Summer Madness pt. 3

Once again, playtime is over.

“A good name is to be chosen rather than great riches, loving favor rather than silver and gold. The rich and the poor have this in common, the Lord is the maker of them all. A prudent man foresees evil and hides himself, but the simple pass on and are punished. By humility and the fear of the Lord are riches and honor and life.” — Proverbs 22:1-4

First and foremost, positioning is the same. Solid month and a great way to close out Q2.

Twas an eventful week to say the least. Arguably the two most salient recent developments are 1) the consistent obliteration of the yen, and 2) the potential outcomes should the Dems truly be finished with Biden.

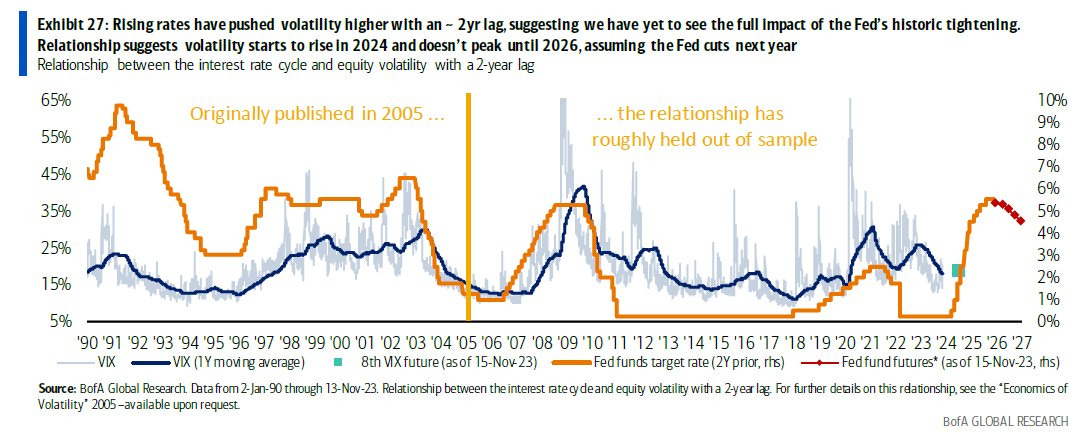

The former goes back to my assertion that cross-asset vol should not be expected to be muted/lower for the rest of the year.

That’s 38-year lows for the yen and there’s plenty of room for it to decline further given present circumstances. One might think that after such a disaster of a “debate” last night the $ would decline materially. However, this wasn’t the case.

