I See Your Fantasy, You Wanna Make it a Reality Paved in Gold

Well, now that's over.

I want to paint a vivid picture of how equities, rates & commodities look now ahead of a pivotal FOMC. A few key themes:

A hawkish Fed repricing is being severely underpriced by equities.

Rotation has been happening underneath the hood for a few weeks.

As stated in my last post, equities have trudged forward in spite of the shift in rate cut expectations. Emphasis on trudged.

Fed is still trapped between a rock & a hard place, and given their history of flip-flopping, they are likely to shift to a hawkish stance once again.

Time to dig in to each of these.

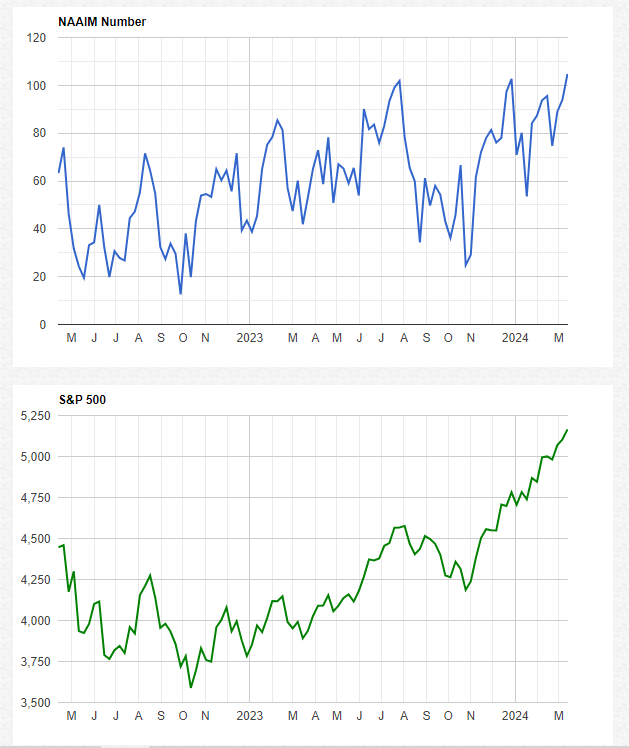

“Everyone is bearish”

