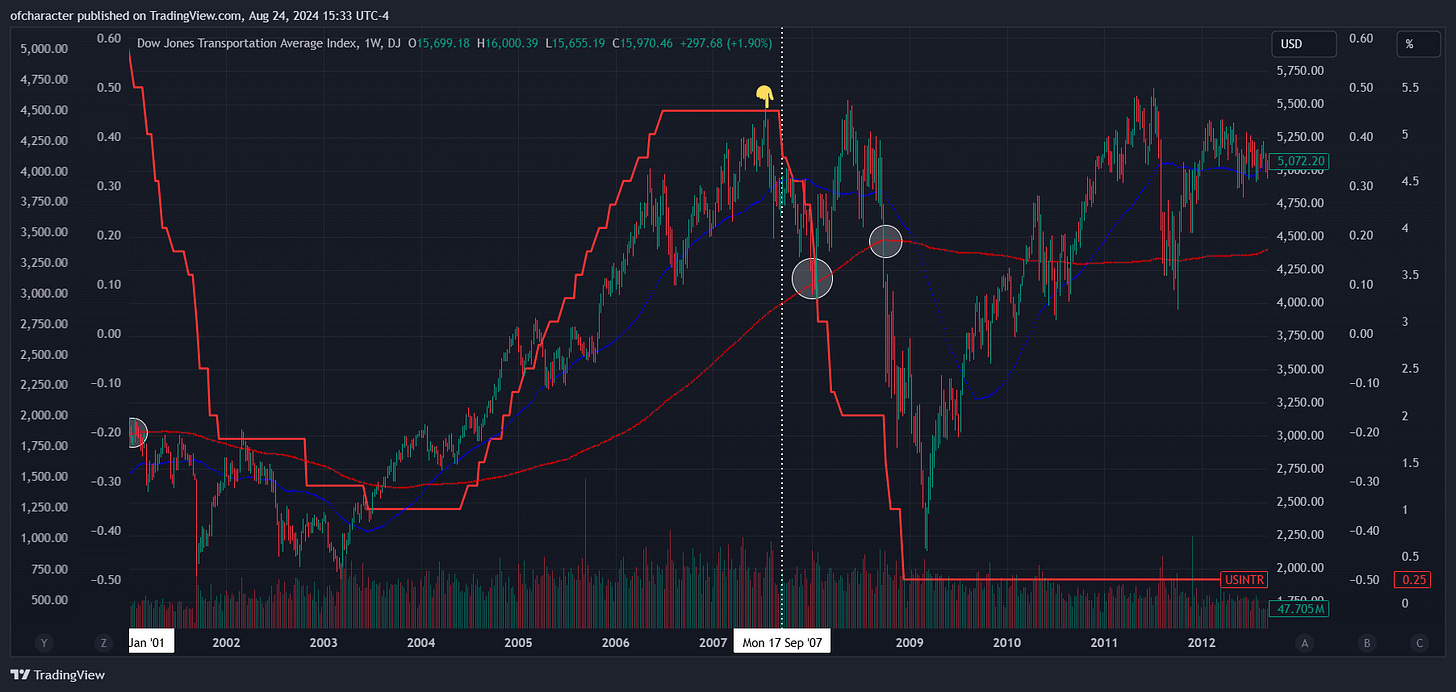

Looking at the 3 most recent “1st rate cut” scenarios from a perspective of Dow Theory:

Not once did transports make new highs after the first rate cut. Overlaying NDX (other indices are fine too) yields a clear-cut picture:

This picture is not exactly confidence-inspiring for bulls in the longer-term.