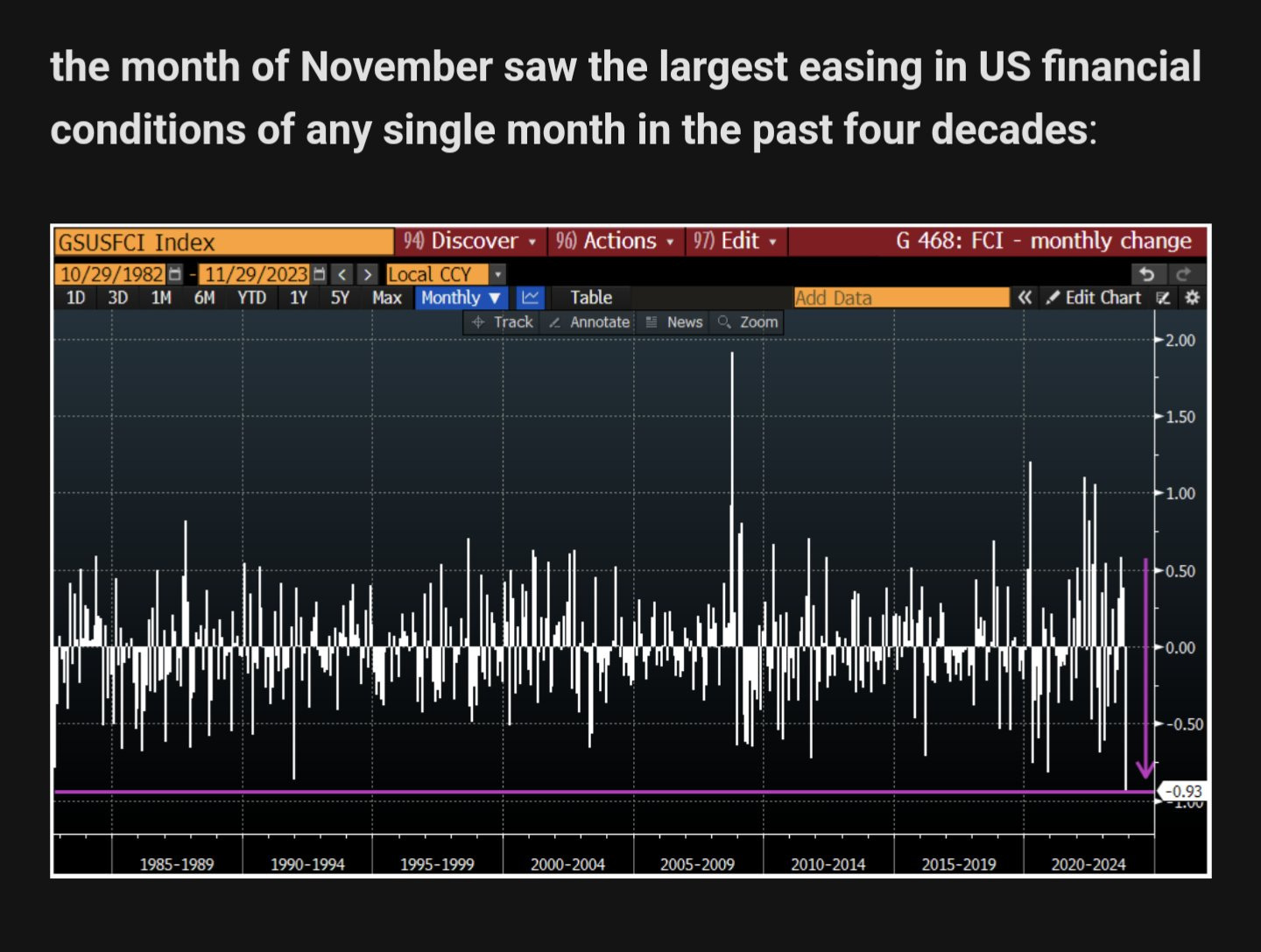

IMV, this is because rates have been expected to come down by the majority since the beginning of the year, but they haven’t budged at all since the Fed has been given no leeway to cut rates — thanks to their foolish December pivot.

“To top it off, at the last FOMC, Powell gave commodities — and equities — the greenlight to run. In what was a disastrous display of indecisiveness — and dare I say, a lack of credibility — the Fed released the animal spirits. And you know what they say, “Don’t fight the Fed.” Powell previously stated that the material rise of yields was welcomed, as it behaved like rate hikes/implicit tightening — making their job easier. But yields had dropped considerably since he said that. In fact…

It wouldn’t be farfetched to consider this development as rate cuts given what Powell said about implicit tightening. Despite this, Powell came out singing a surprisingly dovish tune.

Mission accomplished? Not even close. These recent remarks from the Fed give credence to my earlier assertion that the Fed has absolutely no credibility.” —

Equities have essentially shrugged off the need for alignment between rate cut expectations and reality, and bonds (long end) have continued their subpar performance.

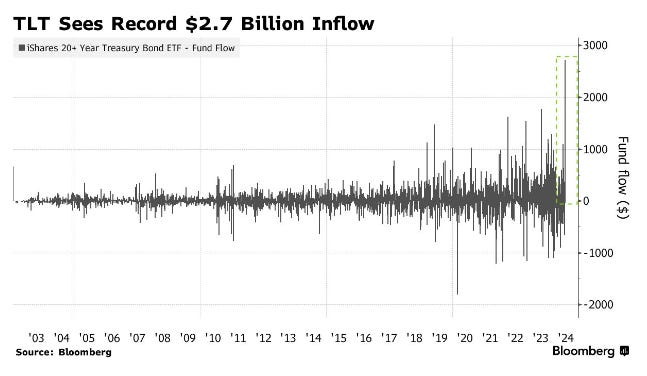

What traders/investors should now consider is the not only the perspective of foreigners who dabble in bonds, but also the risk/reward of owning them after last night’s fiasco. Who in their right mind would own the long end given current & future fiscal profligacy, inflation persistence, & crystal-clear absence of sound leadership.