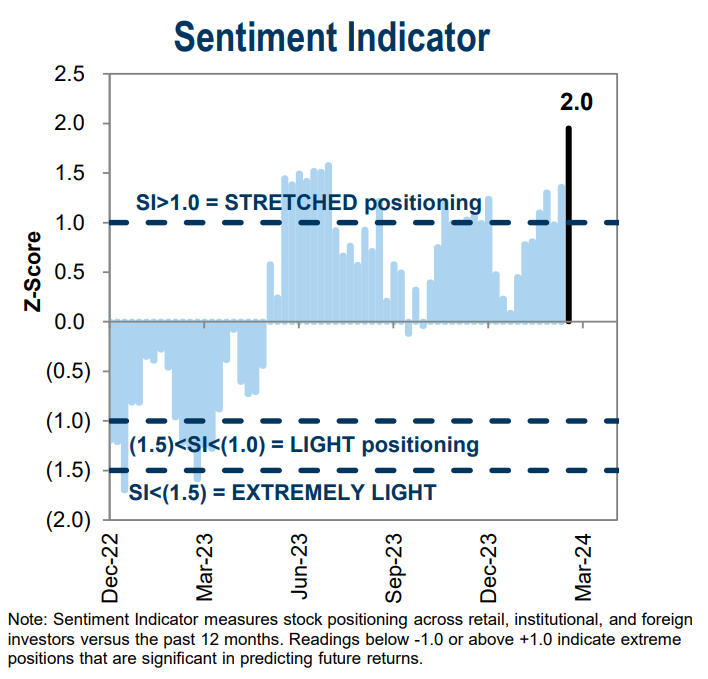

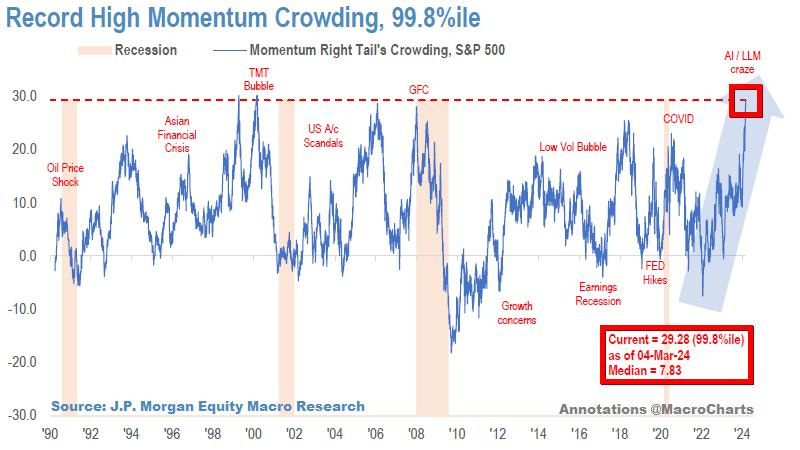

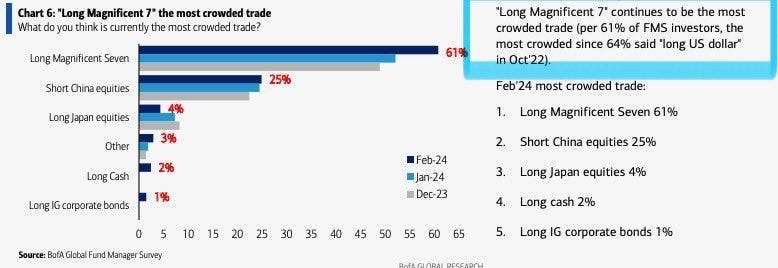

I hear/see this a lot, especially at tops. The market is currently sleepwalking into a hawkish Fed repricing due to recent inflation data. Positioning is stretched & there’s zero indication that “everyone is bearish.” Illustrated below:

And last, but certainly not least,

I want to reiterate:

This momentum trade is currently as crowded as the long USD trade was in Oct ‘22, and that was a major inflection point.

In reality, few people are actually bearish.

R O T A T I O N

Taking a bit from an older post:

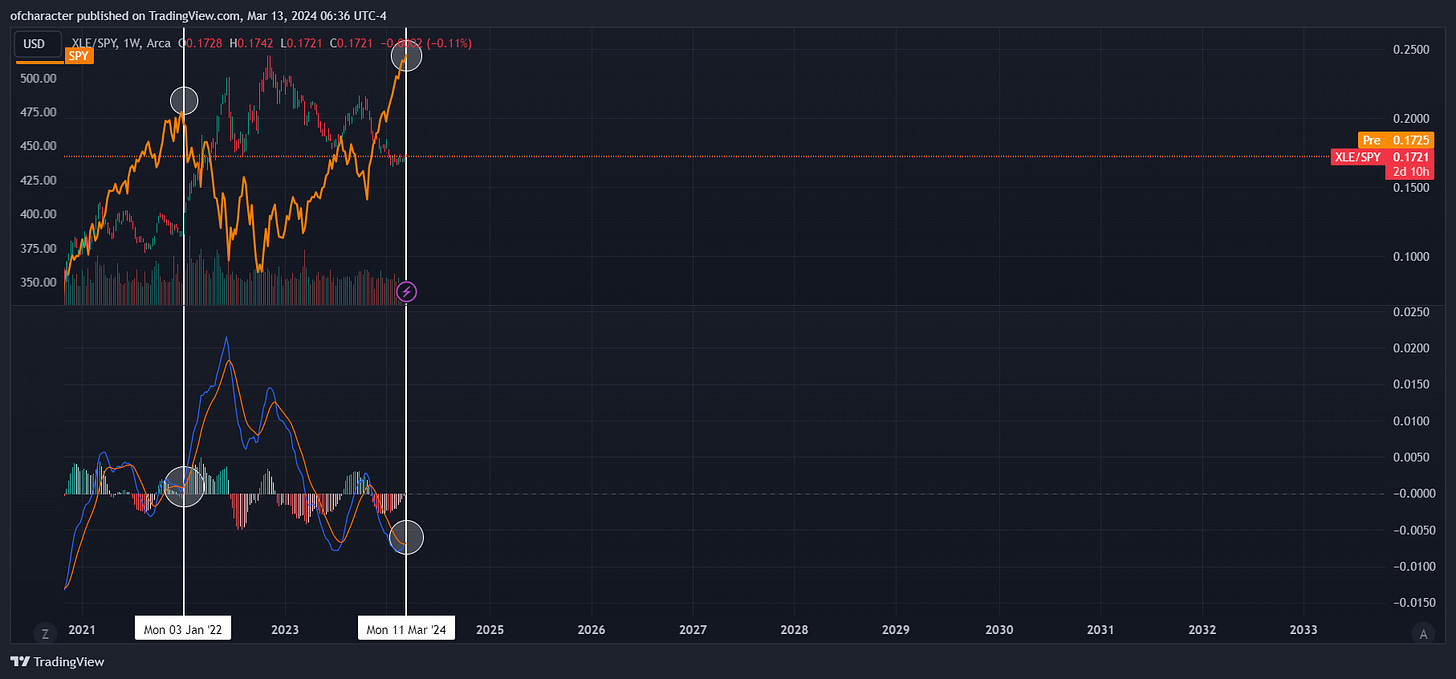

Lastly, something else to watch for, especially if it continues — which I believe it will:

Oil is quietly outperforming the major indices YTD.

This outperformance is no longer quiet.

YTD performance update:

OIL: +12.24%

SPX: +7.84%

NDX: +6.85%

DJI: +3.06%

Shocking, right? Not really. There’s been a rotation happening underneath the hood for a bit, notably in energy and consumer staples.

As you can see, this doesn’t really bode well for equities in the near future. This rotation is a reason why 30% of my port is in energy/oil right now.

Euphoria’s Waning/ Distribution’s Taking Place?

I flagged a long China trade back in late January when Asia Genesis had to close down due to poor performance. Time for a performance check since then:

HSI: +11.77%

FXI: +13.48%

SPX: +5.50%

NDX: +2.76% (lol)

DJI: +1.88% (lol)

An important note from that post:

All conditions considered, taking a shot at a long China trade looks more appealing than it has in quite some time. Should this trade materialize, US equities would likely experience a drag as the capital that so speedily & relentlessly rushed out of China and into Japan & US markets decides to park it back home.

This drag in US equities becomes more apparent when you note the performance of equities since Jan CPI was reported.

Indices have barely moved since then while positioning gradually became exceedingly crowded in the momentum trade. Now to venture into why I believe the market is in for a rude awakening.

The misadventures of a flip-flopping, data dependent Fed

I’m going to have to dig deep into the archives for this one. Going to try and keep this portion as short as possible.

Firstly, because this dilemma the Fed’s presently in is so reminiscent of the 70s, it’s imperative that I make this distinction clear.

In the 70s, the Fed did not give forward guidance. The speed of dissemination of information also paled in comparison to what we currently experience. What I am alluding to here is that it is much easier to pivot now than it was back then. All you need to do is say the wrong things —while market participants perpetually misunderstand the Fed’s reaction function — to usher in a pivot.