The Turbulence of the Post-Pandemic World

Keeping this as short and simple as possible, we’re at a key inflection point in both markets & the economy. A quick blast from the past:

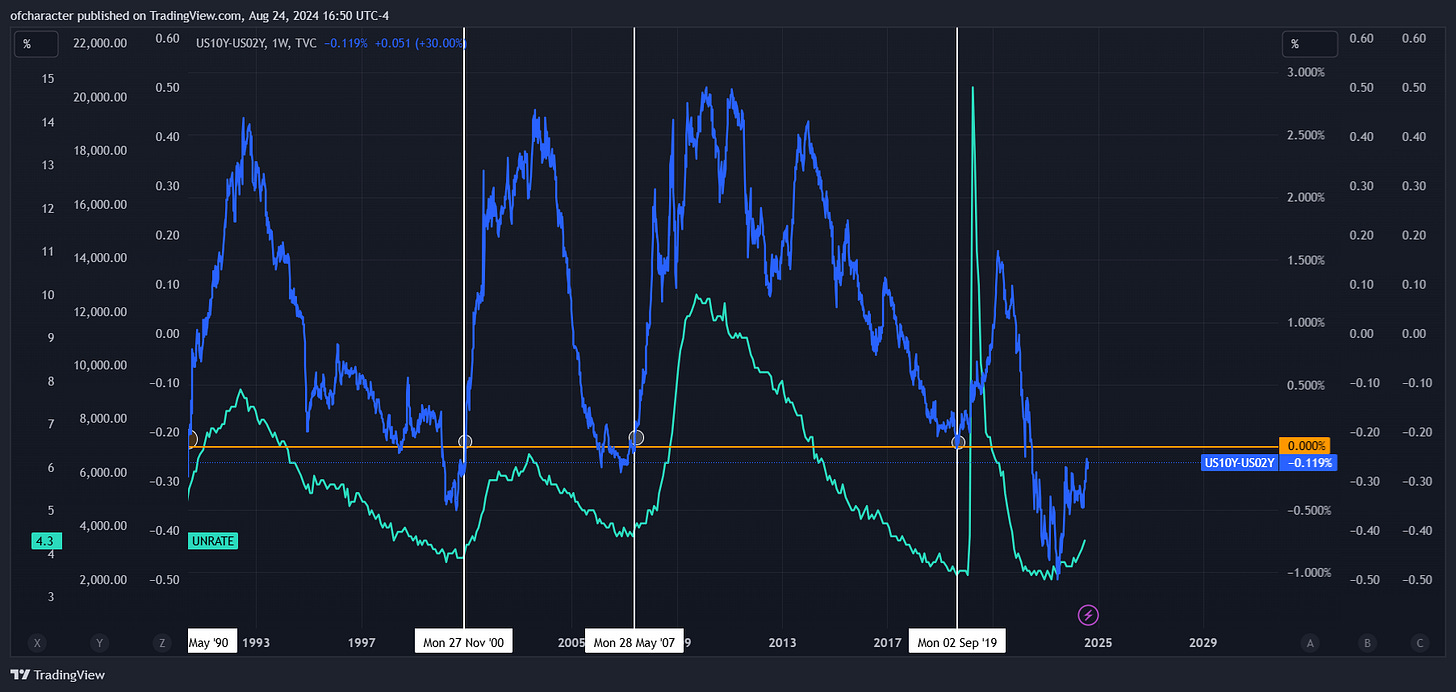

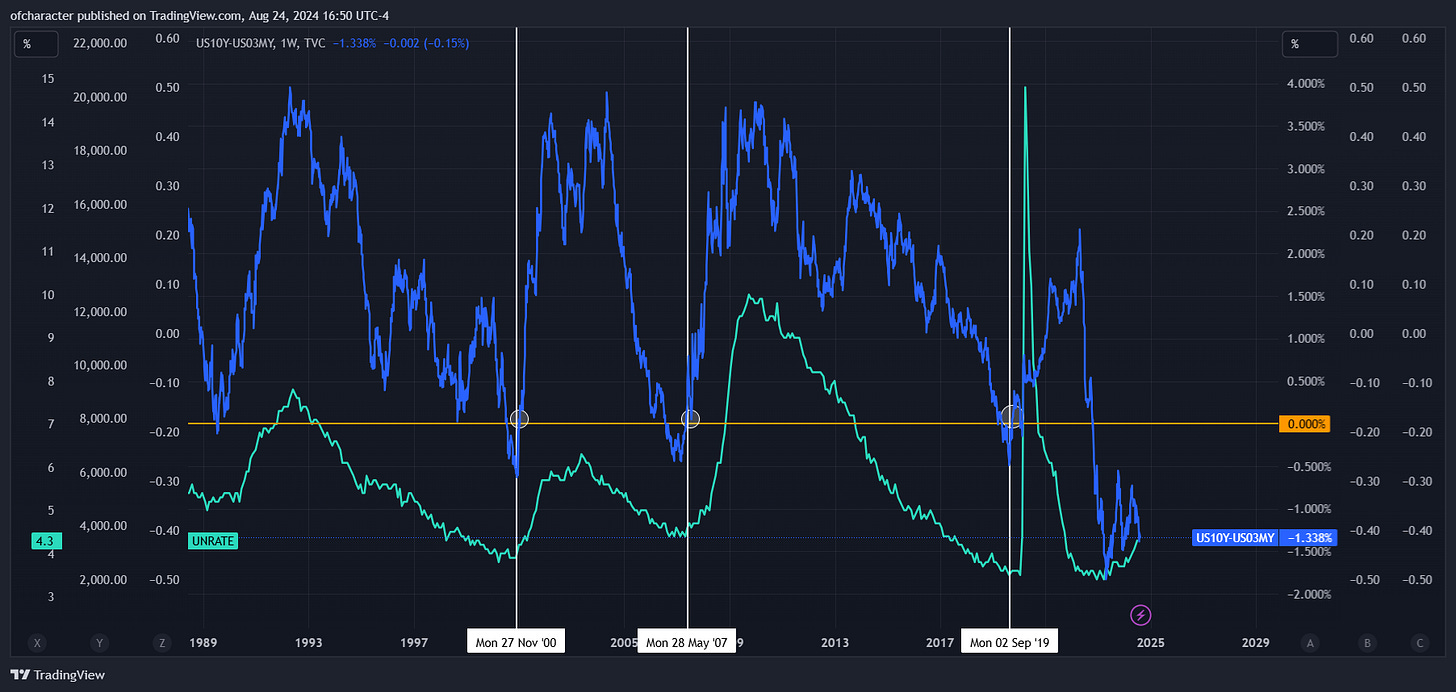

Neither of the closely watched spreads of the yield curve have re-steepened yet. Everyone knows that they have inverted already, but few recognize that this is a testament to how early we are in this bear