The record inflow into bonds on Monday just before this event makes me wonder what those people were thinking.

Whatever it was, we most certainly weren’t on the same page.

Similarly to the way that investors/traders perpetually long for rate cuts, there is a large cohort that perpetually desires to go long the long end and ride to Valhalla. They have failed countless times over the past few years and believe that this is their chance — again.

Note that rates dropped as of late and small caps saw virtually no relief despite this. To me, this is a major red flag and signals that the 10y has a date with 5% this year. Let the bear steepening begin.

On top of this, equities don’t look any better than they did last time around, especially when you take last night into consideration.

Another Hindenburg omen

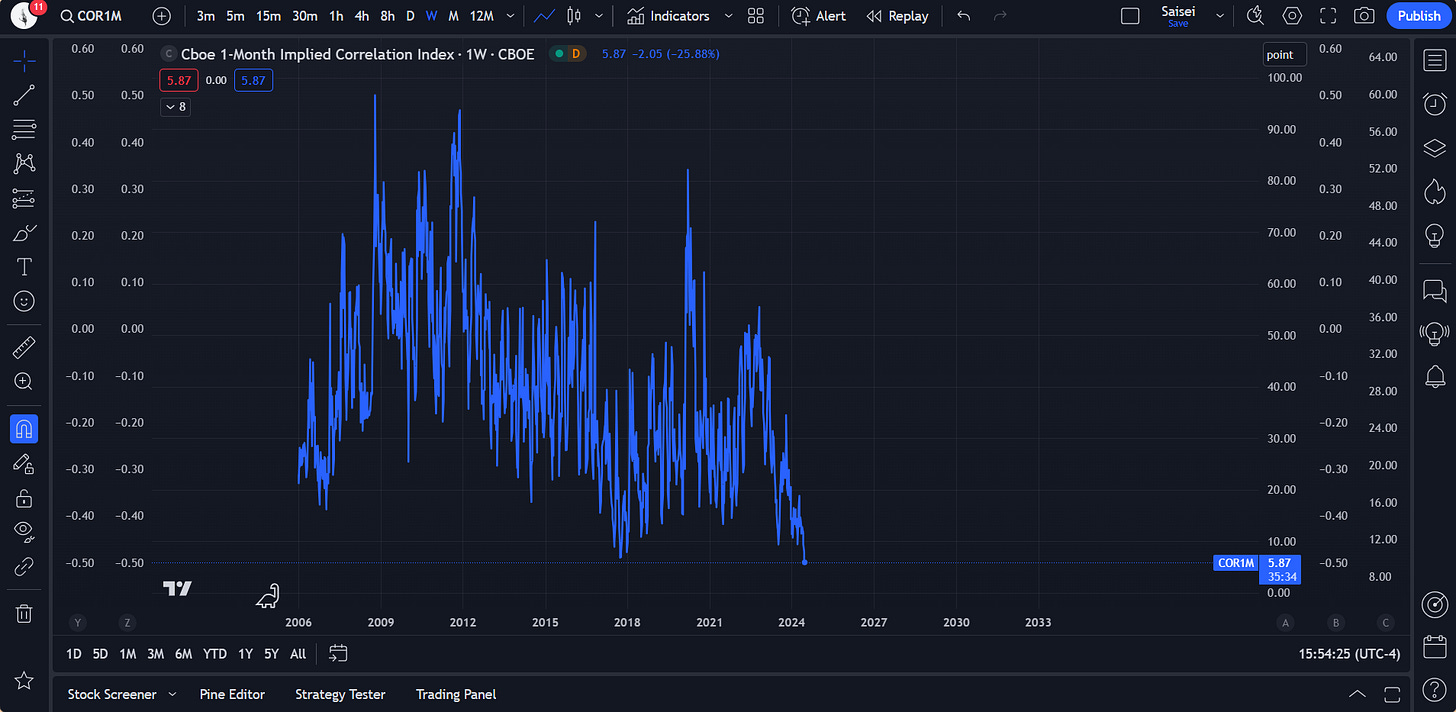

Correlation is not only at record lows, but this is the first time it has been this low with the yield curve inverted. Another “first ever”