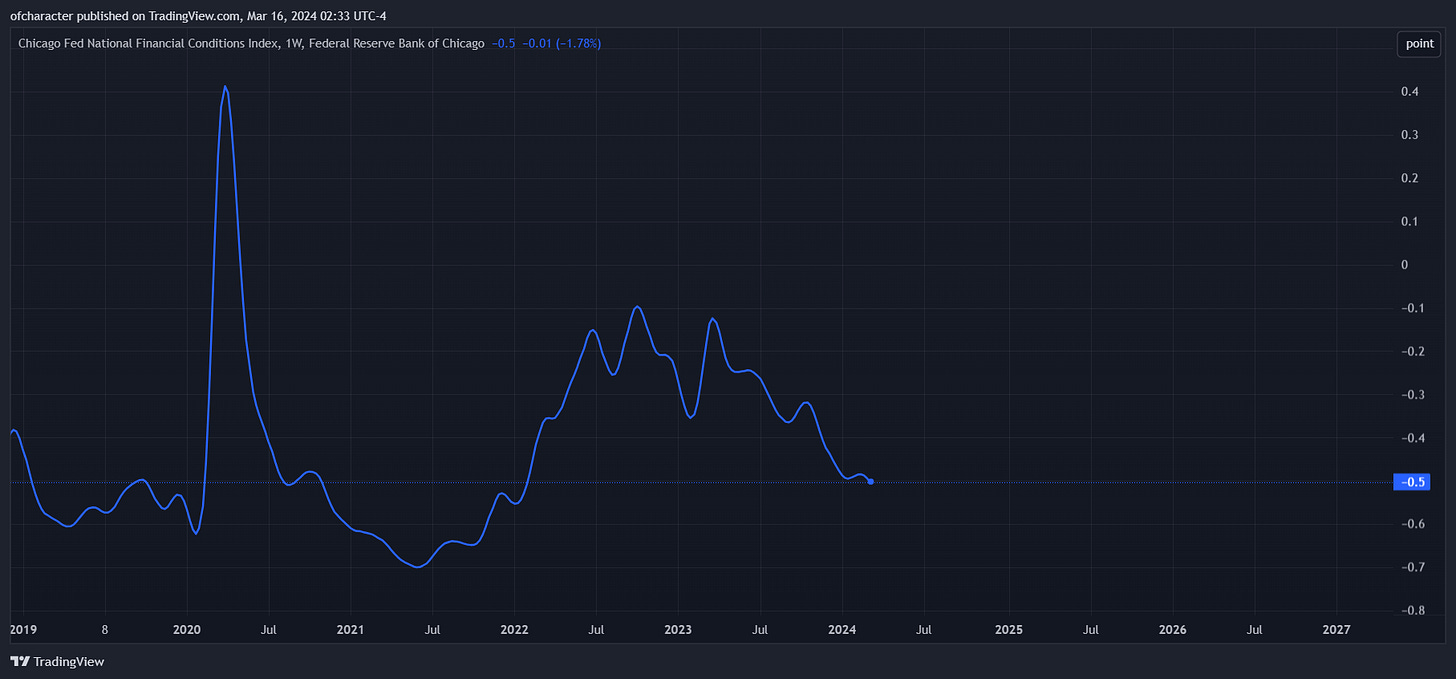

I have a post from March 2023 that showcases the disadvantages of being “data dependent” with forward guidance. It can lead to an undesired, historic loosening of FCI. Some small excerpts from the post:

While the current inflationary period is undoubtedly reminiscent of the 70s, it’s pivotal that we don’t use history as a roadmap for the future in this instance. Stop-n-go policy begot higher and exceedingly volatile inflation in the 70s. In our current circumstance, we have no wiggle room to make this same mistake. This leads me to highlight the third major policy error from the Fed.

As stated in my ‘23 recap, in what was a disastrous display of indecisiveness — and dare I say, a lack of credibility — the Fed released the animal spirits by pivoting with their forward guidance.

Back to the March ‘23 post:

This is a fairly drastic change from Powell’s last dismissal of FCI easing since October. Data dependency has its pros & cons, and its cons were certainly put on display here. The most influential CB in the world shouldn’t be flip-flopping due to data dependency when it’s already firmly behind the curve.

We are there again — firmly behind the curve. Recent claims of rates being in restrictive territory by Powell are genuinely laughable. This is simply just not true, for very obvious reasons, such as:

FCI is looser now than it was at the beginning of this hiking cycle. L O L

High-beta momentum is roaring, just like it was in 2021, when rates were at ZERO.

Piggy-backing of the 2nd point, humor yourself and go look at the names of certain meme coins that are rising everyday. Euphoria may be an understatement.

Once again, this is a problem for very obvious reasons, such as:

It interferes with the plan to get inflation anchored to 2% as quickly as possible since the US consumer is in pain and excess pandemic savings are down materially since 2021.

It enables things like oil to run easier. As if their fundamentals weren’t good enough already, the Fed had to usher in some unmerited FCI easing.

It keeps the Fed trapped between a rock and a hard place since the labor market is showing signs of softening, growth has peaked, and inflation is still sticky in a PIVOTAL election year.

In conclusion, a hawkish Fed repricing due to recent inflation data is being severely underpriced by equities. The long end of the curve already understands. The USD gets it as well. The market is at a major inflection point, and so is the economy. Powell & Co. have a serious decision to make next week. Do they focus more on waning growth & a softening labor market, or sticky inflation? I am leaning towards the latter, and I think somebody else (no big deal) is too:

So, positioning is still the same as noted in my previous post. Powell’s got the fate of the US consumer in his hands. No pressure.

Until next time,

Pierre.