market. Re-steepening of the yield curve has coincided with the advent of recessions and further continuation of downturns. —

Here’s what the yield curve looks like after sustaining the longest inversion in history:

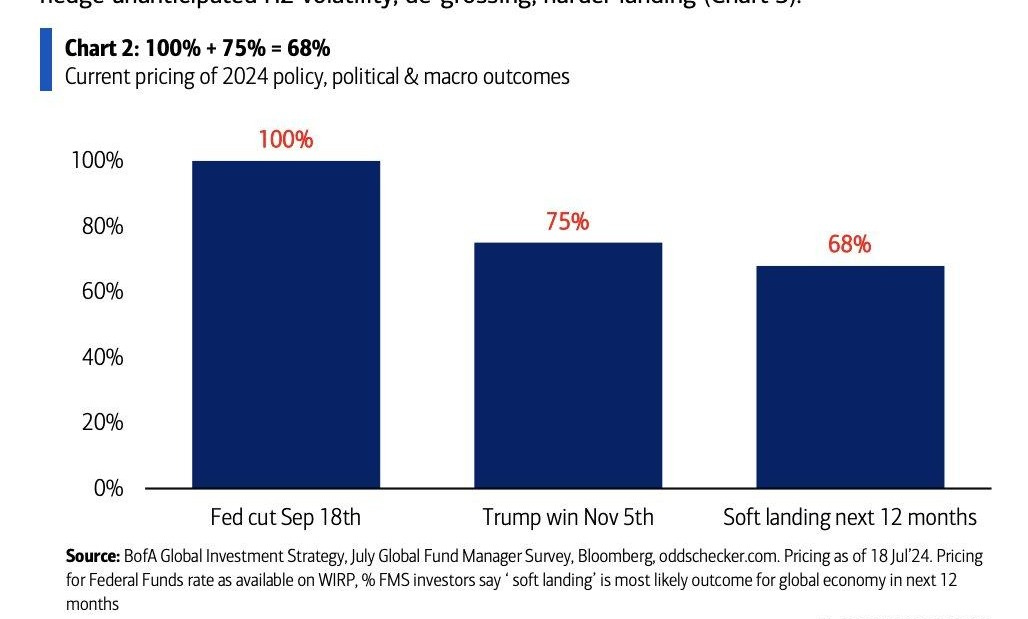

I figured it’d be good to revisit this since the Fed has now made it clear that unemployment is their focal point. A hard landing is supposedly not in the Fed’s plans, but this view is as consensus as it can possibly get.