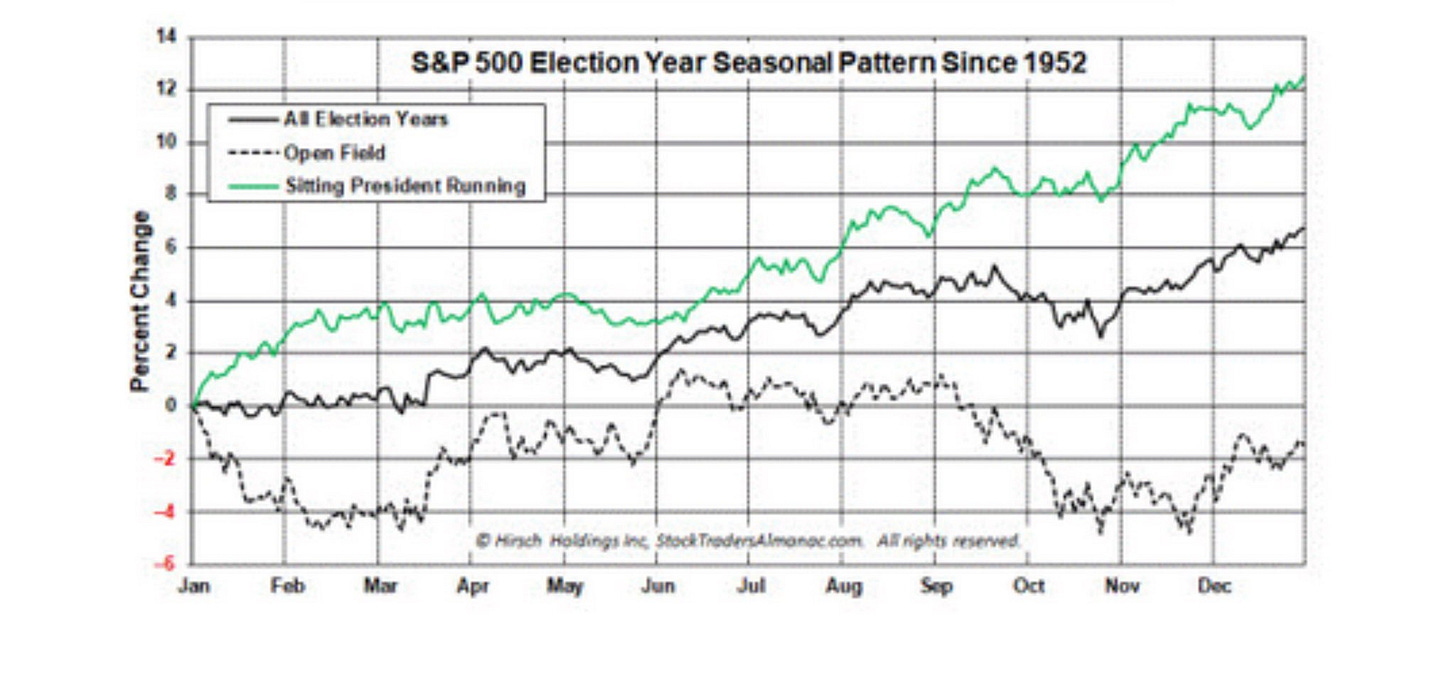

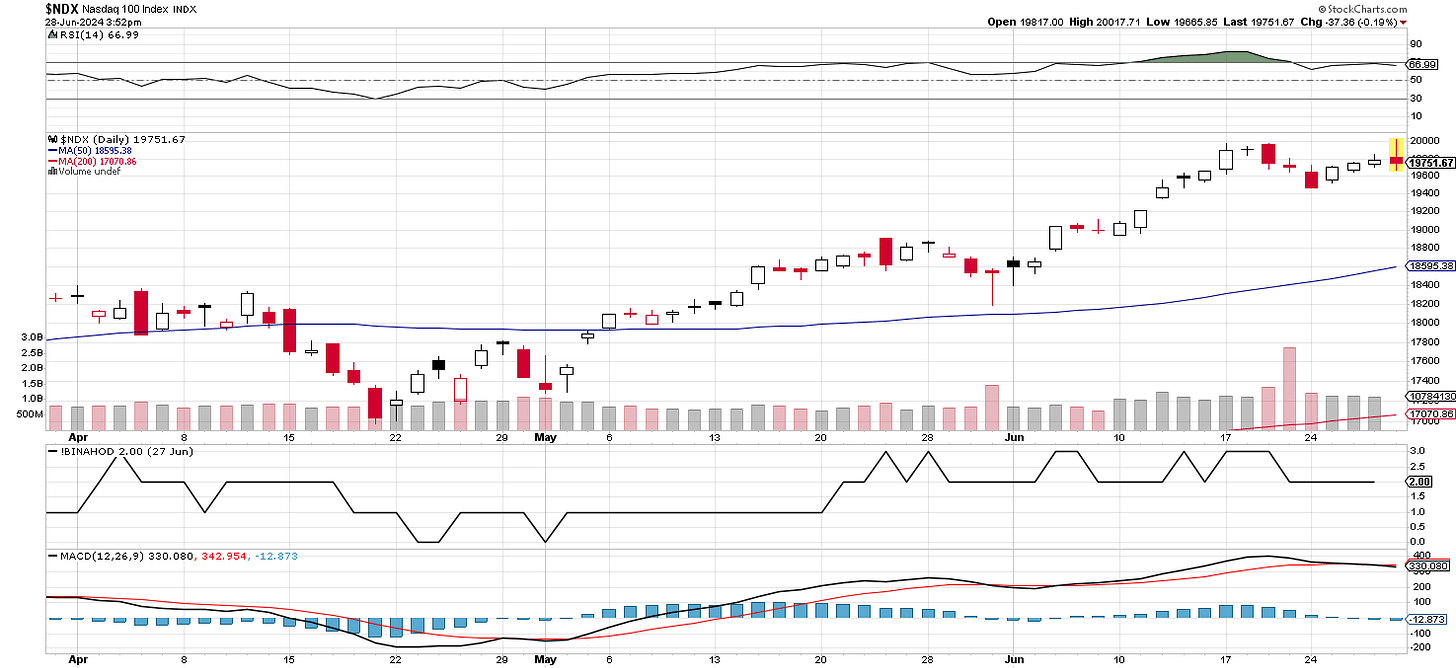

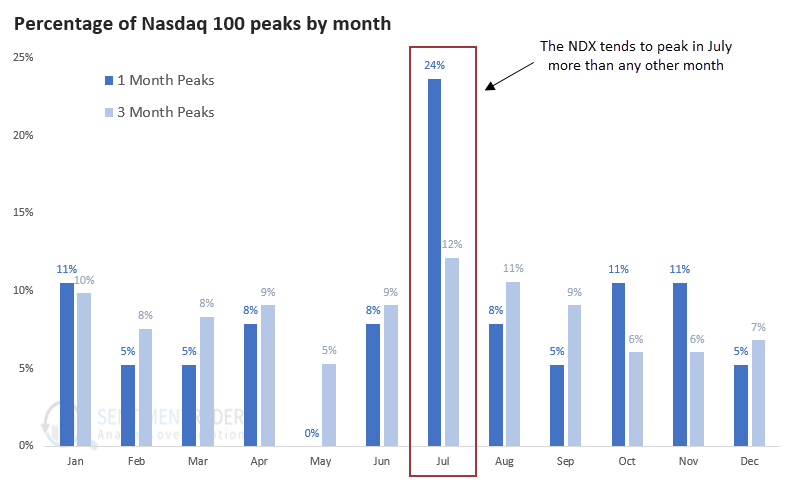

NDX/semis (semiconductors) seasonality points to tops (at least interim) in mid/late July, but that may be pushed forward given current circumstances.

And index vol is going to wake up in a major way whenever it does.

Playtime is most certainly over no matter what angle you look at markets from. Better get your house in order.

Until next time,

Pierre.