Hartnett clarifies: “soft” (or “no”) landing consensus (86% according to FMS).”

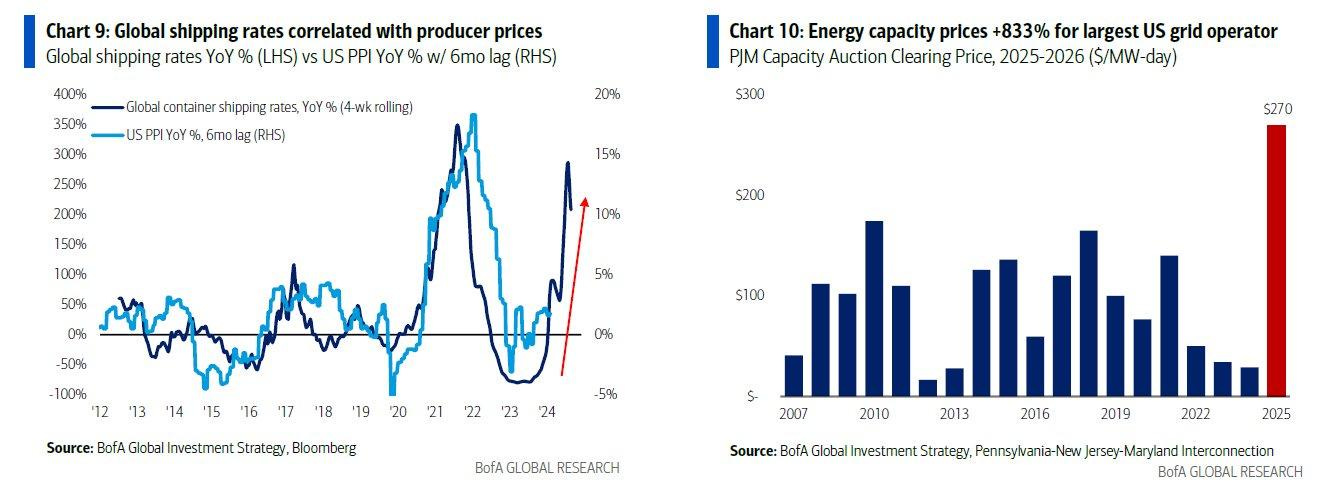

Can’t say that I’ve shared a “soft landing” or “no landing” view even once throughout this cycle. I certainly won’t be jumping on any of those trains now as the Fed unabashedly takes a victory lap on inflation. I still vehemently disagree with this “mission accomplished” approach to inflation considering that:

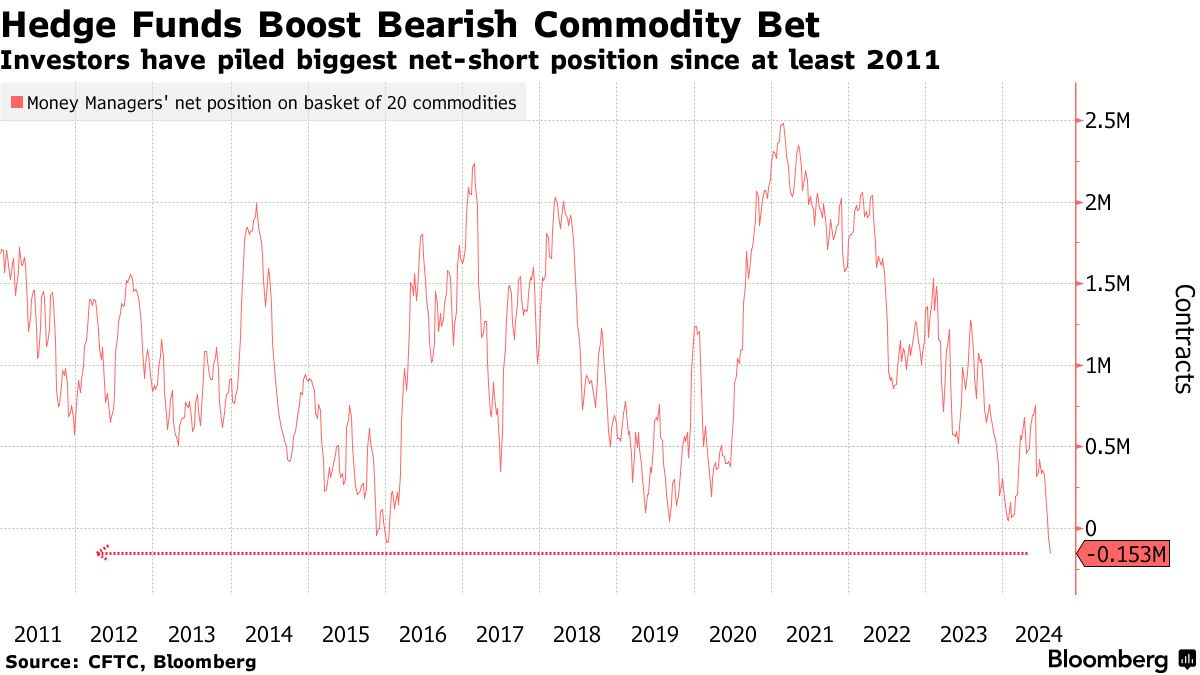

We’re about to cut rates while commodities are historically under-owned in an exceedingly volatile geopolitical climate and prices are still relatively elevated.

We’re in the nascent stage of stagflation.

Populism is still large and in charge.

Fiscal profligacy is here to stay.

The Fed is still stuck between a rock and a hard place.

Speaking of the geopolitical climate…

The rise in global shipping rates is also correlated with the escalation of geopolitical tensions, and I do not expect them to magically abate anytime soon. I expect them to heat up, especially as the election approaches and into 2025/through the rest of this decade.

With the “1st rate cut” solidified, it seems prudent — from a risk/reward standpoint — to seek out long commodity opportunities over equities. Again:

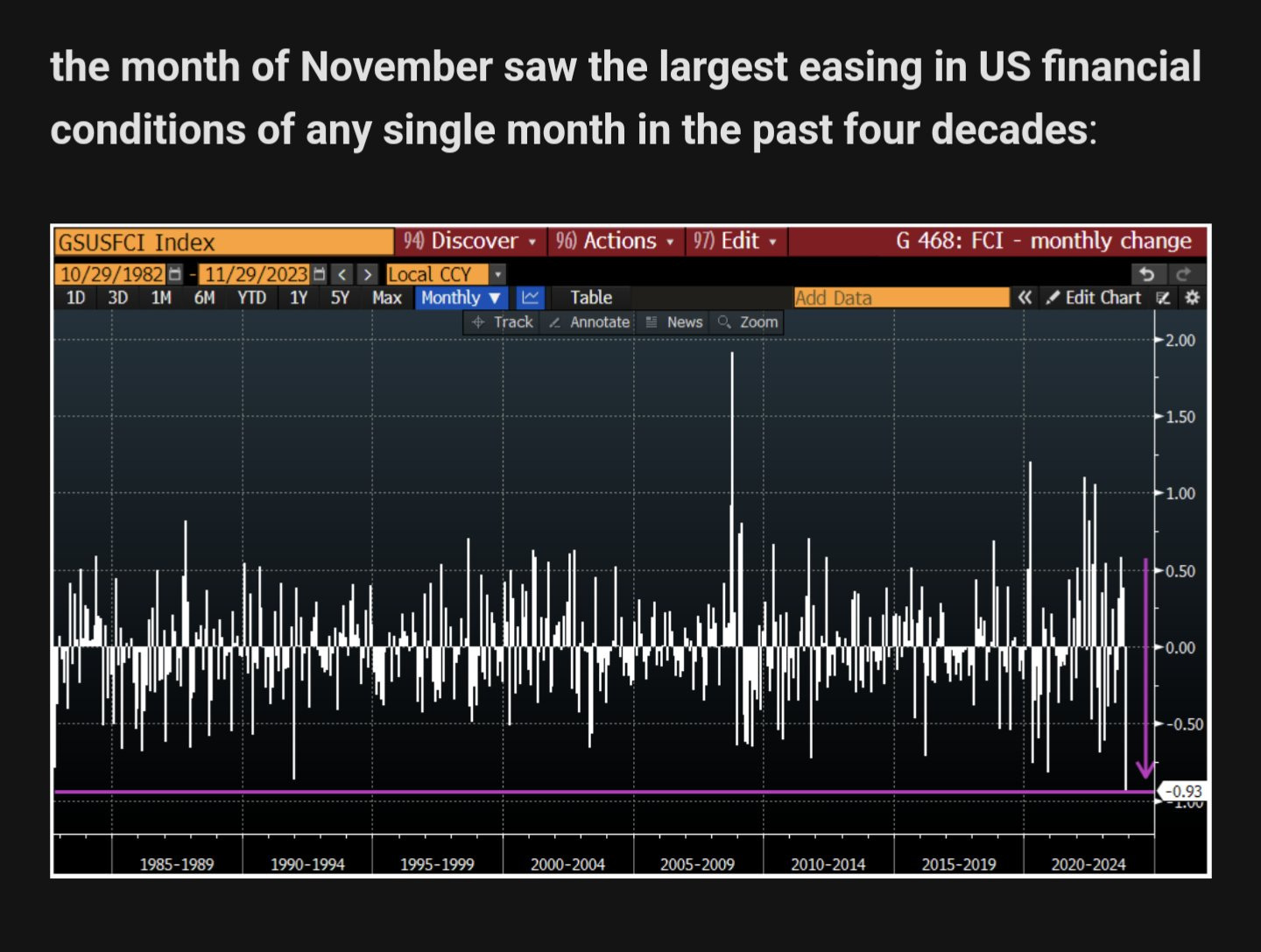

This brings me back to last Dec’s FOMC, when the infamous “Powell pivot” occurred:

To top it off, at the last FOMC, Powell gave commodities — and equities — the greenlight to run. In what was a disastrous display of indecisiveness — and dare I say, a lack of credibility — the Fed released the animal spirits. And you know what they say, “Don’t fight the Fed.” Powell previously stated that the material rise of yields was welcomed, as it behaved like rate hikes/implicit tightening — making their job easier. But yields had dropped considerably since he said that. In fact…

It wouldn’t be farfetched to consider this development as rate cuts given what Powell said about implicit tightening. Despite this, Powell came out singing a surprisingly dovish tune.

—

From the same post above:

I got aggressively long oil and moderately long gold shortly after FOMC on Dec. 13th.4 It looks I’ve been granted a second chance.

Also, the reasoning for the gold long is not only due to the release of animal spirits by JP, but also because I believe that stagflation is here. And gold performs exceptionally well in this environment. I’ll likely be short bonds (long end) soon as well.

No new lows for gold since. The gargantuan demand from CBs + the fact that gold is a hedge against monetary and fiscal incompetence has helped out a lot.

And no new lows for oil either. The disconnect between the paper and physical markets here will be resolved in due time. Patience is key.

It gets better:

No new lows for the entire commodity basket since the “Powell pivot.”

That day also happened to put in a multi-month low for vol and induced some spot up, vol up behavior:

Most importantly, we received 3 consecutive uncomfortably hot CPI prints after this. Which reminds me, the floor for rates (long end) does not look too far from here considering present and future circumstances:

Will be fun to see everything play out now that we’re finally cutting rates.

Until next time,

Pierre

“Let us hear the conclusion of this whole matter:

Fear God and keep his commandments, for this is man’s all. For God will bring every work into judgment, including every secret thing, whether good or evil.” — Ecclesiastes 12:13-14